The rise of plant-based meat in China

Foreign and domestic companies vie for China’s meatless market.

Demand for plant-based meat is surging in China, the world’s leading consumer and importer of pork, as concerns about swine disease and possible links between animal meat and the coronavirus pandemic spur many consumers to rethink their diet and health. And several plant-based protein producers are lining up to fill that demand and expand their footprint in China’s lucrative meatless market.

Vegetarian meat alternatives were already on track for major growth in China before the pandemic, with consultancy Euromonitor predicting China’s plant-based meat market would grow from around $10 billion in 2018 to nearly $12 billion by 2023. Aside from those numbers, there are plenty of other reasons to believe China’s meatless market is ripe for entry.

African swine fever wiped out 180 million of the country’s hogs last year, and reemerging swine disease outbreaks in China are still posing major obstacles for pig farmers and slaughterhouses across the country. Ongoing concerns surrounding pork in China are driving the cost of pork — which reached record highs in November — to rise again. China is also continuing to ban meat imports from various countries amid the pandemic, as coronavirus outbreaks have sickened hundreds of workers at meat-processing companies across the globe.

The Chinese government was already aiming to cut the country’s meat consumption by half by the year 2030, and research suggests the population could be open to it. A consumer survey conducted by a New Zealand research institute in 2017 suggested 39% of Chinese people are reducing their meat intake. A 2019 study published in the academic journal Frontiers in Sustainable Food Systems found that, of Chinese respondents, “62.4% were very or extremely likely” to purchase plant-based meat. The authors of the latter study do note that the average Chinese respondent was “disproportionately urban, high income, and well-educated” in comparison to the national average.

That acceptance of plant-based protein is good news for food companies vying for market share in China. In April, Starbucks locations in China began offering a vegetarian-friendly lasagna made with meat alternatives from the California-based Beyond Meat. In June, Beyond Meat made its burger debut on the mainland through a partnership with Yum China, the restaurant company that operates KFC, Pizza Hut, and Taco Bell stores in China. KFC offered Beyond Burgers for a short trial run at select locations in major cities, including Beijing and Shanghai. Pizza Hut also added the burger to its menu for a few days, marking the chain’s first foray into flipping patties in China. Taco Bell served up a week of tacos made with Beyond Burger patties at three of its Shanghai stores. In July, Beyond Meat made its way onto grocery store shelves at Freshippo, Alibaba’s supermarket chain (“Hema” in Chinese).

Last year, Beyond Meat’s biggest rival, Impossible Foods, debuted its plant-based product in China during the National Import Show in Shanghai. “By transitioning to plant-based meat, China can help boost quality of life for everyone, avert biodiversity collapse and reduce the impact of global warming,” said Impossible Foods CEO and founder Patrick Brown in a press release. Earlier this year, Impossible Foods secured $500 million in funding, mostly from investors in Asia, and is now valued at $4 billion. The company, also based in California, hit that milestone even amid global economic turmoil brought on by the pandemic.

But these two big players aren’t the only brands seeking meatless market share in China. Beyond Meat and Impossible Foods could be up against stiff competition from homegrown Chinese companies. Whole Perfect Food, a Shenzhen-based company also known as Qishan Foods, already occupies a large chunk of China’s meat alternative market and makes annual sales of $44.6 million from its massive range of plant-based products. Founded in 1993, the manufacturer sells more than 300 items, including faux oyster sauce and plant-based abalone. Now, the brand is further expanding its product range, recently introducing dozens of mock sausage varieties made from pea and soy protein. The company also teamed up with Walmart last year to launch its products at store locations in China.

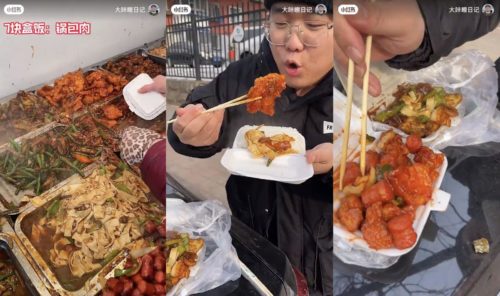

Newer players are also vying for a piece of the plant-based pie. Food tech company OmniFoods developed the ground pork alternative Omnipork, made from soy, pea protein, mushrooms, and rice, and in 2018, Hong Kong restaurants began serving Omnipork in soup dumplings, or xiao long bao, as well as sweet and sour pork and pork-stuffed mushroom. The company recently followed that up with Omnipork Luncheon, a plant-based luncheon meat. David Yeung, founder of the social enterprise Green Monday, which launched OmniFoods, believes plant-based pork alternatives have more appeal than mock chicken or mock beef in Asian countries. “In Asia we need different types of products and meat alternatives. Western companies focus on Western cuisine,” he told South China Morning Post.

Another newcomer, plant-based protein producer startup Zhenmeat, began selling mooncakes made from plant protein during last year’s Mid-Autumn Festival. The company is looking to raise $2 million in capital this year, and recently launched two new products that aim to satisfy the tastes of Chinese consumers: deep-fried mock pork tenderloin made from pea, soy protein, and sweet potato starch; and plant-based crayfish made from seaweed and kanuka extracts. In addition to being the largest consumer and importer of pork in the world, China is also one of the largest consumers of crayfish.

“Our unique advantage is to find the most favorite dishes in China and use tech to replicate these meat dishes,” Zhenmeat founder and CEO Vince Lu told CNBC.

Whether they already consume strictly plant-based diets or they are exploring flexitarian dining habits, Chinese consumers should have plenty of meatless options to choose from in the years to come. It remains to be seen whether incumbents like Whole Perfect Food, newcomers like Zhenmeat, or foreign brands like Beyond Meat and Impossible Foods will end up dominating that lucrative market.