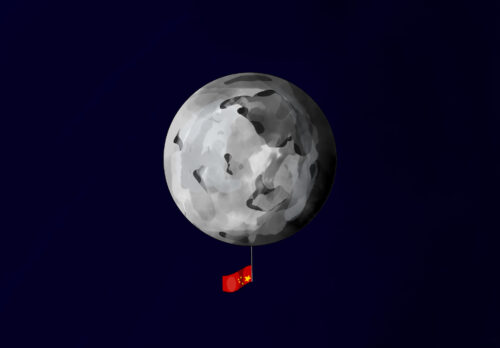

How Chinese technology companies took on the world

Guoli Chen, professor of strategy at INSEAD, and Jianggan Li, founder and CEO of Momentum Works, discuss Chinese technology companies, the ecosystem that created them, and their expansion across the globe.

Below is a complete transcript of the China Corner Office Podcast with Guoli Chen and Jianggan Li.

Chris Marquis: Hi everyone. Thanks so much for joining us today on China Corner Office, a podcast powered by The China Project, the New York-based news and information platform that helps the West read China between the lines. I’m Chris Marquis. I’m a professor at the Cambridge Judge Business School.

And today, we are joined by Guoli Chen, who’s a professor of strategy at INSEAD, and Jianggan Li, who is founder and CEO of Momentum Works. We discuss Chinese tech companies and their global expansion, which is the subject of their recently co-authored book titled Seeing the Unseen: Behind Chinese Tech Giants’ Global Venturing. The phrase ‘seeing the unseen’ intrigued me, and so we started our conversation with Guoli explaining what unseen means in the context of their book. We also then discussed the protective nature of the Chinese tech ecosystem, which Jianggan pointed out might result in more challenges for Chinese tech companies going global to compete. Both Guoli and Jianggan stress the adaptation of people, organizations, product and leadership, or POP Leadership as they discuss this framework in their book, as a crucial differentiation factors when facing global competition.

We also discussed how Chinese history and culture play a role in shaping business in China. We discussed Máo Zédōng’s 毛泽东 legacy from his military and political strategies to personal anecdotes that have had a lasting impact on contemporary Chinese leadership styles. Guoli pointed out that Mao’s endurance is somewhat of a double-edged sword, for while it gives these tech leaders an advantage of moving fast in China’s hyper-competitive tech market, it also creates stability and transparency issues that overseas markets of value.

We also touch upon a reevaluation the authors do of the effects of the cultural revolution, and how this period of significant turmoil may have actually contributed to later business vibrancy. Guoli and Jianggan talk about the failed IPO attempt of Ant financial as a case study that illuminates the challenges Chinese tech companies face with the tightening of regulation in China. They also explained the logic behind the underlying regulatory framework and how crackdowns function.Given this environment and COVID restrictions, we also discussed how more Chinese firms, especially VCs, are moving out of China and into a more favorable environment such as Singapore where both Guoli and Jianggan reside.

This episode was recorded before the Chinese 20th Party Congress, and we touch upon possible outcomes in the discussion, some of which are consistent with news coverage following the Congress of reaction among Chinese business elite. It does seem that the trends we discuss will only strengthen incoming years. We conclude our discussion with Guoli and Jianggan giving valuable suggestions based on years of experience from both academia and industry to Chinese companies wishing to expand into foreign territories in this challenging era.

Thanks so much for listening and enjoy the show.

Guoli and Jianggan, welcome to China Corner Office.

Jianggan Li: Thanks for having us, Chris.

Chris: First, maybe Guoli, I’ll start with you. Really enjoyed reading your new book co-authored with Jianggan, Seeing the Unseen: Behind Chinese Tech Giants’ Global Venturing. Obviously tech in China is a hugely important industry, and then also this idea of going global is something that’s also a really important aspect of China’s economic development story.

First question I have is about your title Seeing the Unseen. Can you just say a little bit about what’s the unseen part in your title?

Guoli Chen: You know that our book focus on these Chinese tech companies, Alibaba, TikTok, and then see how do they emerge in the past in the last decades and what are the challenge they’re facing nowadays in the overseas expansion. So, there are several things which we thought it’s unseen or maybe is misinterpreted by many Western or popular medias such as, for instance, the growth of the Chinese tech companies is simply because of the Chinese government’s protection, which is not true. We think, do not over attribute the success or growth of the Chinese tech companies to the Chinese government’s protection. Because if you think about it, with a gigantic homogeneous market, which is very unique, which is very different from the U.S. in terms of language, in terms of consumer behavior, together with a group of the high inspiring and ambitious Chinese entrepreneurs, actually it is pretty natural that China will breed its own giants either in the tech or not tech. And interestingly, however, the unique ecosystem that China has created over the years, which are ecosystem or the macro environment system that created over the years actually create a bottleneck for them to further grow in the international market. Which means the same recipe works in China may not work in other places.

Another misperception or unseen part is many people think that in China copyright means copy it right. So, they thought the Chinese company perhaps just copy, but actually what we find is Chinese company do not plan to copy tech products or business models. The reality is that the simple copying actually is not enough to succeed in China. On the contrast, actually Chinese companies go beyond copying. They continuously make innovations to stay competitive. And think about the WeChat versus WhatsApp. And they are very different species nowadays. And compare like PayPal versus Alipay. Again, very, very different. In the book there, we discussed several factors which is I think unseen or misinterpreted.

Jianggan: Can I just add a quick point about number one, I’ve met lots of founders from China over the last few years, and one thing that many of them were telling me is that they wish that the government had led people like Google and Facebook into the country because that would change the competitive dynamics. I mean, if you look at all the leading tech companies in China, their margins are slim. Alibaba’s tech rate is like 4% versus in Japan where they are charging more than 10%. So, they said, “Okay, the government closed the wall,” and people somehow ended up having a super fierce competition within China and nobody has good margins.

Chris: These correctives of how the West sees Chinese innovation is a super important aspect of your book. I’m amazed just the innovations in tech and in WeChat, Alibaba. Last time I was in China, which was a couple years ago obviously, you could go into convenience stores and pay by your face. They used facial recognition to get in and out of university campuses, so you don’t have to show your ID. All these things that are just so much further advanced than the West. So, I think this is a really important aspect of your book.

One follow-up question I have I want to ask Jianggan, it’s in regard to what you were saying about the protected nature of the Chinese ecosystem. It’s protected but also this gigantic market of 1.4 billion people. And even though companies like Google and Facebook couldn’t get in, if you look at ride-sharing for instance, where Uber actually was able to go in, but still DiDi destroyed it, and at least, in my experience, DiDi is such a better app, has so many other options.

This made me think about one of the really interesting metaphors that you use in the book is this famous crocodiles in the Yangtze, which you point out is actually alligators not crocodiles, versus shark. Can you talk a little bit about this metaphor, alligators versus sharks and how Chinese companies are going to go global, they’re going to have to compete with sharks, but yet they’re crocodiles in the Yangtze.

Jianggan: That quote was made famous by Jack Ma (马云 Mǎ Yún), I think about 20 years ago, and of course, when he could still speak freely. Basically, back then, context is that when Alibaba was building this C2C commerce platform, which later became Taobao, and people were skeptical because you have much, much bigger companies like eBay at that time, and of course Amazon was on horizon as well. So, people were skeptical whether Alibaba would ever make it, building a C2C platform. He famously said that, “Okay, eBay is a shark and they’re fierce in open waters, but when they come to Yangtze, in the river ecosystem, where we are the crocodile, and of course, Yangtze River, that kind of animal is actually alligators, but we’re the crocodile and we are able to defeat them in our own ecosystem, which later turned out to be the case.

And the funny thing is that if you fast forward that by 15 years, you see that Alibaba has become a giant in China, and they have been trying to enter other markets. I mean, they’ve been trying to enter India a few times, in Southeast Asia, through Lazada and a few other investments. Ali Express has been building sort of ecommerce across the world, and they bought a company in Turkey as well. So, a lot of things are happening, and they are becoming a shark, and they are trying to compete against the local crocodiles or alligators. And it turned out like many of the issues the previous generation of sharks faced, they are facing the same issue. You’re very successful in your home country, but once you get out, you face different realities, and how do you adapt?

Chris: What can you say about that adaptation? Is there any rules like okay, if a company, Ali or WeChat, or TikTok might be a really good example, although that is increasingly seen as under regulatory scrutiny. I know Ali has had issues and many financial services companies have had issues because frequently the finance sector is heavily regulated. I know that, for instance, Alipay in the U.S., I’m actually not able to use that, even though in China, I can use Alipay because actually it’s restricted so only Chinese citizens in the U.S. can use Alipay. So, I’d love to hear a little bit about what sort of recommendations or rules you would have for Chinese tech companies going global.

Jianggan: In the book, we actually use a framework called people, organization, product and leadership. And the most important part is leadership. And what we see in TikTok here is that the leadership personally spend lots of time and spend lots of effort, crucially a lot of mental space deciding what to do in the international markets. And this is something that we don’t see in other companies. In Alibaba’s case, most of decision-makers they’re in China most of the time, and even if they spend one or two days per month with Lazada, and it doesn’t really help them make the decisions. So, really it comes down to when you have become successful and you have a pathway that you have used to become where you are. And now you are in a market or a set of markets where the realities are very different.

The feedback you receive from the market is different, people are telling you different things, and you are not in a market full time to judge what’s right, what’s wrong, and you don’t know how much resources to allocate. So, all these issues which require the leaders to make decisions, and not only the leaders, but people on the supply chain, right? I mean, Alibaba supply chain people in China need to see that, and how much logistics space they allocate for Southeast Asia, et cetera, et cetera. All these issues become very complicated. I think it was the same issue that Amazon faced in China.

Chris: One of the things I actually appreciate about your book is that you talk not just about success cases like a lot of books do, but actually, I mean there’s even more that we can learn from the failure. Guoli, Jianggan mentioned the model that you have for the book, which I think is another big contribution of it, the People, Organizational, Product and Leadership or POP-Leadership framework. Can you describe this model a bit more, and maybe also a little bit how you developed it based on these cases?

Guoli: A big background of this type of model is like when we wrote a book on Chinese funds for the practitioners, and one challenge that we faced actually that things happen and change very fast, especially in the tech sector. So, it is a real look at environments, which represent a very volatile, very uncertain, very complex, and very ambiguous. When we wrote the book, we thought that we would like to develop a framework which is relatively have universal implications and which is relatively stable, which can help to analyze the past and also provide the guideline for the future. That is a background of why we developed this model. So, we call it the POP leadership. So, you can see that on the surface level, when we do the careful analysis, and then on the surface level, we see there’s a lot of the products or services issues, but what we cannot see, or maybe unseen, or difficult to see, it’s like ultimately, that is the organizations and people. And like Jianggan said earlier, ultimately it’s the leadership practice.

Eventually the leadership is the one who set the ambition, set the direction for their firms. And part of my own academic research is about the leadership effects. To understand a firm’s strategy, and sometimes we need to study the strategist because the leaders provide a very shortcut for us to have quick comprehensions, and even forecast what’s the next strategic move. In the book we talk about like Jack Ma of the Alibaba and Mr. Zhāng Yīmíng 张一鸣 of ByteDance. Overall, we spent lots of time to build this model to try to give the more detailed illustration what the POP Leadership means.

The first “P” is people. They are the micro agents of the front who make things happen. So, the core management questions for people is where to hire, how to motivate, how to train, how to evaluate, how to build a core value, and to end up with the best lieutenants.

And the “O” represents organizations, address the fundamental issues such as decision rights, information, communication, resources allocations. And fundamentally, one of the very interesting and very critical perspectives like how to keep the organizational agility when firms become bigger and bigger is how does the Chinese firm keep this agility by continuous organizational restructuring, rotation of the executives. This is the part which is related to organization.

And the second “P” which is the product, or this is the interface of services and products engage with the clients. This is the part to generate and capture value. And so, products is related to a series of the strategic decision including like what to offer, when to enter, where to enter, how to enter, right? So, our book has the framework and have a more detailed illustration of each components and what are the key questions. So, we hope this POP Leadership frameworks can help us and help the reader to have a very quick look and relatively comprehensive analysis of the challenge when they edit the overseas market.

Chris: That’s one of the things that I really enjoyed about your book. I mean that it has both academic background and rigor but also deep practical insights and connection to the real world, which is really, I think many times very rare.

That brings up a question, there should be more team ups like this between academics and practitioners. How did you guys come to write this book?

Guoli: At INSEAD, actually we offer an MBA elective, we call China Strategy. So, in this classroom, in addition to have these like case analysis, a very typical MBA educations, I try to invite guest speakers from different industries to give a talk, share with our students on their insights, and the challenges in the business world, right? And at that point of time, actually I have one session specific on Chinese company going overseas. Jianggan is our INSEAD’s MBA alumni doing some very related work, and so I sent email to Jianggan, and then he agreed to be part of our panelist in the guest speakers so we’d know each other. And then, a certain point of time, we thought, okay, given this is a critical question and we receive lots of questions from both academic and practitioners about what this Chinese tech companies, like, what they’re doing, or what’s the mindsets of the leaders. A certain point of time we thought, why not we just write a book. So this is, to go back to your earlier question, this is a combination or the integration of both academic and practitioner.

Chris: One of the things I really like about the book is how it really takes Chinese history and culture very seriously in thinking about business strategies. And one of my interests is the lasting effects of Mao on China, and you discuss a number of aspects of that.

Jianggan, maybe I can start with you. Can you say a little bit about, particularly maybe like Mao’s military strategies and philosophies, and how those are really relevant to business and followed by Chinese business?

Jianggan: Maybe let me start with some reflection. Me, I mean, I’m from China originally, but I came to Southeast Asia in Singapore since I was in high school. So, last 10 years I’ve been building companies, fortunately enough to be able to sell tech companies in Southeast Asia. And for a long time, I was jealous about my counterpart in China, right? Because whatever they can build is much bigger. But since 2015 onwards, I’ve been traveling regularly to Beijing to Hangzhou and to Shenzhen, where all the major tech companies are based, and I’ve been talking to lots of founders. I was hoping to get my experience about how to design a product, how do you acquire users? Everyone talks to me about history, talks to me about strategy, and sometimes even mythology.

In particular, the wisdoms from Mao came up a lot. At the initial, it actually shook me quite a bit because in my mind Mao was this revolutionary, ruthless, not even related to business. But I started reading some of the books and then I started having discussions with these people. They said, “This analogy that these people use, Communist Party in China is a very successful startup, starting with 12 or 21 delegates and overcame much, much more powerful enemies over the course of the history. Lots of tactics used, lots of strategies used, and eventually sort of existed through founding the People’s Republic.”

When people think about okay, what they can learn from the founders and they can’t really learn from traditional case studies from most traditional companies because those guys are in very, very different environment. FMCG (fast-moving consumer goods) companies took more than 10 years to figure out how to do Japan, but this guys are facing much more compressed timeline. So, they went to Mao, all the challenges he faced, etc. And even how he does the product research, the level of detail, and it’s lot of tremendous amount of learning about tactics, etc.

Chris: My favorite Mao idea that relates to business is surrounding the cities from the countryside. It’s actually quite brilliant. I mean, in many ways, my understanding is that back in the early days of the CCP, fighting the KMT traditional, orthodox, Marxist-Leninist ideas of revolution, followed by the Soviet Union is that you want to have the factory workers in the cities they are the ones that actually are the leaders of the revolution.

But China at the time had lots of peasants, lots of rural people. And so, this was even sort of scoffed at by Stalin and other people that Mao ideas, and this is what actually really was tremendously influential in defeating the KMT. And I hear Pinduoduo or even Huawei, back very early, have actually used this strategy to say, “Okay, we’ll rely on China’s large rural population, maybe third and fourth tier cities. Why compete with Alibaba in the developed areas? There’s this huge market region.”

Jianggan: And I think this also leads back to the point that you have done enough investigation about the market that you are in, right? So, Mao’s investigation told him that the real dynamics and the real resources we can mobilize are in the countryside, and that’s how what we can win the revolution. I mean, if we focus on the cities as the orthodox thinking tells us to, we’ll be losing the war. I think that’s a real understanding about power dynamics in the country and how he adds his resources.

Chris: I have a question actually still, Jianggan for you. I realize the name of your company is Momentum. There’s this Chinese term, shì (势), some people that are in academic field, Guoli discuss this idea of momentum as a special aspect of Chinese business strategy.

Jianggan: Shi, yeah.

Chris: Is that the idea that you’re focusing on in your company?

Jianggan: In a way, yes. Actually, we came out with the English name first before the Chinese name for the company. The momentum basically means that we keep moving, we’ll leverage the right resources.

The notion you mentioned about shi, this is actually very, very big reflection that I personally had over the last 10 years of working in tech is a lot of success is happening with the right time, and with the right people, and with the right resources. I mean, many of the tech companies in the last 10 years succeeded because they were the first ones to arrive when hundreds of millions of people became part of the internet. So, if you’re at the right time and whatever you do, the benefits will double. If you’re at the wrong time, no matter how hard you work, it’s very hard for you to succeed.

Chris: Guoli, I’m curious as well to ask you about some of these Mao strategies that we talked about like surrounding the cities from the countryside. Any way you think these might actually be, as you think about globalization, double-edged swords because the companies may be really focused on China-specific market, which then, as we’ve talked a little bit about, it would make a challenge for them to go global, do you have any thoughts on that?

Guoli: I think it’s definitely a double-edged sword across several dimensions. And one of the points that I mentioned earlier, it’s about the unique ecosystem that China have created over the years, and then, if we kind of bottleneck for this Chinese company to grow or expand in the international market. This is mainly from the product level of the discussion, but we think about this like POP Leadership. In addition to the products and then the organization level actually also create a bit the double edge sword because the organization in China, in the tech sector actually it’s very agile, right? This is the way that the Chinese tech firms that they can cope with these hyper-competitive market. So, this is the organizational challenge that they build a structure or restructure to deal with the challenge that they’re facing in domestic market.

But however, if they go overseas, we observe actually this overseas market, especially if you think about the subsidiaries actually they need some level of the stability or maybe commitment, or relatively clear reporting line. You can see in China, if in the headquarter there’s so many organizational restructuring and change, on the one hand, it’s good. This is the way to deal with a hyper-competitive environment. However, if you are the country managers, you are in the subsidiaries, then if you see the organization do the similar things in the overseas market, then the signal to the external stakeholders or internal employees actually, it will be interpreted differently. So, this is again related to the other dimension, people dimension. Chinese internet firms have its own pretty unique culture, which could be appreciated by employees in China. But if you use the same ways to motivate people in overseas, perhaps it’s not going to work. Fundamentally, if we think about the challenge of these Chinese tech firms facing when you go overseas, I think China or big gigantic domestic market could be both a blessing and also a curse.

Chris: The uniqueness of the market is certainly one aspect that I think a lot about and find very interesting. And Jianggan, I want to ask you also again, about another aspect of Mao and how the market is very unique.

One of the arguments that I found really interesting that I had not heard before. Some of the military stuff, I’ve talked to entrepreneurs and heard some of these ideas, but actually you argue that the Cultural Revolution itself also has played a role in the development of the market in positive ways, which is interesting always to think about things that maybe are frequently seen as negative. We have bias, actually, everything gets lumped as negative. For instance, in my research looking at Mao’s influence, we actually look at how the Great Leap Forward, while obviously had hugely disastrous effects in a number of ways, actually had number of positive aspects around frugality and actually creativity. But this is the first time I’d actually heard about the Cultural Revolution in the way that you guys talk about it. Can you say a little bit about it?

Jianggan: I always thought that Cultural Revolution was a disaster. I still think it’s a disaster, but practically speaking, there have been some positive aspects, and I feel that in particular, especially in the past few years that I’ve been building businesses outside China and I’ve been evaluating sort of taking investment opportunities in many countries. And in many countries, you just see the huge resistance in terms of the sort of traditional interest groups in terms of the resistance to building infrastructure, etc. Even you saw the ethnic Chinese communities that we see in Southeast Asia, it’s very hard to build new businesses because old business interests have been taken care of by large traditional groups.

And whereas you look at in China after the Cultural Revolution, when the reform and opening up happened in the 1980s and 1990s, it was a clean slate. It was basically lots of old interest groups destroyed, but you’re left with people who are really, really hungry for success. That hunger, plus the lack of resistance from an infrastructure point of view, from a traditional interest group point of view, really made lots of things happen and really, really made a single market happen. Now I look at Indonesia, I look at India, I look at many markets where things are large, and populations large, but if you look into details, these are not single markets. You have to deal with lots of, lots of local groups to make things happen.

Chris: It’d be interesting to talk a little bit as well about the current regulatory environment then a number of crackdowns on tech companies in the last couple years, famous ones Ant’s IPO, Didi IPO going public. Guoli, I’d like to get your thoughts on this particularly Ant Group’s IPO. What’s your read of the tightening of the domestic situation for tech companies?

Guoli: I think they are both more specific implications or specific reason versus more broader implications. For Ant Financials’ case, I think the failed attempt of the IPO back to October, 2020, I think this is a mix of business considerations and IPO valuations and national financial security system, or even a balance between tech/innovation versus regulation/control for Ant Financial itself. From the business perspective, the company have now evolved into a virtual financial service more for everything from consumer loan to micro-SME loan to mutual funds, insurance policies and travel bookings, right? This is, again, it’s a very typical phenomenon that we observe in China, which we call the super apps.

That is from the business’s side, but the questions I bring to the government from this like national level or China is how to regulate and how to evaluate. So, is it a pure tech company or it’s a financial company? And if it is under tech and then if it is under financial company, actually they’re facing different regulations. I think the concern from the country is if the consumer loan or the micro loan was not monitored, not well regulated. And then what are the potential problems? In my reason of the issues about the financial crisis, right? So if you use that specific case of the Ant Financial, actually there are more considerations is perhaps it’s not only tech itself. It’s actually, it’s also getting into the finance and regulation and control, how to reduce the risk.

Chris: Jianggan, I’m curious your thoughts as well on this Ant’s specific case, obviously DiDi’s specific case, there’s a lot of crackdowns in the gaming industry. So, what’s your assessment of these crackdowns?

Jianggan: First, crackdowns have been happening even before the latest wave since last year. In 2019, there was a crackdown on FinTech B2B lending. And even before that, there was a crackdown on ICOs back in 2018. So, this actually leads back to what we talked at the beginning of this pod. When things start to develop in China, it suddenly becomes very competitive. I am in Southeast Asia. If a new business sector, new tech sector has four major players, it’s already competitive. But in China, sometimes you’re talking about hundreds of players trying to seize the same opportunity. From a regulator’s point of view, as Guoli already pointed out, it’s very hard to balance in the beginning. So, if you come down too hard too early, you sort of strive for innovation. But realistically, I mean it’s very hard for you to come out with the realistic regulatory frameworks.

Typically what you see with mini regulators is that they will wait and see, they will study, and if the things become out of control, they ban it out right. There have been lots of discussions, why can’t the government study that in a little bit more detail? But in many cases, we see that okay, system regulators are already being created and lots of lots of retail investors or retail consumers get impacted. So, sometimes they probably don’t have the time to do a more detailed study before they take a drastic action.

Chris: I want to follow up with you actually, actually both of your discussions, but I’ll start with you, Jianggan. Some of these crackdowns are an issue, also the COVID policy in China is at least in the Western press, seem that there’s some resistance. And I hear that more and more entrepreneurs and VCs are actually setting up shop in Singapore. Both of you are in Singapore, is that something that you’ve been seeing with this trend possibly reverse maybe after the 20th Party Congress if COVID restrictions relax a little bit?

Jianggan: We’re recording that beginning of October, and the past two weeks have been crazy. Every day I was meeting three to four parties coming from China, and in the past when major VCs, when major tech companies come to this region, they will send someone to investigate whether it’s worth for them to make some investments or expand business. What happened in the last two weeks is that you see the bosses of companies, you see the funding and managing partners of VCs, etc. It sort of forced people to do, as you look at what are the opportunities outside, and a question of whether this will change something fundamentally or whether these people will come back, I think, at the end of the day, it depends on any individuals, how comfortable they are with the opportunities, how they assess the opportunities.

My sense is that, if after the Party Congress and COVID restrictions would be eased and if there’s a big economic stimulus, I think many people would still go back to China. But if like, I don’t know, 5% out of these thousands of people who came out managed to stay, I think that would still cause some interesting dynamics in ecosystem.

Guoli: I think there are two major factors which might influence how the trends are going to continue and whether Singapore continues to be an attractive place for this like Chinese overseas expansion, or the first stop. The first factor, it’s how many Chinese firms and bosses are determining to go overseas expansion. And this question actually is influenced by I think two factors. One of course, is the comparative, what’s the business opportunities within China versus the opportunities outside China? What we see in the last two or three years, or think about this like Chinese tech giants. And then, if we take a look of the proportion of the revenue, many of them actually are still very China centric company, including like Tencent or like Alibaba. So, which means like in the past globalization or overseas expansion is perhaps just a dessert or maybe appetizer for the overall business group, right?

And China is still a big dragon tech market. Nowadays, I think with this policy change and then maybe some economic situation shift, and it is possible that, at least I think the possibility is increasing that over six expansions could be the main dishes for some companies or some bosses and leaders. So, this is from the comparative view about the economic situation with China and outside China. And definitely we see there’s some shift. And, of course, for many of them, because they grow up in China, they made a success in China, they still feel more familiar with the Chinese business environment. But once the situation got better, perhaps many of them still decided to go back.

Chris: I like your metaphor of appetizers and desserts and main dishes as that leads me into actually our final question I have for both of you. Chinese companies wanting to go global, what are two to three headline recommendations to them based either on your book or your other work. What would you give them? Maybe Guoli, let’s start with you.

Guoli: First, it’s perhaps be humble, especially if you have prior success in China. And sometimes people will become more and more overconfident and many mistakes that in those earlier days that a U.S. company being arrogant, the mistakes that they made in China that please try not to repeat the same mistakes when they go overseas.

And related to the second one maybe is be sensitive or attentive, right? So, go back to our earlier discussion about Mao’s strategy, right? So, you need to have a deep understanding of the local market. You need to do this like the deep level of the investigation before you make the decision. And maybe the third one, it’s think clearly, what’s the purpose for go overseas? Is it like the business or/market driven, or it is pushed by your investor? Or maybe some of them could be a personal ego driven. In that case, maybe you have to have a second source, whether you would like to go overseas or not.

Chris: Jianggan, how about you?

Jianggan: Two specific pieces of advice. First dedicate enough mental space to a new market. So, mental space means that you need to have the time to think and have the time to reflect, have the time to make decisions. That’s from leadership point of view. And second, leadership, and your top lieutenants, you really need to learn English. This is actually crucially important because I’ve seen many cases where the leaders are in a market but they just don’t speak English. And of course, the truth is that in most foreign markets, we see in Southeast Asia as well, that the elites of each country, they’re usually Western educated, they speak good English. So, if you can’t connect with elites of the country, it’s very difficult for you to mobilize the resources.

Chris: We’re unfortunately out of time. I would love to continue talking about this topic, which is I think shared interest between all of us. But I just want to thank both of you, Guoli and Jianggan for joining us today on China Corner office.

Guoli: Thank you, Chris.

Jianggan: Thank you.