Japanese beauty products under scrutiny in China over radioactive wastewater concerns

“I was so disgusted by the news. Even though my action doesn’t matter so much, I personally will not buy anything made in Japan going forward."

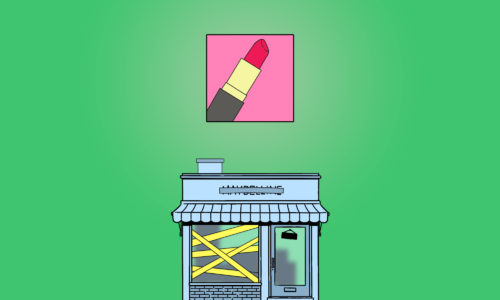

As public fear and anger continues to mount in China over Japan’s controversial discharge of treated nuclear wastewater, a slew of Japanese cosmetic brands have found themselves under greater scrutiny from Chinese shoppers, who have been pressuring the companies to disclose their production processes, especially the use of water in manufacturing.

The doubts over Japanese beauty products have been building since June, when the operator of the wrecked Fukushima nuclear power plant, the site of the second-worst nuclear disaster in history, began tests of newly constructed facilities for discharging diluted radioactive wastewater into the sea.

At the time, the trial sparked a viral debate on Chinese social media, with worried consumers raising questions about the safety of all sorts of made-in-Japan products, including cosmetic and skincare items. In a post widely circulated on Weibo, a handful of Japanese beauty brands — including premium ones such as Shiseido and Clé de Peau Beauté — are identified as unsafe. In response to a June poll conducted on Xiaohongshu, the preferred destination for Chinese shoppers looking for honest product reviews, nearly 80% of the 4,472 participants revealed that they wouldn’t use Japanese skincare and makeup goods due to safety concerns caused by the discharge.

Some affected brands were quick to react. For instance, American consumer products giant Procter & Gamble (P&G), which owns prestige skincare brand SK-II, released a statement on the issue, stressing that no radiation risks had been identified in the manufacturing site for SK-II, and that it would take the initiative to require targeted radiation testing to ensure the safety of SK-II products.

For brands that haven’t publicly addressed the controversy, they’ve been combating the negative allegations in private conversations with shoppers. When reaching out to official online retailers for Japanese brands like Shu Uemura and Kosé, local journalists reported that their inquiries about product safety were met with similar responses from customer service representatives, who emphasized that the products were manufactured in strict compliance with Chinese regulatory requirements and standards.

However, these attempts weren’t enough to curb the skepticism. According to Chinese media reports, since news broke last week that Japan had released its first batch of treated radioactive water into the Pacific Ocean, Chinese social media sites were awash with confessions from people who had returned the Japanese beauty products they previously purchased, either due to safety worries or in a patriotic gesture. Some even declared boycotts of all types of Japanese products, citing frustrations at its government’s “irresponsible” behavior.

“I was so disgusted by the news. Even though my action doesn’t matter so much, I personally will not buy anything made in Japan going forward,” a Xiaohongshu user fumed while seeking recommendations of alternatives to her favorite Japanese sunscreen and powder foundation.

Ever since a massive earthquake and tsunami in 2011 destroyed the cooling systems for the Fukushima Daiichi nuclear plant, triggering meltdowns in three reactors and releasing large amounts of radiation, the plant’s operator, Tokyo Electric Power Company Holdings, also known as TEPCO, has been pumping in water to cool down the ruined nuclear fuel rods that remain too hot to remove.

As the tanks storing the water are set to reach capacity in early 2024, the Japanese government announced plans in 2021 to gradually release the treated but still slightly radioactive water following its dilution into the Pacific Ocean, a multi-phase process that will take up to four decades. Although Japanese officials promised that they would bring tritium levels in the discharge well below all safety limits, a pledge that’s been supported by international organizations like the International Atomic Energy Agency (IAEA), the plan has provoked controversy both at home and abroad, with China and South Korea voicing the loudest opposition to the scheduled disposal of 1.34 million metric tons of water.

With its beauty products enjoying a long-established reputation among Chinese consumers, Japan used to be the biggest cosmetics exporter to China from 2019 to 2021, before France took over the title. Before the COVID-19 pandemic and its resulting travel restriction, Chinese tourists also contributed heavily to the domestic sales of Japanese cosmetics. It was estimated that 70% to 80% of Chinese visitors to Japan bought beauty goods, which catapulted Japan’s cosmetics market to record size in 2016 and 2017.

But the past few months have witnessed a dip in numbers. According to data from China’s customs authority, there was a 31% decrease in cosmetic imports from Japan last month compared with the previous year, following an 8.4% drop in June.

As animosity toward Japan intensifies in China over the wastewater release, selling products to Chinese shoppers will become even harder for Japanese cosmetic companies. And this is a particularly devastating blow for brands like Shiseido, which sees China as its biggest market, accounting for nearly 30% of the total sales. In the aftermath of the discharge news, the Tokyo-based cosmetics giant already suffered immediate financial implications: On August 28, the company recorded the largest weekly drop in its stock price in almost 10 months, falling by 6.8%.

Japan’s cosmetic industry isn’t the only sector affected negatively by its disposal of wastewater. Shortly after Japan began dumping the water from the plant north of Tokyo into the sea on Thursday, the Chinese government announced that it was immediately suspending aquatic imports, such as seafood, from its neighboring country. Previously in July, China’s customs authority introduced a ban on food imports from 10 Japanese prefectures, including Fukushima, while vowing to step up its inspection and monitoring processes for food from other parts of the country.

But for some industries, the situation has been a boon. In China, numerous supermarkets have been struggling to restock their salt shelves as consumers rush to stock up on the essential seasoning, fearing that its supplies would be disrupted by the controversy and the price would go up. The panic-buying frenzy has been so intense that the state-run National Salt Industry Group, China’s biggest salt producer, had to release a statement on Friday, urging shoppers to “purchase rationally.” Meanwhile, on Alibaba’s ecommerce platform Taobao, searches for radiation detectors have soared 232% in the past week, despite experts questioning the accuracy of such devices.