The Chinese LED company lighting up the world’s stages

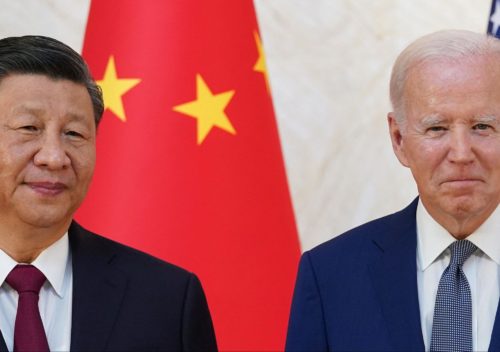

Absen is a Chinese company whose products everyone saw in 2022 in the NBA, the FIFA World Cup in Qatar, and even the G20 Summit in Indonesia.

On January 5, Absen 艾比森, a company that was founded in 2001 and listed on the Shenzhen Stock Exchange in 2014, delivered a glowing performance forecast for 2022:

- Annual revenue of 2.80 billion yuan ($414.82 million), a year-on-year increase of 20%.

- Net profit of up to 230 million yuan ($34.07 million), an increase of 668%.

Absen’s business is light-emitting diode (LED) color display screens, including outdoor and indoor screens that can be used for advertising, real estate, transportation, stage performance, radio and television, in stadia, and for security.

The company put its great showing in 2022 down to an increased expenditure on research and development. From 2020 to 2022, Absen invested about 316 million yuan ($46.81 million) in research and development expenses, including on:

- MicroLED (a next-generation emissive display technology that promises bright displays and superior image quality compared with conventional OLED, the current premium emissive display technology);

- Virtual cinematography (i.e., filming in a computer graphics environment);

- LED fire and flame displays;

- Extended reality (XR) virtual productions;

- Naked Eye 3D LED displays (i.e., with no glasses required); and

- Chip-on-board (COB) LED displays, which are brighter, consume less power, and have a higher-quality beam of light compared with conventional LED technology.

All the world’s a stage

Absen made a big splash abroad in 2022: Revenue in overseas markets increased by nearly 80% year-on-year, while revenue in the Chinese market declined slightly.

According to the technology research company Omdia, in the third quarter of 2022, Absen was the global leader in the higher-end segment of the LED market of fine pixel pitch LED displays below 1.99 millimeters, holding a global market share (excluding China) of 24%, followed by Samsung in second place with 17.2%. (Pixel pitch refers to the distance in millimeters from the center of an LED cluster to the center of the next LED package adjacent to it; the smaller the pixel pitch, the higher the screen resolution.)

In 2022, Absen’s displays were visible at some of the world’s most popular events, including:

- 2,000 square meters (21,527 square feet) of LED fence screens in all eight venues and all 64 games of the FIFA World Cup in Qatar. (Absen’s prominent role in Qatar prompted CCTV to run two broadcast segments on the company in December, in one of which the journalists visited Absen’s “smart factory” in Huizhou, Guangdong Province.)

- A 1,020-square-meter (10,979-square-foot) LED screen, reportedly the largest in Europe, installed on a high-rise building near Vienna, which used 1,400 frames of Absen’s transparent LED modules.

- An 800-square-meter (8,611-square-foot) outdoor screen at a shopping mall in Jakarta, Indonesia, the outdoor display of the Djakarta Warehouse Project (DWP) music festival, and the stage display of the 2022 G20 summit that took place in Bali.

- The 2,043-square-meter (22,000-square-foot) Airlot 21, Florida’s largest virtual production stage, which opened in March 2022 in Orlando.

- A 70 million-pixel LED screen at Salt Lake City’s Vivint Arena, home of the Utah Jazz NBA team.

Competitors

Absen may be lighting up stages around the world, but it has some serious competition in China. In the third quarter of 2022, there were two Chinese LED companies that reported much larger total revenue than Absen, which reported revenue of 679 million yuan ($100.59 million), an increase of 21.68% year-on-year, and net profit of 32 million yuan ($4.74 million), an increase of 253.48%:

- Leyard 利亚德: Revenue of 2.07 billion yuan ($306.81 million), a year-on-year decrease of 7.25%, and net profit of 164 million yuan ($24.29 million), a decrease of 30.38%.

- Unilumin 洲明科技: Revenue of 1.75 billion yuan ($259.26 million), a decrease of 7.95%, and net profit of 132 million yuan ($19.55 million), an increase of 13.24%.

Leyard is one of the global market leaders in the large format display (LFD) market, which are flat screens usually employed for commercial purposes to display advertising, information, and real-time messages in corporate and public environments. Unilumin, on the other hand, specializes in LED video wall displays and the extended reality (XR) and augmented reality (AR) market of virtual film and television production.

The takeaway

The year 2022 was a breakout year for China’s LED display companies, which are now lighting up some of the world’s biggest stages and are some of the leading global players in the industry.