I had a loan in Africa…

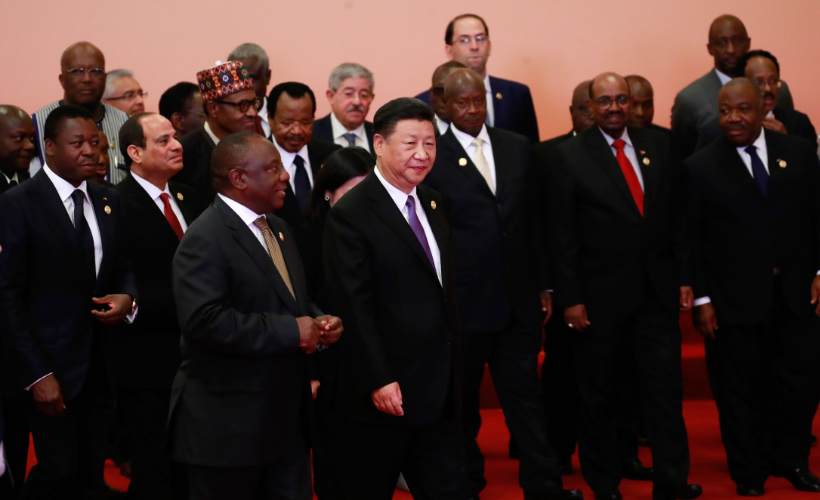

There’s plenty of news about China’s relations with African countries after last week’s Forum on China-Africa Cooperation (FOCAC) in Beijing, and much of it is connected to loans:

- Two years ago, South Africans were scandalized by “state capture” — the takeover of state assets by corrupt actors who skim money off for themselves. The primary villains, as Quartz explains, are the Guptas, “a wealthy Indian immigrant family,” and their “close friend,” former president Jacob Zuma. Now, new evidence of Gupta corruption has come to light: Investigative website amaBhungane (isiZulu for “dung beetles”) reports that when the Guptas helped arrange a $1.5-billion loan to South African rail and port operator Transnet from China Development Bank (CDB), they siphoned off nearly $7 million for themselves.

- Current South African president Cyril Ramaphosa’s state visit to China last week “yielded promising results following the signing of several cooperation agreements between the two countries on Sunday in Beijing, including a $1.1 billion trade investment deal with the Bank of China,” says City Press.

- Another $90 million would “go into the production of hard coking coal and thermal coal through an open cast mining project in Makhado in Limpopo.” There are two problems, according to The South African: South Africa is running out of coal, and the proposed plant is “in direct contravention” with a new government plan to reduce pollution and ease the country’s reliance on coal-burning power plants.

- China agreed to restructure some of Ethiopia’s loans, “including a loan for a $4 billion railway linking its capital Addis Ababa with neighbouring Djibouti,” reported Reuters. The repayment terms for a loan for the Addis Ababa-Djibouti railway have been extended from 10 to 30 years.

- “Botswana says China agreed to extend loan and cancel debt,” says the South China Morning Post: “Botswana’s President Mokgweetsi Masisi did not disclose the size of the loan, but last week the ministry of finance said Botswana was seeking (US$1 billion) for transport infrastructure.”

- 16 U.S. senators sent a letter to Secretary of Treasury Steven Mnuchin and Michael Pompeo, Secretary of State, warning “that China’s growing influence in Africa through crippling debt agreements threatened America’s economic and national security interests on the continent,” reports the Standard of Kenya.

Reactions to FOCAC and Chinese loans

Complaints about African countries falling into Chinese debt traps are increasingly common in African media.

- The Zambian government has denied social media reports that “it was poised to surrender Kenneth Kaunda International Airport to China for allegedly failing to meet its debt repayment obligations,” according to the Lusaka Times.

- Nigeria’s Inwalomhe Donald says: “Loans from China are irresistible because they come with less strings attached on matters such as governance, democracy or human rights. Bureaucrats too can easily get a cut without much accountability. Yet, the loans are like a Trojan horse.”

- From Kenya, Godfrey K. Sang writes: “Anyone with a problem with alcohol, considers whoever buys them more booze without judging them, as a good friend. But are they? Africa is like an alcoholic who has discovered a friend who will splash before them lots of alcohol and asking no questions. And China is probably fully aware that its debt-driven diplomacy is only driving Africa further into dependency.”

- “Have we reached peak China-Africa?” is the title of a China Africa Project podcast interview with scholar Luke Patey, a senior researcher at the Danish Institute of International Affairs and author of a controversial recent piece in the Financial Times, titled, “The Chinese model is failing Africa — struggling infrastructure projects are leading to a debt crisis” (porous paywall).