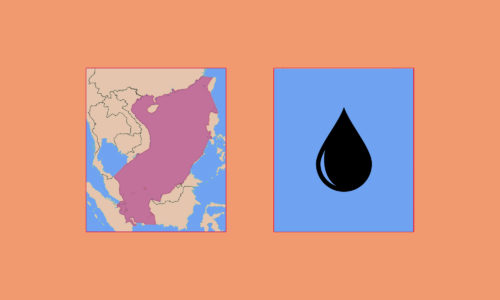

Here comes the petro-yuan

The Wall Street Journal reports (paywall) that “China is preparing to launch its own yuan-based oil futures contract, a move set to shake up the 96 million barrel-per-day global crude market currently dominated by trading in London and New York.”

- No official launch date has been announced, but “traders and analysts in China say they expect trading in it to begin late this year or in early 2018.”

- The WSJ says the move could “challenge the role of the U.S. dollar — currently the dominant commodity-pricing currency — by making it possible for crude exporters to sell the oil in another currency.”

- However, the chaotic state of China’s existing commodities futures markets and the government’s record of frequent interference in domestic financial markets are likely to “arouse wariness among foreign participants.”

-

Short selling

Carson Block bets that Nasdaq-listed Chinese stock is a ‘fraud’ / Bloomberg

A prominent short seller is targeting China Internet Nationwide Financial Services, “a Nasdaq-listed stock that went public in July.” -

Artificial intelligence PR wars

Tencent finds vulnerabilities in Google’s AI system / Caixin (paywall)

“Chinese tech giant Tencent Holdings claims it has found a ‘significant security loophole’ in Google LLC’s machine-learning platform, TensorFlow, which could expose programmers to ‘huge risks’ when editing code using the system.” -

Bye-bye, Hollywood, hello, malls in second-tier cities

Wanda refocuses on property as China issues code for acquisitions / Variety

China’s Wanda plans ‘large-scale’ capital ties with retail giant Suning / Reuters -

Screen tech

Japan Display in talks over $1.8 billion-plus investment from China firms: Kyodo / Reuters -

On-demand bicycles

Bike rental companies aren’t collecting abandoned bikes because it’s too expensive: report / TechNode -

Beer

Asahi to sell its stake in China’s Tsingtao for $941 million / Bloomberg -

The business of soccer

FIFA World Cup signs on China dairy producer Mengniu as sponsor / Bloomberg