Ant Group IPO reportedly delayed in Hong Kong

Ant Group’s listing in Hong Kong likely won’t be completed by the end of October, as originally hoped, due to scrutiny from Chinese regulators. The IPO is unlikely to be derailed, but Ant could soon be the target of largely symbolic sanctions by the Trump administration.

In late August, Ant Group, the Alibaba-affiliated financial technology giant, filed for a massive IPO on the Hong Kong and Shanghai STAR stock markets. The dual listing, which could raise as much as $35 billion and lead to a valuation of about $250 billion for Ant, is set to be one of the largest in history. At the time, the company expected to list potentially by the end of October.

The IPO is now being delayed, primarily by Chinese regulators, but also by the threat of executive action by the Trump administration, despite the fact that Ant does almost no business in the U.S. — its Alipay app is not even available for American users.

Held up in Hong Kong

Reuters reported two days ago that though Ant’s listing had been quickly approved for the Shanghai STAR stock market, the China Securities Regulatory Commission had not yet approved its Hong Kong listing, and was “looking into the role of Alipay, Ant’s flagship payment platform, as the only third-party channel through which retail investors could buy into five Chinese mutual funds investing in the IPO.”

- This unusual step “sidelined banks and brokerages, the traditional route for retail investors to buy into funds.”

- Ant’s “overconfidence” is “unlikely to derail” the IPO, though the company could have avoided this trouble by observing recent regulations that “call for better disclosure on how and under what terms funds operate with online partners,” says Reuters Breakingviews.

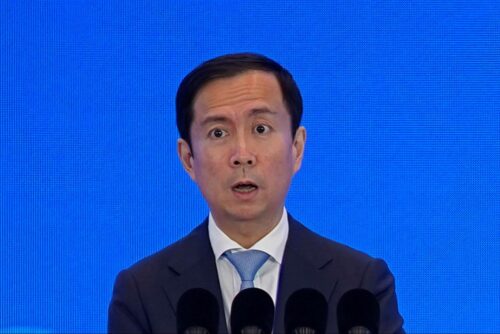

Pompeo proposes a preemptive strike

Even though Ant Group says that 95% of its business is within China, and Ant’s involvement in the American market is limited to a handful of partnerships that allow Chinese users to access financial services overseas, the Trump administration says the company is a significant national security risk.

“The U.S. State Department has submitted a proposal for the Trump administration to add China’s Ant Group to a trade blacklist,” Reuters reports today. Officials reportedly “fear the Chinese government could access sensitive banking data belonging to future U.S. users.”

- It’s no surprise that the State Department is pushing for this: In August, before Ant submitted its IPO proposal but after President Trump ordered the forced sale of TikTok, Secretary of State Mike Pompeo had proposed what we called an American Great Firewall to keep out Chinese technology.

- Pompeo’s plan designated “clean” network services, technologies, and apps as those that do not have origins in the People’s Republic of China. On the same day the plan was announced, Trump signed an executive order that would later be interpreted as a complete ban on Tencent’s WeChat app (though that action is currently held up in court on free speech grounds).

A blacklist on Ant would likely be through the same route as the restrictions on Huawei, except instead of crippling the Chinese company, it would have almost no practical effect. Ant does not depend on American technology to run its Alipay app or any of its other services.

- So what does the Trump administration want? “China hardliners in the Trump administration are seeking to send a message to deter U.S. investors from taking part in the initial public offering for Ant,” suggests Reuters.

- Will it work? Probably not. Investors and companies are overwhelmingly ignoring U.S.-China political tension. American bankers showed strong demand for $6 billion of dollar debt sold by Beijing today, the Financial Times reports, and despite a few Chinese companies leaving Wall Street or hedging their bets in Hong Kong, “Goldman Sachs forecasts a record number of Chinese listings in New York this year,” the Economist reports.