Activision Blizzard and NetEase’s feud, explained

The messy breakup has it all: disgruntled gamers, changing power dynamics, and even shade-throwing beverages.

For millions of gamers in China, January 23 marked the end of an era: As its 14-year licensing partnership with Chinese game company NetEase came to an end on Monday, American game developer Blizzard Entertainment suspended most of its game services in the country, leaving millions of players unable to access a treasure trove of popular titles, including World of Warcraft (WoW) and Overwatch.

Although two months have passed since Blizzard first announced the breakup, an outpouring of sorrow and nostalgia emerged across Chinese social media in the wake of the partnership’s official termination. “Knowing that the split is set in stone, I’m still deeply saddened by how things ended,” a Weibo user wrote, adding a series of crying emojis. “Playing WoW with my homies was such a major part of my childhood and adolescence. These are memories I’ll forever cherish,” another person commented.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

The Blizzard-NetEase fallout has not only shocked Chinese gamers, but it has also baffled industry insiders and analysts alike. For more than a decade, the two gaming titans had a seemingly amicable relationship, working together on local publishing of multiple Blizzard titles. It was as mutually beneficial a partnership as one could hope for, netting both parties millions of dollars of revenue each year.

So naturally, speculation has been rife as to how the Blizzard-NetEase relationship went sour. Fueling the rumors even more is an escalating public dispute between the two studios that involves sternly worded statements, shade-throwing, and narrative control.

There’s a lot to unpack. How do we explain the messy parting and what it means for Blizzard and NetEase?

A ‘jerk’ who ruined the deal

On November 16, 2022, Hangzhou-based NetEase and Blizzard Entertainment, a division of video game holding company Activision Blizzard, separately announced that they had broken off talks on a new licensing deal to extend their long-running partnership. As a result, Blizzard had to shut down local services for several of its most popular titles in mainland China — including Overwatch 2, Diablo III, World of Warcraft, StarCraft, Hearthstone, and Heroes of the Storm — starting January 23, the day the previous deal expired.

In its statement, Blizzard Entertainment said that it failed to strike a deal with Netease that was consistent with its “operating principles and commitments to players and employees.” It added that although it would suspend sales of affected titles to China in the coming days, upcoming releases for World of Warcraft: Dragonflight, Hearthstone: March of the Lich King, and season 2 of Overwatch 2 would continue as planned. Meanwhile, its biggest revenue generator, Diablo Immortal, an online role-playing game it co-developed with NetEase and launched in China in July 2022, would continue to be offered in the country, as it’s covered under a separate agreement between the two companies.

“We’re immensely grateful for the passion our Chinese community has shown throughout the nearly 20 years we’ve been bringing our games to China through NetEase and other partners,” Mike Ybarra, president of Blizzard Entertainment, was quoted as saying in the statement. “Their enthusiasm and creativity inspire us, and we are looking for alternatives to bring our games back to players in the future.”

On the other hand, NetEase chief executive William Ding (丁磊 Dīng Lěi) said in a statement that there were “material differences on key terms” that the two companies could not agree on. “We will continue our promise to serve our players well until the last minute. We will make sure our players’ data and assets are well protected in all of our games.”

While both companies opted to remain professional in their initial announcements, leaked information suggests there’s more to the story. In an internal email obtained by the Washington Post, Ybarra told Blizzard employees that “a misalignment in principles and approach” between the two studios caused the breakup.

“Every few years we review our agreements with them. We have been working through this process in good faith to extend our existing agreements,” Ybarra said. “However, their approach was not aligned with our commitment to players, employees, and our operating principles.”

In a LinkedIn post on November 17, Simon Zhu (朱原 Zhū Yuán), head of global investment and partnership at Netease, posted an emotional, cryptic message that ruffled some feathers. “One day, when what has happened behind the [scenes can] be told, developers and gamers will have a whole new level [of] understanding of how much damage a jerk can make,” he wrote. “Feel terrible for players who lived in those worlds.”

Tit-for-tat jabs and disses

In the following weeks, Blizzard and NetEase kept their lips sealed about the divorce. By early January, both parties seemed to have moved on. Netease reportedly laid off or reassigned staff from a Shanghai-based team previously responsible for handling local distribution of Blizzard’s titles in the country. The U.S. gaming developer, on the other hand, was actively talking to Chinese companies in search of NetEase’s replacement, according to the Washington Post.

But the news about the separation resurfaced and made headlines again on January 16, when Blizzard provided an update. In a statement posted on its official Weibo account, Blizzard said it had contacted NetEase a week before with a proposal to extend their partnership for six months, but the Chinese company declined. “It is a pity that NetEase is not willing to extend the services of our games for another six months on the basis of existing terms as we look for a new partner. For this reason, players won’t be able to continue playing our games,” Blizzard said. “But we want to make it clear that it’s not over yet. We are still looking for a distribution partner who shares our values and principles.”

Within hours, NetEase clapped back. In a sternly worded rebuttal, NetEase accused its longtime partner of being “rude, inappropriate, and not in line with business logic.” Writing on Weibo, the Chinese company likened the situation to a couple going through a separation, where its American spouse was “overly confident” and “unreasonably demanding.”

Using a popular Chinese euphemism used to describe unfaithful or indecisive partners, NetEase wrote: “It’s as if they were riding a donkey while looking for a horse, proposing a divorce while still engaging with the same partner. It’s apparent that Blizzard doesn’t care about its players.” NetEase also denied rumors that it was its attempt to control the IP rights of Blizzard’s titles that caused them to part ways, emphasizing that it had been using Blizzard’s gaming assets upon mutual agreement.

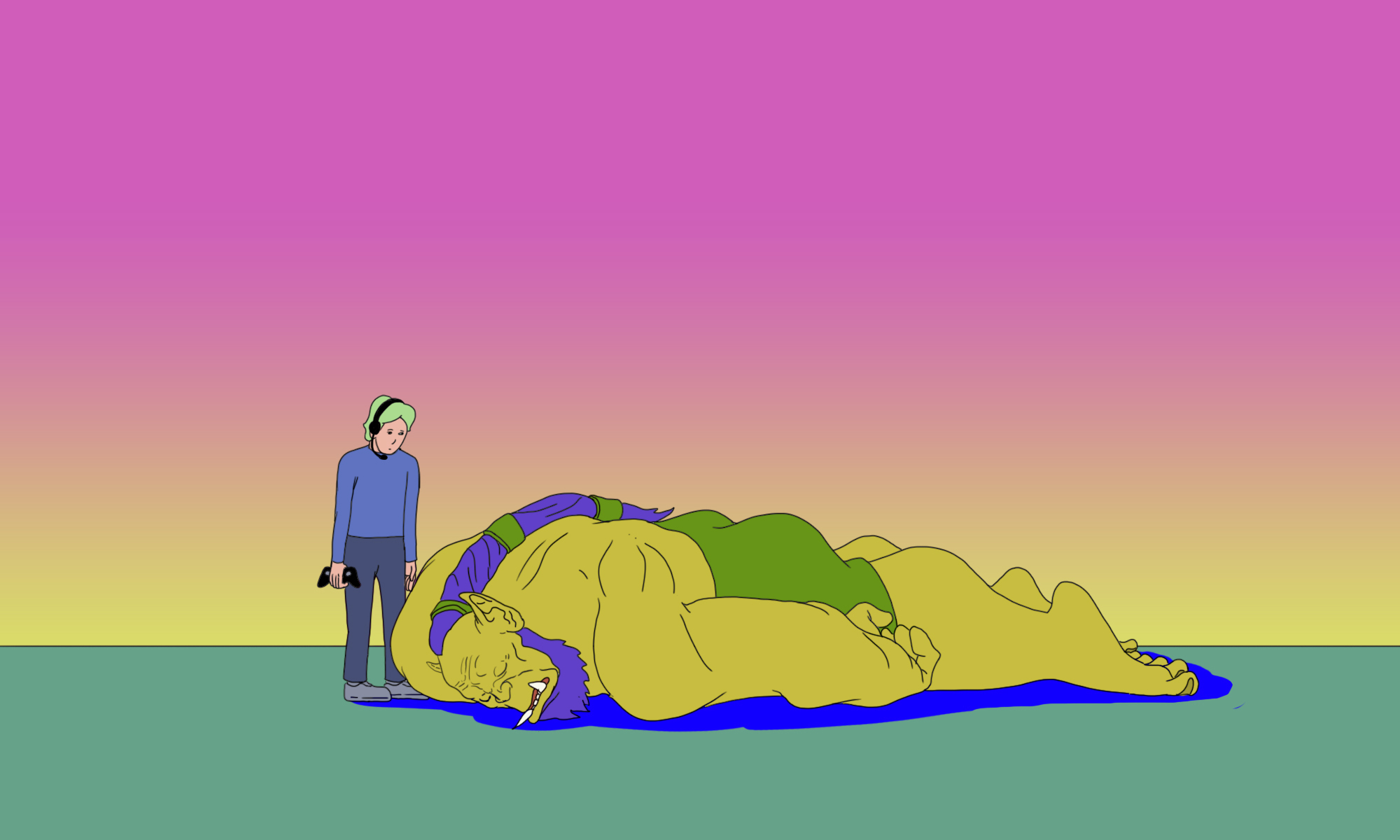

The acrimony escalated when NetEase launched a full-blown social media campaign against Blizzard. On January 18, on the official Douyin account of its battle royale game Naraka: Bladepoint, NetEase livestreamed a group of workers dismantling statues and displays of Blizzard’s games at its Shenzhen headquarters, including a replica of Gorehowl, a legendary weapon well known among WoW players.

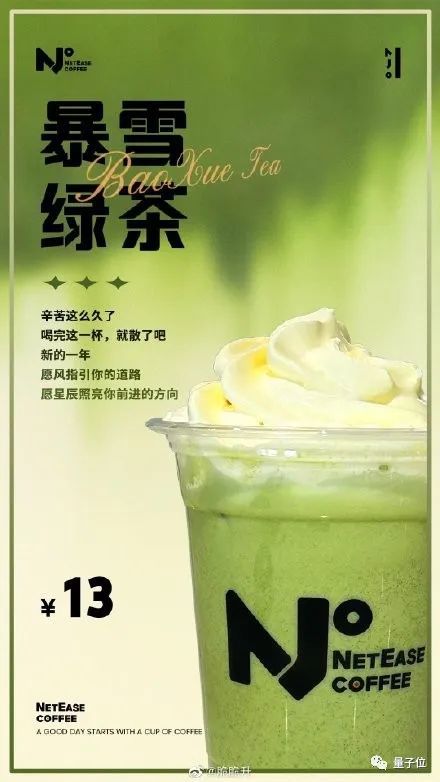

At one point during the livestream, the demolition crew was shown being treated to a special drink launched by NetEase Coffee, a beverage chain owned by the tech company. Priced at 13 yuan ($1.92) and available to regular customers, the limited-edition drink, “Blizzard Green Tea,” is named after a Chinese internet slang term for young women who pretend to be sweet and innocent but are dishonest and calculative.

“NetEase wants to show that they care about its player base, and that it wants to bring games like WoW and other licensed games to China,” said Daniel Ahmad, Director of Research & Insights at Niko Partners, a market research and consulting firm covering video games, esports, and streaming in Asia and the Middle East. Meanwhile, Ahmad told The China Project, Blizzard “has a really popular IP in China, especially among old, traditional PC gamers. To see their titles disappear, fans will always look for the party at fault, something to direct their anger towards.”

In the wake of NetEase’s shade-throwing tactics, Blizzard has become a target of indignation for Chinese gamers. Under its January 16 post on Weibo, which has amassed nearly 40,000 comments, the U.S. gaming behemoth is harshly criticized for alleged recklessness. “It’s too late to act regretful. If you really cared about players, you could have planned things out more carefully,” a Weibo user commented.

We might never know how things really went down

According to the Wall Street Journal, the writing had been on the wall for months, as negotiations between the two companies for a new deal soured. While the dispute is probably centered on money, people familiar with the matter told the news publication in November that a disagreement over the handling of user data was one of the obstacles to renewing the deal.

The Blizzard-NetEase deal was first struck in August 2008, and was renewed on a four- to five-year cycle. Over the years, the alliance helped NetEase become China’s second-biggest games distributor after local rival Tencent, and offered Blizzard a way into a key Asian market.

Under Chinese law, all digital games are required to receive a license from authorities in order to be distributed locally and fully monetized. Because non-Chinese entities can’t submit games to Chinese regulators for review, foreign publishers have to team up with local companies if they want to introduce games to the Chinese market. “The ball is really in the Chinese publisher’s court to decide what a deal should look like. For overseas companies, what they can do is negotiate as best as they can for the deal,” Ahmad said.

For Blizzard and NetEase, their partnership wasn’t completely devoid of controversies and hiccups. For example, in 2018, to please Chinese censors, Blizzard banned a professional player of Hearthstone, its digital card game, from competing and took away his prize money after he expressed support for the Hong Kong pro-democracy protests. Despite some bumps on the road, the two companies “generally had a good relationship for 14 years,” Ahmad said.

“There’s never been anything that came to the surface around the partnership ending. So that’s why a lot of people were surprised and there’s been speculation regarding why it broke down that quickly,” said the analyst. “I think what happened here is that Blizzard tried to negotiate a better deal for themselves and they haven’t been able to get NetEase to agree to some key points, like how players’ data is used and how the relationship will progress. Because of that unique aspect of how China’s gaming market operates, it makes it sometimes a bit difficult for foreign companies to find the right partner.”

A trailblazer in the Western gaming world and the owner of many iconic franchises, Blizzard’s reputation has taken a nosedive in recent years. It started in July 2021 with a lawsuit citing numerous cases of sexual harassment, sexism, and deplorable practices in the workplace. A stream of damning revelations followed, causing Blizzard’s share price to tank from more than $100 per share in early 2021 to less than $60 in December. A month later, American tech giant Microsoft announced plans to acquire the scandal-ridden developer for $68.7 billion in cash, marking what could be the biggest gaming deal in history if completed. However, because of antitrust concerns raised by regulators in both the U.S. and other countries, Microsoft’s planned takeover has hit a roadblock, with it battling several lawsuits that accused it of unfairly stifling competition.

In light of the potential merger, rumors swirled that Microsoft might have played a role in the Blizzard-NetEase negotiations. But Ahmad found this theory unconvincing. He pointed out that Microsoft has been partnering with NetEase to localize and distribute its popular action-strategy game Minecraft for the Chinese market. The deal is set to expire in 2023. “If Microsoft let that contract expire and doesn’t renew, then it might be a Microsoft thing,” Ahmad said. “But as of right now, there’s no sign that NetEase or Microsoft will terminate this partnership.”

Daniel Camilo, a Shenzhen-based gaming consultant who specializes in the Chinese market, put forward a different theory. He told The China Project that the cause of the Blizzard-NetEase breakup might be simpler than most people thought.

“While that would indicate a tremendous level of incompetence and ignorance both about publishing and the Chinese market, it is not unreasonable to consider that perhaps Blizzard’s representatives assumed they could simply break up their deal with NetEase and then just keep the games in China with another partner,” he said. “That is not how it works, and it might explain the back-and-forth on Blizzard’s end. It might have underestimated how complex it is to publish and operate games in China.”

Blizzard and NetEase will be fine

In any case, the Blizzard-NetEase relationship is very much over at the moment. In their investor-focused press releases, both companies assured stakeholders that the parting wouldn’t have a substantial, long-term impact on their financial results. But revenue decreases are expected in the immediate term. As reported by the Washington Post, China accounted for approximately 3% of Activision Blizzard’s net revenue in 2021, which amounted to nearly $300 million. For NetEase, the separation would cost it $400-700 million, per Ahmad’s estimation.

To offset financial losses in the long run, both companies wasted no time finding or leaning into new profit opportunities. Ahmad pointed out that NetEase had a slate of existing, self-developed tiles to fall back on to retain its players, such as Justice Online, a massively multiplayer online game that shares WoW’s gameplay mechanism and style, but features traditional Chinese aesthetics and mythological elements.

In the first two weeks of January, NetEase also relaunched two games that were temporarily taken offline due to lackluster receptions. Both titles bear suspicious resemblances to Blizzard’s blockbuster games. “Because NetEase still has these licenses, they still have the ability to operate these titles,” Ahmad said. “The re-releases have received very limited publicity so far but it’s clear that NetEase is trying to launch games or ferry its Blizzard player base into games that it operates and try to keep that player base in its system.”

Single and ready to mingle, Blizzard is reportedly in the market looking for a new partner to bring its games back to China. There are several candidates, but Chinese tech conglomerate Tencent is “definitely the one that makes the most sense,” Ahmad said.

“For one, Blizzard already has a relationship with Tencent’s Timi Studios, which has been operating its first-person shooter game Call of Duty: Mobile locally,” he added. “Given Tencent’s strong distribution channels and its experience managing tons of overseas game franchises, it really is on paper the sole logical partner to replace NetEase.”

ByteDance, the Chinese parent company of video app TikTok, might also be in the race. Unknown to most, the emerging Chinese tech giant has a video games unit named Nuverse, which acquired Shanghai-based gaming studio Moonton at around $4 billion valuation in 2012 as ByteDance sought expansion into the video games business. According to Ahmad, other contenders include Tencent’s rival Alibaba, which has its own video game department, and Beijing-headquartered gaming developer and publisher Perfect World, which is Valve’s Chinese partner as the publisher of Dota 2 and Counter-Strike: Global Offensive.

Despite its size and growing importance, China’s gaming market is notoriously difficult to break into due to strict regulations and content policies. The past few years have been particularly challenging for global game developers, as the Chinese government initiated a sweeping crackdown on its video games sector, halting the license approval process and introducing new restrictions to limit how much young people can play video games.

The tough curbs have shaved off more than half of the market value for sector leaders like Tencent and NetEase, but things are looking better for 2023. Last month, Beijing granted licenses to 84 domestic games and 44 foreign titles, the first batch since authorities froze new game import approvals 18 months ago.

For Blizzard, to relaunch local services of its titles that went offline, the easiest way is to transfer the licenses of the affected games to a new partner once it finds one, a process that still may take months, if not longer. Although the regulatory environment is becoming friendlier, the Blizzard-NetEase drama may be a wakeup call for foreign gaming studios hoping to access Chinese players. “It might convince some developers and publishers around the world that perhaps it is more trouble than it’s worth to get their games in the Chinese market,” the gaming consultant Camilo said. “Hopefully a positive shift will happen to change this perception.”