How companies are dealing with the Uyghur Forced Labor Prevention Act

Craig Allen, president of the U.S.-China Business Council, and Jon Gold, vice president of Supply Chain and Customs Policy at the National Retail Federation, help make sense of how companies can deal with the sweeping effects of the Uyghur Forced Labor Protection Act, which just went into effect in late June.

Below is a complete transcript of the China Corner Office Podcast with Craig Allen.

Chris: Hi, everyone. Thanks so much for joining us today on China Corner Office, a podcast powered by The China Project, the New York-based news and information platform that helps the West read China between the lines. I’m Chris Marquis, a professor at the Cambridge Judge Business School. And today, we’ll be featuring a recording of a live webinar discussion about how companies are dealing with the Uyghur Forced Labor Protection Act (UFLPA). This new act, which just went into effect in June, is unprecedented, and that it places the onus on manufacturers and importers to ensure their supply chains are free of forced labor. Under prior forced labor provisions, importers were presumed innocent until proven guilty, so to speak.

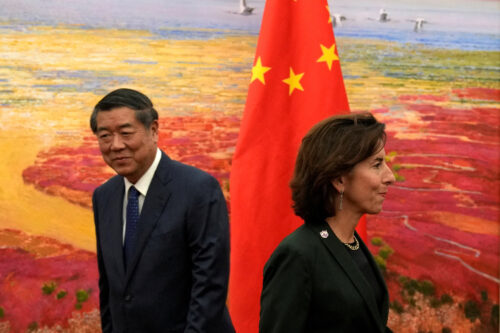

Joining me to discuss the provisions of the act are Craig Allen, President of the U.S.-China Business Council, and Jon Gold, Vice President of Supply Chain and Customs Policy at the National Retail Federation. Craig and Jon discussed how companies, in their respective associations, are working to meet these requirements and also how the act will be enforced by U.S. customs and border protection.

While the provisions of the UFLPA are quite sweeping as it applies to imported items from anywhere in the world that has any material or labor from Xinjiang, Craig and Jon also reflect on some of the key sectors that are most affected initially, which include the apparel industry, which uses Xinjiang cotton, and also the solar industry as about 50% of the world’s polysilicon comes from Xinjiang. We also discuss topics such as how China will respond and the potential further sanctions from the administration this year. We conclude with Craig and Jon providing valuable advice for companies on how to cope with these challenges and what to anticipate in the future. Thanks so much for joining us and enjoy the show.

Chris: Welcome, everyone. My name’s Chris Marquis, and I’m a professor at Cambridge University Judge Business School. And it’s great to have you with us on this live The China Project CEO webinar recording of the China Corner Office Podcast, which is a show focused on leaders and companies facing the challenges and opportunities of doing business in China. And today’s webinar is in partnership with the U.S.-China Business Council, a nonpartisan non-profit organization that represents over 250 American companies doing business with China. Our topic, as I’m sure you all know, is how U.S. companies are dealing with the Uyghur Forced Labor Prevention Act.

And to discuss this, we have two leaders who are intimately familiar with the topic, including Craig Allen, who is President of the USCBC, welcome Craig. And also, Jon Gold, who is Vice President of Supply Chain and Customs Policy at the National Retail Federation. Welcome, Jon. Craig and Jon, welcome to China Corner Office.

Craig: Thank you.

Jon: Thanks Chris.

Chris: Jon, actually, we’d love to ask you the first question. So, the Uyghur Forced Labor Protection Act, can you give us a little bit of context and background on this bill, what’s its purpose?

Jon: Sure. So, I’m going to step back a little bit further than where the bill originated, really go back to 2015, 2016, when Congress actually made some changes to the forced labor laws within the United States. They made changes to the Trade Act 1930, where they removed what was known as the consumptive demand provision within the Forced Labor Law. So, they made that change, which essentially eliminates any consumptive demand. Under the previous law, if there were products that were not available in the United States, [companies] could bring it in, in that scenario. But now closing that loophole, CBP has been more enforcement focused on preventing goods, or maybe forced labor from coming into the United States. So, that was kind of a starting point for where we are today.

And really the issue of the Uyghur Forced Labor Prevention Act really started back in around 2018 when we first started seeing reports coming out about the mass detentions of the Muslim Uyghurs in Xinjiang and the treatment of the Uyghurs. As more reports started coming out, documenting the situation, the widespread state sponsored forced labor, I think that’s when members of Congress and others started really getting interested in the issue and trying to figure out what they could do. In addition to Congress getting involved, obviously CBP had a ramp up of their forced labor investigations, where they created a forced labor division in 2018, where they started looking more and more at the issue of forced labor. And started ramping up some of withhold the release orders that they really hadn’t been issuing over the years and started picking up on issuing more of those withhold release orders.

And as well as commerce adding more companies to the entity list as well. With all of that happening, you had members of Congress that then started introducing legislation focused on the Uyghurs, and really trying to create a ban on the importation of any products made with forced labor coming out of the Xinjiang region. Legislation was first introduced in 2020 by Representative Jim McGovern in the House and Marco Rubio in the Senate. The bill actually passed in the House in 2020, but did not move out of the Senate. And that was the end of the session at that point in time so it did not move.

The bill was reintroduced in 2021 with the new Congress and it passed relatively quick, passed the Senate in July of 2021 and the House in mid-December 2021. And then, within a week of passing in the house, it was signed by the president, and it took effect on June 21 this year. There were some differences between the bills, between the House and the Senate versions that got addressed throughout the process, so when you had a vote on kind of the conference to deal with those issues. But in general, the bill creates a rebuttal presumption that applies to all goods made in whole, or in part, which is critical in the XUAR (Xinjiang Uygur Autonomous Region), or made with forced labor and prohibited importation unless the importer can provide clear and convincing evidence that the goods were not produced with forced labor.

This means that both finished goods that are produced outside the XUAR, in other parts of China or elsewhere in the world, may still be banned from importation if any raw materials in the XUAR are used within the production of that good. And it’s important to note that there is no de minimis exception to this. That’s why that, in whole or in part, is such a critical part of this. We’re now here a month plus since the law, the rebuttal presumption has taken effect. The rebuttal presumption is an assumption that any good originating in Xinjiang, or associated with Xinjiang, or is made by a company that’s on one of the entity lists is made with the forced labor. So, it is deemed to be illegal to import because there is a presumption that it is made with forced labor.

Chris Craig, can you weigh in on this as well?

Craig: Another way of looking at this is that it is a presumption of guilt. Anything that is coming in from Xinjiang is presumed to have forced labor. It’s very difficult for a company to prove that there is no forced labor if it is coming in from Xinjiang. I’d just like to underscore Jon’s point in whole or in part. If one takes that literally, that would mean an atom of the materials coming in from Xinjiang would potentially disqualify it from entry into the United States. So, that whole and in part is important language. And the presumption of guilt is also an important element or characteristic of this legislation, which makes it difficult to be fully in compliance, and to know that you’re fully in compliance

Jon: And I say, and Craig, to your point, you have to prove the negative, which is extremely difficult to do.

Chris: I’d like, Craig, to stay with you. Jon got us started a little bit on some of the background of this, dialing back to some of the earlier laws on forced labor. For those, presumably, it’s not sort of a guilty until proven innocent type of situation. Can you give us a little bit of historical background on forced labor laws in U.S. customs?

Craig: As Jon had noted, this law is kind of based on the infamous Smoot–Hawley Tariff Act of the 1930s. Within Smoot–Hawley, there was some odd exemptions, that if there was insufficient supply in the United States that effectively, the law was not enforced. So, that was changed, as Jon noted, in 2016. The driving force behind this are the concerns about Xinjiang’s very specific situation. So, since 2020, we’ve had a good number of withhold release orders that have been implemented. Just to take a second and explain what a WRO (Withhold Release Order) is, it’s when customs seize a product and requires additional information, and after which it’ll eventually be released, or if that additional information is not forthcoming, it might be destroyed, or the importer might be required to export it outside of the United States.

So, heretofore, most of the seizures that we’ve seen as a result of concerns about Xinjiang have been in the apparel and in the solar panel industry that precedes the Uyghur Forced Labor Prevention Act because a good number of companies have been put on the Entity’s list. Or other parts of the law have been used to exclude products coming in from those companies of concern.

The Uyghur Forced Labor Prevention Act changes all of that and sets a much wider net from which customs can question or seize product. So, I think that the major consequence of this for companies has been companies need to be much more careful and curious about their entire supply chains. We have always had interest and concerns about this supply chains, but, depending on the company, people had different concerns. Now, everyone is concerned and is trying to, if you will, investigate or interrogate their supply chain as far down as possible. And that is not a simple matter to prove that one is in full compliance with the law.

Chris: I’d love to hear a little bit as well about the industries and products that Craig mentioned, cotton and silicon and its need to actually examine the entirety of one’s supply chain. Jon can you comment on how your members are thinking about this.

Jon: As Craig noted, the recent withhold release orders have been issued by customs. I mean, they certainly have ramped up over the past couple of years, especially since the director was founded at CBP. The WROs initially focused on companies, solely focused on a company who was applying a certain product. And we saw a number of those that came forward on apparel, on hair care products, on solar products, polysilicon, tomatoes. And then we did have two WROs that were issued, I think, last year, that looked at a full category of products. So, looked at cotton and cotton products and the tomato and tomato products. This was prior to the UFLPA being signed into law. They were subject to the WRO.

I think it’s important to note that once the WRO is issued, the number of detentions that have happened with the imports that have been coming in, just to read the latest stats that customs has put out there, which is fiscal year 2022, which covers October 1 of 21 to June 30 of 2022, they issued six withhold release orders and detained well over 2,000 shipments. But they haven’t released the number of those shipments that have been released because companies have not been able to provide the information that was requested, which I think, as Craig noted is complicated, because as CBP and other agencies have been telling us, and telling industry, they want you to know your supply chain, which means going all the way back to where the raw materials came from.

Going back to where the cotton was farmed, where the sand came from, and the quarts that go into polysilicon and solar panels, where the tomatoes are grown. So, all that, you have to get to know all the way back within your supply chain, which is very difficult for some companies that don’t really get beyond their tier two, tier three, maybe tier four suppliers. Not going back to your supplier of your supplier, of your supplier, but now having that focus to be able to map out your supply chain from beginning to end, basically, is what the requirements are.

I think you noted the breadth of this, because it’s not just limited to what’s coming out of the XUAR, but where those inputs and components that touch the XUAR, are they somewhere else within China that’s utilizing a peering program, using the Uyghurs? Or if a product is being used somewhere else coming out of another country. What we’ve seen thus far and we’ve heard thus far, at least some of the detentionees, under the UFLPA, have not been from China. Their country of origin is from somewhere else. So, the breadth here isn’t just limited to just China. Again, it extends outward to other countries as well.

Chris: What I’m hearing is that there could be a shipment from France or Vietnam, and if there was Xinjiang components in those their subject to the act, that really, I think, expands, at least, as I’m thinking about sort of the catchment, in some ways, of this legislation a lot.

Craig, I’m curious, I’ve mentioned France, how are other countries approaching this issue? The EU or the UK, is this something where they’re also thinking about similar types of laws or implemented similar laws?

Craig: Let me follow up on what Jon said and note that there are allegations that Uyghur labor brigades are being shuffled around China, and that there are concerns by CBP that Uyghur forced labor could be used in a product coming out of other provinces outside of Xinjiang. I think that there is some documentary evidence that such types of group labor contracts do exist. And this further complicates the matter because now the degree of inspection by companies has to include looking at all of the labor contracts and trying to determine whether or not there might be any group labor. And if there is a group labor, then, exactly, who is being contracted out? Anything coming out of Xinjiang is essentially forbidden, right? Effectively. But that’s not enough. Companies need to know their supply chain better than that so as to ensure that there’s no Uyghur forced labor from another province as well, or another country,

Chris: I can see Xinjiang is a bound region, we can identify those products come from there. What you’re saying is that, okay, let’s say if someone’s producing in Gansu with Uyghur labor, that then also is applicable to that production. But it seems the underlying issue should be about forced labor, in some ways. It seems that forced labor, in general, should be the issue, but it’s being identified by whether or not there’s Uyghur employees.

Craig: So, the allegation is that there are Uyghur employees organized by the public security bureau or other government entities who are maybe working against their will. And thus, this is not limited to Xinjiang. And companies need to prove that labor conditions in the factories from where they’re sourcing have no source labor, no matter where those factories are located. And as Jon had noted, there have been cases where product coming in from third countries have been stopped due to components. So, the group bonded labor is a variation on that.

Jon: Just real quick to note. You’re looking at ensuring you have a clean supply chain. There’s also a concern that, let’s use cotton for an example, that you might not have any cotton within your supply chain coming out of the XUAR. But there’s a concern that at some point within the supply chain, your cotton, which may be coming from the U.S. or somewhere else, somehow gets commingled with cotton out of the XUAR. And how do you disprove that is one of the bigger concerns, where there’s assumption that just this happens no matter what. I think that’s the other part of this too is making sure that you don’t have these commingling challenges and issues that happen in the supply chain.

Chris: Before diving into what other countries are doing, Craig, I’d like to actually stay with Jon and talk a little bit about enforcement. So, you mentioned some of these stats of the withhold release orders. Do you think this is going to ramp up? I know, as I was reading about the act, there’s actually a lot of funding for additional staff for CBP. And it seems that might take a while to actually, in some ways, scale. And so, can you comment on enforcement now and in the future?

Jon: The rebuttal presumption took effect on June 21. So, they’ve certainly been ramping up enforcement since then. They haven’t put out the enforcement stats to date on what they’re doing, but as you noted, Congress has appropriated a significant amount of money for CBP to beef up the enforcement going after forced labor. They were given $30 million in fiscal year 22 and additional $70 million for fiscal year 23 to staff up an additional 300 officers to help address the issue of forced labor, certainly has been a challenge going forwards. They were given limited amount of time to get things up and running for the UFLPA. When the law was passed, they were given 180 days to get the DHS strategy in place.

Part of the concern was that, and something that we had pushed back on a little bit when we were discussing this in Congress, was that you’re going to have the forced labor enforcement strategy being issued the same day when the rebuttal presumption takes effect. The concern we had all along was that for companies needing to know how to adhere and comply with this, we need more time to be able to do that. So, putting out the strategy on the same day that this takes effect doesn’t give companies enough time to really understand what the process is going to be going forwards. How do you address the rebuttal presumption? How do you seek an exemption for that? And to be honest, even prior to the UFLPA, going through the WRO process, there have been challenges and questions, how that process was working then that still we’re trying to get addressed.

Knowing the short timeframe they were under, they’ve put this now into effect and they’re working on it. There are a lot of other questions that keep coming up on the enforcement and how it’s working that we’re continuing to push forwards. DHS had a hearing, looking at their strategy, seeking input on their strategy. They didn’t have a strategy that we were providing comments on, said, “Here are the elements we want to look at. So, give us comments on the elements.” So, we didn’t have an opportunity to comment on the strategy that’s been put out. We certainly hope that it’s a living document that we can continue to update as we learn more about how the enforcement is going, what’s happening on forced labor, and everything else.

We continue to push CBP and the forced labor enforcement task force to really look at industry as a partner in this, because we all share the same goal of ensuring that there is no forced labor within our supply chains. So, we want to work with them on addressing these issues and looking at the path forward, looking at things like technology and how can that be used going forwards. We continuously call on CBP, let’s do some pilot programs, and looking at the different technologies that are out there and see how they work, because what CBP’s going to learn from a technology vendor is going to be a little bit different than working with an importer who may be testing that same technology and see how it works for us.

So, it’s ongoing. We certainly expect a ramp up in enforcement, not just because of the money that CBP has been getting, but because of the whole government approach to this. And the fact that Congress really is paying attention to this and with all the other issues ongoing with China too, this is just something else that we’ve gotta put into that basket of things to be aware of.

Chris: Right. There’s a number of very interesting questions that have come in. And one of them, I’ll start with one from Ray Friedman (from Vanderbilt). He asks about the complexities that we have discussed for the first 20 minutes. They are very extensive, were these issues discussed at all in the legislative process?

Jon: Yeah. Look, we worked closely with the sponsors of the legislation and others to really kind of talk through all these different challenges in the supply chain. We wanted to work with them. And again, pass legislation that we knew was going to be helpful in work, but the ongoing sentiment was you have to know your supply chain. You’ve gotta go beyond your tier one, tier two, tier three. You’ve got to know the entire year supply chain, which we’ve told many, many folks are extremely difficult to do because you don’t have those contractual relationships with the vendors of your vendors, sub-vendors, and things like that. But the continued push is that, regardless, you’ve got to know your supply chain.

We pushed as hard as we could. I know many different industries, as well, all engaged, again, sharing the goal of eliminating forced labor within the supply chain. We continue to talk about that. We talked about the need to make sure we’re adhering to the international standards that are out there on forced labor, and how do we address it, and try to mitigate it as well. I mean, many companies have mitigation procedures in place when they do find an issue to go in and try and resolve that.

And one of the concerns with doing kind of the outright ban is that one, if it’s the U.S. alone that’s doing that ban, that poses one problem, because those shipments then are going elsewhere. But if we’re not trying to mitigate and resolve those issues, how does that help the worker on the ground if we’re not trying to mitigate and resolve? Is the expectation the ban’s going to then force China to change all these practices and not do it anymore?

Chris: And I’m curious, if the U.S. is sort of standing alone on this, and obviously the U.S. is a big market, but if the EU, you can still import goods from Xinjiang, I mean, there’s not really much incentive for China to change because there’s a lot of other markets that they can sell those products to. Craig, can you give us an update maybe on some of the other country’s responses to this, particularly the EU, I think, is interesting?

Craig: What I would note is that the EU is also looking at the same problem independently, but also with the, if you will, encouragement of the U.S. But I think that the EU will eventually land in a quite different place than where the Uyghur Forced Labor Prevention Act lands. The Europeans seem to be focusing on forced labor as a general problem within the global trade regime. And without reference to Xinjiang is requiring companies to know more about and to be able to report upon and have documentary evidence for all the way down their supply chain. So, they’re trying to open the aperture of supply chain information to ensure that there’s no forced labor coming in from anywhere. So, at least as I understand the EU instrument, that is not yet in force, but that they intend to bring into force in the near term.

There’s a ban on forced labor from anywhere and reporting requirements to ensure that European importers comply with the law. And at least in my view that the principle of having this in effect for anywhere around the world is a noble principle, and the presumption of guilt, if anything, is coming out of Xinjiang is quite different in approach. Perhaps the European efforts or predicated on U.S. efforts. I know that there’s a lot of dialogue, back and forth, between Brussels and Washington on this. In contrast, I don’t know any other country in the world that would ban anything coming in from Xinjiang. And I’ve asked friends, allies, partners about this, and they would just note that they don’t have any legal mechanism to ban products coming in from Xinjiang.

That said, a number of countries, and the EU would be in the lead here, have taken other actions to address the alleged human rights abuses in China, including sanctioning of individuals and other types of activities. So, it’ll be interesting to watch the European legal process and other countries as well. Will they follow the U.S. example? To what extent will they follow the U.S. example? Will they focus on Xinjiang or not? Is a question that I don’t know the answer to.

Jon: Craig, your point, though, about the legal authority in regards to forced labor is an important one. And I think that ties into what the U.S. is trying to do as a whole. You now have the United States trade representative that is seeking comments on a trade strategy to deal with forced labor. If you look at the USMCA (United States-Mexico-Canada Agreement), there was a provision in USMCA that required Canada and Mexico to put forced labor laws on their books. And they’re in the process of doing that. So, USTR (United States Trade Representative) is looking at using that as a model, if we ever get back into negotiating free trade agreements, that this is going to be a requirement that countries now have a forced labor requirement on their books.

And those comments are due to USTR by Friday, I think the fifth. We’re going to see kind of how USTR moves forwards with that. I mean, we continue to say this needs to be, not just a whole government approach, but a multilateral approach going forwards. So, hopefully, that’s where we can get more emphasis from other countries engaging in this and get out of the kind of U.S. only ban kind of situation.

Craig: Jon, I think that your point is really important because one of the options that companies have, if their products are investigated or seized by customs, is to re-export them. And the obvious place to reexport them would be north or south. But those avenues are going to be closed off. There’s also the reputational risk that a company would face. And really, that’s a key risk, sort of we haven’t really addressed it here, but that is a key risk that companies would face.

How do you ensure that you’re not caught up in this and that your product is able to flow into the country without that type of investigation and/or seizure? And probably the best way to do that is to know your supply chains very well and ensure that those supply chains don’t have any direct nexus or indeed, indirect nexus with Xinjiang. And if you do that, you will probably be in compliance with U.S. law.

Chris: We have a number of questions about actually what happens when a product is identified as potentially having materials from Xinjiang. So, Jon, I’d like to go back to you. I mean, Craig mentions re-export as one possibility. So, let’s say a company is importing something and the CBP says, Okay, we’re holding this for suspected Xinjiang materials. What happens then?

Jon: So, you’ve got a couple of options if you do receive a detention notice that your shipment is being held under the UFLPA. One, you can decide to re-export the shipment at any point during the investigation. You can also elect to destroy the shipment as well, if you don’t want to re-export it. But under the law, you do have the opportunity to request an exception to the rebuttal presumption, but you need to provide clear and convincing evidence that there is no forced labor associated with the shipment or that UFLPA does not apply. In addition to the exception, you can also argue that the shipment is beyond the scope of the UFLPA so that, basically, the imported goods are sourced completely outside of the region and have no connection to the entity list as well.

But things Craig noted early on, it’s going to be very difficult for companies to prove that clear and convincing evidence. CBP has outlined in DHS, the Forced Labor Enforcement Task Force, outlined in their enforcement strategy, as well as the imported guidance, what you need to do, the types of information you need to provide in order to hopefully be successful in getting the exception. The type of information that CPB is going to be looking for is documentation of a due diligence system or process. That includes mapping of the supply chain, a written supplier code of conduct, forbidden use of forced labor, training your employees on forced labor risks, doing independent verification of the implementation, and the effectiveness of your due diligence system.

Looking at supply chain tracing information, looking at evidence pertaining to the overall supply chain, and again, mapping out every step along the way within your supply chain. The role of the different entities within your supply chain. Evidence pertaining to the merchandise of any component. So, things like purchase order, the invoice, certificate of origin, seller’s inventory records, shipping records, information on supply chain management measures such as in internal controls. And then evidence that the goods were not mined, produced, or manufactured, wholly in part, in the XUAR. It is extremely complicated. And the challenge here is that when you do get a detention notice from CBP, it’s only going to indicate that the detention notice is because it’s subject to UFLPA.

They’re not providing you with any of the additional information for you to be able to go and do your due diligence to find out where within the supply chain the issue may be. And that’s something we continue to push customs on, is provide that additional information so companies can do the due diligence they need to figure out where the problem may be. And one, not provide you reams, and reams, and reams of information, but provide you a better opportunity to do the investigation and identify where the problem may be and how to address it going forwards. If CBP does grant an exception, they have to then provide a report to Congress and the public as to why the exception was granted and the evidence that was received to be able to prove the exception as well.

Chris: If they’re not actually providing that detailed information, how does CBP go through actually potentially identifying something that’s subject to this act? I mean, one of the questions actually in the queue is that through their own investigation, is there civil society or third-party independent complaints that actually get these facts established?

Jon: It’s a little bit of all of that. They’re certainly getting petitions from NGOs and civil society. They’re obviously doing their own investigations, using their own targeting, looking at shipment information, looking at country of origin, doing their own Intel along those lines, and looking at whether or not anybody who’s on the entity list, any shipments are coming from those that have been put onto the entity list as well. But a lot of it, there are petitions coming in from civil society and others that they have now have to go out and do their investigations on. But CBP has not shared, and we don’t expect them to share, kind of what their targeting system is and how they’re making those determinations.

But again, asking for that additional information to help, not only the companies get a better understanding of what’s happening and where the problem may be, but again, provide CBP a better opportunity to do the investigation and understand. So, again, they’re not getting the books and books of information. That makes their job more difficult to kind of go through all that. One of the things they have asked companies to do is, as you’re providing all this information, on the top, make sure you have an explanation, a basic information, a kind of map that shows the journey of the product, and explains to them an easy way every step along the way, and then the documentation that helps support that going forward.

Chris: And imagine, I mean, for every company to do this, in and of itself, is a huge challenge. Are there any third parties or systems or other mechanisms that have started to be created in order to help with this process? And part of that as well is, is there any sensitivity in China to doing this? I want to ask Craig actually about the U.S.-China relations topic. This, in and of itself, could potentially be a sensitive topic to be talking about within China. And Jon, to first stay with you a little bit, to hear from your members about what sort of third parties are arising to do this, and then if there’s any sensitivities in doing it.

Jon: There certainly are different technology vendors that are coming forwards that are helping with doing the supply chain tracing, supply chain mapping, documentation tension, lock chain, all that, folks are certainly taking a look at now, but it is time consuming. It is costly. It is very difficult, especially if you’re looking at one shipment, but trying to do that for the entirety of your supply chain is extremely difficult for all importers. Very difficult for small and medium sized folks that might not have the resources to be able to do that and don’t have the control that some of the larger importers might have. Again, they don’t have the control all the way back to where the raw materials came from. But looking at those traceability and visibility tools is something that a lot of companies are looking at now.

Again, many are doing some tests on that. DNA testing, looking at that to see where the cotton is coming from. Are those readily available in the commercial quantities we need right now? I think that’s something that everybody is exploring. Again, this is another reason why we’re asking CBP to conduct these pilot tests, to know what technologies are there and how they work in the field and with businesses. We know CBP has held two days of meetings with different technology vendors to understand what’s out there and what companies are doing. It was great. The technology vendors got a chance to go in and talk about their different technologies, but there wasn’t an opportunity for the trade to come in and talk about how they’re using some of those technologies, which we think is a critically important part of this.

Recognizing that CBP is looking at their own technologies, and how do they improve what they’re doing? But they’ve gotta also include the trade as well as a part of that discussion and how some of these technologies are really being used out in the field. I like to always go back to where we were in a post 9/11 situation, where focus always was, what happens to the container itself and how do we secure the container and make sure that it’s not being manipulated. We had a lot of technology vendors out there talking about smart containers, smart seals, container security devices, and you had to test those to make sure they actually worked. And we ran many, many pilot projects that many importers participated in to learn that they weren’t as effective as thought. Sounded great on paper, but when you test it out in the field, it was a very different situation. Just using that as an example of why we need these kind of pilots to look at the technology and how, together, we can help to enhance that, I think, is a really important part of this.

Craig: There’s a lot to unpack there. Allegations and the accusations made about Xinjiang have been very forcefully denied by the Chinese. Nonetheless, the law is the law, and American companies will follow American law, period, full stop, end of story. I think that the Chinese government certainly understands that, Jon had alluded to the fact that there are various measures that the Chinese could take to retaliate against American companies that they felt were unfairly treating Chinese businesses. Thus far, we have seen no sign of those laws or regulations being used associated with the Uyghur Forced Labor Prevention Act. And indeed, when, kind of looks at this from the 30,000-foot level, the Chinese government has an interest in seeing goods flow back and forth as smoothly as possible. The last thing that they would probably want to do would be to put an American company in a conflict of law situation when they’re trying to export out of China.

I would say that the Chinese government has taken some steps that are worthy of mention and worthy of follow-up here. About six weeks ago, the Chinese government in Geneva, or in Beijing, the National People’s Congress ratified two conventions that prohibit forced labor on a global basis. That’s something that I’ve been suggesting they do for about two years. And so, they have ratified that and brought forced labor restrictions into place across China. That’s an excellent first step. However, there needs to be follow up by allowing independent verification that there’s no forced labor in any factories that are involved in global trade. And while the Chinese government has spoken about this issue, I’m not sure that we’ve seen any major changes on the ground.

In other words, I think it would be difficult to get an independent certification that there’s no forced labor in a factory in Xinjiang today, but we need to move in that direction, and it can’t be a kind of window wash. It’s got to be independent verifiable certification that ILO (International Labor Organization) procedures are being followed in full, and that there is no forced labor. I think that, within the Chinese government, a good number of people fully understand the necessity in the trade area and in foreign affairs area. However, they perhaps are having difficulty in convincing colleagues in the national security or the police area that commitment, if you will, to the ILO needs to be visibly enforced.

Without that independent certification, then we’re not going to make a lot of progress, and the Uyghur Forced Labor Prevention Act, I think, will roll out. I think Jon indicated that this is an ongoing process, that additional resources are being put at it. And really, additional information on the ground in Xinjiang would be very helpful now if we’re to mitigate damage. I continue to urge the Chinese government to allow factory inspections, basically at will, anywhere in Xinjiang as well, but we’re not there yet.

Jon: I just want to come back to one of Craig’s earlier points as far as reaction within China to the UFLPA. Obviously, early on, there were some campaigns against individual retailers, consumer, social media campaigns, against retailers who had removed any reference to Xinjiang on their websites and talked about not using forced labor. And those were directed in the China market itself. There were retailers that were targeted and saw an impact on H&M and a few others too. Some of those campaigns that we saw were happening as companies were speaking up, speaking out about use of forced labor in Xinjiang.

Craig: Nationalism and patriotism, verging into jingoism sometimes, is really a prevailing attitude in many places, including China. And that companies need to message very, very carefully on this subject. There are thousands of companies whose sales in China and in the U.S. are material to their overall performance. And if you’re the CEO of any of those companies, you need to have great discipline in terms of your communications, in terms of your compliance, in terms of your presentation in both markets because you can’t afford to lose either one. I think that the H&M case is one that we’ve all studied. No one wants to go there. In order to avoid that conflict of laws and avoid the nationalist furor, it requires great corporate discipline, all the way down the line for everyone.

Chris: One of Craig’s earlier points mentioned potential for third party certifications, etc. And Jon, curious what your thoughts are on that. I mean, so these exist, not necessarily investigating Xinjiang production, but other areas like labor rights, and etc. What’s your sense on potentially rolling something like that out?

Jon: I mean, look, folks have been using third party auditors for decades looking at their CSR programs. And we think that is certainly a part of this, but I think, as Craig noted, having the inability to get credible, reputable auditors into Xinjiang to do the types of audits that are needed is extremely difficult. And until we can make that happen, it’s a challenge. Even if you’re using the auditors elsewhere, I hate to say it, but the whole auditing system has come under attack over the past few years, which has been a challenge as well.

How do we reposition that a little bit to make it clear that these audits are worthwhile, and they are good, and they’re being done by reputable agencies, and reputable people? And that has just been an ongoing challenge over the years. And this issue just only further highlighted that challenge. Again, the fact that you can’t get auditors and inspectors into China, into Xinjiang to examine the situation, makes it even more difficult.

Craig: Chris, if I could add, I think that, as Europe moves closer to filling or to implementing its ban on imports associated with forced labor, I suspect that you’re going to see incremental change around the world. Because the list of requirements that Jon, so skillfully, ran down earlier before, the certificate of origin, the packing list, the bills of lading, shipping records, etc., those are going to be required by the Europeans as well. And I think that we’re looking at a little bit of a paradigm shift globally, if you take North America and Europe put together, that will lead to greater transparency throughout the supply chain, or else. So, hopefully, this will lead to greater customer satisfaction and certainty. The products that they are producing are made with voluntary, normal market-based labor practices over time. But to get from here to there is going to take a while.

The compliance costs of getting from here to there are enormous given the presumption of guilt, if anything, is coming from Xinjiang. So, we have a real challenge for companies. I would have to say that, if you’re a Korean company, or an Italian company, or a Spanish company selling into the U.S., you are equally liable according to this law. So, it’s not affecting only Jon’s members at all. It is much broader than that. And it’s going to take us a while and a lot of expense to get to a place where we could certify that there’s no forced labor, even though we had no evidence.

Chris: Actually, one of the questions in the queue asked whether both of you thought that this would actually raise the standards globally on things like child labor, minimum wage. Some of my research, the supply chains in coffee and cacao, and there is tremendous forced labor actually in those industries today. And so, but your expectation, I think, Craig, I’m hearing, is that actually this will have spillover effects in raising the level of transparency, such that other forced labor will likely be eliminated too.

Craig: We already see much higher degree of concern about supply chain integrity, a much higher degree of documentation that all is well. I think that that kind of process, while expensive and it’s gonna increase prices, is what we should anticipate in the future.

Jon: I think they’re going to look at this as a lesson. I think, as you noted, there certainly are issues with forced labor in other industries, where you mentioned Cacao. I mean, you look at fishing, there’s a huge issue in fishing that’s been going on for years. I think they’re going to look at this as an example, but again, just the complexity of the supply chain and the ability to get back to origin for many of these companies, your ability to go back and trace all the way back to where again, the supply chain starts is very complicated. And until we get that full transparency in place, which is going to take a while, it’s going to be a challenge.

But I think, again, no company wants forced labor used within their supply chain. I think they’ve been upfront and honest about that, and that’s part of their due diligence, part of their CSR. It’s part of what they do. And now it’s just, you’ve got to step that up even more and be able to go back all the way within your supply chain. Difficult for everybody, especially for small, medium size importers. Folks are going to have to kind of continue to figure this out. And again, work with the agencies. I mean, again, this is something where we want to work with DHS, work with customs, work with USTR to understand all these complexities, and how do we address those complexities at any stage in the supply chain and have them help us provide these tools to address some of these issues as well.

Chris: Well, the one lesson that I’m hearing from you, Jon, or maybe what you would tell your members is know your supply chain, know your supply chain, know your supply chain. How about Craig, and we have about a minute left, for your members, do you have any other messages that you would give them?

Craig: I do think knowing the supply chain is the key shift that the Uyghur Forced Labor Prevention Act has engendered. But also, the importance of communications up and down your company, and that has to be very disciplined and very strategic so as not to incite a nationalist response in either country. I guess that the third thing is it’ll be very interesting about how this will impact on supply chains coming out of China. For example, the textile apparel trade, the furniture trade, home furnishings trade, will there be a shift in manufacturing location associated with this, and also increasing price of labor in China? The numbers will be interesting to watch, a year, two years from now, but I suspect that it will accelerate trends already underway.

Chris: Thank you both. We’re unfortunately out of time. Really appreciate you sharing your expertise on this really important topic with all of us. And thank you very much for joining us on China Corner Office.

Jon: Thank you, Chris.

Craig: Thank you.