TikTok is mostly owned by Americans

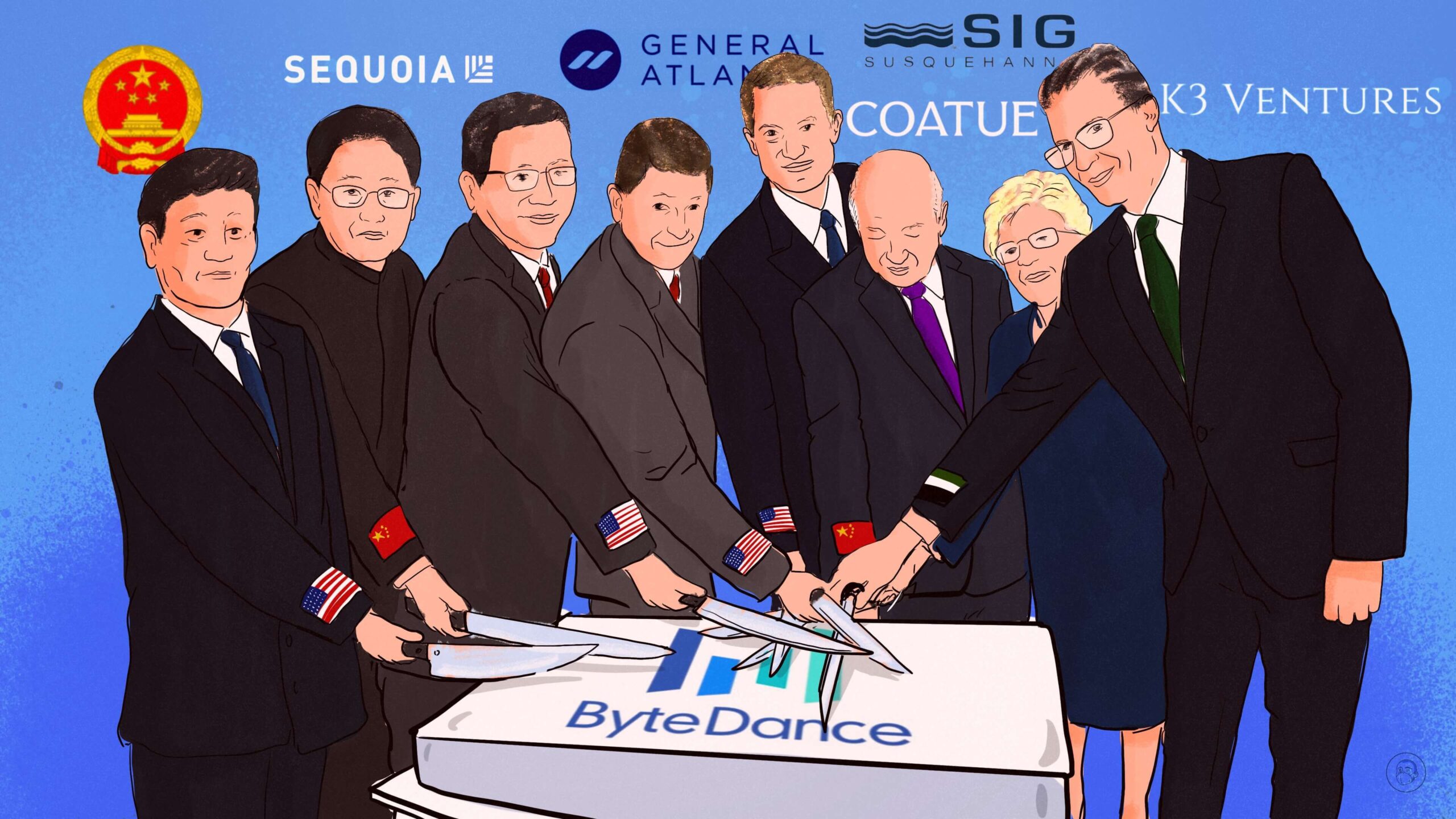

ByteDance is financed by billions of dollars from global — in particular American — investors. This complicates the conventional notion of ByteDance being a ‘Chinese company.’

Chinese tech giant ByteDance is the most valuable private technology firm in the world, on paper. Its latest fundraising round on March 15 priced the company at $219 billion.

Its subsidiary, the short-video app TikTok, is used by over 1.5 billion people across the world — close to a third of the online population globally. But TikTok is not as integral to ByteDance as these eye-boggling numbers would suggest: Around 80% of ByteDance’s revenue comes from within the P.R.C.

As a private company, ByteDance is not bound by the same disclosure requirements as publicly traded companies, and so its ownership composition and structure are not possible to verify. However, by compiling data from the business information provider Crunchbase, Chinese media reports, government submissions, and interviews, The China Project has put together a picture of ByteDance’s ownership.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Corporate structure

ByteDance, like many Chinese companies that have sought investors outside mainland China, relies on a variable interest entity (VIE) structure in which an umbrella entity is incorporated in the Cayman Islands. According to evidence submitted by TikTok to the U.S. Court of Appeals for the District of Columbia Circuit in 2020, the U.K.’s House of Commons, and TikTok’s own website, underneath this company, ByteDance Ltd, sit two strands of subsidiaries. On one side is TikTok (also a Cayman-based company) and its various subsidiaries; on the other is Douyin and its own mainland-based subsidiaries.

For the most part, it is the Cayman Islands–based holding company in which investors park their money. To date, ByteDance has attracted over $9 billion from over 30 separate investors across 12 funding rounds.

Two-thirds of these are non-Chinese investors, of which the vast majority are based in the U.S., with some from Europe and Latin America. In March, G42, an Abu Dhabi investment firm led by Sheikh Tahnoon bin Zayed, a member of the UAE’s royal family and a former national security adviser, also acquired a $100 million stake in the company.

Sequoia Capital, American firm General Atlantic, and Singapore-based K3 are the most active investors, having participated in more funding rounds than any other entities. However, this doesn’t necessarily reflect the sizes of their respective stakes.

The composition of the company’s board may give an indication of who the key investors are. According to ByteDance’s website, these include:

- Liáng Rǔbō 梁汝波, co-founder and chairman, who assumed founder Zhāng Yīmíng’s 张一鸣 board seat in 2021 after the latter stepped back;

- Arthur Dantchik, representing SIG Asia Investments, a subsidiary of the U.S.-based financial services firm Susquehanna;

- William E. Ford, the chairman and CEO of General Atlantic, a U.S.-based private equity firm;

- Philippe Laffont, founder of Coatue Management, another American investment company; and

- Neil Shen (沈南鹏 Shěn Nánpéng), the founding and managing partner of Sequoia China, the Chinese arm of the American venture fund Sequoia Capital.

Crunchbase data lists only three board members, William E. Ford, Adam Silverschotz, and Dave Yuan. However, it seems this information is obsolete: While the latter two remain investors in ByteDance, they no longer have seats on the board according to their LinkedIn profiles and respective company websites.

According to the Financial Times, as of November 2021, 60% of ByteDance shares were owned by global investors, 20% by employees, and a further 20% by Zhang and Liang. The company has since restructured, and Zhang has vacated the board and his position within the company, so the extent to which this rough division remains accurate is unclear.

However, given that the only share purchases since then have been in the secondary market (in other words, buying existing company shares rather than ByteDance issuing new shares), it is likely that the global investors remain the majority shareholders.

From this perspective, while questions about TikTok’s future in the U.S. and other countries continue to swirl, it seems clear that there is a significant amount of American money on the line, and American investors who stand to lose out by further damage to TikTok, which operated at a loss in 2022.

The issue for these investors, however, is that their ownership shares do not equate to a similar share of control over the company. That remains perhaps the most difficult question of all.

Beijing’s seat at the table

The original company was established in March 2012 as Beijing ByteDance Technology Co., Ltd. and renamed in early 2022 Beijing Douyin Information Services, Ltd. The state-owned China Internet Investment Fund (CIIF) owns a 1% “golden share” stake. According to a Reuters report, this share was agreed upon in late 2019, though the stake was only registered in 2021. As such, the Chinese government, via the Cyberspace Administration of China (CAC), appointed an official, Wú Shùgāng 吴树刚, to the board of Beijing Douyin Information Service, Ltd.

The Financial Times reported that Wu has a say over business strategy and investment plans, mergers and acquisitions, and profit allocation, and a vote on the group’s top three executives and remuneration packages. However, other reports suggest that he rarely attends meetings and ByteDance usually deals with the CAC directly.

While much attention has been drawn to the existence and operation of golden shares, especially in Chinese technology companies, we still do not know how they function nor how much potential influence they give the Party.

Meg Rithmire, an associate professor of business, government, and international economy at Harvard Business School, told The China Project that this is actually “pretty typical” for technology and media firms. “It started with online news magazines, where the Beijing government was getting nervous about non-traditional media sources and wanted to make sure it had insight into what those companies were doing.”

The key to understanding this structure, Rithimire emphasizes, is the “multiple logics” at play. “Sometimes it’s that [the government] wants insight from a company, and they want access. And so it doesn’t mean control. It means a seat at the table.”

Often, this logic is content-oriented: The Party wants to know what information is reaching its citizens, and how it is reaching them, and so wants influence over content moderation and censorship. In other cases, the Party wants to see the financial information of these firms because it doesn’t necessarily trust them. This was the logic behind many acquisitions of stakes following the stock market crash in 2015: Beijing was surprised at what had been going on in the country’s financial markets, and didn’t understand the technology involved or the extent of high-risk lending.

Sometimes, Rithmire says, “the logic is strategic, in terms of ‘I want these companies to do X, and so I’m financing them to do that.’” Globally, it is this strategic logic that people have seized on. But as Rithmire reiterates, “we don’t know how these Party cells influence firms’ decisions. Systematically, we really don’t know.”

Uncertainty

“Multiple logics” is an astute explanation for the Party’s involvement in ByteDance. However, the Chinese state’s opacity about which of those logics is being exercised begets uncertainty. The correlation of golden shares in “strategic sectors” only increases the suspicion of policymakers overseas.

Nevertheless, according to the company’s own disclosures at least, CIIF’s golden shares only pertain to a China-based subsidiary — Beijing Douyin Information Service Co., Ltd. — and do not equate to ownership in, let alone a board seat on, the superordinate company.

An IPO for ByteDance has long been rumored to be in the works. In January, Zhang Yiming’s 99% equity stake in Douyin Co. Ltd was pledged to Douyin Vision Co., Ltd, a wholly foreign-owned entity of Douyin Group (Hong Kong), Ltd. This has once again ignited those rumors.

Such a move, should it indeed happen this time around, would lead to more clarity about ByteDance’s ownership. What is clear for now, however, is that while the company is overwhelmingly oriented toward providing products for the domestic Chinese market, there are many American and global players who have significant interest in the company’s continued success.

Companies:

Sources and additional data:

- ByteDance – Funding, Financials, Valuation & Investors / Crunchbase

- Submission to the Senate Select Committee on Foreign Interference through Social Media, by Rachel Lee, Prudence Luttrell, Matthew Johnson, John Garnaut / Submissions – Parliament of Australia

- TikTok Ceo’s Written Responses to Senators’ Questions / U.S. Senate

- TikTok written evidence to UK government / Department for Business, Energy, and Industrial Strategy

- 字节跳动党委:要把讲导向守责任放首位 / Sina Finance

- 高准的第一刀:挥向抖音,拆分字节 / Chinaventure

- 獨角獸上市|張一鳴退股抖音? 字節跳動否認:控制權不變 分析料鋪路上市 / Yahoo Finance

- EXCLUSIVE Fretting about data security, China’s government expands its use of “golden shares” / Reuters

- UAE Royal’s G42 buys into ByteDance at $220 billion value / Bloomberg

- Baillie Gifford writes down ByteDance and claims China can’t invade Taiwan / The AIC

- Revenue at TikTok owner ByteDance rose more than 30% in 2022, topped $80 billion / The Information

- The TikTok investors with the most to lose from a U.S. ban / The Information

- TikTok faces potential US ban if Chinese owners do not sell stake / Financial Times

- Who really owns ByteDance? / The Wire China

- Golden grip / The Wire China

- Revenue of ByteDance rose more than 30% in 2022, topped USD 80 billion / EqualOcean