Google parent company Alphabet is back in China (because it never left)

While widely credited with "having left China," Google still operates a significant in-country presence and through its parent company, Alphabet, continues to launch new projects in China and invest into Chinese companies of all sizes.

Alphabet Inc. on Tuesday of last week removed a mobile application from its Google Play Store that helped users locate and delete apps developed by Chinese-based companies. The app, “Remove China Apps,” was developed by Indian firm OneTouch AppLabs, gaining popularity due to growing anti-China sentiment in India since the first kerfuffle of what is now a serious security situation at the Himalayan border region between the two countries.

While the move received criticism, Sameer Samat, the Vice President of Android and Google Play, clarified the decision in a blog post, writing that Google doesn’t “allow an app that encourages or incentivizes users into removing or disabling third-party apps or modifying device settings or features unless it is part of a verifiable security service.”

Just days earlier, YouTube, another Alphabet subsidiary, disclosed that its algorithm had automatically, albeit “accidentally,” removed certain phrases criticizing the Communist Party of China.

This is not the first time Alphabet has faced scrutiny for its actions in or related to China. Indeed, Google famously “exited China” circa 2010 when it sanctimoniously declared it would no longer censor its search results, which it only did after years of protest from employees and human rights activists, in addition to the resignation of its China president, Kai-fu Lee (李开复 Lǐ Kāifù).

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Yet all these years later despite minimal public awareness of the fact, Alphabet and its subsidiaries continue to invest in partnerships and projects in the world’s largest internet market. Verily, an Alphabet “moonshot” project in the life sciences space, has multiple job openings in China as the company races to roll out Project Baseline, an ambitious new research venture focused on COVID-19 antibody testing. (It should be noted that many of these job openings in China were on their site way before COVID-19, so their presence there isn’t just a collaboration to solve the current crisis).

Verily is just one of a few Alphabet companies that currently have operations or employees in China, one of which is Google itself with more than 300 employees in-country.

Beyond direct operations, Alphabet also makes investments in Chinese companies on a regular basis through CapitalG, it’s private equity fund, and Google Ventures, its venture capital fund.

Multiple China projects have been launched over the years

In May 2018, Waymo, a driverless-car company owned by Alphabet, registered a Shanghai subsidiary called Huimo Business Consulting. It started with an initial capitalization of around $500,000 and its business registration includes services like logistics management consulting and supply chain consulting. According to a report from McKinsey and Company, by 2030, China will become the world’s largest market for autonomous cars, with total revenues expected to exceed $500 billion.

However, Waymo’s place in the world’s largest consumer market is far from secure, given stiff competition in the self-driving vehicle market from SAIC Motor — China’s largest carmaker, working in conjunction with Alibaba — and Germany’s BMW and Daimler, who are already licensed to test autonomous vehicles on the ground in China.

A game on Chinese social networking app WeChat, “Guess My Sketch” (猜画小歌 cāi huà xiǎo gē )represented another Alphabet attempt to gain footing in China’s market. The AI-powered drawing game dominated WeChat in the first 24 hours of its release in July 2018 and was shared by nearly 1 billion users. The game is similar to the web-based Quick Draw game that Google launched outside China in 2016.

Alphabet’s ongoing investments in China also include $550 million for a 1% stake in NASDAQ-listed JD.com, the second-largest e-commerce platform in China behind Alibaba. As part of the deal, JD.com joined Alphabet’s online merchant advertising platform, Google Shopping.

In January 2018, Google led a $120 million series D direct investment in Chushou, a Chinese mobile game live streaming platform, alongside investing in Manbang Group, a truck-hailing company. In 2015, Alphabet executives noted there were about 500 employees in 2015. That number has since increased to 700 people, mostly salespeople or engineers, across offices in Beijing, Shanghai, and Shenzhen.

Prior to Trump’s addition of Huawei Technologies to a trade blacklist in 2019, Google enjoyed a longstanding strategic partnership with the Chinese technology behemoth. Huawei — now the world’s third-largest smartphone manufacturer by market share — runs a version of Alphabet’s Android operating system on its devices. And in January 2018, they formed a partnership to enhance their mobile messaging platforms. A Huawei press release confirmed that its mobile phones would integrate Google’s Android Messages across Huawei’s smartphone portfolio.

However, in May 2019, Alphabet suspended business with Huawei that required the transfer of hardware, software, and technical services, exchanging only that already publicly available via open source licensing. While users of current Huawei smartphones with Google apps were permitted to continue to use and download app updates, Huawei lost access to proprietary apps and services provided by Google.

In April 2018, CapitalG joined with Japan’s SoftBank and others to invest $1.9 billion into a Chinese transportation startup called Manbang, which is basically “Uber for big trucks.” That same year, Google co-invested $15 million with Tencent and others into a Chinese biotech startup called XtalPi. In November of last year, CapitalG teamed up with many of the same Manbang investors to put $15 million into a Chinese investment information sharing platform called Ucaidao, according to Crunchbase, a U.S.-based aggregator of private investment information.

Not just apps and deals, but Google’s hardware supply chain, too

Alphabet has also turned to China over the years for production server and data center components. 9to5google, a Google-focused blog and news site, notes that while many of Google’s hyperscale data center peers purchase complete server racks from China, Google typically only buys components, preferring to do final assembly and customization in-house. While sourcing of many of these components is being moved out of China to avoid Trump-imposed tariffs according to numerous public reports throughout 2019, it remains unclear how much hardware Google directly sources within China.

In 2018, Google announced the Titan Security Key, which ensures secure logins into online web services, at its annual Cloud Next conference in San Francisco. CNBC reported that the product is manufactured by Feitian, a Beijing-based security company listed on the Shenzhen Stock Exchange. Amid all the other headlines, “Google manufactures security-focused device in China” strikes a discordant note.

Nest, an Alphabet company that sells hardware products like smartphones, smart speakers, and thermostats, that collect vast amounts of data from private homes around the world, continues to advertise job opportunities in China. Most of the openings are for engineers to test products and to recruit manufacturing and supply chain managers. But to avoid the tariffs resultant from the U.S.-China trade conflict, Alphabet recently relocated much of its Nest production and server motherboard manufacturing to Taiwan and Malaysia.

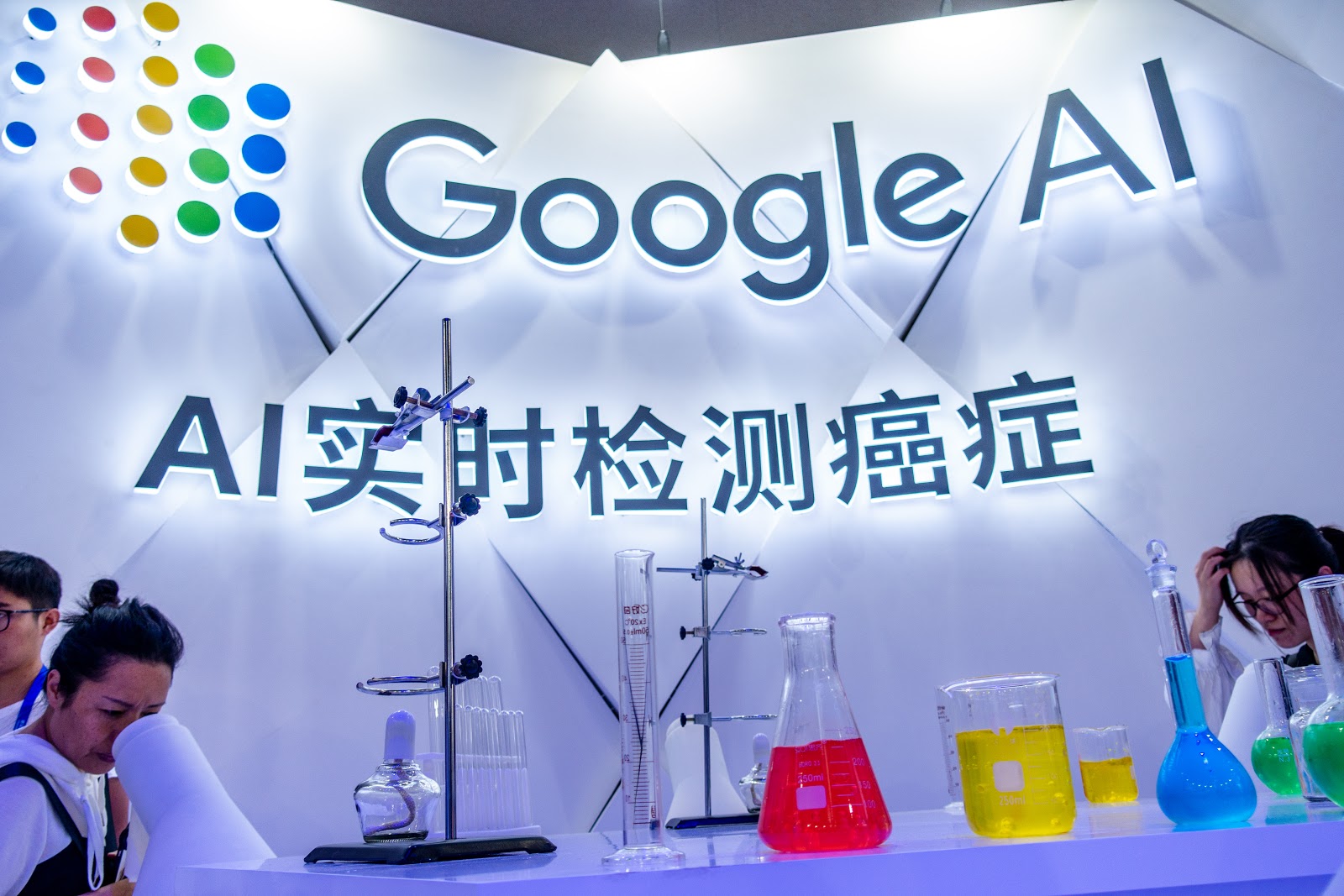

People visit the stand for Google’s AI technology demonstrating real-time cancer detection during the 2018 World Artificial Intelligence Conference in Shanghai, China, 22 September 2018. Credit: Oriental Connect via Reuters.

Not just apps and hardware, but cutting edge technologies of the future

In 2017, Alphabet launched the Google AI China Center in Shanghai, comprised of a team of Beijing-based researchers, to focus on “basic research.” The research facility is based in Beijing, where Google has an existing office, and has hired employees with backgrounds in machine learning. Dr. Fei-Fei Li (李飛飛 Lǐ Fēifēi), chief scientist at Google Cloud, wrote, “I believe AI and its benefits have no borders. Whether a breakthrough occurs in Silicon Valley, Beijing or anywhere else, it has the potential to make everyone’s life better.” Dr. Li left Google and the project to return to her professorial work at Stanford less than a year later, and the current status of the Google AI China Center is difficult to guess given a dearth of public reporting on it since its founding.

The move has stirred questions among some of political allegiance. Billionaire Silicon Valley investor Peter Thiel, one of President Trump’s highest profile supporters in the tech industry, has previously accused Google of having a “seemingly treasonous” relationship with China. In a New York Times op-ed, he expressed concern over Google’s AI center in China, given that it is a beneficial military tool — “valuable to any army” — to gain an intelligence advantage, for example, or to penetrate defenses in the relatively new theater of cyberwarfare, where we are already living amid the equivalent of a multinational shooting war.

Google has maintained that it does not work with the Chinese military. Treasury Secretary Steven Mnuchin met with CEO Sundar Pichai in July 2019 to discuss the company’s AI work in China and later told CNBC that he had not seen “any areas where Google is working with the Chinese government in any way that raises concerns.”

Alphabet subsidiary Verily Life Sciences prepared to enter the Chinese market in early 2017 with an $800 million investment from Singapore state-owned investment firm Temasek Holdings. Bloomberg speculated this indicated a near-term entrance into the China market by Verily, who could use Temasek’s expertise as it expands into Asia

Verily specializes in data-driven life sciences research and software development for the healthcare field. Verily partners with various research institutions, including the Broad Institute and the National Institutes of Health, to connect researchers with data sets through cloud-based technology. Among numerous other projects, the company also innovated an artificial intelligence application to test for heart disease, as Quartz reported.

The company continues to list open job opportunities in China for software engineers, UX designers, software quality engineers, senior test engineers, and more. One listing for a Security DevOps Engineer requires, as a minimum qualification, proficiency with Alibaba and Tencent Cloud.

A long history in the making

Alphabet and China share a complex and controversial history, riddled with starts and stops, that dates back to the early 2000s.

Then-known just as Google and without all its current subsidiaries and brands, its first attempt to break into the world’s largest consumer market was short-lived. The search engine launched Google.cn in 2006 and promptly shut it down in 2010 after public disputes over censorship (Google.cn had to censor search results to win legal approval to operate in China). Then, in 2018, reports emerged that the conglomerate was developing a prototype of a new, censored Chinese search engine known as Project Dragonfly. Public furor, on top of internal rifts that resulted in several Google employee resignations, effectively ended the project in 2019.

However, to this day, Google — now Alphabet — refuses to give up on China. They’re back, because they never left, and it’s unclear what, if anything would bring Alphabet’s China run to a real end.

A Timeline of Google’s China Activities

2000: Google adds Chinese language support to its global Google.com search engine

|

2005: Google hires Kai-fu Lee, a former Microsoft exec, to be President of Google China, expands into new offices at Tsinghua Science Park at China’s Tsinghua University, and announces formation of China research and development center

|

2006: Google launches Google.cn search engine

|

2007: Google acquires a $5 million stake in Xunlei, a Chinese search engine

|

2009 March: YouTube blocked in China for showing Chinese security forces beating Tibetans

|

2009 September: Kai-fu Lee, head of Google China, leaves abruptly to start a venture fund, although many note that Google had been losing market share in China and was under pressure to stop censoring search results to retain access to the China market

|

2010: Google shuts down censored China search engine after reporting Chinese state-sponsored hacking attacks on them and other major Western tech companies

|

2014: Gmail, GSuite, and other core Google products are blocked in China

|

2015: Chinese AI company Mobvoi receives series C funding from Google after forming partnership

|

2016: Google holds a China-specific version of its Google Developer Day event at the China National Convention Center and revives use of the Google.cn URL for the first time since 2010

|

2017 January: Alphabet’s Verily Life Sciences, a biotech company, prepares to enter the Chinese market

|

2017 May: Google announces it will launch a new investment arm investing in early-stage artificial intelligence startups, CapitalG

|

2017 August: Google begins offering TensorFlow machine learning platform for free in China at tensorflow.google.cn

|

2017 December: Google hosts second Google Developer Day China event and announced launch fo the Google AI China Center

|

2018: Google begins building Dragonfly, a censored search engine

|

2018 January: Google invests $15 million with Sequoia China and Tencent in U.S.-China biotech firm XtalPi (晶泰科技)

|

2018 January: Google directly invests in $120 million financing round for Chinese video gaming platform Chushou

|

2018 January: Google signs a patent licensing deal with Tencent

|

2018 April: Google co-invests part of $1.9 billion financing round for Manbang, China’s “Uber for big trucks”

|

2018 May: Alphabet’s Waymo, a self-driving car company, establishes a Shanghai location with $500,000 initial capitalization. China is the world’s largest car market.

|

2018 June: Google invests $550 million in Chinese ecommerce platform JD.com. JD.com in exchange joins Google Shopping.

|

2019 July: Google shuts down Dragonfly after widespread controversy

|

2019 November: CapitalG invests part of $15 million funding round for Ucaidao

|

2019: Google unwinds some China activities, including certain types of hardware manufacturing due to trade war tariffs and Huawei licensing partnerships due to regulatory issues

|

2020: No major announcements in 2020, though the company still employees cumulatively more than 500 people in China and has numerous job openings in China posted at all times

Google has five China locations: Hong Kong, Shenzhen, Guangzhou, Shanghai, and Beijing. Verily and Waymo, Google subsidiaries, both have Shanghai locations, and Google’s new AI research center is based in Beijing. Another one of Google’s China footprints is through CapitalG, Alphabet’s investment arm that has deployed an increasing amount of capital in China through AI investments.