Wind power bottlenecks between China and the West are slowing down green energy adoption

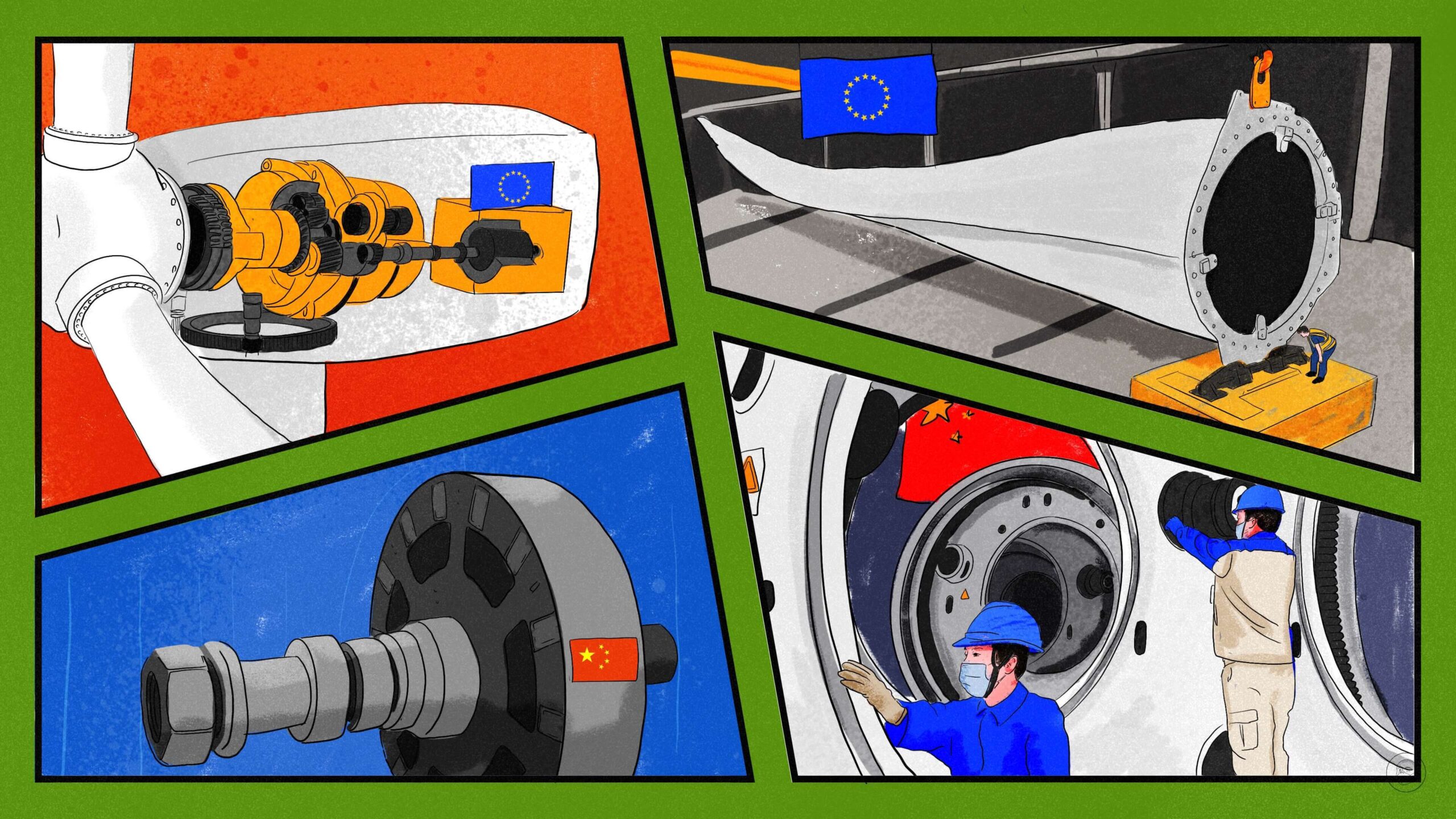

Wind turbines that make clean electricity need magnets from China and bearings from the West. But the smooth trade in such goods that will be vital for an energy transition away from fossil fuels is under threat.

Western and Chinese wind power companies are historically intertwined, and they now have to weather punishing import duties and supply chain bottlenecks because they remain interdependent for key component parts.

In the 1890s, Danish scientist and inventor Poul la Cour used government support to build the first wind-powered electricity generator in Askov, Denmark, laying the foundation for the modern wind power industry. Vestas, a Danish company that traces its roots back to a blacksmith shop founded in 1898, started making modern wind turbines in the 1970s. By 2021, Vestas claimed to have “installed more wind power than anyone else,” and accounted for the largest share of 17.7% of the 29,234 wind turbines installed worldwide in that year.

Vestas also played a key role in the development of China’s wind power industry.

So, in 2022, it didn’t go unnoticed when China’s Goldwind overtook Vestas as the world’s leading wind power company by installing 12.7 GW or 14.76% of global wind power installations, compared to Vestas’ 12.3 GW (14.30%).

China’s wind power boom

Goldwind’s ascendance coincided with a boom that led to China’s current 380 GW of installed wind power generation capacity, 95% of which was installed since 2010. The country now takes over 14% of its total energy capacity from wind power generation. In 2021, China generated 382,814 gigawatt-hours (GWh) of wind power electricity, 71.55% more than the United States, the world’s No. 2 wind power generator, International Renewable Energy Agency data showed.

In the early 2000s, China’s largest wind power companies challenged Western wind power leaders and fanned the flames of competition. Manufacturers such as Vestas were pushed out of China and high Western import duties made it costly for Chinese manufacturers to sell their cheaper and bigger turbines in Europe and North America.

Effectively barred from the West’s largest markets, Chinese wind turbine manufacturers now are selling their wares elsewhere, taking advantage of lower thresholds to market entry in Asia, Africa, Eastern Europe, Central and South America, and the Middle East.

At the end of 2022, Goldwind, for example, had a backlog of orders of 2.09 GW in Asia outside China and 1.20 GW in the Middle East and Africa. By comparison, European orders for all Chinese wind turbine installations were for 186 MW. North American orders were for 12 MW.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Turbulent times

In the late 1980s, China had no expertise to build, maintain or service wind turbines, leaving the door wide open for Vestas and others.

In 1986, Vestas entered China, effectively marking the start of China’s wind energy industry. Two years later, a Danish government grant of $3.2 million helped establish Xinjiang Wind Energy. Soon, China’s first wind farm went up at Dabancheng, Xinjiang, in northwest China, with 13 turbines of 150 kilowatt capacity each — tiny compared with the 16 MW turbines standing in China’s offshore waters today.

In 1987, Wǔ Gāng 武钢, a former professor of hydroelectric engineering, joined Xinjiang Wind Energy and worked at Dabancheng. In 1998, with Beijing’s support, Wu and a few of his colleagues founded Goldwind with a simple objective: build China’s own wind turbines.

In 1990, in a move toward independent manufacturing, Xinjiang Wind Energy stopped importing whole turbines and started buying spare parts. It would take nearly a decade for the company to produce the S600, China’s first domestically-produced wind turbine but from that point onward, China’s domestic wind industry took off.

Suffering decades of choking pollution that comes with industrialization and bending under the price shocks that come with being a net importer of oil, China’s government launched a wind power concession in 2003 to encourage Chinese companies to compete in the renewables space. Seemingly overnight, dozens of domestic wind turbine makers appeared on the scene.

Then, the winds shifted. In 2005, the National Development and Reform Commission required that all China’s new wind turbines be built with at least 70% domestically-produced equipment, thus making it harder for Vestas and other international wind companies to operate profitably in China. By 2007, Chinese wind power companies installed 55.9% of China’s new wind power generation capacity, surpassing overseas competitors for the first time.

By 2010, when China rescinded the 70% localization policy, Vestas held a mere 2% market share in China. In its place was a group of Chinese manufacturers led by Goldwind, Windey (founded in 2001), Mingyang Smart Energy (2006), Sany Heavy Energy (2008), and Envision (also a producer of electric vehicle batteries, software, and net-zero carbon emissions industrial parks, founded in 2017).

As of 2022, 98% of China’s wind market was held by 10 Chinese companies. The five companies mentioned above controlled 45% of the market.

As in the case of Goldwind, which Vestas helped shape with Danish government support, the biggest Chinese wind turbine manufacturers started out by copying Western turbines, acquiring Western technology, or by forming partnerships with Western manufacturers. Western and Chinese wind firms were intensely interdependent, sometimes unhealthily so.

For instance, after Chinese wind power firm Mingyang was listed on the New York Stock Exchange, it admitted in 2011 to the Securities and Exchange Commission that its position could be adversely affected if it lost its licensing agreement with longtime German partner Aerodyn Energiesysteme, a turbine and rotor blade engineering firm. Mingyang previously had characterized to shareholders its partnership with Aerodyn as a “collaboration.”

There also are several reported cases of theft of intellectual property by Chinese wind power firms from overseas competitors. In 2018, for instance, Chinese wind turbine maker Sinovel was convicted of stealing U.S. company AMSC’s source code for the computer systems that help regulate electricity flowing from wind turbines to the grid.

Castings and bearings

Despite the turbulent relationship between China’s wind power leaders and their Western mentor-competitors, when it comes to the manufacturing and supply chains that underpin the industry, they all still need each other to make the blades turn.

Today, the trade in turbine components, including sophisticated bearings and rare earth metals, is an arena in which both Western and Chinese wind power firms must compete and cooperate.

The main components of wind turbines are the towers (made up of ladders, cables and platforms), the nacelle (the pod atop the tower housing the generator, gearbox, drive train, and brake assembly), and the iconic rotor blades themselves.

The main costs of the blades are accounted for by raw materials, most of which are incurred paying for Glass Fibre Reinforced Polymer (GFRP), the corrosion-resistant composite material used to make the blades. In 2022, China was the dominant player in fiberglass production, accounting for nearly 60% of global production capacity. When considering the whole turbine, including the tower, steel accounts for 24% of the total materials of an onshore turbine and 90% of an offshore one.

Wind turbine components are molded to specifications in castings, which then are assembled in a labor- and energy-intensive process. More than 80% of global production casting capacity is concentrated in China.

Copper and zinc also are critical to turbine manufacturing. China processes more of these minerals than any other country but traditionally has not been a major exporter of either.

Though well supplied with fiberglass, castings, copper and zinc, China lacks critical capacity to manufacture the kinds of bearings used in several areas of a wind turbine to reduce friction between moving parts and contrarian their motion.

Slewing ring bearings are generally used to adjust a turbine’s pitch (the angle of its blades) and its yaw (its orientation to the wind). These bearings enable the blades to rotate efficiently and China makes plenty of these domestically.

What China’s wind power industry currently lacks most is the capacity to produce its own roller bearings, the parts critical to the smooth operation of a turbine’s shaft and gearbox. Very technical in their manufacturing specifications, roller bearing production capacity is based almost entirely in the West.

Permanent magnets

Many wind turbines employ magnets made from 17 rare earth elements (REE). These magnets also are used in the electric vehicles (EV) China now leads the world in producing.

Getting rare earth elements out of the ground is a dirty mining process over which China had a decades-long stranglehold, as the U.S. and other developed economies tried to protect their local environments.

When, in 2010, China cut off all rare earths exports to Japan over a fishing trawler dispute and the EV industry boom began to make rare earths even more critical, the U.S. and other countries got back into mining. China’s share of global REE production decreased from 86% in 2014 to 58.3% in 2020, when it held 37% of global rare earths reserves.

China still holds an overwhelming advantage in the making of wind turbines, of which there are essentially two types: those with a gearbox and those without.

For turbines “with,” wind turns the blades and the rotor, which in turn, spins the shaft that connects to a gearbox connected to a generator, where the low-speed, high-torque rotation of the blades is converted into electrical energy.

The drawback of this kind of turbine is that turbulence can wear out the bearings in the gearbox, which in itself is a heavy and complicated mechanism requiring frequent maintenance, especially on large offshore wind turbines that operate on higher wind speeds.

In 1991, the introduction of direct-drive turbines eliminated the need for a gearbox by connecting the rotor directly to the generator, where magnetic poles to sustain the appropriate electrical output. Direct-drive generators are significantly larger than generators in gearbox turbines.

The permanent magnets at the core of the generators in direct-drive turbines contain expensive, heavy, rare earth elements such as neodymium and dysprosium, the most important component parts that Europe’s wind industry must import, most often from China.

“China currently supplies over 90% of the world’s permanent magnets and is the dominant producer and processor of rare earth elements that they depend on,” Anders Hove, Oxford Institute for Energy Studies senior fellow told The China Project.

De-risk, not de-couple

Western governments and wind power manufacturers are keenly aware of their dependence on China, heightened ever since Russia invaded Ukraine. EU governments don’t want to replace now-taboo imports of Russian oil and gas with a dependence on Chinese components for renewable energy.

In March 2023, the European Commission drafted targets aiming to make at least 40% of clean technologies in the EU by 2030. The target for batteries and wind energy was as high as 85%. In the U.S., the Inflation Reduction Act of August 2022 boosted new offshore wind capacity with tax credits for domestic production of wind turbine blades, nacelles, towers, and foundations.

China is still key for Western wind power, especially when it comes to rare earth elements, but there’s an attempt in the West “to de-risk supply chains, not decouple,” Joseph Webster, Atlantic Council Global Energy Center senior fellow told The China Project. “It’s important to emphasize that. The West is expanding its critical minerals mining and refining capacities, ensuring that Europe and other democracies are not potentially held hostage to sole-supplier dependency.”

Companies:

- Vestas

- Goldwind Science and Technology 金风科技

- Xinjiang Wind Energy 新疆风能

- Mingyang Smart Energy 明阳智能

- Sinovel 华锐风电

- Windey 运达股份

- Envision 远景能源

- Sany Renewable Energy 三一重能

- American Superconductor (AMSC)

Links and sources:

- China’s wind power companies are giants, but they aren’t going to take over the world — yet – The China Project

- Column: China widens renewable energy supply lead with wind power push / Reuters

- 国家能源局发布1-5月份全国电力工业统计数据 / China Electricity Council

- We discover the founding precursors of wind power / Siemens Gamesa

- Wind Turbine Suppliers see record year for deliveries despite supply chain and market pressures / GWEC

- Goldwind and Vestas in Photo Finish for Top Spot as Global Wind Power Additions Fall / BloombergNEF

- 二十年打造一支出海军团,中国风电如何崛起? / 36Kr

- 风行电照:中国风电军团仅用二十年,掀翻丹麦百年基业 / Cloud Zixun

- Xinjiang harnesses wind power to build clean future / China Daily

- 2022 Annual Results / Goldwind

- Ming Yang admits reliance on Aerodyn / Windpower Monthly

- Global Offshore Wind Report 2022 / GWEC

- China’s wind industrial policy “succeeded” – but at what cost? / Atlantic Council

- 如何从零造一台风力发电机 / 36Kr

- Global Fiberglass Market is Poised to Reach US$ 23,217.3 Million By 2031, Says Astute Analytica / Global Newswire

- What bearings are used in wind turbines? / Acorn

- The Future of Wind Turbines: Comparing Direct Drive and Gearbox / Engineering.com

- Strong Market Opportunity: Outlook for direct drives and gearbox-based wind turbine technologies / RenewableWatch

- Gear or No Gear, Not a Battle / WindTech International

- 跌停的明阳智能: 订单在手,增持不愁 / OFweek

- More consolidation for China’s rare earths industry as Beijing seeks geopolitical leverage / The China Project

- Wind Turbines: how dependent is the EU on China? / Energypost.eu

- LEAK: Brussels targets 40% of clean tech manufacturing in Europe by 2030 / EURACTIV

- The Inflation Reduction Act Will Help Boost Offshore Wind Production / CAP