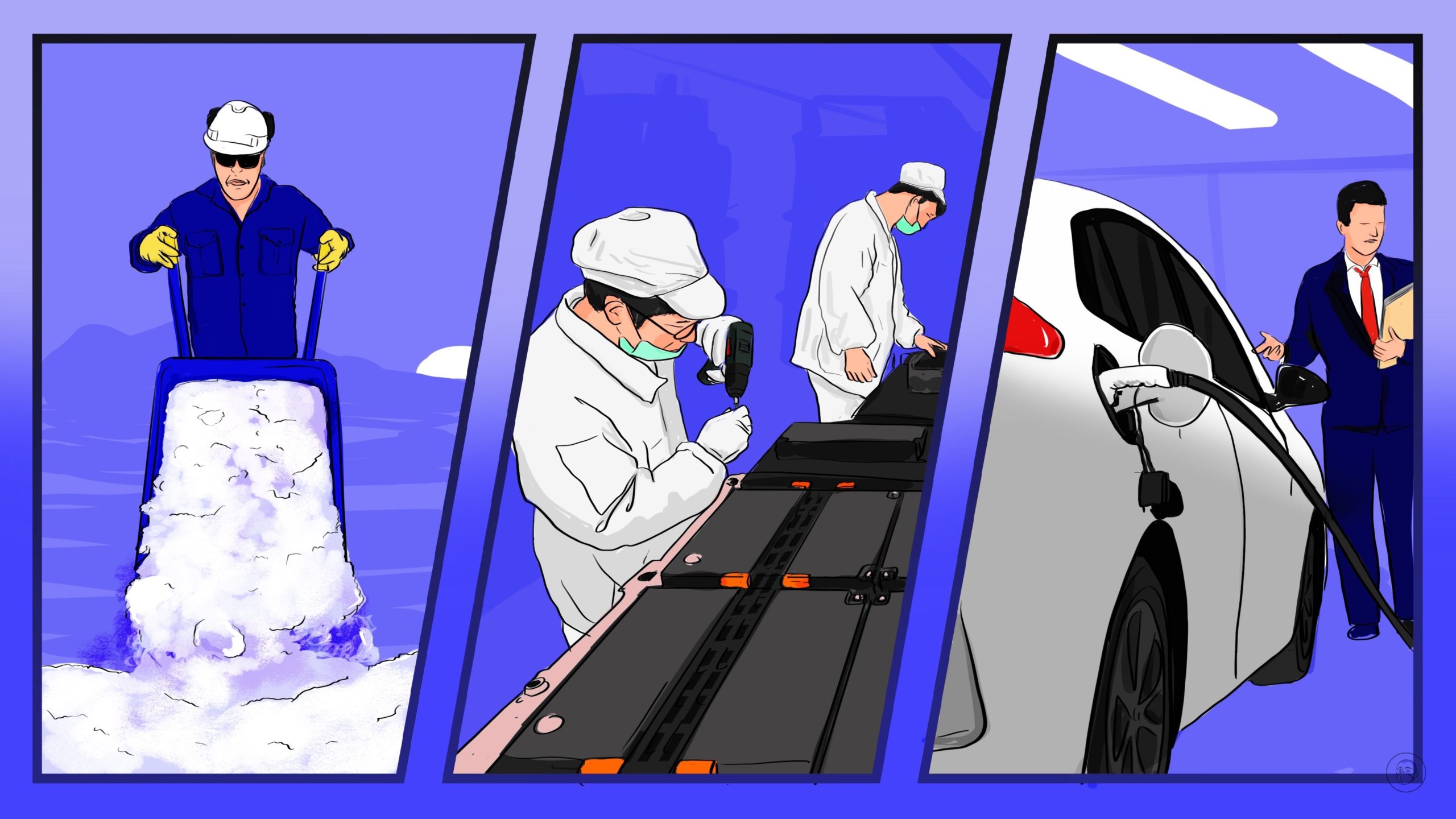

China’s lithium battery companies want to control the whole supply chain

As the penetration rate of electric cars approaches 25% in China, China’s lithium battery companies want a piece of the insane profits to be made from extraction and processing raw materials.

Several announcements in one day

Last Wednesday, September 28, was a big day for China’s lithium battery industry: Several companies announced new capacity and production expansions and greater integration of the whole supply chain:

Electric vehicle battery king CATL 宁德时代 announced an investment of 14 billion yuan ($1.96 billion) to construct a new production base of around 60 gigawatt hours (GWh) in Luoyang, Henan Province. This follows announcements earlier this year that the company will invest 13 billion yuan ($1.82 billion) to expand production at its Xiamen production base, and 14 billion yuan ($1.96 billion) at its Shandong base, in addition to a further 50.9 billion yuan ($7.15 billion) to build a 100 GWh production base in Hungary.

Ganfeng Lithium 赣锋锂业, China’s leading producer of lithium salts, announced a framework agreement with the city of Yichun, Jiangxi Province, for the construction of a new lithium battery manufacturing base with an annual output of 30 GWh, as well as a lithium project with an annual output of 7,000 tons, and a battery-grade lithium salts mine with an annual output of 50,000 tons.

GEM 格林美, China’s leading recycler of electric batteries, announced the signing of agreements with the Wenzhou city government of 10.8 billion yuan ($1.51 billion) for the construction of an industrial recycling park and related lithium battery material projects.

Hunan Zhongke Electric 中科电气 announced a new production facility of 2.8 billion yuan ($393.35 million) with an annual output of 130,000 tons of lithium battery anode materials.

Victory Precision 胜利精密 announced an investment of 5.6 billion yuan ($786.71 million) in new production lines for the company’s lithium batteries layout, and an investment of 3.6 billion yuan ($429.88 million) by WLY 万里扬 in a vehicle alloy structural parts project with annual capacity of 120,000 tons.

These five announcements on one day are merely the latest in an ongoing headlong rush to expand production. As of September 28, a Chinese newspaper counted 26 new expansion projects related to storage and power batteries that have been announced so far this year alone, with a cumulative investment of 290 billion yuan ($40.74 billion) and total production capacity of 820 GWh. These projects involve all of China’s largest electric battery producers. In addition to those mentioned above, the companies include Sunwoda Electronic 欣旺达, Farasis Energy 孚能科技, CALB 中创新航, Gotion High-tech 国轩高科, Eve Energy 亿纬锂能, Zhuhai CosMX Battery 珠海冠宇, and Shenzhen Desay Battery 德赛电池.

And looking into the future, everything seems electric: CATL’s total electric battery production capacity is set to reach 440 GWh by the end of 2022, and the company expects to enter the 1 terawatt-hour (TWh) era by 2025. According to an industry report, Chinese production of new energy vehicles (NEVs) is expected to reach 6 million units in 2022, which will require 450 GWh of battery power. Global sales of NEVs are expected to reach 20 million units by 2024, and China’s production of electric batteries is expected to reach 2 TWh by 2030.

Who works for whom? Following the profit trail.

Back in July at the 2022 World Electric Vehicle (EV) and Electric Storage (ES) Battery Conference that took place in Sichuan Province, Zēng Qìnghóng 曾庆洪, the chairman of auto manufacturer GAC Group 广汽集团, joked that with the cost of electric batteries accounting for up to 60% of his company’s cars, “am I not working for CATL now?” In response, Zēng Yùqún 曾毓群, the chairman of CATL, who was also at the conference, explained that he himself is working for the upstream raw material providers, because that is where the highest profits are being made.

Indeed, with the sharp increase in the prices of raw materials from 2021, the average gross profit margin of lithium providers in the second quarter of 2022 was 64.3%, accounting for the vast majority of profits in the lithium battery industrial chain. The highest profit margin in the entire industry is in the lithium salts part of the supply chain: In the first half of the year — during which the price of lithium carbonate rose from about 280,000 yuan (about $40,000) per ton at the beginning of the year to nearly 520,000 yuan (about $73,000) — lithium salts extraction companies could achieve a gross profit margin of more than 90%. The gross profit margin of electric battery manufacturers, on the other hand, was below 15%, or even below 10% for some companies.

The cost of lithium salts accounted for only about 10% of the total cost of an electric battery in 2020, but by September 2022, this ratio had increased to nearly 50%. As a corollary of this, the gross profit margin and total profit of NEV and electric battery manufacturers have declined across the board in the first half of the year, and will not recover as long as the price of lithium remains high.

This situation has prompted an increasing trend this year of vertical integration in the lithium battery industry, in which electric battery companies are investing in raw materials, and raw material companies are producing batteries. As a raw material producer as well as an electric battery manufacturer, Ganfeng Lithium is a leading example of the trend of integration of the lithium battery production chain: In July, Ganfeng Lithium started construction of a 5.4 billion yuan ($758.61 million) solid-state battery production base in Chongqing.

Industry-wide integration

There are also several other companies that are expanding their footprint across the production chain in an attempt to improve their cost structures and profit margins:

- On September 27, lithium battery manufacturer Eve Energy announced plans to acquire a 20% stake in the Shandong Province–based lithium salts producer Ruifu Lithium 瑞福锂业 for 800 million yuan ($112.38 million). This follows a number of other recent investments in lithium mining by Eve Energy.

- Sunwoda Electronic, another lithium battery manufacturer, has set up a nickel-smelting joint venture project in Indonesia, and acquired lithium salts prospecting rights in Qinghai Province.

- Tianqi Lithium 天齐锂业, one of China’s largest lithium producers, which reported total profit of 11.6 billion yuan ($1.68 billion) in the first half of the year, a year-on-year increase of 13,420%, has made several investments this year in downstream companies, as has Huayou Cobalt 华友钴业, which invested in downstream ternary and cathode materials companies.

These developments show that we can expect further consolidation and vertical integration of the entire lithium battery supply chain as the competition to power the world’s cars, trucks, buses, and eventually boats and planes intensifies.