Decoupling will make China investing cleaner

As tensions between China and the U.S. mount, some of the gray areas confronting global investors will sharpen, argues Gerard DeBenedetto in his look at the China markets this week.

As U.S. President Biden was attending Quad meetings in Asia, Secretary of State Blinken outlined the long-awaited administration’s China policy. The takeaway related to investment can be summarized in the following words from Blinken:

The United States does not want to sever China’s economy from ours or from the global economy — though Beijing, despite its rhetoric, is pursuing asymmetric decoupling, seeking to make China less dependent on the world and the world more dependent on China. For our part, we want trade and investment as long as they’re fair and don’t jeopardize our national security.

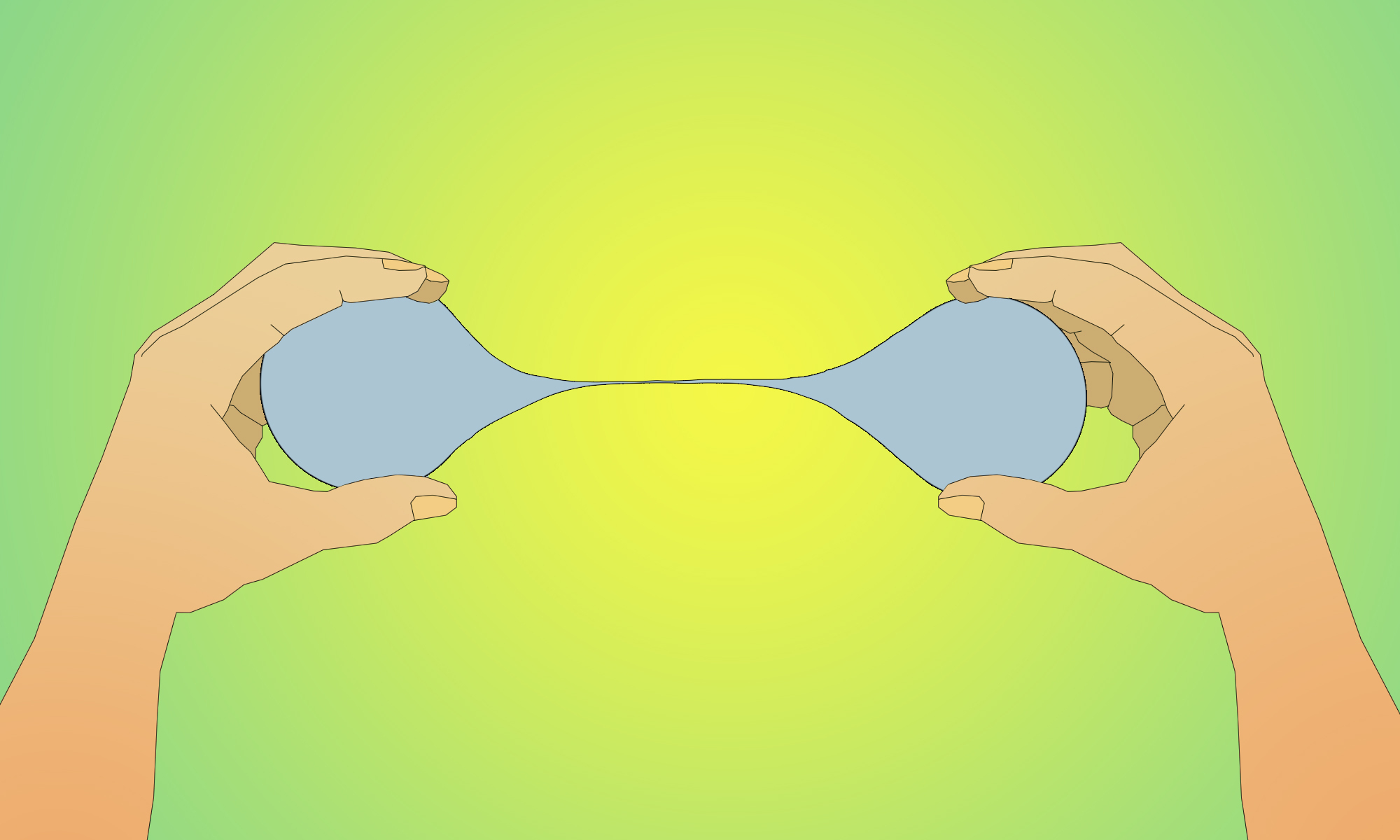

The U.S. and China are diverging in many ways, but they are converging with their trade policies. China’s commitment to dual circulation (growing exports and increasing domestic consumption) and the continuation of the Trump-era tariffs on imported China goods should put investors on notice. Shipping disruptions as a result of COVID lockdowns are accelerating the divergence. In fact, U.S. exports to China peaked in October 2021 and imports from China peaked in December 2021.

Trade doesn’t tell the whole story; many U.S.-based companies depend on mainland China sales and manufacturing, whereas few China-based companies depend on global sales. Alibaba, perhaps the best-known Chinese company, derives only 8% of its revenue outside of China, according to its annual report. Apple, perhaps the best-known U.S. name, derives 20% of its revenue ($25 billion a quarter) from a place called “Greater China.” This shows how navigating this era of decoupling is more difficult for global firms.

The emerging model is quite simple and one that existed in the years before China’s accession to the World Trade Organization (WTO) in 2001. Any firms on the ground in China at that time were there to develop a local business for local customers. The idea of outsourced manufacturing simply did not exist at scale for global brands, although Hong Kong and Taiwan firms were already building out factories. Conversely, the few China-based companies listed in the U.S. were state-owned enterprises in the commodities and airline industries. Fast-forward two decades and foreign companies are having to defend their unknown supply chain partners and business practices while Chinese companies with no business in the U.S. are being forced by American regulators to disclose financial information that might be called spurious at best.

Yum China — which operates KFC, Pizza Hut, and the Little Sheep hotpot chain — didn’t start as a China-only business, but now its 12,000 restaurants on the mainland operate without much international scrutiny. While it remains a listed company in the U.S., a secondary listing in Hong Kong was consummated in September 2020. Contrast that with Airbnb, which recently announced its departure from the mainland, citing competition and costs. Perhaps simply selling to or investing with its local rival Tujia 途家 would be a more profitable strategy.

For investors, this decoupling makes allocation much cleaner. No longer will China exposure be influenced by U.S. market beta and the fortunes of Chinese companies will rise and fall based on their own merits. Allocating to mainland and Hong Kong shares is easier than ever, and as the regulatory nudging continues, so, too, will the concatenate listings away from New York and toward China.

A-Share Intelligence is a weekly column.