Africa-China economic relations are dominated by state-to-state interactions, but Chinese private companies are making a unique impact on the continent’s economic transformation. Here’s how.

Economic relations between Africa and China are dominated by state-to-state interactions, specifically related to infrastructure development. However, the Chinese private sector is operating in Africa in a manner distinct from the private sectors of Europe and North America, and is making a unique impact on the continent’s economic transformation. This article will lay out the key features, nature and scale of Chinese private sector activity and investment in Africa; highlight emerging tensions and challenges; and close with insights on the unique strengths of the approach of Chinese private sector players in Africa.

To point out the obvious, the specific articulation of the Chinese private sector in specific African countries differs, often informed by the economic structure of the country, political economy dynamics and the features/capabilities of the private sector in the host country.

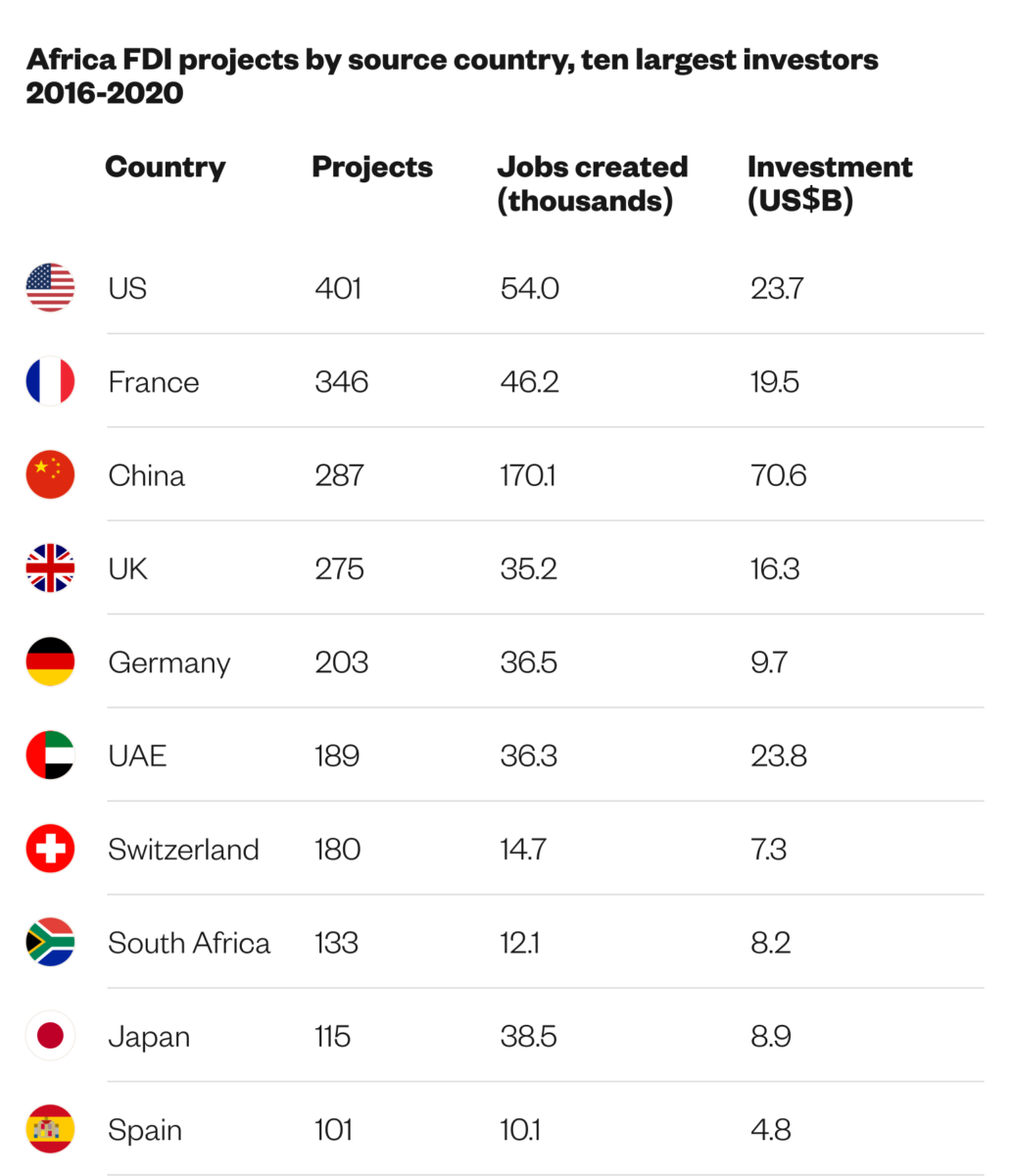

Since 2000, China’s direct investment in Africa has increased by more than 25% per annum. Between 2017 and 2020, China was the largest investor in Africa by jobs and capital and third by number of projects; over this three-year period, 20% of Africa’s capital came from China. Bear in mind however, that China still lags behind Europe and the USA in terms of overall FDI stock over time due to the historical ties Africa has with the latter. That said, China has gained this position of prominence despite the fact that it does not have the historical ties, language or relative proximity of the U.S., U.K. and France. Updated data on the sectoral focus of Chinese investment into Africa is thin, but seems mainly concentrated in transport infrastructure, extractives, manufacturing, services, construction and real estate.

Private firms predominate in Africa

Contrary to narratives on a state-led and state-financed “China Inc.,” the majority of Chinese firms active in Africa are privately owned, with very few receiving financial support from the Chinese government. By 2019, Chinese private companies accounted for more than 70% of Chinese investments in Africa in terms of volume and value, and in number 90% were private enterprises. The model of engagement has been evolving from one driven by trade to one driven by investment — transitioning from “going to Africa,” to “settling in Africa,” to “setting down roots in Africa.” Chinese investments in African countries are on average predominantly market-seeking rather than export-oriented. This suggests that African countries are not seen by Chinese investors as low-cost destinations to produce for third markets, but rather as viable markets in their own right. In my view, this feature of Chinese private sector engagement in Africa is probably one of the strongest, and demonstrates the foresight of getting market share early in a rapidly urbanizing continent, with generally positive economic growth (COVID-19 notwithstanding), growing pockets of wealth, and home to the youngest consumers in the world.

It is important to note that while ideological alignment with the Chinese State may be important for Chinese private firms to maintain a “license to operate,” this should not be conflated with receiving state financing. There seems to be a distinction emerging between the Chinese private sector’s ideological alignment and the receipt of state financing. Meaning, while ideological alignment remains important to firm survival and its license to operate, Chinese firms are using their own money to invest in Africa usually without the financial backing of the state.

Job creation and skills and knowledge transfers

Chinese private investment is an engine of job creation in Africa. Despite claims to the contrary, Chinese private sector firms are not in the business of just hiring their own. African employees make up on average 70% to 95% of the total workforce in Chinese firms. Indeed, in Ethiopia and Angola, research by SOAS of the University of London estimates that Chinese firms contributed the lion’s share of newly created jobs between 2013 and 2018 in both countries, accounting for over 60% of new jobs in some years. It should be noted that Ethiopia and Angola have positioned themselves to have above-average Chinese investors presence, linked to national industrialization plans for example. Further, Chinese firms do not introduce a “race to the bottom” in terms of wages in Africa; a World Bank survey of firms in Ethiopia found median wages in Chinese firms were 60% higher than in domestic firms. The relative strength of labour institutions, especially unions, also contributes to wage equalization among foreign firms in some African countries.

In addition to creating jobs, Chinese private firms play an important role in the transfer of skills, knowledge and technology to Africa. For example, to improve African workers’ productivity, Chinese firms invest in labour upskilling efforts and usually provide some form of training for low- and semi-skilled local workers. In terms of higher-level skills, studies have found no significant difference between European and Chinese firms in the transfer of managerial know-how, which is remarkable given the significant linguistic barriers faced by Chinese firms.

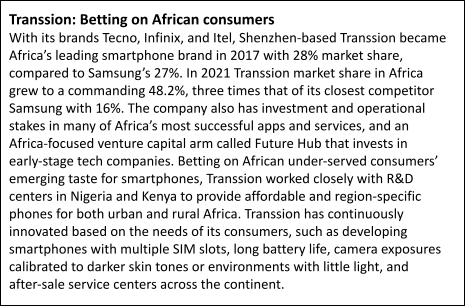

The picture on technology transfer is more complex but has been revolutionary for Africa. The first phase of Chinese investment focused on building out Africa’s digital infrastructure, and laying the terrestrial and undersea fibre optic cables and mobile broadband systems that provide internet to Africans. Here the Chinese State has leveraged its financial tools and abilities to act as a “critical mediator for extraterritorial corporate expansion,” especially in less developed markets such as Africa. This has then evolved into the “Digital Silk Road” which, as Adegoke points out, includes everything from cross-border e-commerce, smart cities, and fintech apps through to big data, Internet of Things, and smartphones. Here, Chinese firms have tended to react to business opportunities without state financial support, making significant inroads in e-commerce, smartphones and fintech. The Digital Silk Road is part of Chinese government’s Belt and Road Initiative (BRI) which finances projects mainly in the energy, telecommunications and transport sectors across Africa, Asia and Europe. So far, China has listed 43 of Africa’s 55 countries as partners under the BRI. The financing modalities for the BRI come in various forms, ranging from “packaged loans,” blended finance and interest-free loans to projects funded at full commercial rates. With that in mind, there are also politically informed push factors driving Chinese investment in and transfer of technology to Africa. As Olander points out, China is keen to use further expansion in Africa as part of their drive to set next-generation technology standards, and with the Global North becoming more hostile to key Chinese tech firms, regions like Africa have become much more important even though they are not nearly as lucrative.

Challenges

With such dynamic and burgeoning engagement by the Chinese private sector in Africa, challenges have emerged. The first point of tension is focused on environmental conduct. Mayer highlights the activity of Chinese firms in timber and rubber value chains and their role in deforestation and displacement of local communities; high biodiversity-value forest loss and illicit timber trading; and rising environmental costs. There is also deep alarm about illegal fishing and overfishing by Chinese (and European) super trawlers on the West African coast, particularly off Ghana, Senegal, and Guinea. This is leading to multiple layers of problems such as the collapse of marine ecosystems, the loss of livelihoods of coastal communities by depleting fish stocks, and continued biologically unsustainable fishing activity.

The second point of tension is metals and mineral mining activity. I will preface this point by stating that Chinese control (public and private) of African mine production stood at only 6% of the total value by 2018. Ericsson et al point out that Anglo American Plc alone controls more than twice the aggregated control of all Chinese companies and is around 10 times larger than the single largest Chinese company in Africa. Copper, bauxite, cobalt, zinc, gold, manganese, chromite and uranium (in that order) are the economically most important metals controlled by Chinese companies in Africa. Mining companies from Europe and North America also engage in behavior that is of concern. The concern here is focused on mining activity that occurs in conflict-prone areas, and that Chinese firms (public and private) are continuing the tradition of limiting value addition on the continent; and are keeping Africa in the economically vulnerable position as a provider of raw materials. Additionally, there is concern that increasing geopolitical tensions between the U.S. and China combined with the competition for world class deposits (particularly in Central Africa) and continuously growing metal demand will spill over into instability in key regions in Africa.

The third emerging point of tension has to do with the treatment of Africans. Chinese private sector firms have been in the public spotlight for the physical abuse and bigoted treatment of African workers. There is also concern about what is perceived as racist treatment of Africans in China, racist policies implemented by some Chinese firms in Africa, and Chinese nationals making bigoted comments about Africans.

Yet despite the challenges, it is clear that the Chinese private sector has managed to make significant inroads in Africa, taking market share of established players, securing new markets, and adding value to the continent.

How Chinese private firms succeed in Africa

I think the first has to do with Chinese (and Global South) economic proximity to Africa. China was in a similar economic position to Africa not too long ago and this seems to translate to a familiarity with how the private sector works in Africa. The African private sector is dominated by informality — the informal economy accounts for 80.8% of jobs and is the backbone of economic activity in urban areas in particular. This means contract negotiation, business set-up, performance setting, market entry strategies etc. are all done in a culture dominated by informality. Whereas investors from the Global North often view this as a massive risk to be managed and fixed, Chinese private sector players do not seem to be too preoccupied with it. This lends a form of mental fortitude, resilience, and ability to manage the uncertainty that is linked to deeply informal markets with massive data and information asymmetries.

The second factor is the unique approach Chinese private sector players have towards risk. Not only do they seem more willing to take on the risks of doing business in Africa, they seem more sensitive to the market, and adept at identifying and managing risk. Chinese private sector firms also have advantages in the allocation of production factors and can effectively control the cost of innovation and risk which translates to more flexibility in investment and operations; and can grasp market opportunities faster. Most private enterprises that invest in Africa are based in China’s coastal provinces (i.e. Guangdong, Zhejiang, Jiangsu and Shandong) with a more developed private economy and deep private sector expertise that is already outward-facing.

Chinese private sector players have been tactical in the criteria used to determine where and how they invest in Africa. For example, Chinese private companies have congregated in sectors that have been overlooked by Global North enterprises such as infrastructure and manufacturing. Most Chinese private sector enterprises choose to invest in countries with foundational assets such as a large population, economic volume and market size. Finally, Chinese private sector players have a different ideological bias to Global North investors that has proven important for Africa. Chen et al found that total FDI (Global North dominated) is strongly attracted to an environment of good property rights and rule of law whereas Chinese FDI is attracted to politically stable environments, without reference to the rule of law in Africa.

Since Chinese investment is less sensitive to the property rights and the rule of law environment, accounts of Chinese investment in “good governance” countries and “poor governance” countries are similar in Africa. This means that African countries that have difficulty in attracting investors from the Global North because of “governance concerns” are able to elicit Chinese private sector interest. And for those countries, China’s share of inward investment is large. Thus, from an African perspective, the Chinese private sector seems more “democratic” in the application of their entrepreneurial capabilities and interest. This has enabled the Chinese private sector to fill gaps and seize market opportunities in Africa left open by the ideological preferences of investors from the Global North.