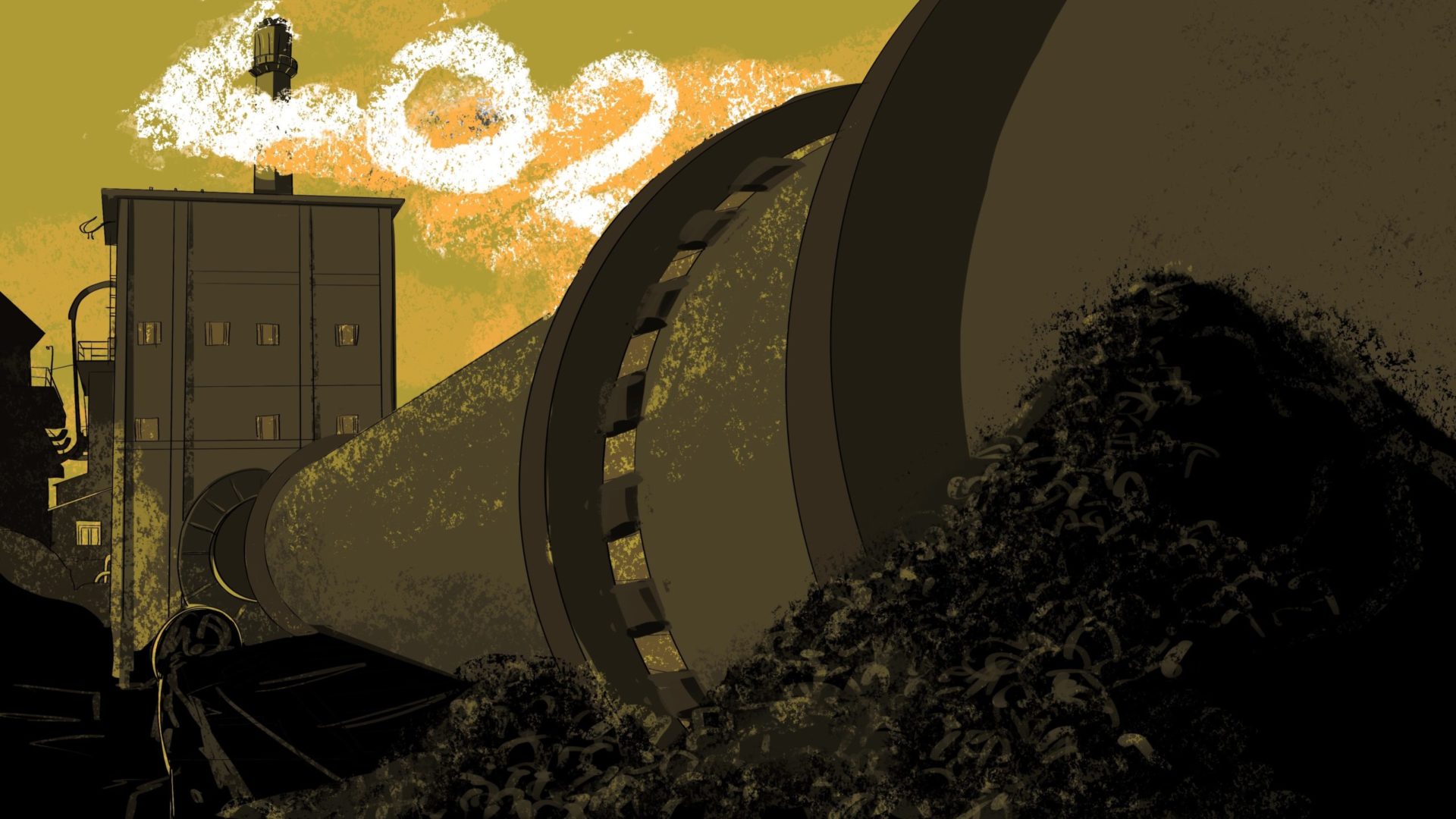

Can China’s cement industry be cleaned up?

China produces almost 60% of the world’s cement and accounts for most of the colossal carbon footprint of the industry. Plans and new technology are afoot to clean up cement, but it might prove to be largely impossible.

China’s cement industry is currently locked in a struggle with two adversaries: COVID-19 and high coal prices — in addition to older problems like oversupply and lack of demand. COVID-19 and lockdowns have suppressed demand for cement, even in the traditional March-April peak season: Closed construction sites mean no concrete pouring.

- From January to March this year, China produced 387 million tons of cement, a year-on-year decrease of 12.1%, according to National Bureau of Statistics data.

- In March during the traditional peak season, cement output was only 187 million tons, a year-on-year decrease of 5.6%, and producers are reporting shipment rates as much as 30% lower than last year’s.

- The ex-factory price of coal has now reached the level of 1,400-1,600 yuan/ton ($208–$238/ton), an increase of more than 80% year-on-year.

- One estimate found that in the first quarter of this year, net profits at listed Chinese cement companies decreased by 16.95% year-on-year.

As it suffers from a slowing economy, the industry is now also confronted with its greatest challenge: to clean itself up.

The context

The cement industry is highly energy-intensive and inextricably linked with coal because of the extreme heat required to produce cement:

- Producing a ton of cement requires the equivalent of 200–450 kg of coal (441–992 lbs) and it emits at least 600 kg (1,323 lbs) of carbon.

- Thus, cement has a colossal carbon footprint of about 8% of global emissions, more than double those from flying or shipping — and China produces nearly 60% of the world’s cement.

- In 2020, China’s cement industry emitted about 1.23 billion tons of carbon, accounting for about 14% of the country’s total carbon emissions.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

How is China planning to clean up cement?

- China’s Emissions Trading System (ETS) became fully operational in 2021, requiring companies included in the program to deposit emission permits with the government to account for a portion of their 2019–2020 carbon emissions. It is expected that the ETS will be expanded to the cement industry in 2022, although cement companies participating in regional pilot ETS programs since 2011 have regularly struggled to afford enough permits.

- New technology, including the use of alternative fuels, low-carbon clinker and low-carbon cement, and carbon capture and purification could make a big difference. Sinoma International Engineering 中材国际, for example, claims to have set up 25 more energy-efficient “smart” cement factories.

- Many of the larger cement companies are investing heavily in cleaner energy sources: Anhui Conch Cement 安徽海螺水泥, for example, will invest 5 billion yuan ($743.30 million) in the development of photovoltaic power plants this year, expecting to reach 1 GW of installed photovoltaic power generation capacity in 2022.

The takeaway

For China to reach its “double carbon” goals, it will have to clean up its dirty cement industry. The success or failure of this effort will also have a massive impact on global carbon emissions.

Experts believe that it is possible for China’s cement industry to reach carbon neutrality in 2060, but only (as one recent study put it) by means of “advanced and aggressive emission abatement scenarios” that could cost as much as 345 billion yuan ($51.28 billion). China’s largest cement producers say they are aiming to reach peak carbon emissions in 2025, but the outlook is highly problematic: As yet there is simply no obvious technology to eliminate emissions from cement production.