Huarong was born from one global crisis. Will it survive the next?

Huarong, a state-owned debt management company, indirectly owns shares in almost 80,000 Chinese companies. But as rumors swirl about Huarong's financial health, we need to scrutinize the entirety of China's larger state-owned financial sector.

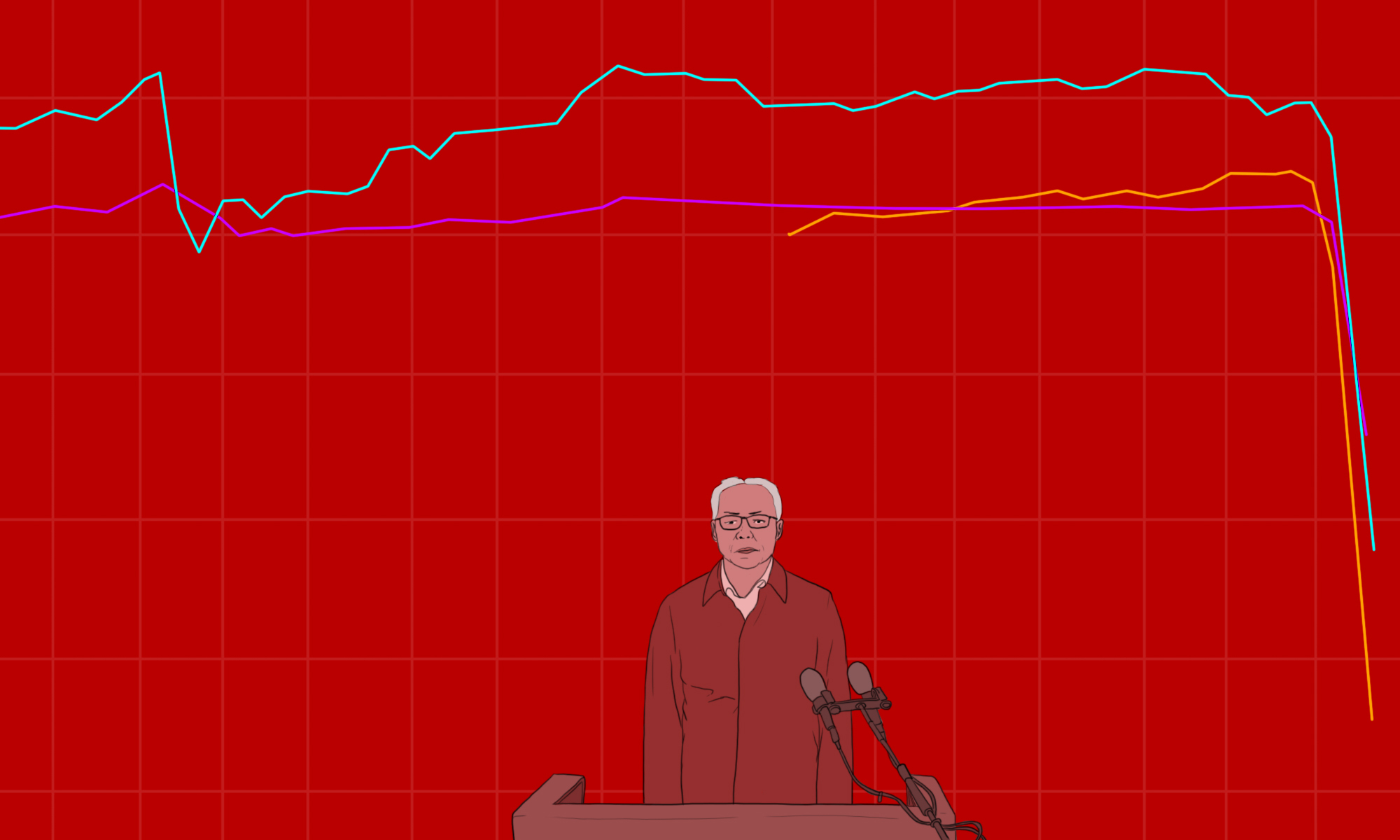

Perhaps no state-owned entity has received more attention this past month than Huarong Asset Management Co., a publicly listed distressed debt manager and one of China’s “Big Four” state-owned asset management companies. In late March, after the company failed to produce its 2020 annual report, rumors circulated that the company was on the verge of bankruptcy. Huarong bonds plummeted for weeks until banking regulators assured the public that the company had sufficient liquidity, a statement which was widely understood as a signal of government support. Even now, the true state of Huarong’s current finances remain unknown.

Huarong’s troubles began in 2018, when company chairman Lài Xiǎomín 赖小民 was arrested on corruption charges. Under Lai, Huarong became the lender of last resort for many hard-hit state-owned companies, and became a shadow banking powerhouse. Earlier this year, Lai was executed for using his position as company chair to accept or ask for bribes amounting to 1.8 billion yuan ($277 million), an unusually severe penalty for a corruption case.

But this story is about more than just one big state-owned company gone wrong. It is also the story of how China’s state-owned financial sector was able to create the illusion of fiscal health by accumulating more unhealthy debts. Huarong is one of four key institutions created by the Ministry of Finance to help China weather the 1997 Asian financial crisis by cleaning up toxic bank loans. After the 2008 global financial crisis, the weight of bad debt in China’s economy shifted — as did Huarong’s primary focus — from banks to state-owned enterprises (SOEs). While the shift did wonders for all parties’ balance sheets, it allowed bad debts to accumulate for both SOEs and asset management companies.

Huarong was created to deal with one financial crisis and was only able to survive by living off the excesses resulting from another. Today, the world is again in economic turmoil, and Huarong and the other state-backed asset management companies are still dealing with the aftereffects of the last two crises. If China is to avoid being pulled into a financial crisis by the nation’s debt management companies, it will need to break their cycle of rolling debts: It must either clear their debts, or let them fail.

How it all began

Huarong is an asset management company (AMC) created with the express purpose of selling non-performing loans from government institutions. In the late 1990s, China’s big four state-owned banks were bogged down by bad loans, most of which were linked either (in Chinese) to state-backed programs or SOEs. To clean up the major banks’ balance sheets and free them to pursue profitable businesses, China’s government created four AMCs in 1999 — Huarong, Cinda, China Orient, and Great Wall — each corresponding to one of the big four state-owned banks. The AMCs were immediately tasked with purchasing the debt from the banks at full value, which they were to sell to private investors to recoup losses. Meanwhile, the big four banks would be freed from their negative assets, allowing them more freedom to invest in the economy.

What makes the founding of the big four AMCs unusual is that they were required from the start to purchase high-risk loans from state-owned banks at full price — as if they were a low-risk loan from a healthy creditor. To do so, the AMCs had to borrow about 1.4 trillion yuan ($170 billion) from the central bank. They were given 10 years to repay the bank, with the expectation that their core business would be selling high-risk state-owned bank debt. In other words, the companies were required to shoulder all the losses incurred from bad bank investments, while also paying additional interest. Given there was no initial expectation of alternative sources of revenue, the AMCs had been handed an impossible task on day one.

Climbing out of the hole

By 2009, the AMCs had successfully disposed (in Chinese) of about 80 percent of the bad loans they had received, at only 20 percent their original value. Yet because the original bad debt purchase in 1999 was done with borrowed money, they still owed the original value of the bad loans plus interest to the central bank. By the time the central bank’s bill came due, the AMCs were only able to pay off the loan’s interest, according to reporting at the time (in Chinese). China’s government ruled to allow the AMCs a 10-year extension, during which interest would continue to accrue.

But by this time, the AMCs had expanded their businesses (in Chinese) to include other forms of debt products, and some were angling to be broader financial institutions. Huarong was one of the forerunners of this, spearheaded by then chairman Lài Xiǎomín 赖小民 (in Chinese). In 2012, to assist Huarong with its ambitions to become a commercial finance entity, the Ministry of Finance opened (in Chinese) a “shared account” (共管账户 gòngguǎn zhànghù), which allowed the ministry to lend money to Huarong to repay its original debt to the central bank.

This move helped clean up Huarong’s balance sheet so it no longer appeared to be in debt and could market itself as a broader financial institution, but Huarong was still expected to repay capital and interest. In essence, Huarong was exchanging one IOU to the government for another.

Had the government forgiven Huarong’s debt, the company would have been free to seek out whatever opportunities it chose, and Huarong’s future may have been different. But Huarong still owed the government money based on its original mission to deal with state-owned bank debt from the 1990s. The only way to pay off Huarong’s bill was to seek out the highest possible returns on investments — by making investments no one else was willing to make.

Turning a profit

For Huarong to pay off its bill, it would need to move away from its original core business. Fortunately for Huarong, lending regulations relaxed significantly after 2008 in an effort to protect China’s economy from the global financial crisis. Huarong managed to become highly profitable by pursuing company equity.

Many of Huarong’s acquisitions came directly from its purchase of distressed government debt. After purchasing debt from state-owned enterprises, rather than re-selling the debt or liquidating businesses, Huarong would pay off debts in exchange for company shares. In many cases (in Chinese), local governments aiming to protect local SOEs wouldn’t give Huarong any other option. The option to swap debt for equity is common in financial markets around the world, but rarely is it done at the scale that Huarong and other AMCs relied on it.

With the economic boom of the 2010s and loose lending regulations, Huarong and the other big AMCs pivoted from meeting their obligations to turning a profit. According to an employee (in Chinese) at another big AMC, “During that period of relaxed regulatory oversight, debt financing was basically the same as bank lending.” Companies would hand over equity to AMCs to paper over bank debt or to finance projects (such as real estate development). For many companies, the approval process was faster and easier (in Chinese) since there was less legal oversight than in the banking sector. Today, Huarong directly owns shares in over 300 companies (in Chinese). An initial estimate made using Chinese public records in Sayari Graph shows Huarong indirectly owns shares in almost 80,000 Chinese companies.

During the 2010s, most sectors of the economy were booming. Those that were not could just take out another loan against future projected earnings. Real estate likewise tended toward high projected values, as magnates envisioned future commercial centers across the country. Huarong was able to profit from both growing profits from SOEs buoyed by China’s rising GDP and anticipated earnings from its assets.

A third global crisis

Today, the world is navigating yet another global economic downturn resulting from the COVID-19 pandemic. Though Huarong was created from the ashes of one crisis and found immense profit thanks to the response to another, the company’s good fortune may be running out. Some of Huarong’s highest profile acquisitions — such as HNA Group and Dandong Port Group — have gone bankrupt. Bloomberg estimates that SOEs currently carry approximately $4.1 trillion in debt, and failed to repay 57 percent of their repayment obligations in 2020. This is particularly bad news for Huarong, who had come to depend on SOE profits to repay their own debts.

Huarong’s problems may be the most visible of the four big AMCs, but its business model is no different. Cinda Asset Management Co. directly owns shares in 400 companies (in Chinese); China Orient Asset Management Co. owns shares in 440 companies (in Chinese); and Great Wall Asset Management Co. owns shares in 170 companies (in Chinese). Indirectly, the three own shares in hundreds of thousands of enterprises.

The growth cycle of the 2010s which Huarong used to pay off its original debts is not likely to happen again, requiring new sources of income to offset these losses. Unfortunately, Huarong and China’s government appear to be approaching the company’s financial problems by using old methods: passing debt to someone else. Reportedly, Huarong has proposed offloading their unprofitable assets — very similar to how the AMCs were originally conceived in 1999. To buy time while regulators consider Huarong’s options, state-owned bank Industrial and Commercial Bank of China has agreed to lend Huarong money to repay the AMC’s obligations through August. But taking out a loan to repay debt just perpetuates the cycle Huarong has been trapped in since its inception.

If Huarong were to truly break the cycle, one of two things needs to happen. Either the government (or a state-owned bank) gives — rather than lends — it the capital needed to clear its debts, or the government lets it fail. In the former, the capital can come with strict requirements for restructuring — Huarong, at least, would be able to come out without future obligations or compounding interest. In the latter, Huarong would be absolved of repaying any obligation and would pass any responsibility on to their primary shareholder, the Ministry of Finance.

Huarong and the other big AMCs were meant to protect China from the Asian financial crisis. To do so, they were given an impossible task — to repay the full price of the state-backed banks’ debts with no other assets to speak of. They completed their mission only by taking advantage of lax regulations and a fast-growing economy made possible by countermeasures to the 2008 global financial crisis. Now bad debts are catching up again. The question is, will China’s government allow Huarong and other state-backed financial institutions to finally write off their bad debts even if it puts them in the red — or will the government find another way to roll these debts over (with interest) until the next financial crisis?