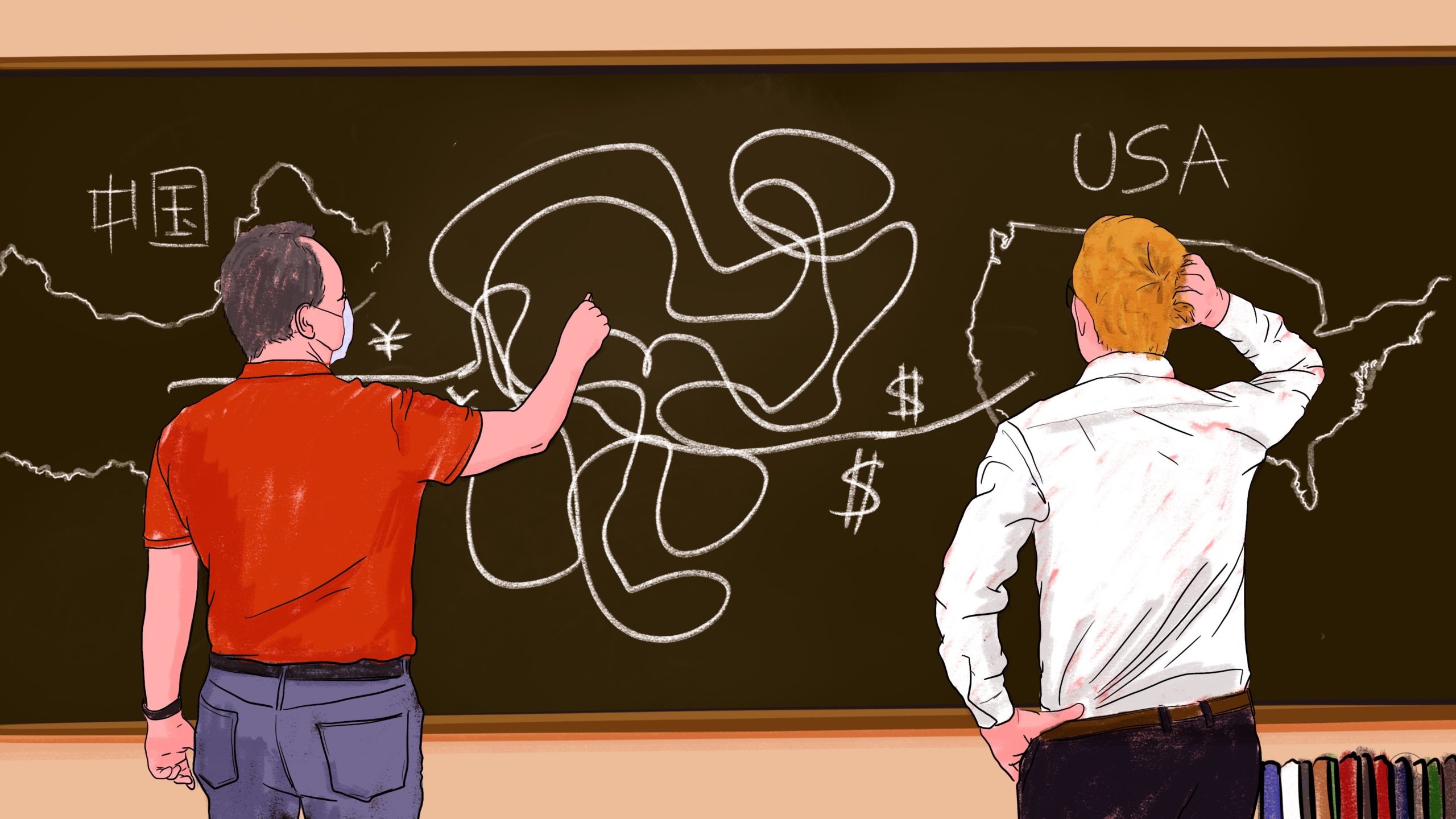

Under-the-radar private Chinese investments are a blind spot for U.S. regulators

For years, China’s sovereign wealth fund has made investments in large private American investment funds that finance startups and companies working on strategic or sensitive technology in the U.S. — but regulators have yet to investigate these activities.

U.S. lawmakers are increasingly setting their sights on Chinese investment in the U.S. An executive order from the Biden Administration in September directed the Committee on Foreign Investment in the U.S. (CFIUS) to consider exposure of sensitive supply chains to foreign investment, and Florida and Texas recently proposed legislation to ban foreign entities from purchasing land in those states.

But CFIUS, the body charged with regulating foreign investments in the U.S., has a significant blind spot — foreign investments going to large American private equity or hedge funds, such as Blackstone, Carlyle and Sequoia. Among these firms’ foreign limited partners are Chinese entities with links to the government, including its sovereign wealth fund, China Investment Corporation (CIC) 中国投资, which in 2022 surpassed Norway’s Norges Bank Investment Management to become the world’s largest sovereign fund.

CFIUS doesn’t have the authority to review Chinese institutional investors becoming limited partners (LPs) in these types of funds. The Trump Administration beefed up CFIUS’ jurisdiction with the Foreign Investment Risk Review Modernization Act (FIRRMA) of 2018, which allowed the agency to review investments that resulted in non-controlling stakes in firms (previously CFIUS could only review controlling transactions). But the Act did little to empower the committee to regulate investments in private equity and venture capital; private equity firms lobbied successfully to ensure that Congress included carve-outs to continue to allow foreign funds to become LPs in American funds.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Chinese sovereign wealth investment in the U.S. is still growing

2022 was the most difficult year for global sovereign wealth and paid pension funds in recent memory, according to a new report from Global SWF, a consultancy. Taken as a whole, investments by sovereign investors saw losses across all asset classes during 2022, with investments in private equity being especially hard hit.

Nevertheless, U.S. financial giants have generally promoted deepening ties with China despite opposing trends in U.S. government policy, and have even done business with China’s sovereign wealth fund itself:

- In 2020 the CIC launched a $5 billion fund with Goldman Sachs, called the U.S.-China Industrial Cooperation Fund, focused on investing in American manufacturing.

- CIC bought a stake in Blackstone Inc. in 2007, eventually selling its holdings in 2018.

- CIC partnered with American firm Invesco to purchase part of a Midtown Manhattan high-rise in 2017.

A recent report from the Foundation for Defense of Democracies (FDD) makes the case that Chinese firms with links to the Chinese government make investments in large private American funds in order to gain access to startups and companies working on strategic or sensitive technology.

The FDD report examines CIC, which was founded in 2007 with registered capital of $200 billion, and its subsidiaries CIC International, CIC Capital, and Central Huijin Investment 中央汇金. CIC’s international activities are carried out by CIC International and CIC Capital, while Central Huijin Investment invests in major Chinese state-owned financial firms. CIC is now the world’s largest sovereign investor with over $1.3 trillion in assets under management. CIC holds controlling stakes in major Chinese commercial banks such as Bank of China 中国银行 and China Construction Bank 中国建设银行 through its subsidiary Central Huijin Investment. Through these holdings, CIC has controlling stakes in hundreds more Chinese firms.

CIC has in recent years deepened its links to private equity and hedge funds, moving away from investing in listed companies in favor of increasing the share of its investments in private equity, as shown in the charts below. If the U.S. government cracks down on CIC’s investments in private American funds with access to sensitive tech, that trend could be in for a sharp reversal, or CIC may simply seek out opportunities with private funds outside the U.S. CIC does invest in American publicly listed companies, and has in recent years gradually increased the share of its global public equity investments in the U.S., despite heightening tensions between the two countries. In November 2022, CIC endorsed deepened financial ties across borders by calling for a “free, open and orderly” flow of international investment.

Nathan Picarsic, one of the authors of the FDD report, told The China Project he believed there were ways for U.S. regulators to continue to allow foreign investment in private funds while still protecting sensitive information or the intellectual property of tech startups.

“There likely is a way, but it probably has to revolve around a focus on informational rights that are conferred in investment partnerships, as opposed to dialing up or down ownership and control definitions,” he said.

“If there’s some measure taken there and funds are able to demonstrate that not only are they not providing ownership or control or influence over companies they’re investing in, but they’re also restricting the informational rights that foreign investors receive, it’s possible to have a guarded house on that front.”

Speaking about the Biden Administration’s recent executive order, Picarsic said that while the order updates guidance on private investments, it still won’t empower CFIUS to review foreign entities becoming LPs in private equity funds. “This indirect pathway appears to remain completely untouched by the updated guidance of the executive order,” he said. “I think the concern that we would probably raise would be that all of this comes down to the degree of enforcement, the ability of the government to execute on the guidance that is reflected in the executive order or in any related legislation.”

Other Chinese entities

Other state-linked entities have made forays into global venture capital funds with access to innovative tech firms, according to the FDD report. Chinese government guided funds have begun investing in American funds with access to advanced tech. Little known entities such as Chongqing Angel Investors Government Guided Fund 重庆天使投资引导基金有限 and the Beijing State-Owned Assets Supervision and Administration Commission 北京市人民政府国有资产监督管理委员会, for example, have made investments in IDG Capital, an established global venture capital firm.

Sequoia Capital, a successful venture capital fund based in the San Francisco Bay Area, has also seen backing from funds with government connections. Often, however, these investments take place in entities that are domiciled inside China, complicating how American regulators would address such concerns.

Sequoia has come under fire before for alleged connections to the Chinese government. Neil Shen (沈南鹏 Shěn Nánpéng), founder of Sequoia’s China-based investing entity, is a member of the national Chinese People’s Political Consultative Conference (CPPCC), and Sequoia previously employed the daughter of Wāng Yáng 汪洋, a former member of the Politburo Standing Committee, China’s most powerful government body.