Shorting the yuan — trade war gloom and boom update

America will be barbecuing and letting off fireworks tomorrow, so it seems unlikely that a settlement will be reached between China and the U.S. to stop the July 6 tariffs from coming into effect.

Meanwhile, Nikkei Asian Review reports that “the 11-member Trans-Pacific Partnership trade pact, which does not include the U.S., will prepare for its next stage of expansion when chief negotiators meet in Japan in mid-July to discuss how to usher new members in.” Last week, Japan’s parliament ratified the latest version of the trade agreement. Nikkei says that “many members hope” that adding new members and “showing some tangible merits of free trade” might help entice the U.S. back to the group. Other news from the global economic upheaval:

THE YUAN AND STOCK MARKETS

- Chinese central bankers said they will not weaponize the yuan in the trade conflict with the U.S., “helping the yuan reverse some of its recent plunge,” reports Bloomberg (paywall).

- Chinese state media today urged investors not to panic over the trade war, calling “a recent sell-off in mainland stock markets an ‘irrational overreaction,’” according to CNBC .

- The message may not be going through if a “senior foreign exchange trader at a Chinese bank in Shanghai” cited by the Financial Times is to be believed: “Maybe they go ahead with tariffs, or maybe there’s an agreement, but no matter how this gets resolved, China’s trade surplus is going to come down… Onshore clients are buying dollars in bulk, and banks’ prop desks in the offshore market are all shorting the renminbi.” The story is headlined China central bank seeks to reassure after renminbi tumble (paywall).

CHINA’S STRATEGY

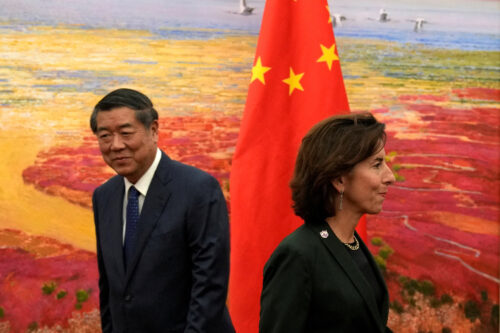

- China has been urging the E.U. to form an anti-U.S. alliance on trade, says Reuters , reporting on meetings in Brussels, Berlin, and Beijing that involved Vice Premier Liu He 刘鹤 and Foreign Minister Wang Yi 王毅.

- Kicking the debt can down the road? The South China Morning Post reports that “Beijing has signalled a softer stance in its campaign to cut debt from the economy, removing a key statement of intent from a monetary policy document.” The article attributes the change of attitude to “slowing economic growth, an increase in credit defaults, and the devaluation of the yuan amid rising tensions over trade with the US in the past month.”

- Censorship instructions for Chinese media about the trade tensions with the U.S. as revealed by China Digital Times (unverified but they have a great track record) give another idea of how the Chinese leadership may be thinking.

CHINESE TECH IN THE U.S.

- The Trump administration has moved to block China Mobile “from offering services to the country’s telecommunications market, recommending its application be rejected because the firm posed national security risks,” according to CNBC .

- What are the risks posed by China Mobile? We don’t know. Quartz reports that the only document available to the public about the security risk is mostly “a mess of black boxes.”

- China Mobile’s shares “trade at almost one-third of global peers’ valuation,” according to Bloomberg (paywall). But there are good reasons: With China’s mobile market nearly saturated, the carrier “has limited growth potential, while bearing the brunt of Chinese government pressure to reduce rates.” Bloomberg says costs also “loom for upgrading its network to 5G.” With the latest news of the American block on China Mobile, one analyst told Bloomberg that the company’s stock “probably won’t rally until mid-2020.”