Alibaba plans dual listing on mainland China stock market

Alibaba is one of the world’s most successful tech companies, and the largest ecommerce company in China. Its market cap — just like that of China’s other internet service behemoth, Tencent — has skyrocketed in recent years to around $500 billion, reaching the top tier of market listings previously occupied in this century only by American tech giants such as Google, Facebook, and Amazon.

There’s just one problem: Chinese investors have been unable to profit from the stock boom of these Chinese tech titans. Alibaba is listed on the New York Stock Exchange. Tencent is listed in Hong Kong. Internet search giant Baidu is listed on the Nasdaq Stock Market.

2018 could be the year that these listings come home.

- Alibaba “is working on a plan to list on a stock exchange in its home market, China, according to people familiar with the matter,” the Wall Street Journal reports (paywall).

- But first, securities regulators in China need to change the rules to allow the listing of foreign-registered companies. Alibaba is incorporated in the Cayman Islands.

- Another issue: “Alibaba has a complex ownership structure that gives its founders and a small group of executives more control over the company than other shareholders,” and “China…currently forbids companies with shares that carry different voting rights to list on the mainland.”

- One solution under consideration to address these and other issues, the Journal said (paywall) on March 6, is “to allow such companies to issue depositary receipts, so they can bypass Chinese law prohibiting firms incorporated overseas from going public on the mainland.”

- These Chinese depository receipts (CDR) will “very soon be released,” Yan Qingmin 阎庆民, the deputy head of the China Securities Regulatory Commission, said on March 15, according to China Banking News.

Alibaba is far from the only large Chinese company making plans, or expected to make plans, to dual list in mainland China if the rules change to allow it.

- Smartphone maker Xiaomi was asked by authorities to make a dual listing in mainland China when it makes its expected $10 billion initial public offering (IPO) in Hong Kong later this year, the Wall Street Journal reported (paywall) on March 1. And according to the Journal’s March 6 piece (linked above):

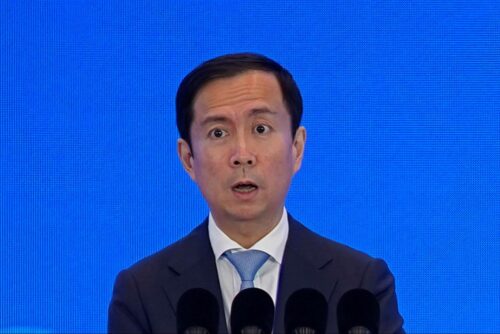

- Tencent will “actively consider” listing in China, said the company’s CEO, Pony Ma.

- Baidu “always wanted to come home to China,” according to its chairman, Robin Li.

- JD.com’s chairman, Richard Liu, said that “if the authorities allow it, we are willing.” JD, listed on the Nasdaq Stock Exchange, is China’s second-largest ecommerce company.

Alibaba’s shares rose “more than 3.5 percent” midday today, March 15, upon its announcement that it plans to double list in China, CNBC says. Another good sign for China’s internet companies: Bloomberg reports that the manager of the Dynamic Power Global Growth Class Fund, Canada’s top-performing international equity fund, considers Chinese stocks such as Tencent, Alibaba, JD, and Weibo Corp. to be cheap. “They’re taking the right steps, they’re making the right investments,” he said, adding, “They’re not as expensive as you think if you look three to five years out.”