Petroyuan: China seeks to break dollar dominance in oil trading

China is the country with the highest volume of oil imports, and is one of the top 10 oil-producing countries, yet until this week, Chinese currency — known as either the renminbi (RMB) or the Chinese yuan — had little to do with the purchase of the world’s most traded commodity. The U.S. dollar remains the default trading currency for oil and most other products, and China wants to change that, and usher in the era of the “petroyuan.”

- The Shanghai crude oil futures debuted on March 26, and in five hours of trading, “almost 40.7 million barrels of oil changed hands” and became owned in RMB-denominated contracts, Caixin reports (paywall).

- It was “a good, if modest, start,” the Economist says (paywall), with two goals:

- First, to “hedge against volatility,” as “Chinese refiners and traders have struggled to manage currency risks because of capital controls.”

- Second, to one day “create a standard for oil pricing as a rival to Brent in Europe and West Texas Intermediate in America.”

- For more on how these oil futures work, both when they are traded and what they are intended to do for individual investors, see this piece in Bloomberg.

Today, Reuters reported that China is planning on further pushing for the trading of oil in Chinese currency, as regulators had “informally asked a handful of financial institutions to prepare for pricing China’s crude imports in the yuan,” according to three sources.

- “A pilot program for yuan payment could be launched as early as the second half of this year,” according to two of the sources.

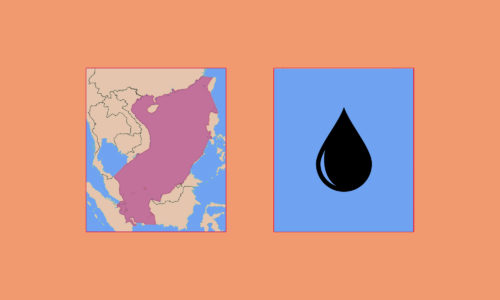

- Russia and Angola look to be potential target customers for the initial plan, one of the sources said, as both are eager like China to break the dollar dominance in oil trade.

- Markets for other commodities could follow, if the oil imports via the Chinese yuan are successful.

- But the Chinese yuan still has a ways to go, Reuters says, because of its “illiquidity in forex markets” — only 4 percent of transactions on the “$5 trillion-a-day currency markets” use Chinese currency on one side of the trade, while the U.S. dollar is involved in nearly 90 percent.

- Finally, unless China’s foreign investment rules open up substantially, “talk of a petroyuan replacing the petrodollar will be premature,” the Economist adds.