What happened to Syngenta’s mega IPO?

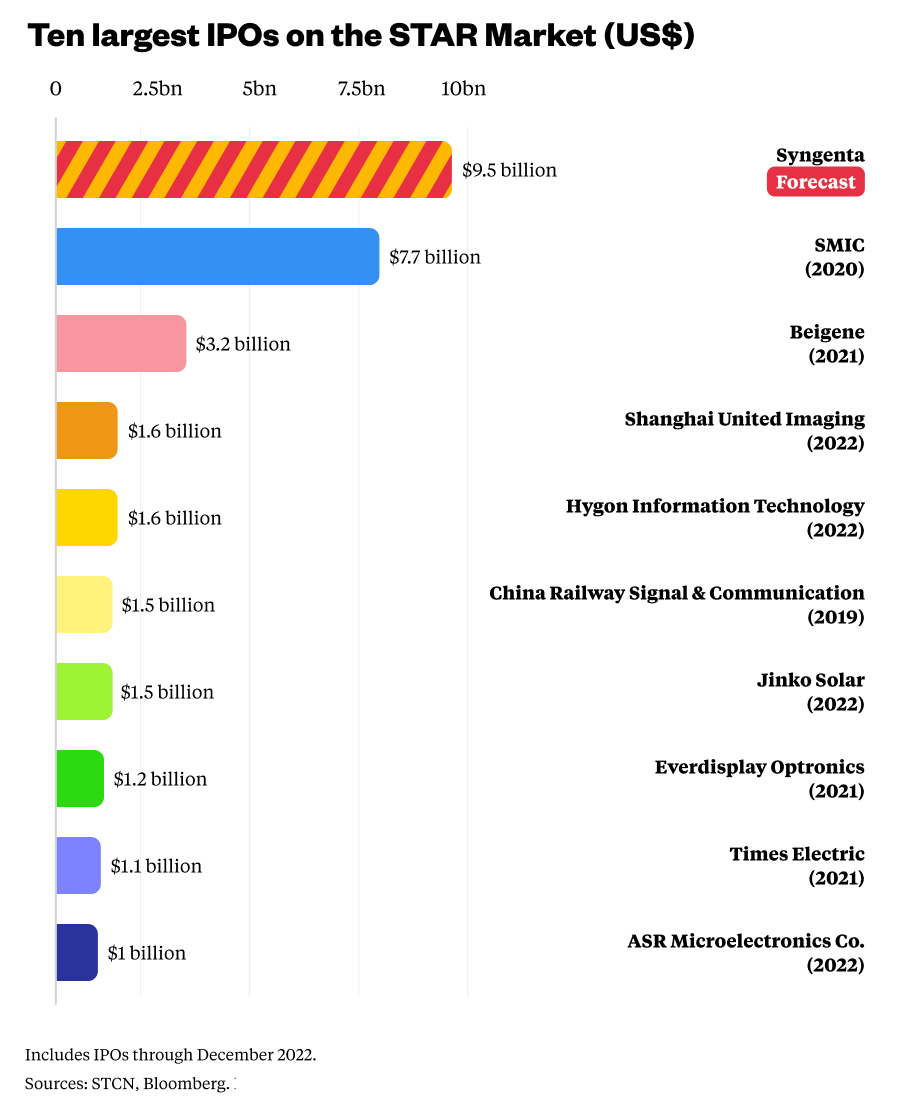

The IPO would have been the biggest in the history of the STAR market, but it’s not going ahead, for now, and observers can only speculate as to why.

A terse note posted to the website of the Shanghai Stock Exchange in late March announced the cancellation of a key meeting in the lead-up to an initial public offering (IPO) for the agribusiness giant Syngenta.

Syngenta, originally a Swiss company founded in 2000 after the merger of the agrichemical arms of drug giants Novartis and AstraZeneca, was acquired in 2017 by the Chinese state-owned firm China National Chemical Corp (ChemChina) for $43 billion, at the time China’s largest foreign acquisition ever. With over 55,000 employees and operations in more than 100 countries, the company sells herbicides, pesticides, and proprietary strains of seeds, and researches new smart agriculture technologies.

Despite its enormous size, Syngenta has never listed on a stock exchange.

The company has been eyeing an IPO since 2021, aiming to raise 65 billion yuan ($9.5 billion). The listing would be the largest IPO in the history of the Shanghai Stock Exchange’s Science and Technology Innovation Board (STAR market), a hub for Chinese tech equities.

So why has Syngenta’s IPO hit this speedbump, and what does it say about China’s financial markets?

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.China news, weekly.

No one knows exactly why the mega IPO stalled

Shanghai’s Nasdaq-style STAR market has become a home for major Chinese tech firms like the flagship chip maker SMIC, new energy firms like Jinko Solar, and many others. The STAR market has come a long way since it was established in July 2019 with just 25 companies: in 2022, it ranked first globally among stock exchanges in terms of IPO proceeds, raising nearly $34 billion from 116 IPOs. Returns on market equities on the STAR market have generally outperformed other exchanges in China.

But the STAR market faces some challenges, including its small size: The total market capitalization of equities on the exchange in December 2022 hovered at just over $800 billion, relatively small for such a large listing as Syngenta’s would be. Syngenta is expected to be valued at at least 300 billion yuan ($45 billion) after listing.

In the wake of the delayed Syngenta IPO, some observers have pointed to the market’s small size as a potential factor in the decision. The major float for Syngenta could be destabilizing, pulling money away from other listed equities and causing market-linked indices to suffer. The STAR 50 index, which tracks equities on the STAR market, peaked in July 2021 and fell through 2021 and into 2022. In recent months, it has shown signs of recovery, and regulators may be putting off the IPO to prevent possible downward trends if Syngenta pulls capital away from other stocks.

Others have cast doubt on the notion that regulators stalled the IPO over fears that it could destabilize the market, pointing to the consistently high offerings on China’s financial markets. “Recent months’ IPOs are in the range of 100 billion yuan [$14.6 billion] per month,” said Allen Feng, Associate Director of China Market Research at Rhodium Group. “If Syngenta goes ahead, it will just boost monthly IPO [numbers] to 160 billion yuan [$23.4 billion]. It is a relatively high, but not insanely high number.”

By mid-February, total funds raised by listings of A-shares in China so far in 2023 hit 170 billion yuan ($24.9 billion), with IPOs on the STAR market contributing around 4.3 billion yuan ($628.7 million). In 2022, a total of 123 IPOs took place on the STAR market, with a total fundraising amount of 252 billion yuan ($36.8 billion).

“If you tell me we are having five or 10 similar sized IPOs coming in the pipeline, I will be worried about supply,” Feng told The China Project. “Just one IPO, I don’t buy it.”

Some observers simply critiqued the opaque nature of the regulators’ decision. One op-ed in an online Chinese finance publication called for greater transparency from regulators and the exchange. The author notes that the official grounds for canceling the meeting to evaluate the listing plan could include “force majeure, unforeseen events, or other special circumstances,” but that these were overly vague and insufficient explanations. The author speculates that market stability was a likely factor, but also mentions the possibility that the Shanghai exchange was concerned that the timing was not opportune for the IPO, and that the listing would have failed to meet lofty expectations.

While exact explanations for the delay are elusive, it shows a continued tendency of officials to intervene. “It says that regulators are not ready to fully let go of IPO oversight just yet,” Taylor Loeb, Senior Analyst at the research firm Trivium China, told The China Project. “In fairness to regulators, though, this is a massive, unique IPO on a relatively new exchange.”

Part of the draw of Shanghai’s STAR market is that the listing process is meant to be faster and more market-oriented than other exchanges in China in order to offer innovative tech companies ready access to capital. Reforms implemented this February further loosened rules for IPOs on the STAR market, with China’s securities regulator no longer conducting close vetting of listings, instead passing that responsibility onto the exchanges.

But this is not the first time that a major listing on the STAR market has hit roadblocks, raising questions over the independence of China’s financial markets. Alibaba affiliate Ant Group aimed to have its IPO on the STAR market in 2020, which was set to be among the largest in history. The IPO was called off due to issues with “information disclosure requirements,” but many speculated the cancellation rather had to do with comments from Alibaba founder Jack Ma (马云 Mǎ Yún) criticizing the Chinese authorities’ regulation of financial markets.

What the IPO means for Syngenta

Syngenta first filed for an IPO on the Shanghai exchange in July 2021, announcing that it would use most of the capital raised for cutting edge agricultural technology research and development, global mergers and acquisitions, and repayment of long-term debt. It would also expand and upgrade production assets and other capital expenditures, as well as its Modern Agricultural Platform (MAP) services. Syngenta’s MAP centers allow Chinese farmers to modernize their crop production and plug in to a distribution network.

The agricultural technology industry is competitive, with major multinationals like Monsanto, Advanta, and Inari developing and marketing both non-modified and genetically modified organism (GMO) seeds, while other firms are developing herbicide and pesticide chemicals to maximize output and offering smart agriculture solutions to farmers.

Chinese firms have been stepping up their game in recent years when it comes to digitalization of agriculture, with strong encouragement from the government. As China’s population ages and farm labor becomes more scarce, smart ag solutions from companies like Syngenta will help to maintain agricultural production. The company operates a total of 628 MAP centers in China with more than 2 million registered users, and these centers are part of that push toward smart ag that is helping to modernize farming in China.

Syngenta’s financial report for 2022 reported total sales of $33.4 billion, a record for the company, growing $5.2 billion or around 19% over the previous year.

Food security, GMOs, and Syngenta

Over the past several years, policy makers in Beijing have placed a renewed emphasis on food security as an element of overall national security, and have begun to highlight the importance of seed research and genetically modified organisms to these efforts.

GMO crops have in the past been a sensitive issue in China, with heavy restrictions on the use of the technology, and the general public is largely suspicious due to perceived health risks around GMO foods, but major changes appear to be coming down the pipeline.

“The seed technology area is very interesting in China right now,” said Darin Friedrichs, Director of Market Research at Sitonia, a consulting firm that focuses on China’s agricultural market. “China is now adopting GMO seed technology, but at a cautious pace, and there is a desire for seeds to be Chinese and Chinese technology, rather than being reliant on imports.”

Since 2021, officials have pointed to GMOs as important for China, with that year’s annual “Document No. 1,” typically focused on rural issues, suggesting a new importance for GMOs in China. Then in early 2023 Beijing moved to approve the use of genetically modified strains of corn, developed by Syngenta Group, in a small number of pilot zones. This marked the first time Beijing had approved commercial use of GMOs for staple crop planting in China, previously only ever approving licenses for cotton and papaya growing.

The summer of 2022 saw extended drought across China’s southern region, at the same time that the war in Ukraine led to a spike in fertilizer prices. The events led to crop production challenges, and highlighted the role GMOs could play in helping China cope with climate change and supply chain risks going forward.

The takeaway

The unexplained delay of Syngenta’s listing on Shanghai’s STAR market points to a lack of transparency and regulatory heavy-handedness. However, Syngenta is still likely to have its IPO, and China’s recent decision to go with Syngenta for GMO corn pilot projects bodes well for the company. As policymakers gradually opt to approve the use of GMO crops, and as smart agriculture takes root on the country’s farms amid sweeping demographic changes, Syngenta is well positioned going forward. But investors may have to cool their heels until the regulators make up their minds.

Companies:

- Syngenta

- ChemChina

- SMIC

- Jinko Solar

- Ant Group

Sources and additional data:

- At $34b, China’s STAR market was was the world’s top bourse by IPO proceeds in 2022 / Deal Street Asia

- Syngenta’s Blockbuster China IPO Gets a Step Closer / Wall Street Journal

- Shanghai STAR market’s Size Hits USD833 Billion / Yicai Global

- 2022年科创板40家IPO“折戟”原因揭晓,这家公司被通报 / Sina

- “巨无霸”先正达取消上会原因应透明 / 金融投资报

- China securities regulator implements new IPO rules designed to boost market / Reuters

- Syngenta Group reports record $33.4 billion sales and $5.6 billion EBITDA in 2022 / Syngenta Group

- 拟募资650亿的农业巨头先正达上市搁浅,商誉惊人或藏风险? / Sina

- Companies Promote Digital and Smart Agriculture in China / Sixth Tone

- 科创板3周年大盘点:募资6348亿,市值6万亿,江苏力压广东,苏州霸气超深圳,“券茅”赚麻了 / STCN

- 新年以来A股股权融资超1700亿元 科创板和创业板仍是企业IPO募资主阵地 / Xinhua