China’s New Live-streaming Sales Weapon – Zhibo Daihuo

Mixing elements of entertainment, infomercials, and social media, China's live-streaming sales stars can drive more than $10 million in sales in just an hour.

If you haven’t grown too fatigued of reading COVID-19 related news in the past few weeks, you may have come across the image of a huge pool party that took place in Wuhan, Ground Zero of the coronavirus.

It could almost be a parallel universe, one where COVID-19 didn’t happen, one in which social distancing and face masks aren’t part of your everyday vocabulary. Whilst the image sparked some mixed feelings across the world — awe, envy, anger and even disgust — the photo captures China today: when, as BBC writes, “Wuhan has moved on from the its January lockdown”, whilst the rest of the world has just begun to slowly recover and reopen images like this seem still far out of reach.

This hit China first and that meant the country ended its nationwide lockdown at the turn of March and April, a time when Europe and the US was seeing the highest case jump and death rate. And in just two months, by the end of June, China’s Total Retail Sales of Consumer Goods has returned to pre-COVID levels. Whilst offline retail may still face some challenges ahead, one key driving force behind the rapid return to consumer spending has been live-streaming sales.

This new world created opportunities for many individuals and businesses. Back in April when all we heard about was the daily rise in cases in New York, China had very different headlines. Yonghao Luo, who made his name as a celebrity English educator and later with smartphones, used his rather charismatic and eccentric personality and joined the world of live-streaming sales.

Rather than just creating one or two short promotional videos, Luo spent 3 hours live-streaming from a home studio. It was his first ever live-streaming gig, and the purpose was to sell 23 products, including a smartphone made by Xiaomi, a smart lock by Philips, and some catfish snacks. The result was what Chinese social media joked as “passable” performance for a first-time live-streamer — and regardless of how new he was to live-streaming sales, a total of 48 MILLION people watched the show, and within 3 hours, he sold a 110 million RMB worth of products (~16 million USD or ~13 million GBP).

This sounds impressive right, $16million in sales, but what might surprise you is Luo wouldn’t have even made the top 5 list of the most revenue generating live-streaming sales shows in 2019. Wei Ya, a wholesale-vendor-turned-live-streaming-host set the record at a whopping 267 million RMB worth of sales in one sitting last year ($40 million USD). Li Jiaqi and Li Ziqi, two Chinese live-streaming A-listers regularly deliver 150 million RMB sales live-streaming shows.

Live-streaming sales is in fact not a brand new thing per se. You can probably liken it to the old-time live infomercial, except it happens on social media with an unlimited time slot. But it’d be inadequate to look at it without considering the entertainment part of it, which makes Chinese social media live-streaming so unique.

You might be wondering how this differs from QVC. The hosts for live streaming sales platforms are not just featuring brands and products (who can pay hundreds of thousands to just be featured by a livestreamer) they are providing entertainment. The fans (consumers) also get to interact and engage with them, asking questions and commenting during the broadcast. Purchasing is made super easy as well, with just a few taps you can purchase the products being featured by the livestreamers, to quote Arianna Grande, you see it, you want it, you got it, it’s that simple.

Live-streaming sales have become one of the highlight industries that have flourished in China, and opened up new marketing and sales channels to brands, especially amid the coronavirus outbreak.

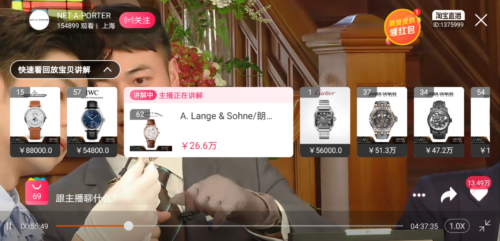

One notable live-streaming sales event this year was staged by the Salon International de la Haute Horlogerie, or SIHH, one of the two most prestigious luxury watch and jewelry exhibitions in the world. Forced to cancel the exhibition due to the pandemic, they turned to Net-A-Porter’s T-mall channel to launch a joint live-streaming sales event at the end of April. Many of the top luxury watch brands, Cartier, Piaget, IWC, etc. were all featured in the live-streaming sessions. According to T-mall, a 350,000 RMB (~38,000 GBP or ~ 51,000 USD) Roger Dubuis limited edition watch was sold within the first minute of its display.

LV (Louis Vutton) launched its first live-streaming sales event on the lifestyle platform, RED. Within an hour of going live, LV’s RED account attracted over 10,000 new followers.

Gucci chose Weibo to be their main platform for live-streaming sales. The 12-hour marathon live-streaming sale saw Gucci break multiple records of branded live-streaming sales, with over 15 million views. Chloe, Dior, Tiffany and many more brands are now adopting live-streaming as a main digital solution to drive sales as offline retail still struggles.

PingPong Digital, has also worked on numerous live-streaming campaigns as well, with one client reaching millions of new audiences and attracting thousands of new fans during their campaign. For brands that are considering live-streaming sales as a potential strategy for the Chinese market, here are a few questions to ask as a starting point.

- Do you have a solid branded social media following on Chinese social media? Live-streaming sales perform best with an existing social media following, simply because when users receive the marketing message they will want to check you out on social media. This is especially important for brands that may not yet be household names in China, as Chinese consumers will always want to verify your authenticity through the verification status associated with your social media official accounts. Having these social channels set up also contribute to converting one-time customers to long-term loyal fans of the brand.

- Which platform do you want to have your live-streaming sales on? Different platforms serve slightly different purposes, even if they may all look similar or you’re more familiar with one platform. Just like LV and Gucci, both chose two different platforms for their respective live-streaming sales events, brands need to choose the right platform that’s best suited for your primary goal.LV chose RED to be their host platform because they were targeting the 75% female audience on RED. Gucci picked Weibo because it attracted the largest and most diverse audience. Douyin may work best for a younger audience, T-mall for the best conversion experience, etc. Brands should choose the right platform based on your needs and your target audience.

- Do you want to launch your own live-streaming sales event or partner with hosts? This question applies to brands big and small. Existing live-streaming influencers may be a good method to raise awareness, but you’re reliant on the host to make the sales for you, and that means working with their style of selling. Although top hosts will most likely place your product among many others, the ability to attract large viewership will almost guarantee at least some conversion. Smaller hosts (think KOC’s) may accept a PR box as payment to feature your products, but some (most) of the larger live-streaming hosts require payment.

If you are interested in learning more about live-streaming sales marketing, and other marketing trends in China, then contact PingPong Digital at info@pingpongdigital.com. We are the leader in Chinese digital marketing in Europe and North America.

Also, sign up for the The China Project X PingPong Digital New Perspectives in China Digital Marketing Email Series for more content like this!