Industrial robots have taken over China’s warehouses and factories, but China can’t yet make their components

New energy industries are leading a big demand for industrial robots in China, but the high-precision components still have to be imported.

Yesterday, Tencent 腾讯 released the second generation of Max, a quadruped robot dog developed by Tencent Robotics X laboratory, which was established in 2018. Max can use visual positioning, terrain recognition, omnidirectional motion planning, and predictive control to accurately identify complex environments and adapt in real time. Max can also jump and do somersaults, with the ability to calculate the optimal trajectory.

The Chinese business press has been especially abuzz with robots since last Thursday, when Tesla CEO Elon Musk showed an image of Tesla’s Optimus humanoid robot prototype at the company’s annual shareholder meeting. Musk stated that Optimus will be revealed in September, and production will commence in 2023.

Robots are building NEVs and batteries

Aside from the dog bots and Tesla marketing hype, the real use of industrial robots is increasing rapidly in China. According to Ministry of Industry and Information Technology data, China produced 366,000 industrial robots in 2021, a year-on-year increase of 67.9%, and in 2020, the use of industrial robots in 52 industries reached a ratio of 246 units per 10,000 workers, which is nearly twice the global average.

In December last year, the Ministry released an industrial robot development plan to strengthen innovation and training in 14 key areas such as intelligent manufacturing and industrial software.

According to the National Bureau of Statistics, in the first half of this year, China’s total output of industrial robots was 202,000 units, a year-on-year decrease of more than 11%. Production in April and May fell by 8.4% and 13.7% year-on-year, respectively, but expanded by 2.5% in June. Industrial mobile robots (usually wheeled) are widely used in China for automobile assembly, consumer electronics, logistics and warehousing, and many other industries.

So far this year, demand for industrial robots from the computing, consumer electronics, home appliances, and metal processing industries has been softer, but demand is particularly strong in the automotive, medical, microchip, and new energy industries, including new energy vehicles (NEVs) and photovoltaics. In particular, demand for robots in the lithium-ion battery industry is soaring:

- According to an industry report released in June, by 2025, demand for industrial robots and mobile robots in the lithium battery industry will exceed 67,000 units and 25,000 units, respectively, with compound annual growth rates from 2021 to 2025 of 35% and 38%.

- Domestic battery companies are perennially seeking to increase automation of their product lines, and hence are introducing robots for more tasks such as material handling, loading and unloading, welding, assembly, and testing.

But China’s robots are still on a long catch-up road

Despite the growing use of industrial robots, the three core high-precision components — reduction drives to shift the speed of rotating components, controller computing systems to manage movement and perception, and servomotors to control positioning, velocity, and acceleration — are almost all imported from Germany and Japan. Reduction drives, for example, which usually account for about 35% of the cost of industrial robots, have always been imported from Japan.

China’s leading industrial robot manufacturer, Estun Automation 南京埃斯顿自动化, finds itself at least 10 years behind global manufacturers like ABB Group, headquartered in Switzerland. Estun still relies on imported technology and components, and is also hamstrung by a lack of human resources in China. There is a scarcity of trained professionals for the full range of robot manufacturing, from basic operation and programming to complex debugging and maintenance, and a system of robotics training and education has not yet been fully established in China.

Yet another problem is a lack of capital investment. Trillions of yuan have flowed into the internet and mobile electronics industries, but it was only in 2020 that total investment in China’s robot industry surpassed the 10 billion yuan ($1.47 billion) level. The lack of capital has contributed to a lack of available talent, which has in turn retarted research and development.

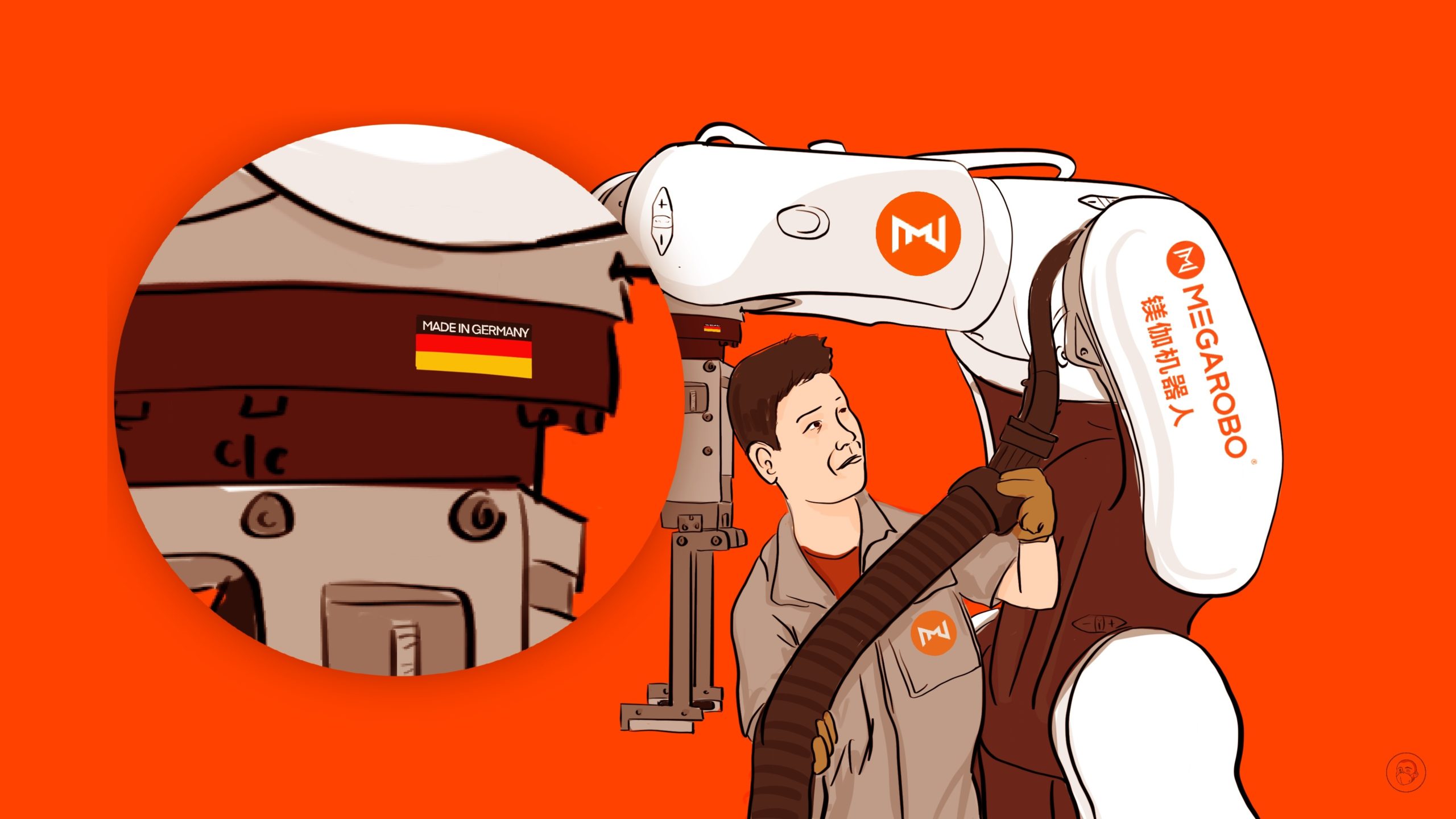

So far this year, total capital investment in the robot industry is estimated to have already reached around 5–7 billion yuan ($740 million to just over $1 billion). As of June 30, there have been 86 domestic investments, including 28 in the 100 million yuan ($14.79 million) range and 33 in the 10 million yuan ($1.47 million) range. The 86 investments went to 42 companies producing service robots for medical, household, and commercial use, 41 producing industrial robots, and three producing specialized robots, including one for removing rust from ships. The highest investment, 2 billion yuan ($295.93 million), went to Megarobo 镁伽机器人, which manufactures industrial collaborative robots (or “cobots”) that interact with humans in a shared space. The Megarobo investment in June, however, was the only one above 1 billion yuan in the first half of the year.

Overall, China has successfully transitioned to the use of industrial robots, but now faces an uphill challenge to replace foreign imports of high-precision components with domestic production. It’s no surprise that the theme of the upcoming World Robot Conference, scheduled for August 18–21 in Beijing, is “Collective creation, sharing, consultation, and benefit.”