The next Chinese behemoths: Healthcare companies

In October last year, China’s State Council announced new rules for approvals for drugs and medical devices, intended to speed up the process by cutting red tape and allowing the use of data from clinical trials performed outside of China.

In January this year, the New York Times noted (paywall) that although Chinese medical scientists had in the past focused their efforts on replicating Western medicines and iterating traditional Chinese treatments, rather than seeking approval for newly developed drugs, that is changing rapidly. Among the medical advances mentioned in the report are drugs to treat lymphoma — the most common form of blood cancer — as well as lung, kidney, gastric, and colorectal cancers.

Chinese pharma companies are still tiny in comparison with their American peers. Jiangsu Hengrui, one of the largest, has a $180 million annual budget. Pfizer, meanwhile, spent $7.8 billion in 2016. But that is changing rapidly, too. Today, Bloomberg reports:

- “In laboratories across China…an army of scientists are racing to catch up with and then overtake their Western counterparts. They’re working overtime on everything from cutting-edge cancer therapies to genetic engineering, and they’re getting a boost from the Communist Party, which wants to build homegrown champions in the drug industry.”

- “Investors are piling in… Venture capital investment in China health-care surged from $1 billion in 2013 to $11.7 billion last year according to McKinsey & Co.”

- As prosperity and pollution increase rates of all kinds of noncommunicable diseases such as cancers and diabetes, “sales of medicines are expected to hit as much as $175 billion by 2022.”

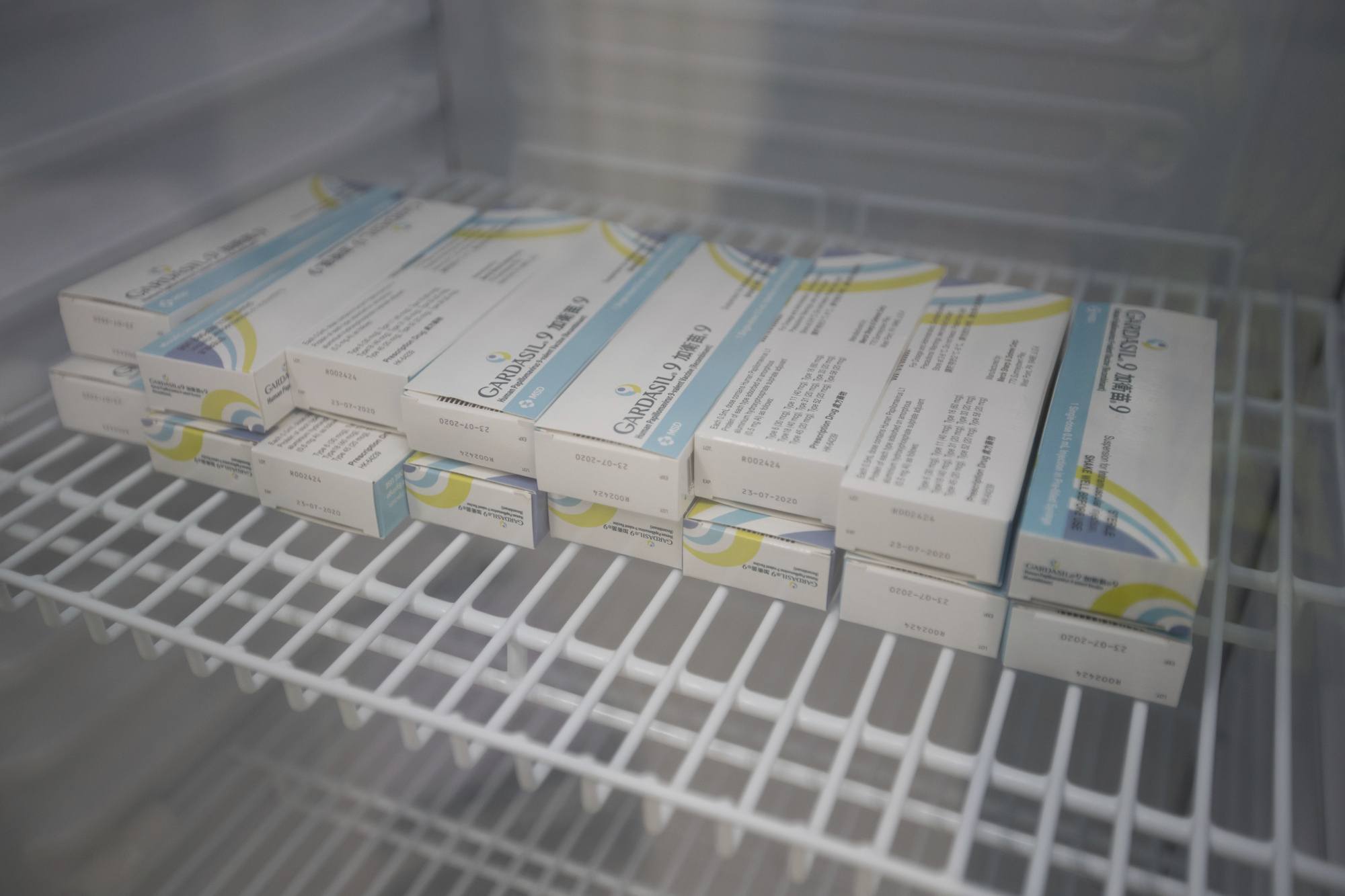

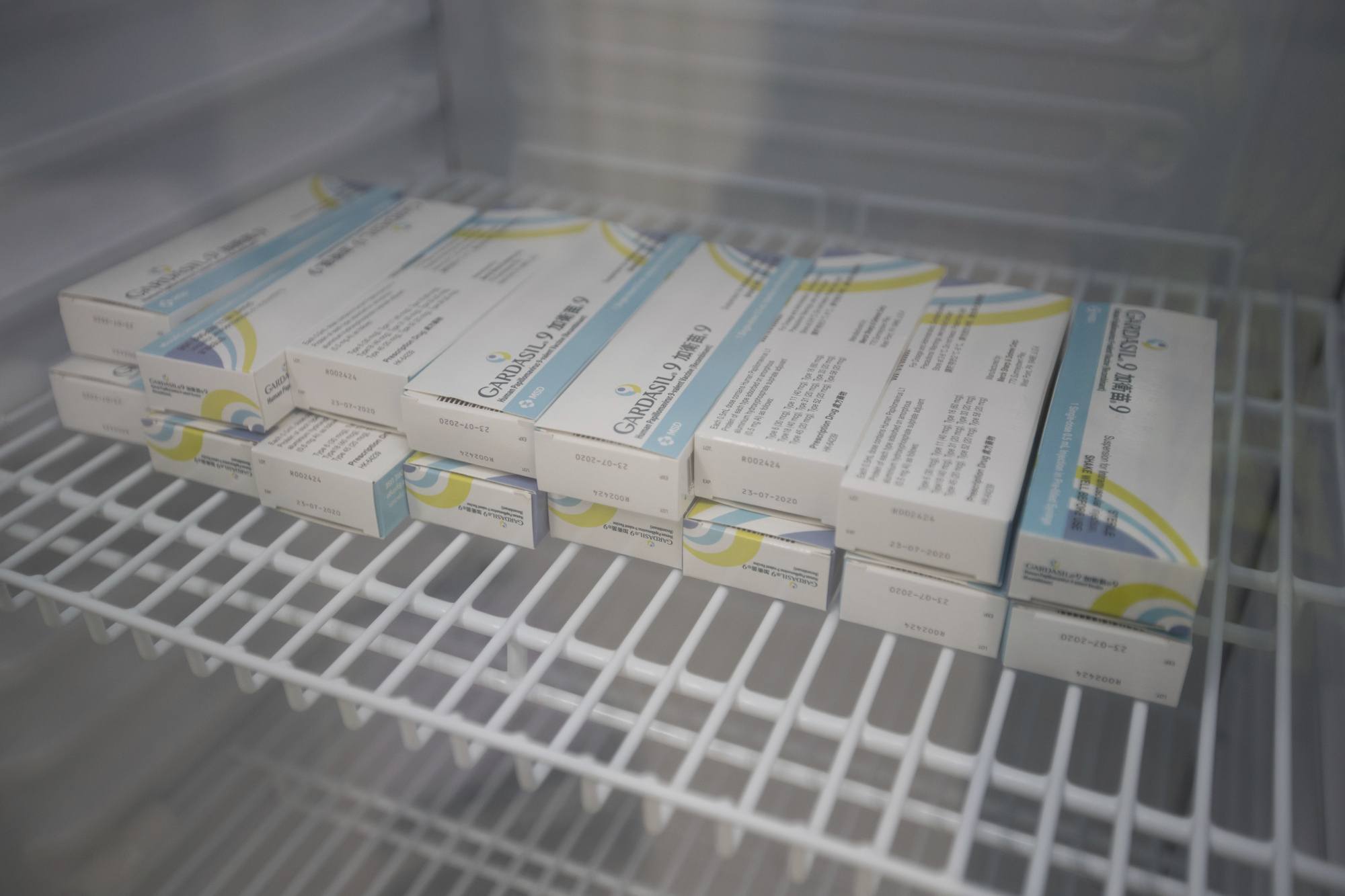

- Made in China 2025, the government plan to boost domestic tech and industrial innovation and capacity, “highlights plans to develop new targeted therapies, antibodies and vaccines while working toward breakthroughs in areas like stem cells.”