After rental firm Danke’s crash: Conflicts and a 20-year-old’s suicide

The apartment-rental company Danke started fast, using a clever financing scheme to earn capital. But it seems like the cash has run out, and its customers — tenants in particular — have been left in the lurch.

In the early hours of December 3, after setting fire to his 10-square-meter room, 20-year-old Zhōng Chūnyuán 钟春源 jumped out of his 18th-story window to his death.

That day was the deadline his landlord had set for him to move out, even though he had paid an entire year of rent through the online broker Danke Apartment (蛋壳公寓 Dànké gōngyù), using a loan via Danke’s partner bank, WeBank.

Zhong’s family told the media they would sue Danke, pending the results of a police investigation, according to Pear Video. This is merely the latest in a string of stories that have cast the secondhand apartment rental company in a terrible light.

How a start-up boasting of “financial innovation” collapsed

Housing is always difficult in big cities for young people with limited income. In China’s megacities, most available apartments are owned by individuals and designed for families, which are often too expensive for single tenants.

It was into this situation that Danke was founded in 2015, with promises to offer young people “affordable” apartments in metropolises through co-living. It expanded aggressively, but burned through its cash just as fast.

Danke sourced flats from property owners, renovated and furnished individual rooms as single units to rent. Despite paying an above-average price to property owners and offering more discounts to tenants, Danke encouraged — one could say lured — tenants to pay a year’s rent upfront.

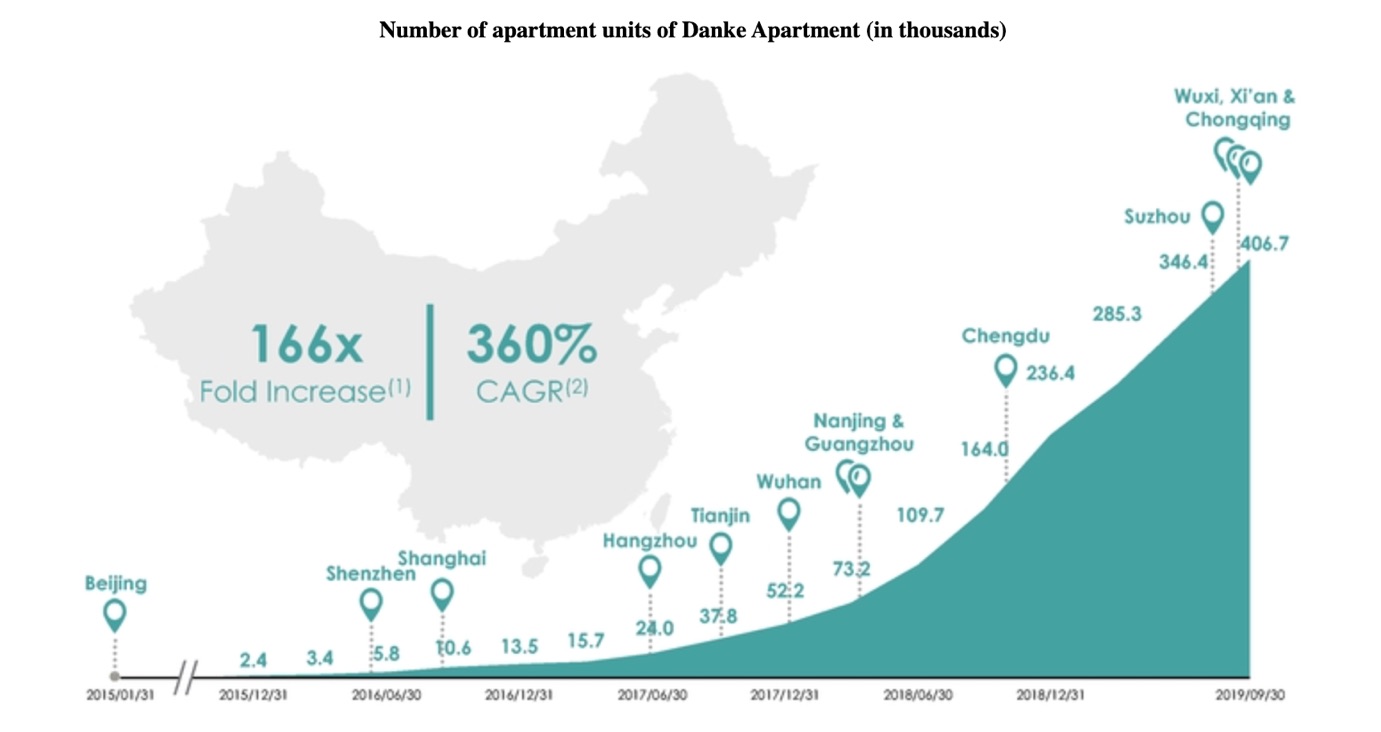

As Danke’s owner, Phoenix Tree — which got listed in New York in January — boasted in its prospectus: “We utilize the upfront payment from the financial institutions to support our expansion.”

In just five years, Danke expanded from Beijing to 13 cities, expanding from 2,434 apartment units at the end of 2015 to 415,459 at the end of this year’s first quarter, according to public filings.

But it seems like the cash has run out.

In June, Gāo Jìng 高靖, Danke’s founder and CEO, was detained by police for an investigation related to another company he previously worked for. The rental firm’s equity financing was interrupted, China’s business magazine Caixin reported on December 7 in a cover story.

Derek Shen (Shén Bóyáng 沈博阳), who was the chairman, resigned around this time, the report said.

The COVID-19 pandemic has also worsened Danke’s cash flow. The company made a net loss of 1.23 billion yuan ($174.3 million) for the first quarter of this year, compared with a loss of 816 million yuan ($125 million) over the same period in 2019.

The result: Early last month, Danke failed to pay landlords, contractors, and even its own employees.

“We are not in bankruptcy and we will not run away,” Danke posted on its Weibo account on November 16.

But tenants in major cities such as Beijing, Shanghai, Guangzhou, and Hangzhou were evicted en masse. Many refused to move out, arguing that they could not afford finding another place while they were still paying off their monthly installments. Some landlords cut off the water and power, or even changed the locks.

Zhong Chunyuan was in an especially dire situation. After graduating from university this summer, he had been unable to find a job, Yi Dichan reported. After his death, the hashtag #广州蛋壳18楼租客坠楼 (Guǎngzhōu dànké 18 lóu zūkè zhuì lóu — “Danke tenant in Guangzhou jumps from 18th floor”) on Weibo has seen at least 40,000 posts and 250 million views.

What’s next?

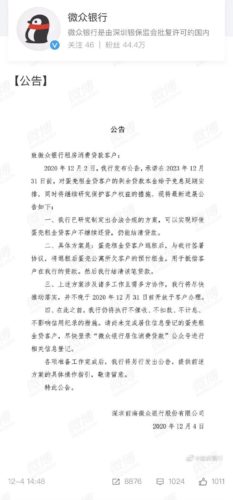

On December 4, the day after Zhong’s death, WeBank, Danke’s partner bank, announced that tenants who move out from their flats do not have to pay future installments and that their credit would remain stainless. WeBank would instead collect what was owed from Danke.

WeBank is China’s first digital bank, backed by Tencent.

The government has been working to find buyers to take over or investors to finance the cash-strapped rental firm. But for now at least, no one seems willing to take on Danke’s debts, according to Caixin.

On Seeking Alpha, a financial research platform, one analyst had this to say about the prospects of the company: “The fundamentals are eroding even as the reputation of Phoenix Tree goes down the drain. Landlords and tenants would have a longer memory of its bad character than investors. Phoenix Tree looks unlikely to rise from the ashes.”

The future of Danke remains unknown, but the anxiety and concerns it has raised are clear — as of press time, there have been more than 320,000 posts with the hashtag #DankeApartment, receiving more than 900 million views on Weibo.