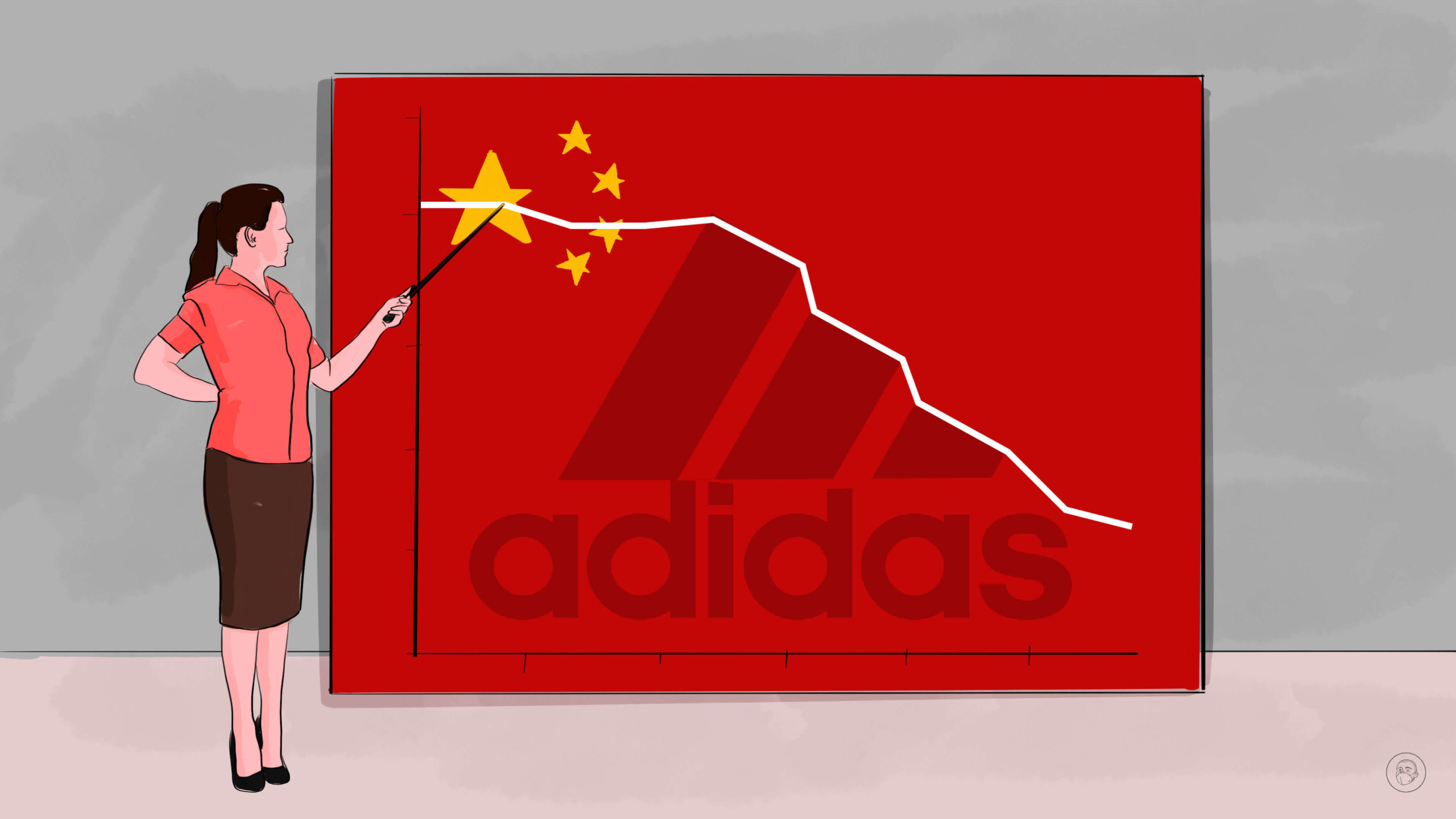

Nike and Adidas are blaming COVID for low China sales, but the numbers don’t add up

Nike and Adidas have posted major revenue losses in China, and they are largely citing pandemic-related measures as the cause. But domestic competitors like Anta and Li Ning are not seeing the same losses, so there is clearly much more to it.

Adidas has posted healthy revenue gains in its other combined markets in the first half of the year, but the company’s revenue in China dropped by 35% year-on-year, with net sales decreasing from $2.4 billion to $1.7 billion. In the first quarter, Nike reported a 55% reduction in its earnings before interest and taxes (EBIT) in China — from $691 million to $311 million.

Weak China numbers have prompted Adidas to cut its growth outlook for the rest of 2022. In the company’s latest earnings report, Adidas CEO Kasper Rørsted explained that the company’s recovery in the Chinese market was slower than expected because of COVID-related closures. In an earnings call on June 27, Nike’s Chief Financial Officer explained that the company’s reduced earnings followed the region’s most widespread COVID disruption since 2020, which impacted over 100 cities and over 60% of the company’s business in China.

But their Chinese counterparts seem to be weathering the lockdowns just fine. Li-Ning 李宁, one of China’s leading homegrown sportswear brands, posted 12.4 billion yuan ($1.8 billion) in revenue for the first half of 2022, a year-on-year increase of 21.7%. Anta 安踏 reported double digit sales growth in the first quarter of 2022, both for its flagship brand as well as the China-based subsidiary of the Italian FILA brand, which it owns. And Xtep 特步 reported a year-on year increase in revenue of over 35% in the second quarter.

On the sharp end of a ‘national tide’

Although it identified COVID as the main culprit, Adidas has acknowledged that it may need to get more in touch with Chinese consumers. In an interview with the German business newspaper Handelsblatt, CEO Rørsted conceded that Adidas had failed to sufficiently understand the Chinese market.

Following Rørsted’s comments, the topic “Adidas CEO admits to making mistakes in China” (#阿迪CEO承认在中国犯了错误#) began trending on Weibo, China’s Twitter-like social media platform. Major media like the nationalistic Guancha.cn website picked up the hashtag, garnering thousands of likes and leading hundreds of Chinese netizens to pile on in the comments, many of whom saw Adidas’ difficulties in China as directly tied to its past statements about avoiding the use of cotton from Xinjiang.

Nike and Adidas were both the targets of a boycott campaign in China in April 2021, led by state media, after they announced they would avoid using cotton sourced in Xinjiang due to allegations of forced labor in the region. This caused a surge in demand for sportswear produced by domestic companies amid a burst of nationalism from Chinese consumers.

While the boycott and social media criticism of Western brands eventually faded, they are clearly still suffering from residual negative sentiment in China. This will flare up during bouts of intense nationalism, such as U.S. House Speaker Nancy Pelosi’s recent visit to Taiwan. Western brands’ popularity is likely to wane amid the “national tide” or “national fashion” — (国潮 guócháo), which emphasizes Chinese culture and support for domestic businesses. Over the longer term, guochao may only become more prominent given its popularity among China’s youth.

Quality and price

There are certain steps Western sportswear companies can take to try and bring their China sales back up to where they once were, according to Allison Malmsten, Marketing Director at Daxue Consulting, a Shanghai-based market research and consulting firm. “First, they have to show that they are willing to localize more, perhaps by working with local brands, athletes, and designers,” she told The China Project. “They should also be leveraging digital strategies and engaging with the community more.”

“Second, they cannot allow their quality to decline,” Malmsten added, explaining that some Chinese netizens have complained that the quality of Adidas’ products has slipped since they moved production from China to Vietnam over the last decade.

Other factors besides nationalism and a failure to localize are likely at play in Nike and Adidas’ struggles in China. The country’s economy is suffering due to a variety of factors, from a collapsing housing bubble to record youth unemployment and a rural banking crisis. As financial woes mount, Chinese consumers may simply be opting to buy fewer expensive Western brands when local competitors offer similar products at cheaper prices. Although the Chinese brands have plenty of high-end products, they also sell a greater range of low-cost items.

Amid an economic downturn and a rise in nationalism that may be generational, the easy money may be over for Nike and Adidas in China.