Not really the end of Hong Kong but a transformation — an interview with economist Alicia García Herrero

The China Project spoke with Alicia García Herrero, chief economist for the Asia-Pacific at French investment bank Natixis and an adjunct professor at the Hong Kong University of Science and Technology, about Hong Kong.

Alicia García Herrero is the chief economist for Asia-Pacific at French investment bank Natixis and an adjunct professor at the Hong Kong University of Science and Technology. She previously worked as an economist with the International Monetary Fund (IMF).

The China Project asked her about the ramifications of U.S. President Donald Trump’s China speech on Friday last week:

Last week, President Trump announced he is moving to revoke Hong Kong’s special status. This followed Beijing’s approval of national security legislation for the city. How will both of these moves impact Hong Kong’s economy?

In reality, Hong Kong is a member of the WTO and the OECD separate from China, so the U.S. cannot decide unilaterally that this may no longer be the case. However, the U.S. can treat Hong Kong as mainland China for any trade or FDI issues.

The U.S. could decide to impose the same import tariffs it has imposed on the mainland during the trade war. In the same vein, any FDI coming from Hong Kong into the U.S. may be treated as that originating in the mainland by U.S. authorities — this is already quite close to being the case after the reform of the Committee on Foreign Investment in the United States. Hong Kong’s special status also gives the city a laxer status for export bans of sensitive technology that Hong Kong would lose.

There is no doubt that this is all negative news for Hong Kong, and all the more so if other countries follow the U.S. On outward FDI from Hong Kong, there have been recent cases in Israel and Australia where Hong Kong companies have been treated as if they were mainland companies in terms of investment restrictions.

If Hong Kong’s special status is revoked, how could that impact trade and the economy more broadly in China and throughout the Asia-Pacific region?

Given that 70% of the mainland’s outward and inward FDI goes through Hong Kong, a revocation of its special status would affect how the mainland invests abroad and how foreign companies invest in China.

China could start investing directly throughout the world or receive investment directly, but that is easier said than done. For outbound FDI, China benefits from Hong Kong’s rule of law and international courts, which give credibility to their companies’ bids as investors.

Most importantly, China benefits from easy access to offshore U.S. dollar funding in Hong Kong. This is true for USD bond finance, with mainland corporates counting for more than 70% of the total amount of USD bond issuance in Hong Kong. It is also true for equity finance as is shown through the IPOs and secondary listings of mainland companies in the Hong Kong stock market.

Hong Kong has played a crucial role as a gateway between China and the West. Would revocation of Hong Kong’s special status eliminate the city’s role as this buffer, or would Hong Kong’s ties with other parts of the world continue to fortify it as a financial hub?

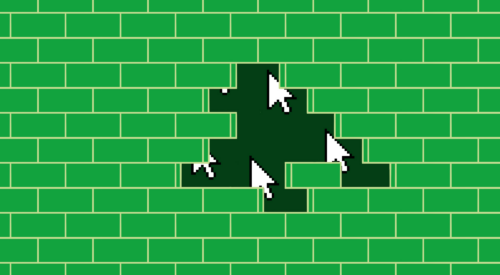

It seems clear that Hong Kong’s role as a buffer — I would also call it a “fortress of arbitrage” in many ways — between China and the West is at stake, but Hong Kong may retain its offshore role within Asia. This is not really the end of Hong Kong but a transformation of its long-standing role.

You have lived in Hong Kong for many years. How would you describe the mood in the business and financial communities there now amid rising U.S.-China tensions?

I have been based in Hong Kong for nearly 14 years. Hong Kong is clearly a victim of Sino-U.S. tensions. Hong Kong is a part of China, and as such, it is hard for the city to maintain broad economic independence in a cold war environment. What we are experiencing was to be expected.