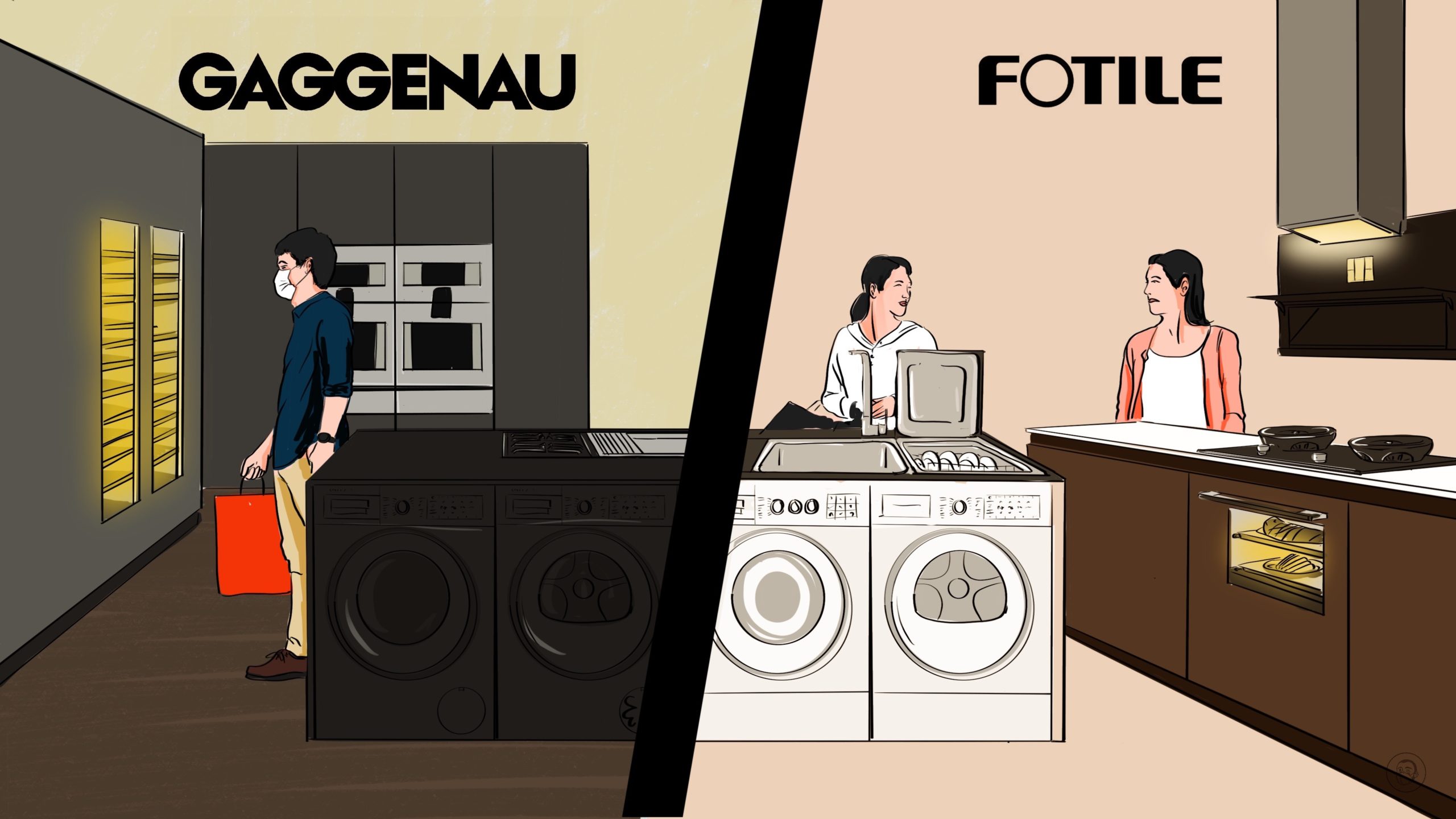

Can Chinese brands take on Germany’s high-end home appliances?

German high-end brand Gaggenau Hausgeräte just opened its first store in China.

Gaggenau Hausgeräte is a Munich-based manufacturer of high-end home appliances that was founded in 1683, and is now owned by BSH Home Appliances, a joint venture between Bosch and Siemens. Yesterday, Gaggenau opened a flagship store in Shanghai, its first in China.

The new store will sell a range of appliances including ovens, cooktops, and refrigerators, with unit prices ranging from 200,000 yuan (just under $30,000) to over a million yuan (just under $140,000).

Gaggenau’s prospects in China are good. Retail sales of all home appliances in China in 2021 amounted to 760.3 billion yuan ($106.31 billion), an increase of 25.6 billion yuan ($3.57 billion) compared with 2020, still 7.4% below the level of 2019, but in the offline market, the proportion of high-end products has been increasing. In 2021, of the top four products — refrigerators, color TVs, cleaning appliances, and washing machines — high-end products accounted for a proportion of 60.7%, 59.7%, 55.9%, and 55.5%, respectively.

The local competition

What competition will Gaggenau face in the Chinese high-end home appliances market? Last week Friday, Wáng Chéng 王成, the COO of TCL Technology TCL科技, a Chinese consumer electronics company and one of the leading players in the global TV industry, delivered a speech at a business summit in which he gave a frank assessment:

- The scale of China’s manufacturing industry is enormous: With total value added of 31.4 trillion yuan ($4.39 trillion) in 2021, China accounts for 30% of the global share.

- But China’s home appliance manufacturing industry, he said, is still concentrated at the middle- and low-end of the value chain, and the gap with high-end technology is still obvious. Chinese companies are still grappling with core high-end manufacturing, from assembly and precision technology to microchips.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

During the period of the 14th Five Year Plan (2021-2025), the Ministry of Industry and Information Technology is attempting to promote the consumption of household appliances, and is guiding Chinese companies to develop “smart and green” home appliances with customizable capabilities for consumers. At a press conference earlier in September, a government official responsible for consumer goods outlined the ministry’s attempts to promote innovation, consumption, and stable supply and production lines for household appliances, as well as to develop globally recognized brands. The official was able to point to some success in this regard:

- In 2021, the total revenue of enterprises in the household appliances industry was 1.7 trillion yuan ($237.72 billion) and total profit was 121.9 billion yuan ($17.04 billion), increases of 15.5% and 4.5% year-on-year, respectively

- China’s exports of household appliances in 2021 exceeded $100 billion, a year-on-year increase of more than 20%.

- Chinese appliances were sold in 160 countries and regions around the world. Chinese refrigerators, air conditioners, and washing machines account for more than 50% of the world’s total.

Yet the official conceded that the challenge now for the ministry is to promote high-quality supply of “smart” household appliances with customization capabilities to meet the diversified needs of consumers.

Does Gaggaenau have real Chinese competitors?

There may as yet not be any Chinese brand that can replicate the global brand recognition of Gaggenau and its ultra-high-end products, but these are the Chinese brands that stand a chance:

Tineco

Tineco 添可, a brand by Ecovacs Robotics 科沃斯机器人, is one of the leading Chinese brands for washing machines, a rapidly growing market segment: In the first half of 2022, sales of washing machines in China reached 1.37 million units, an increase of 87% year-on-year. Total sales this year is expected to exceed 10 billion yuan ($1.39 billion).

In 2020, Tineco launched its first fully-automated “smart” washing machine, along with a series of other “smart” products including vacuum cleaners and sweepers, hairdryers, cookers, and water purifiers. Tineco’s “smart” cookers, for example, allow users to simply scan the barcode of a packaged dish, and the cooker will automatically cook the meal.

In 2016, Tineco released China’s first wireless floor sweeper, which sold a total of 1.09 million units in the first half of this year, an increase of 48.6% year-on-year. Tineco’s washing machines reportedly currently occupy 56.7% of the Chinese online sales market.

Fotile

Founded in 1996, Fotile 方太集团 positions itself as a high-end kitchen appliance manufacturer that sells cooking tops, extractor hoods, dishwashers, water purifiers, stoves, microwave ovens, ovens, steamers, and gas water heaters. Some of Fotile’s most innovative products include a self-cleaning extractor hood launched in 2013, a “sink dishwasher” in 2015, and a “smart” integrated oven in 2019. In the first half of this year, Fotile reported revenue of 7.42 billion yuan ($1.03 billion), achieving double-digit growth year-on-year.

Robam

Founded in 1979, Hangzhou Robam Appliances 杭州老板电器 produces extractor hoods, steamers, stoves, ovens, microwave ovens, dishwashers, water purifiers, and gas water heaters. In August this year, the company launched a digital kitchen appliance brand, ROKI, which is supposed to use artificial intelligence (AI) for cooking by monitoring and modeling temperature, humidity, and duration. Robam claims to have launched China’s first “smart” factory, achieving a 45% increase in production efficiency and a 21% reduction in production costs. In the first half of the year, Robam reported revenue of 4.44 billion yuan ($621.44 million), a year-on-year increase of 2.73%, and net profit of 723 million yuan ($101.10 million), a year-on-year decrease of 8.46%.

Roborock

Beijing Roborock Technology 北京石头世纪科技 specializes in autonomous and cordless vacuum cleaners. The company claims to have produced the highest-selling robot cleaner in China, and in 2021 launched the first dual motor robot vacuum cleaner in Europe. In 2021, Roborock’s revenues were 5.83 billion yuan ($859.49 million), an increase of 28.84% year-on-year, based in large part on 80% revenue growth in overseas markets. In 2021, the company announced that it would begin manufacturing electric cars.