Trade war update: Chinese investment in U.S. plummets, but yuan stays steady

The hostilities continue between the American and Chinese governments, a day after Donald Trump prepared to go all in on his tariff-first strategy.

Since then, the White House Office of Trade and Manufacturing Policy, which is directed by Peter “Death by China” Navarro, ramped up the rhetoric even further with the release of a 35-page report titled, “How China’s Economic Aggression Threatens the Technologies and Intellectual Property of the United States and the World.”

- The title of the report is pretty self-explanatory, but if you need a refresher on the Made in China 2025 initiative at the core of the Trump administration’s criticism of China, we suggest articles at Macro Polo and at the Council on Foreign Relations.

- Though the Trump administration never developed any kind of multilateral strategy at all to pressure China to change its behavior, Europeans are now joining in criticism of Made in China 2025.

- A survey of 532 European companies in China found that 58 percent of them hadn’t been able to participate in the Made in China 2025 initiative, and substantial numbers said that they saw the initiative as driving discrimination against foreign firms, the Wall Street Journal reports (paywall).

- Also, 19 percent “felt compelled to transfer technology in exchange for market access” despite Chinese partners insisting that it isn’t required, the AP says.

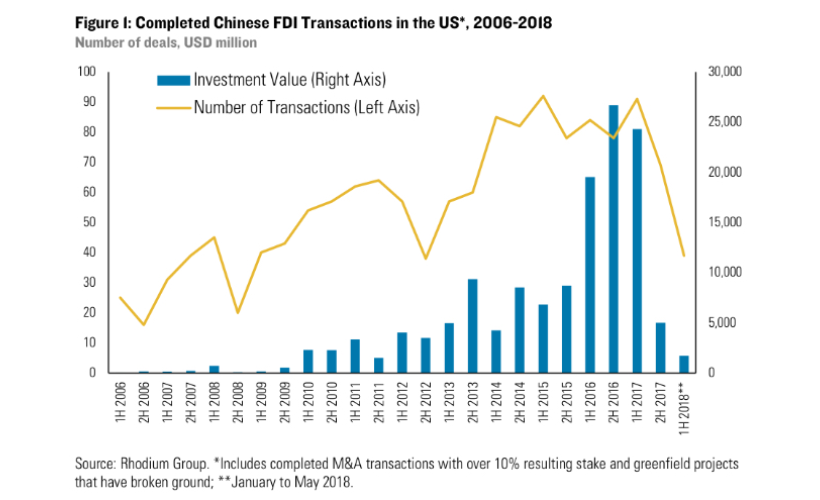

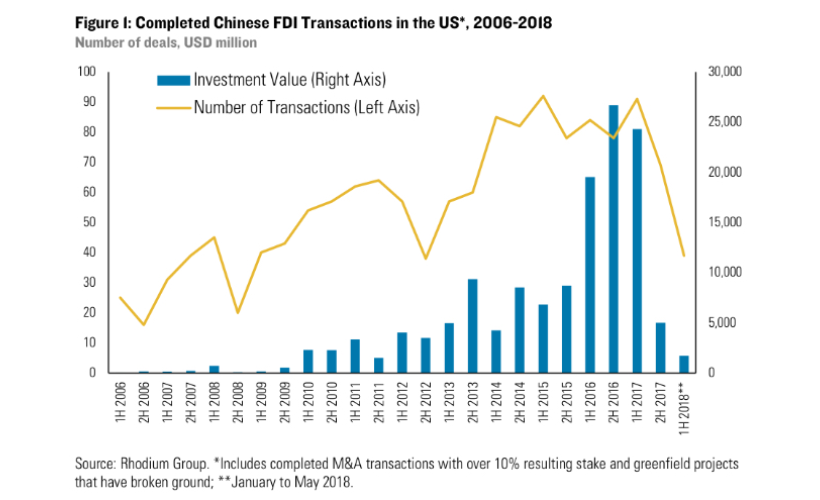

With ever-rising trade hostilities comes a debate: Has cross-border investment already taken a hit as a result?

- “Reversion to the mean” is how Macro Polo recently characterized the slump in Chinese investment in the U.S. from 2016 to 2017, as the former year had a truly remarkable amount of outbound investment.

- But investment has plummeted yet again in 2018, the Rhodium Group reports, indicating that we may be “experiencing a more profound shift” driven at least in part by the trade tensions.

- The numbers: From a peak at $46 billion in 2016, Chinese investment in the U.S. fell to $29 billion in 2017, and was just $1.8 billion in the first half of 2018, according to Rhodium.

Economic observers are also paying close attention to the value of the Chinese yuan. Theoretically, Beijing could offset the impact of import taxes in the U.S. by devaluing its currency, effectively making its exports cheaper.

- “Letting the yuan weaken [is] something that logically the Chinese would consider” if more U.S. tariffs went into effect, Brad Setser, a former economist at the U.S. Treasury Department, told the Wall Street Journal (paywall).

- It hasn’t happened so far. The Wall Street Journal separately notes (paywall) that the latest numbers on a special “trade-weighted” measure of the yuan’s value, called the CFETS index, indicates that Beijing has actually pumped up the value of its currency since March this year.

- It is also an extreme measure. The second Journal report recalls that the previous large devaluation in 2015 “sparked capital outflows,” which Beijing later scrambled to clamp down on. Additionally, another devaluation “could damage Beijing’s long-term goal to open its financial markets and promote the yuan as an international currency,” according to Bilal Hafeez, a strategist at Nomura.

Previously in The China Project’s trade war coverage:

https://thechinaproject.com/2018/06/19/trump-escalates-trade-war-again/