China settles into a ‘90% economy’

A few promising signs indicate China's economy is picking up again. However, top line statistics don't tell the full story, and the CCP is stepping in to prod the economy back into action.

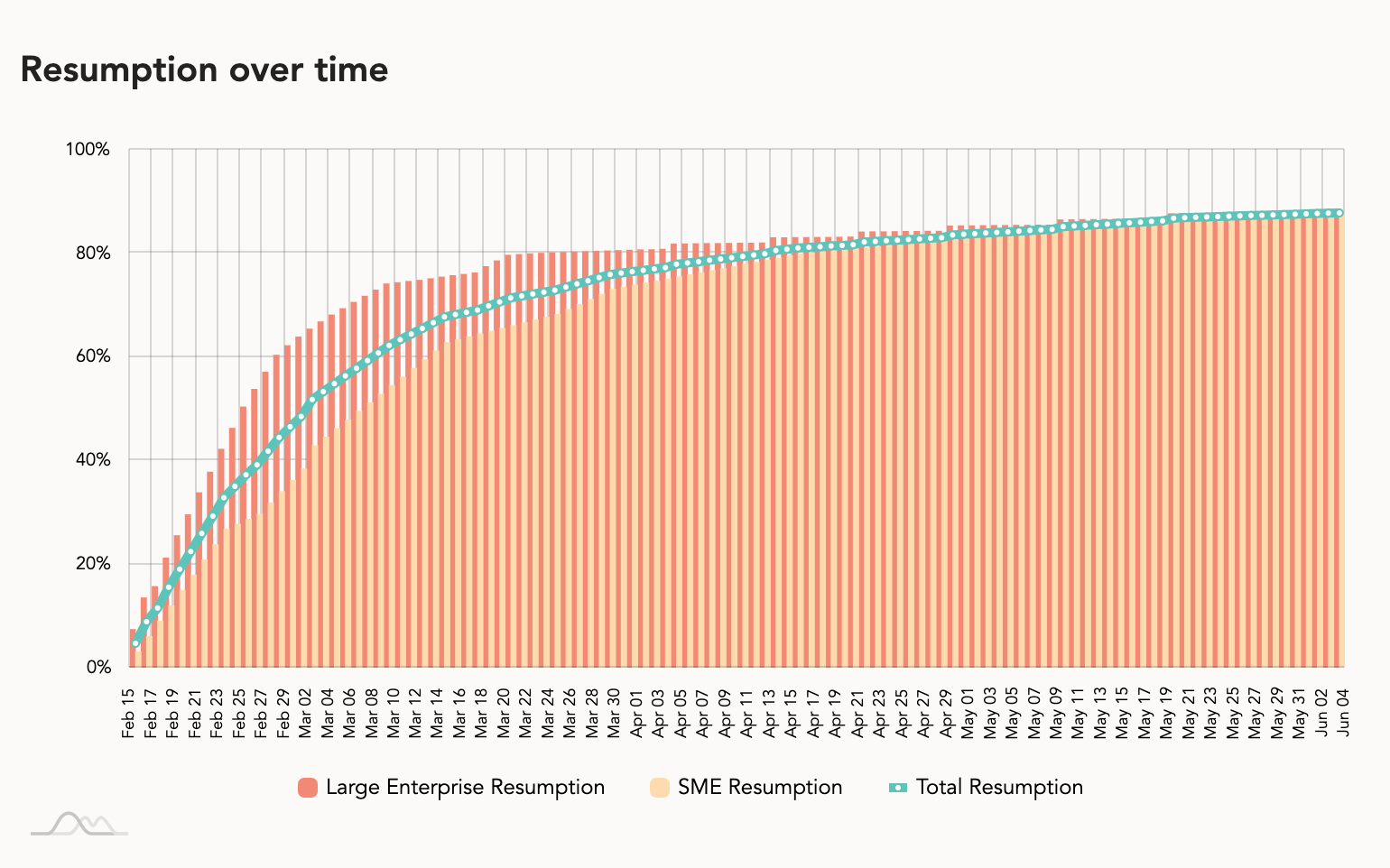

According to a June 3 update of the Trivium China business activity indexes, work resumption is between 87% and 88% for large, medium, and small enterprises in China.

This week also saw another economic indicator in China’s return to around 90% of normal: oil demand. Reuters says that the “surprisingly robust rebound…could be mirrored elsewhere in the third quarter as more countries emerge from lockdowns.”

However, the “90% economy,” as the Economist magazine called it a month ago (porous paywall), while “better than a severe lockdown,” is “far from normal” and will probably have severe, lasting, and unpredictable impacts on employment and livelihoods.

- For example, millions of workers who lost jobs in manufacturing and industry have found work in the gig economy, but legal protections and benefits in this sector are still underdeveloped, writes Viola Rothschild in the Jamestown China Brief.

- Any industry that is heavily dependent on in-person customer interaction, like movie theaters, is in danger. A survey by the China Film Association found that 40% of cinemas in China are at risk of permanently closing, per the SCMP. The China Project has previously reported on uncertainty amid new guidelines to reopen movie theaters, hotels, and sports venues.

Even 90% of normalcy is not guaranteed. Wú Hǎishān 吴海山, a deputy general manager at WeBank, recently wrote in Sixth Tone:

By analyzing satellite images of key steel mills from September 2019 to now, we found China’s steel industry had recovered from a low of 29% of baseline SMI to nearly 80% in mid-February, and was back up to 90% of the baseline by early March. But production has since fallen as the COVID-19 pandemic has cut into global demand.

To address the ongoing economic pain, Beijing is providing modest stimulus in waves to support different sectors of the economy. Here are some of the measures being implemented:

- China’s central bank is increasing lending to small businesses. Per Caixin, “as much as 440 billion yuan ($62 billion)” will be provided to regional banks to distribute to small businesses.

- Beijing is providing direct stimulus to local governments. The SCMP reports that rather than channeling money through provincial governments, which typically distribute funds to local governments in their jurisdictions, 2 trillion yuan ($281.2 billion) will be given directly to local governments.

- Beijing’s city government is giving consumption vouchers worth $1.7 billion starting this Saturday, according to Bloomberg (porous paywall). This appears to be the most ambitious local consumption voucher program yet in China during COVID-19, though other programs go back as early as March and totaled almost $3 billion through mid-May.

Other measures under consideration include using $28 billion from government bond sales to address risks in the banking sector, per Bloomberg (porous paywall).