Could new Philippines telco Dito be a Chinese Trojan horse?

Dito has enjoyed a meteoric rise in the Philippines’ stagnant telecom sector, but it hasn’t been without controversy. Critics are concerned about the national security threat posed by one of its partners, China Telecom, which has a 40% share. But does the public share those concerns?

Two companies have dominated Philippine telecoms since 2011 — PLDT/Smart and Globe — but their hold on the market is about to be tested by Dito Telecommunity, a new telco with Chinese backing and a more than $5 billion war chest, scheduled to launch in March 2021.

Dito, which means “here” in Tagalog, traces its history to the Mindanao Islamic Telephone Company, or Mislatel, which was founded in 1998. At that time, Mislatel received a 25-year license to run a telecom franchise, but tried and failed to launch in Mindanao, according to an NTC official.

So, for 20 years, the company was inactive, until it emerged in 2018 as the sole bidder to qualify through a special selection process that decided the Philippines’ third major telecom operator. In July 2019, Mislatel rebranded to Dito Telecommunity.

Today, Dito is a consortium headed by Davao businessman Dennis Uy. His companies Udenna Corporation and Chelsea Logistics comprise 60% of Dito’s ownership. China Telecom owns the other 40%. Together, the two partners have committed to investing $5.4 billion into Dito. China Telecom is the only in the consortium with any telecom experience.

Uy, a Filipino-Chinese entrepreneur, started his business career running a chain of barbecue restaurants, before he pivoted into the petroleum industry in 2002, and then diversified across a wide range of industries.

Udenna Corporation, Uy’s holding group, has gone on an acquisition spree since 2016, expanding its portfolio from 11 to more than 30 companies across energy, logistics, property and infrastructure development, convenience stores, hospitality education, bakery chains and fast food, casinos, online payments, and more.

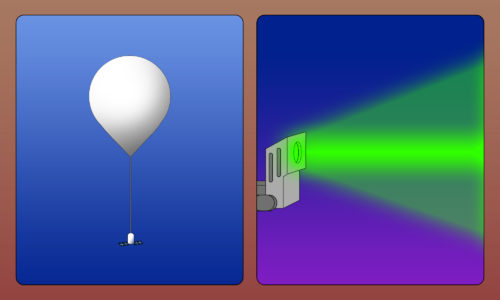

China Telecom, meanwhile, is the largest fixed-line service and third largest mobile provider in China. The Chinese state-owned carrier has a history of alleged hackings of internet networks, rerouting global internet from overseas through mainland servers.

National security and espionage threats

Dito’s meteoric rise has not been without controversy. Critics point to alleged irregularities in the company’s winning bid, which Dito has dismissed as baseless, but the greatest worry arguably is one of national security.

“The biggest concern is that China will be able to listen in on our communications,” says Dr. Renato De Castro, a professor in the International Studies Department at De La Salle University in Manila.

Commentators have cited the infamous Chapter 1, Article 7 of China’s National Intelligence Law, which stipulates: “Any organization or citizen shall support, assist, and cooperate with state intelligence work according to law.”

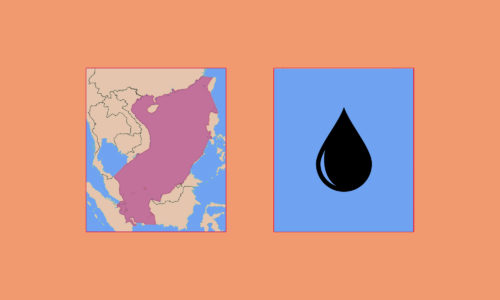

Simply put, the concern is that Dito will act according to China’s national interest over that of the Philippines. This is all the more worrying given that the two countries are locked in a territorial dispute in the South China Seas. And with the U.S. Navy on call to defend Philippine interests should a confrontation arise, Dito could also jeopardize the Philippine-U.S. security relationship.

When asked if this situation would lead to an outcome in the South China Seas where the U.S. possesses the naval firepower and China the ability to tap in on U.S. navigations, De Castro’s reply was terse and emphatic: “Yes.”

Installing Dito’s cell towers on military sites

In particular, the decision to let Dito install cell towers on Philippine military bases has raised the alarm. This is a standard move in the Philippine telecom industry. PLDT and Globe place their own towers at Armed Forces of the Philippines (AFP) sites as a protective measure for their infrastructure. Critics say Dito’s association with a Chinese SOE should preclude it from the same privilege.

Nevertheless, the AFP maintains that allowing Dito onto military bases is “a low threat in terms of the raised concerns about spying, concerns about listening devices or eavesdropping.”

At the same time, banning Dito from army bases and camps could give PLDT and Globe an unfair operational advantage, limiting both Dito’s ability to challenge the duopoly and the creation of faster, more reliable internet access for all Filipinos.

Yet the security concerns extend beyond the Philippine military. With Dito targeting 30% of the market within its first few years of operation, more than 40 million Filipino mobile users could soon be susceptible to eavesdropping from Beijing. (Look no further than the FCC’s lawsuit against the big four U.S. telcos for a glimpse into the kind of data collected by mobile carriers.)

Communications from abroad into the Philippines are another risk area. A world capital in business process outsourcing, the Philippines is home to countless multinationals — including tech and banking giants such as Apple, AT&T, JPMorgan Chase, and Expedia — who outsource customer support to local call centers in the country. These calls may be vulnerable to prying ears as well.

But, for its part, though Dennis Uy and President Duterte are apparently close, Dito says it received no preferential treatment in the bidding process to become the third major telco. The company also maintains that it is a fully independent, Filipino-owned company, and that China Telecom’s minority stake means the consortium isn’t bound by Chinese laws.

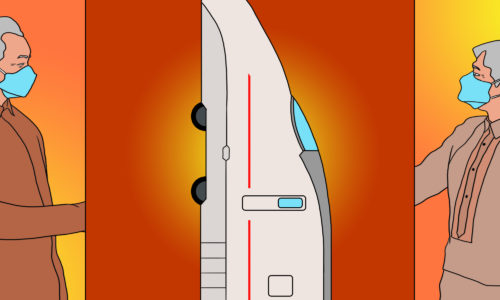

A genuine need for a third telecom player

Despite the concerns of national security and improprieties in Dito’s winning bid, the arrival of a third telecom player would bring welcome dynamism to a stagnant Philippine telecom sector.

Internet speeds in the Philippines rank among the worst in the world, and internet penetration in the country is also relatively low. Average mobile internet download speeds in the country were 16.44 megabits per second (mbps) in August, compared with a global average of 34.82 mbps. This placed the Philippines in 120th among 140 countries surveyed.

Internet penetration, meanwhile, was an estimated 67% in January 2020, covering about 73 million out of 106 million people in the country. Another, less encouraging, estimate from the Asia Foundation’s deemed that 45% of Filipinos and 74% (34,500) of local public schools did not have access to the internet in 2018.

In contrast, Dito has promised to provide internet speeds of 27 Mbps in its first year of operations, double that by year two, and speeds 10 times faster within five years. The telco is required to cover 37% of the Philippines in its first year of operations and targets 84% coverage of the country by 2025.

Internet access has been found to be a key driver of economic growth, so realizing the figures above could go a long way toward improving the livelihood of many Filipinos.

And this is especially urgent in the age of COVID-19. As classrooms and workplaces move to the cloud, tens of millions of Filipinos are at risk of being left behind in the analog world.

To this point, Dr. Nicole Curato, a sociologist at the University of Canberra, alluded to the transformative potential of a third telecom player: “The shift to online learning (and working) highlights digital poverty in the Philippines, so this development can be a game-changer if implemented properly.”

Dito is not the only telco with ties to China

Dito may be the most obvious instance of Chinese influence in Philippine telecoms, but the incumbents also have ties to the mainland, with both PLDT and Globe partnered with Huawei for their 5G roll-out. Globe, in particular, drew controversy over a proposed $400 million project to install Huawei video surveillance systems in Manila and Davao City.

At first glance, the partnerships between Philippine telcos and Chinese firms appear to fly in the face of the U.S. Clean Network program and the Trump Administration’s repeated warnings to source equipment from “trusted vendors” rather than Chinese manufacturers like Huawei.

But the reality is more complicated, and one simple reason the Philippines doesn’t have a third telco player partnered with a “trusted” supplier is that no such companies participated in the bidding process.

“International partners, potential telcos, backed out,” says Mary Grace Mirandilla-Santos, an independent researcher specializing in telecoms and ICT policy, and lead convener of the country’s Better Broadband Alliance.

Where is the U.S. in all this?

If the U.S. wants to counteract China’s influence in global telecommunications, it will need to be present. “It will be crucial for the next U.S. Administration elected November 3 to find ways to be more economically active in Southeast Asia,” says Murray Hiebert, senior associate of the Southeast Asia Programme of the Centre for Strategic and International Studies.

To do this, the U.S. can work together with partners like Japan and South Korea to provide an alternative to China for development finance.

That being said, Dr. William Emmanuel Yu, a technology professional, researcher, professor at Ateneo de Manila University, questioned the notion the Philippines is ignoring the U.S. when it comes to avoiding Chinese telecoms.

Referencing recent comments by Globe’s general counsel Froilan Castelo about the company shifting from Chinese telco suppliers, Yu says, “There is definitely an active effort by both Globe and PLDT to diversify their suppliers. Even before Clean Network, there were already moves to do supplier diversification.”

But ultimately, on the ground, in the wallets of consumers, where it matters most, it’s unlikely Filipinos will be deterred by any connection between a Philippine telco and China, be it Dito, PLDT, or Globe. “The U.S.-China trade war and cyberwar discussions are not a very big concern for most people,” says Yu. “Better service for cheaper is really what will drive this.”