‘Apocalyptic’ — the effects of Entity List action against leading Chinese AI companies

The U.S. Commerce Department action to place eight leading Chinese artificial intelligence (AI) and security companies on the Entity List in early October is already causing major changes throughout China’s AI community. The ripple effects will be felt among U.S. companies in the AI sector and within the venture capital community in China. The eight companies were security camera firms Hikvision and Dahua; iFlytek, a member of China’s so-called National AI Team; AI imaging and computer vision firms Megvii, SenseTime, and Yitu; digital forensics company Meiya Pico; and security system firm Yixin Technology, also known as Ecguard.

The long-anticipated listing is likely based on the firms’ involvement with surveillance and profiling activities in Xinjiang. It is part of a broader “Xinjiang Package” that includes visa restrictions and other potential sanctions. Vice President Mike Pence also criticized China’s policies in Xinjiang in a speech on October 24.

The targeted Chinese AI firms range in size from small to large. SenseTime is currently the most highly valued AI startup in the world, Hikvision, Megvii, and iFlytek are major players in the Chinese AI market beyond security applications, while Meiya Pico is a smaller niche player. They have varying degrees of closeness to the government, and differing financial structures. Dahua, Hikvision, iFlytek, and Meiya Pico are already listed domestically in China. Hikvision and Dahua have also raised concerns over their inclusion in the MSCI index, which is used by many U.S. pension funds to allocate investments.

Some of the firms, anticipating potential U.S. government action, have taken steps to distance themselves from activities in Xinjiang. Megvii, for example, released a nearly 600-page English-language document in August as part of its filing for an IPO in Hong Kong. In the document the firm claims to have minimal business links to Xinjiang and to be working to establish an internal AI ethics review process. Megvii was named to China’s National New Generation AI Governance Expert Committee earlier this year — the group will provide policy recommendations on AI governance issues. Given its IPO process and the reputational hit, Megvii will contest the listing with the Commerce Department, along with Hikvision.

It is unclear if the U.S. review of the firms is mentioned in the IPO filing document. U.S. suppliers can still apply for licenses to supply the firms and will also be considering approaches similar to the Huawei case, in which the export control regulations allow shipment of non-U.S. origin goods. The Chinese companies face differing levels of reliance on U.S. hardware and software, but they amost all need AI-optimized semiconductors from U.S. firms such as Nvidia and Ambarella. The firms have stockpiled some components in anticipation of the U.S. move, but that is only a temporary solution.

Chilling effect already apparent

The U.S. action has already had a chilling effect within the small Chinese AI and venture capital community. In addition to the impact on Megvii’s IPO, the action has called into question the large valuations for AI unicorns such as SenseTime. While the full impact of the action remains unclear, already the move will likely preclude any of the firms from being able to expand into the U.S. market. Many AI startup companies in China have been eyeing the U.S. and other Western markets for expansion, particularly for applications such as medical imaging and autonomous vehicles.

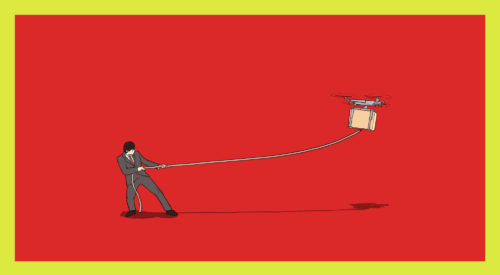

Already, Chinese AI startups are encountering problems stemming from the Entity List action when talking with U.S. companies about collaboration. U.S. companies are concerned about working with Chinese AI companies they fear could also end up under U.S. sanctions. It is now becoming very difficult to close deals with companies that are on the list or in proximity to these companies already on the list — the U.S. action essentially places a “scarlet letter” on the Chinese firms.

The potential closing off of the U.S. market is a major development for China’s AI unicorns. The action is likely to put a major monkey wrench into their ability to continue to raise money through financing rounds, do initial public offerings, and plan global expansion — all of this will make it increasingly difficult to justify their valuations. Already, given these factors, the top AI personnel at these firms are concerned about their future. More AI talent is now available within China as a result, with many leaving or preparing to leave the startup companies.

The investment community has also gotten skittish, and the willingness of investors to fund Chinese startups has dropped considerably. One Chinese AI executive called the rolling impact of the U.S. action “apocalyptic.”

The high valuations of companies such as SenseTime are based on a number of factors, all of which are being impacted by the U.S. action: The top-level AI talent that the company had attracted was one of the principal justifications for the high value of the SenseTime valuation. The company has been able to sign substantial contracts with customers primarily to gain access to their personnel to essentially work as consultants. In addition, staying at the cutting edge is critical in the AI sector, since the field moves forward very rapidly. Firms like SenseTime require a robust research pipeline to stay at the top. A lot of Chinese AI companies, including some of the impacted ones, are looking at designing semiconductors that will help optimize their algorithms. The brand reputation could be the largest impact from the Entity List action, affecting companies’ ability to gain new business contracts.

Another important measure of the impact will be Chinese organization attendance at leading AI and other related technology conferences. Even before the October Commerce Department action, the participation of Chinese AI researchers at U.S.-based conferences had fallen off. Participants in the October Mobile World Congress in Los Angeles noted the near absence of Chinese AI and tech companies. The U.S. is now considered “unfriendly territory” for Chinese AI researchers and some technology companies. Other venues are likely to take over. The International Conference on Computer Vision (ICCV) held last week in Seoul, for example, was well attended by Chinese AI researchers, with 14 Chinese companies in attendance, one-third of the accepted papers coming from China, and nearly 50 percent of accepted papers having a Chinese first author. These conferences are more about applied AI and tend to attract researchers from among the eight companies subject to new U.S. restrictions.

More theoretical AI conferences such as NeurIPS set for December in Vancouver, Canada, have also typically had a sizeable amount of Chinese researchers participate. Their participation was considered so important in 2018 that the date of the conference was moved to avoid overlapping with Chinese New Year. The conference this year will be a major bellwether about the direction of Chinese participation in the global AI research community as Chinese AI firms face further pressure from U.S. government action. For example, the Commerce Department is likely to release a revised list of “emerging technologies,” to include AI-related software and hardware, before the end of the year as part of requirements under last year’s Export Control Reform Act (ECRA).

American AI companies could benefit from the movement of AI talent out of Chinese startups, as the pool of qualified software engineers and data scientists available could grow. However, as the U.S. government increasingly views AI as a key strategic technology and considers America to be in a zero sum competition to dominate the AI domain, U.S. companies may be reluctant to hire Chinese AI personnel. The Trump administration is also making it more difficult for Chinese scientists and engineers to get visas. As the AI communities in the two countries become separated, the danger is that American AI leaders actually lose access to one of the largest pools of qualified talent, blunting U.S. leadership in some fields of AI.