Chinese autonomous vehicle testing in California is coming under growing scrutiny

Seven Chinese autonomous vehicle companies tested their vehicles in California last year, collectively covering over 450,000 miles of roads. But as U.S. policymakers become more focused on espionage and surveillance, the Chinese companies testing in the Golden State may be on borrowed time.

The California Department of Motor Vehicles’ yearly report on autonomous vehicle (AV) testing in the state, released February 17, showed that Chinese firms continue to test their vehicles in the state throughout 2022, even as some policymakers voice concerns over national security risks.

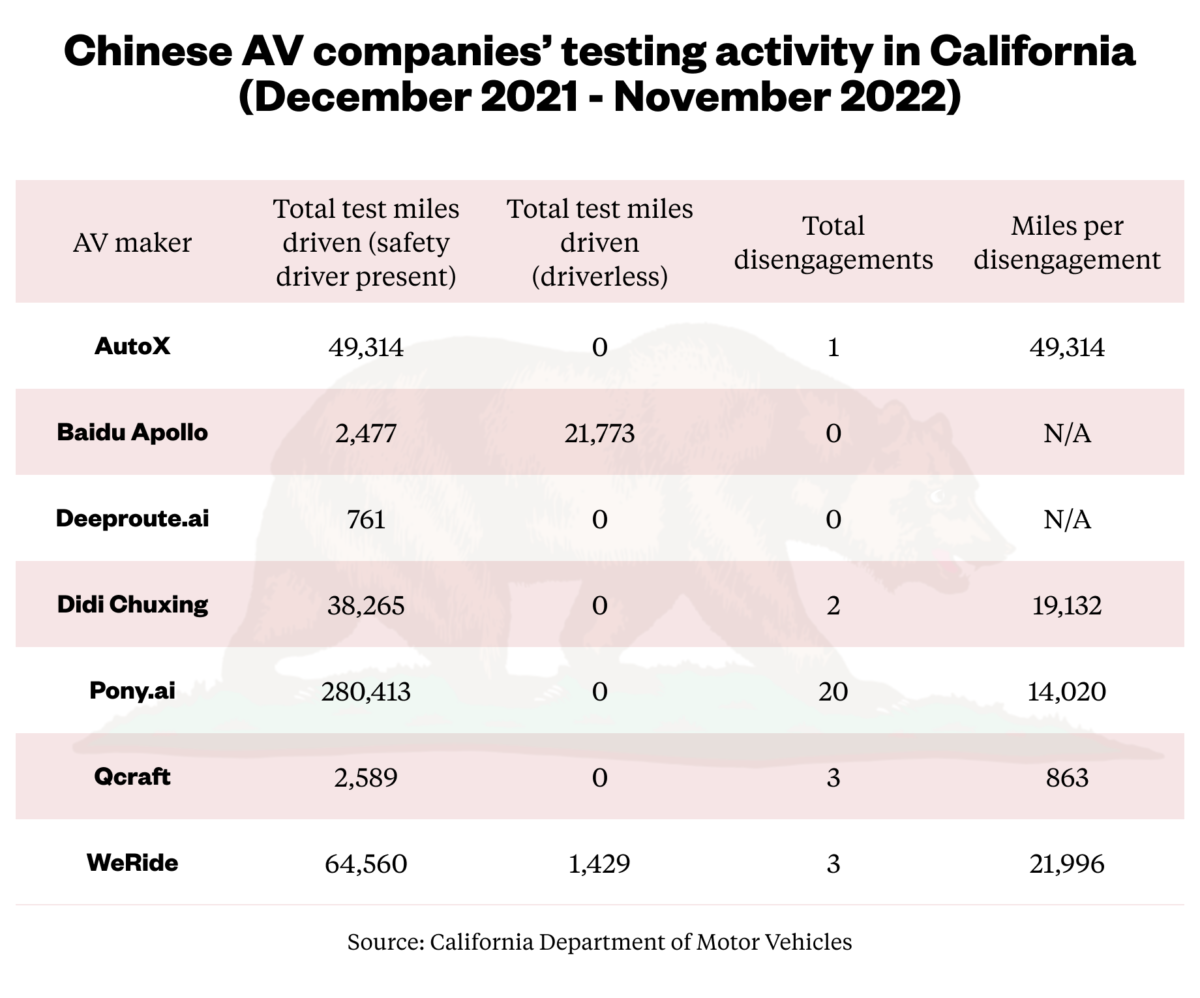

Chinese firms including Baidu’s Apollo, Pony.ai, AutoX, WeRide, Didi Chuxing, and Qcraft 轻舟智航 and Deeproute.ai 元戎启行 tested their autonomous vehicles in California last year, collectively racking up over 450,000 miles in test miles driven during the period covered by the report (December 2021 through November 2022). Pony.ai led the pack of Chinese firms, with its test vehicles driving a total of 280,413 miles.

Chinese AV makers didn’t quite match the level of testing they conducted in 2021, when they drove test vehicles over 510,000 miles around California. While most AV makers decreased their testing in California from the previous year, WeRide and Apollo both surpassed their testing numbers from 2021.

Chinese companies Inceptio, NIO and XPeng also have permits to test in the state, but the records show that they had conducted no test drives last year.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Tracking efficient driving

In addition to data on mileage traveled, California’s DMV records the number of times AVs had to be manually disengaged. (Disengagement reports from the companies describe a variety of circumstances during which the driver had to take over the vehicle, from failures of the vehicle to detect objects correctly, risks caused by other vehicles failing to follow traffic rules, and instances in which other vehicles made sudden lane changes.) The more miles a company is able to test drive without needing to override the autonomous systems, the more effective the system.

Baidu Apollo and Deeproute.ai held the distinction of being the only Chinese AV companies to record zero instances in which a safety driver had to disengage a vehicle. Qcraft had the highest rate of disengagements, with safety personnel having to intervene every 863 miles of testing on average.

While Pony.ai made up for more than half of the test miles driven in California, it was likely much less than what the company had planned for, as California’s DMV revoked its permit to test AV’s in May 2022 after the company failed to monitor its safety drivers’ driving records.

Pony.ai has since regained its license for testing AVs with a safety employee present, the California DMV told The China Project. Pony.ai spent $120,000 on lobbying in Washington in the third and fourth quarters of 2022, according to the lobbying database Open Secrets, although it is not clear if the lobbying activity was directly related to the testing permit issue. In addition to its California permit, Pony.ai has a permit to test in Arizona and has announced plans to begin testing there.

In addition to testing, some Chinese AV companies are planning to launch commercial operations in the U.S., such as offering robotaxi services in the San Francisco Bay Area. AutoX and Pony.ai have both announced plans to provide robotaxi services in the Bay Area.

Are the cars spying on America?

As Chinese AV makers take to the roads in California to test their vehicles, some American policymakers are calling for restrictions on their activities over fears of espionage and surveillance.

In a November 2022 letter to the U.S. National Highway Traffic Safety Administrator (NHTSA), U.S. Representative August Pfluger (R-TX) warned of risks of Chinese firms testing vehicles in the U.S. The letter inquired as to whether the NHTSA conducted any vetting of Chinese firms applying for testing permits, whether they knew of any data transfers from the U.S. to China as a result of these activities, and if the NHTSA had established any rules for what data the companies could collect.

“Chinese autonomous vehicle companies must be considered as a potential threat to our national security based on the tremendous amounts of data being collected while they drive on American roads,” Rep. Pfluger told The China Project in a prepared statement.

However, it’s not clear how effective AVs might be as a piece of surveillance technology. James Andrew Lewis, the Director of the Strategic Technologies Program at the Center for Strategic and International Studies (CSIS) think tank, told The China Project that while AVs posed some risks, they are not the ideal surveillance tool.

“When you think about how you collect intelligence, a driverless car in the middle of nowhere is not the best way,” he said. “Even a driverless car in San Francisco isn’t the best way.”

“If it was ever useful, they would use a car, no doubt about it, but there’s been no evidence that they’ve done that so far.”

Chinese AV firms hoping to test and launch commercial operations in the U.S. could still face some roadblocks. The recent Chinese surveillance balloon incident which led to extensive debate from media pundits and politicians over Chinese espionage epitomized growing suspicions about Chinese surveillance activities.

The California DMV does not currently restrict where any permit holder may test vehicles with a safety driver present.

“Autonomous Vehicle manufacturers authorized to test with a safety driver can test on any public road in California,” a representative from the California DMV told The China Project. “Manufacturers authorized to test without the presence of a safety driver behind the wheel must define the geographic location where testing will be conducted and any limitations (e.g. weather, roadway types, speed).”

Supply chain risks

In addition to firms like Pony.ai and Baidu Apollo that develop fully formed AVs, Chinese companies are involved in manufacturing the building blocks of the vehicles, including the LiDAR, and RADAR sensors, cameras, and computing chips that allow AVs to sense and respond to their surroundings.

For example, Chinese company Robosense produces LiDAR sensors for a variety of Chinese companies, and Horizon Robotics makes semiconductors used in AVs. These companies are also working with non-Chinese automakers to develop their AVs, which could complicate how the U.S. responds to national security concerns around autonomous driving. For example, Horizon has partnered with German automaker Volkswagen, and Robosense supplies Toyota with its LiDAR sensors. Even if the U.S. restricts the activity of firms like Pony.ai and Qcraft, Chinese surveillance tools could still end up on U.S. roads in AVs made by non-Chinese companies.

“People might not feel comfortable relying on China in their supply chains because the Chinese will exploit it if they get a chance, but moving them out, coming up with American replacements or European replacements — that will take a while,” Lewis told The China Project. “So at least for the next few years, we might be stuck.”

The takeaway

Chinese AV companies are still relatively unrestricted in their activities in California, are taking full advantage of their testing permits, and in some cases are making plans to launch commercial robotaxi operations in the San Francisco Bay Area. But a growing unease over Chinese espionage in Washington (and increasingly among the American public) could make the coming years difficult for China’s AV companies in the U.S.

There is also the question of reciprocity: China has already moved to limit the activity of American AVs on its soil. Tesla’s were banned from the seaside town of Beidaihe last summer while top Chinese politicians held secretive meetings, and the company’s AVs were also restricted from entering military and government facilities in 2021 over security fears related to sensors on the vehicles. In the current political atmosphere, U.S. regulators are likely to adopt the same approach.

Companies:

- Baidu 百度

- Pony.ai 小马智行

- AutoX 深圳安途智行科技

- WeRide 文远知行

- Didi Chuxing 滴滴出行 (北京小桔科技)

- Deeproute.ai 元戎启行

- Qcraft 轻舟智航

- Inceptio 嬴彻科技

- NIO 蔚来汽车

- XPeng 广州小鹏汽车科技

- Robosense 深圳市速腾聚创科技

- Horizon Robotics 深圳市速腾聚创科技

Sources and additional data:

- Top 10 Chinese autonomous driving companies to watch / The China Project

- Pony.ai’s license to test autonomous vehicles with safety drivers in California is revoked / The Verge

- Chasing Cruise and Waymo, Chinese AV company AutoX plans to begin testing in San Francisco / TechCrunch

- Chinese startup Pony.ai plans to launch a driverless robotaxi service in California in 2022 / TechCrunch

- Tesla cars barred for 2 months in Beidaihe, site of China leadership meet / Reuters

- Tesla cars banned from China’s military complexes on security concerns -sources / Reuters

- VW invests $2.3B in China AV joint venture / Automotive News Europe

- Toyota Cars to be powered by RoboSense LiDAR / Just Auto