Hidden debt and ‘major implementation challenges’ on China’s Belt and Road

A comprehensive report from AidData estimates that $385 billion in debt from Chinese loans have been hidden from official balance sheets, and 35% of China’s Belt and Road projects have “major implementation challenges.”

One of the major features of China’s ascent to superpower status in recent decades, growing along with the rapidly expanding Chinese economy, is the global proliferation of Chinese development finance.

- Starting in 1999, Beijing encouraged companies and state institutions to “go global,” growing their international presence and experience through commercial projects abroad.

- This effort was supercharged in 2013, when then newly installed leader Xí Jìnpíng 习近平 launched his signature “Belt and Road Initiative” (BRI), aiming to use Chinese resources to construct infrastructure and connect countries across Eurasia and beyond.

- As the U.S. and Western European countries, which traditionally dominated international development, cast wary eyes on China’s rise, they highlighted instances of troubled Chinese overseas investments. Many American politicians in particular accused China of “debt-trap diplomacy.”

A comprehensive accounting of China’s international development reach has been hard to come by, for reasons including the secrecy of many Chinese loans, and the bewildering number and complexity of the country’s overseas investments.

A new report titled, Banking on the Belt and Road: Insights from a new global dataset of 13,427 Chinese development projects, represents the most comprehensive effort yet to quantify and analyze China’s overseas investments. It was produced by AidData, a research lab at the College of William & Mary in Virginia, and covers more than 13,000 projects across 165 countries, from the years 2000 to 2017.

Some key findings:

- $385 billion in loans are “hidden” and not included in official reporting — and the “hidden debt has become more common because lenders fund activity through special-purpose corporations instead of host governments,” the Wall Street Journal writes in its coverage of the AidData report.

- China outpaces the U.S. by a 2-to-1 margin in international finance, with a current average of $85 billion in new lending each year. The AidData dataset as a whole accounts for $843 billion worth of Chinese overseas projects.

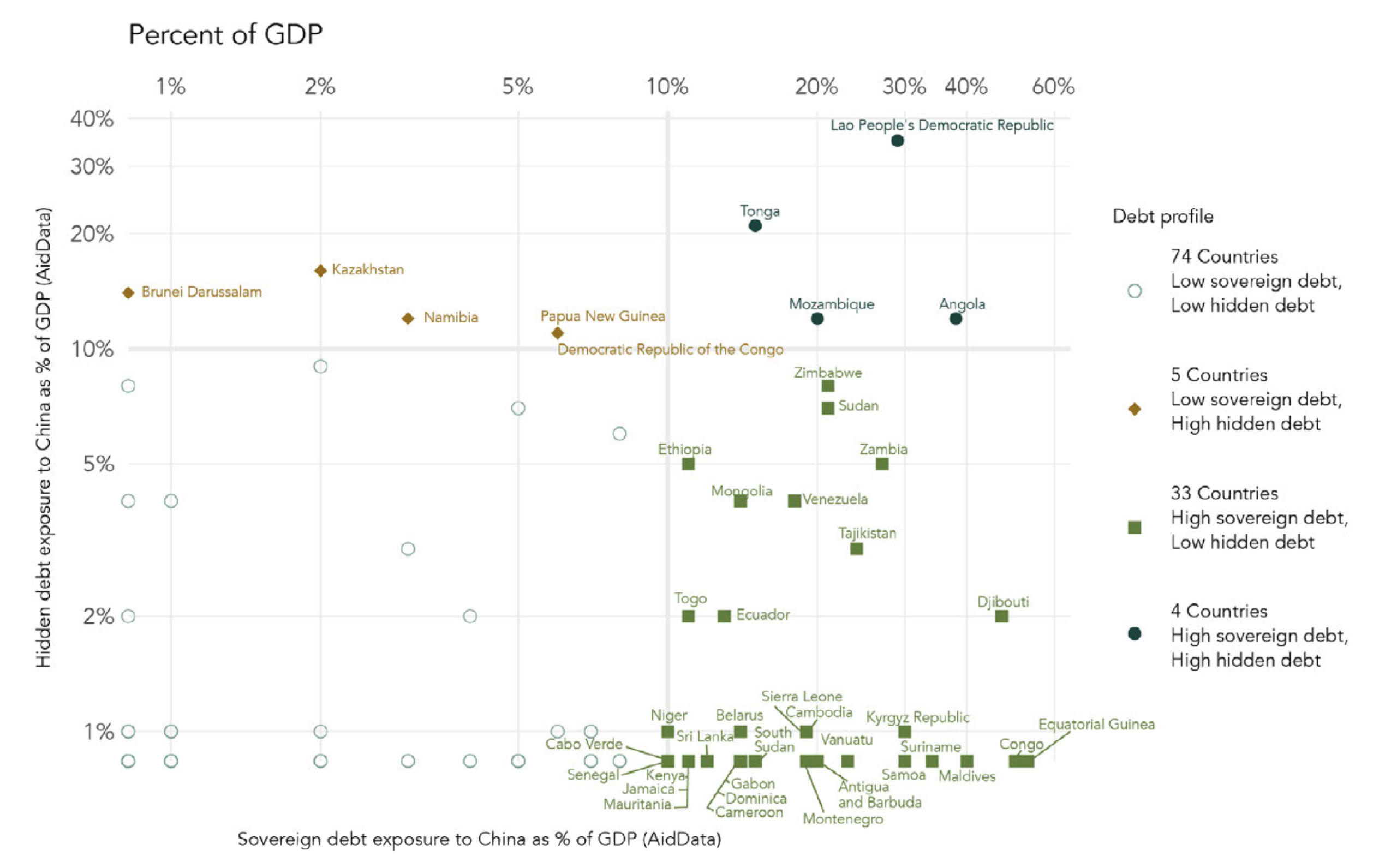

- “42 countries now have levels of public debt exposure to China in excess of 10% of GDP,” AidData writes in its executive summary.

- There are “major implementation challenges” with 35% of BRI projects, AidData writes in its full report, with problems including corruption scandals, labor violations, environmental hazards, and public protests.

- But BRI is not some radically different strategy than what came before: While investments have increased in size since 2013, the “sectoral or geographical compositions” of Chinese investments did not change after BRI was introduced, AidData noted.

The hidden debt is “‘substantially larger’ than previously understood by credit rating agencies and other intergovernmental organisations with surveillance responsibilities,” AidData researchers say, per the Financial Times.

- The extent of implementation challenges also appears significantly higher than previously known: In 2018, an RWR Advisory Group report estimated that only about 14% of Chinese-invested BRI projects had hit major roadblocks.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Further implications

One of the obvious questions that arise from the revelation of so much hidden debt on the Belt and Road is, what happens when countries are unable to pay back the debts? The Financial Times provides some context:

A 2020 study by the China Africa Research Initiative at the Johns Hopkins University found that between 2000 and 2019 China cancelled $3.4 billion of debt in Africa and a further $15 billion was restructured or refinanced. No assets were seized…[Brad Parks, executive director of the AidData team] said, however, that while the “media myth that has developed over time is that the Chinese like to collateralise on physical, illiquid assets,” the latest research suggests that collateralisation of liquid assets is common.

But are host countries always the ones to lose out from bad Chinese investments? Parks pointed out to the Wall Street Journal that, because Chinese state-owned commercial banks such as the Bank of China, the Industrial and Commercial Bank of China, and China Construction Bank have become increasingly involved in BRI financing, “it is ultimately unclear who is most exposed to Chinese lending, the borrowing countries or China, because its government companies are so dependent on the money.”

See also:

- Zambia’s Chinese debt in the pandemic era / China in Africa: The Real Story

“Zambia’s outstanding external public debt to all Chinese financiers [is] approximately $6.6 billion. This figure is more than double that of the most commonly cited figure for Chinese debt in Zambia…[but] it is important to emphasize that Zambia is an outlier when it comes to the weight of Chinese loans. We estimate that Zambia’s loan commitments to all Chinese creditors at the end of 2019 was close to 43 percent of 2019’s gross national income (GNI). The average for Africa was 10 percent.” - Beijing’s top diplomat for Africa reflects on why it’s so difficult for China to change the negative media narrative / China Africa Project

“Wu, like other Chinese stakeholders, took particular exception to the U.S.-led accusation that Beijing is ensnaring African countries with unsustainable amounts of debt: ‘It’s not like we’re forcing anyone in Africa to build our infrastructure and bridges as if holding a gun to his head, saying give us this project. Given our exceptional know-how, it’s only natural [that they’d pick China].’” - EU challenges China’s Belt and Road Initiative with global infrastructure program / The China Project