Pinduoduo, the ecommerce platform for Chinese farmers, had a profitable quarter despite the slowing economy

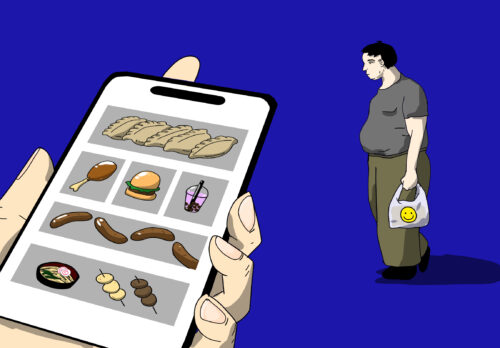

Pinduoduo, a platform that competes with China’s ecommerce king, Alibaba, allows farmers to sell their produce directly to consumers, and it’s making money despite the COVID lockdown slowdowns.

On Friday, Pinduoduo 拼多多, the Chinese ecommerce giant focused on agricultural products and low-end goods, announced better-than-expected results for the first quarter, its fourth consecutive quarter of profitability:

- Revenues were 23.79 billion yuan ($3.75 billion), a year-on-year increase of 7%.

- Net income attributable to ordinary shareholders was 2.59 billion yuan ($410.1 million), compared with a net loss of 2.90 billion yuan ($433.66 million) in the same quarter last year.

- The Pinduoduo mobile app had 751.3 million active users in the quarter, an increase of 4% year-on-year, and 881.9 million active buyers, an increase of 7% year-on-year. (Another list of China’s most popular apps based on active users released in April put Pinduoduo in sixth place with more than 600 million users, just behind Douyin 抖音 with around 750 million. Out in front is WeChat 微信 with over 1.28 billion and Alipay 支付宝 with around 850 million.)

- Some observers pointed to the company’s debt and other liabilities of $13.81 billion as a risk factor. But with cash in hand of $14.29 billion, and receivables of $0.63 billion, Pinduoduo has $1.11 billion more liquid assets than total liabilities.

In March, Pinduoduo was the only Chinese company included in the American business magazine Fast Company’s list of the top 10 most innovative logistics companies of 2022. The magazine lauded Pinduoduo “for appifying farm-to-table freshness” by connecting more than 850 million buyers with over 16-million producers.

Pinduoduo’s rise since 2015 has been meteoric and relentless, and its impact on agriculture and the rural areas has been transformative:

- It pioneered a rural ecommerce model featuring community buying in which various buyers can coalesce for a bulk purchase to receive better deals (although there is some grumbling online about the online bargaining process).

- Pinduoduo has established a cold chain transportation route, and a direct connection between the place of origin of agricultural products and their final consumption.

- In 2020, it launched a grocery shopping network that further improved the distribution of agricultural products.

- It claims to have reduced distribution costs by up to 40%, and to have enabled more than 100,000 farmers to return to rural areas to farm and develop local agriculture.

- The total number of farmers on Pinduoduo born after 1995 increased from 29,700 in 2019 to over 126,000 by October 2021, with the fastest growth occurring in western regions such as Xinjiang, Qinghai, Tibet, and Yunnan.

The context

Pinduoduo was founded in 2015 and listed on NASDAQ in 2018. There has been a buzz about the company since its first year in business, but the last two years have been challenging times for all of China’s tech giants amid the dual onslaughts of COVID-19 and Beijing’s (maybe moderating) tech crackdown.

- In the first quarter, Alibaba 阿里巴巴集团, Tencent 腾讯, and JD.com 京东集团 all reported their lowest-ever growth in revenue; JD.com reported net losses of 3 billion yuan ($444.21 million).

- Domestic consumption is still largely hamstrung by COVID-19 and government-ordered lockdowns. When the storm hit full and proper in the first quarter of 2020, China reported GDP growth of -6.8% and total retail sales of social consumer goods dropped by 19% year-on-year. In the first four months of this year, total retail sales of consumer goods were 13.81 trillion yuan ($2.06 trillion), a decrease of 0.2% year-on-year.

- Moreover, Chinese people are opting to save rather than spend their money: In the first quarter of this year, household savings increased by 7.82 trillion yuan ($1.16 trillion), significantly higher than the average quarterly increase of 5.49 trillion yuan for 2017 to 2021.

These are all significant headwinds, especially for companies that depend on China’s ecommerce-saturated bigger cities.

But Pinduoduo has launched a long-term growth model focused on third- and fourth-tier cities. During the pandemic, the company reduced marketing costs, and in the first quarter, it raised R&D investment by 2.7 billion yuan ($403 million), an increase of 20% year-on-year. The new investment includes a 10 billion yuan ($1.49 billion) agricultural research center.

The takeaway

Pinduoduo is an app without equal: It is harnessing Chinese agriculture to the digital revolution in the cities, and keeping urban residents fed with an efficient distribution system from the farms.