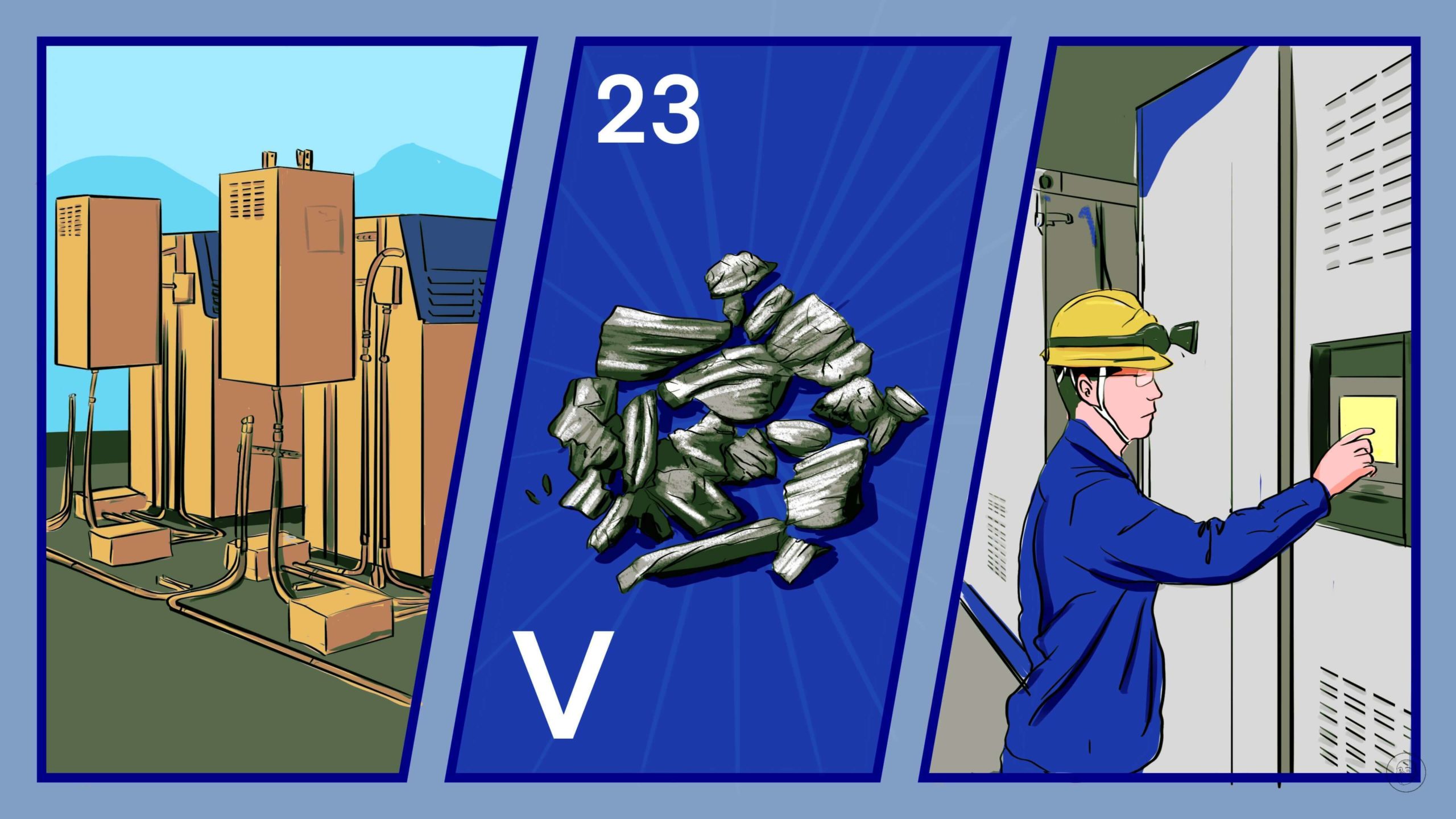

The dawn of the vanadium battery age in China

New energy has a new darling: vanadium flow batteries. Although they are still too bulky for electric vehicles, China has announced several vanadium power generation and storage projects.

Lithium batteries are the focus of much of the electric vehicle industry, although sodium batteries also show promise. But there’s another technology that got a boost last month: vanadium redox flow batteries.

There are many reasons for China to pursue this technology, not least of which is that it has plentiful supplies of the malleable silvery metal, unlike lithium, and that vanadium batteries are relatively easy to recycle. But the technology is so far best suited to large-scale power storage for electric grids: The current generation of vanadium batteries has low energy density, meaning they are still too heavy to be used to power electric vehicles. For now.

September was vanadium month for Chinese power stations

The technology is not new: Vanadium batteries have been in use for years in large-scale utilities, and research on vanadium flow batteries has been conducted in China since the late 1980s. In 1995, the China Academy of Engineering Physics produced China’s first prototype vanadium battery.

In September, however, important developments occurred in China related to the commercialization of vanadium batteries:

- On September 20, construction commenced on China’s first gigawatt-hour (GWh) vanadium flow power station in Qapqal Xibe, Xinjiang, with a total installed capacity of a million kilowatts (kW). The project is expected to be fully connected to the grid before the end of 2023.

- On September 28, a contract was signed in Jishou, Hunan Province, for the construction of a 400-megawatt (MW) vanadium flow energy storage power station with a total investment of 680 million yuan ($94.46 million), expected to be completed and connected to the grid at full capacity by the end of June 2023.

- On September 29, a 100-MW vanadium flow battery energy storage power station and national demonstration project entered the final stage of commissioning in Dalian, Liaoning Province, and is expected to fully enter service in mid-October. The station has a power rating of 100,000 kilowatt-hours (kWh) and can store up to 400,000 kWh of electricity. It can meet the daily electricity demand of 200,000 residents.

The vanadium battery companies to watch

These new vanadium power plants are accompanied by developments in downstream battery manufacturing:

- On August 2, HBIS 河钢股份, China’s second-largest producer of vanadium, announced that it had constructed a 1,000-ton-per-year high-purity vanadium production line, and a 1,000-ton-per-year vanadium electrolyte production line.

- On October 11, Pangang Group Vanadium and Titanium Resources 钒钛股份, China’s leading producer of vanadium, launched a joint venture with battery developer Rongke Power 大连融科 for the construction of a vanadium electrolyte production line in Sichuan Province, and for exploring business models for the commercialization of vanadium battery energy storage.

- On October 13, titanium dioxide manufacturer CNNC Hua Yuan 中核钛白, which had announced a centralized procurement system for vanadium redox flow battery energy storage in September, announced an investment of 510 million yuan ($70.84 million) for the establishment of a new subsidiary focused on vanadium technology. In July, CNNC Hua Yuan launched a strategic venture for the development of the entire industry chain of vanadium redox flow batteries.

According to an industry white paper on China’s vanadium battery industry published this year, the scale of vanadium batteries in China will reach 2.3 GW by 2025 and 4.5 GW by 2030, when the cumulative installed capacity of vanadium battery energy storage projects will reach 24 GW with a total market size of 40.5 billion yuan ($5.62 billion).

The long road to powering electric vehicles

In 2021, China’s lithium resources amounted to 5.1 million tons, accounting for 5.6% of global resources. China needs to import at least 65% of the lithium required by its electric vehicle and battery industries. As a result, the price of lithium carbonate has skyrocketed. Yet unlike lithium, which China has to procure via long supply chains from places like Australia and Chile, China has the largest reserves and is the largest producer of vanadium. In 2021, global reserves of vanadium were 63 million tons, of which China held the largest share of about 9.5 million tons, or 39%, while China also produced 68% of global output.

Unlike lithium-ion batteries, vanadium batteries are much safer, have a long life cycle, and are almost completely recyclable. Vanadium batteries can be charged and discharged up to 15,000 times, and a vanadium battery energy storage power station has a lifetime of about 20 years. With a water-based electrolyte system, moreover, the vanadium battery is immune to catching fire and exploding (unlike lithium-ion batteries).

At the present, however, most vanadium in China is produced as a by-product of the steel industry, and almost all of it is reused in the steel industry. So China would have to expand the production of vanadium to support an independent vanadium battery industry. Another problem is the high initial installation cost of vanadium batteries, which is about twice that of lithium-ion batteries. But the longer the energy storage time of vanadium batteries, the smaller the unit investment cost, and hence the only means for vanadium power to develop vigorously at the present is on a large scale.

The main problem with vanadium batteries, however, is low energy density, which is only 70–75% of that of lithium batteries. As a result, vanadium batteries still have to be used in a large volume, and hence they are not yet suitable for small working scenarios such as electric vehicles.

The takeaway

Vanadium batteries are in their initial breakout stage of commercialization in China focused on power generation and storage for the electric grid. But as the technology develops, vanadium may eventually replace lithium as China’s electric vehicle battery of choice.