China’s photovoltaic boom is just getting started, but there may be dark clouds ahead

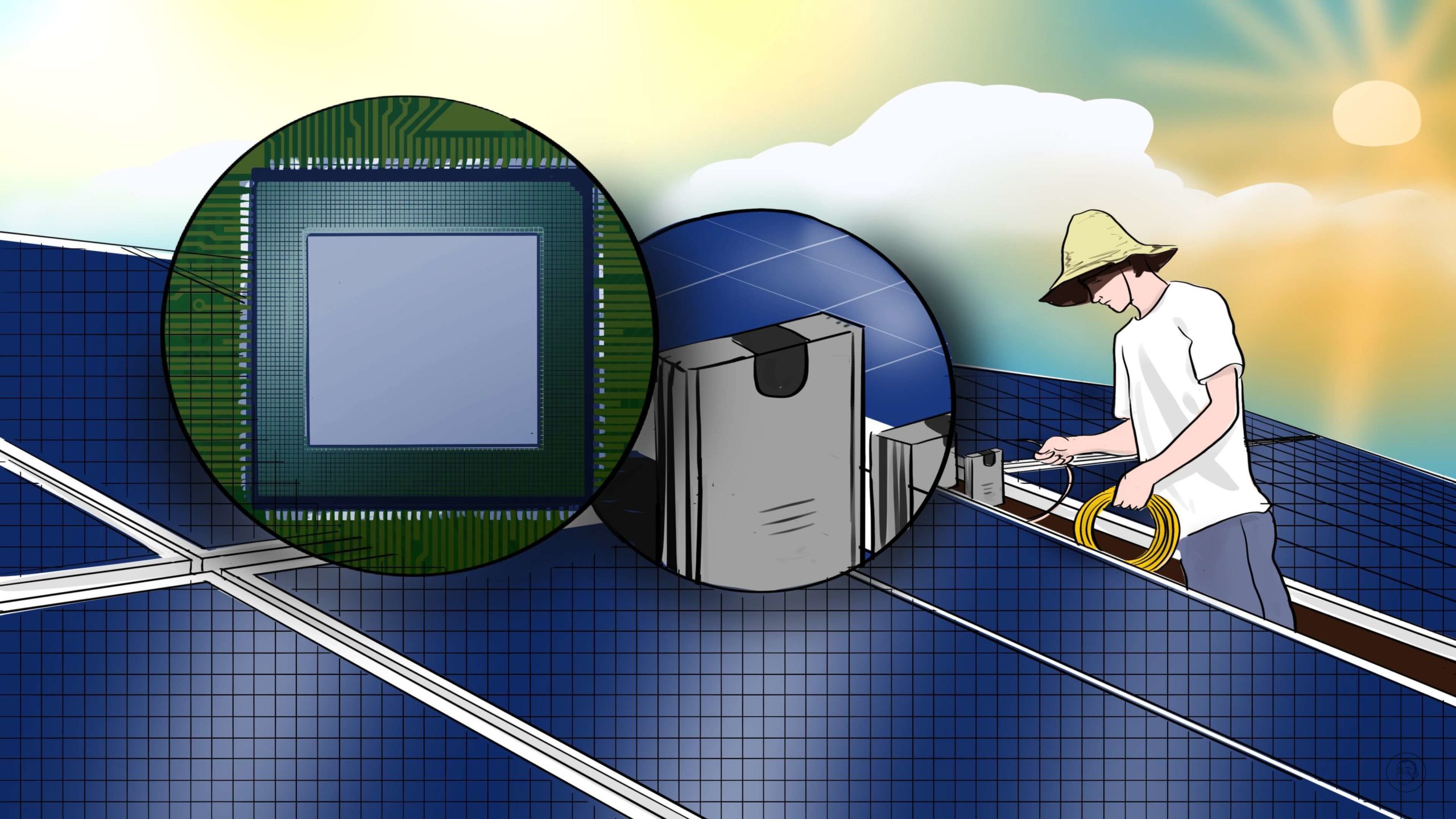

China’s photovoltaic industry is expanding at light speed, and the bosses of photovoltaic companies are now some of China’s richest men. But a shortage of microchips and an increasingly complex global trade environment could throw some shade on the industry.

The sky’s the limit for photovoltaic revenue and profit

Is there any limit to the growth prospects of China’s photovoltaic industry?

According to a Chinese news agency, as of August 12, 78 A-share photovoltaic stocks (covering the whole industrial chain from silicon materials to power stations) had a collective market value of about 3.69 trillion yuan ($545.16 billion), an increase of 154.42 billion yuan ($22.81 billion) in just one week.

Photovoltaic companies are expanding production across the board: A total of 14 projects have been announced for the second half of this year, with a total investment of more than 120 billion yuan ($17.72 billion).

- LONGi Green Energy Technology 隆基绿能, for example, the world’s largest manufacturer of solar panels, this week announced that it’s increasing monocrystalline silicon production at its plant in Inner Mongolia from 20 to 46 gigawatts (GW), increasing the investment in the factory from 6.95 billion yuan ($1.02 billion) to 14.55 billion yuan ($2.14 billion).

- In 2022, LONGi expects to increase production of silicon wafers, cells, and modules by

45 GW, 22 GW, and 20 GW, respectively, with total production this year expected to reach 150 GW, 60 GW, and 85 GW, cementing its place as China’s largest photovoltaic producer.

Revenue and profit are flowing in: LONGi expects to report revenue for the first half of the year of up to 51 billion yuan ($7.53 billion), a year-on-year increase of up to 45%, and net profit of up to 6.6 billion yuan ($975.08 million), a year-on-year increase of up to 32%.

Photovoltaic company bosses are now some of China’s richest men:

- According to calculations by Caijing, as of July 24, there were 57 chairpersons with a stock market value of over 10 billion yuan ($1.47 billion) in the entire A-share market, and 20 of these chairpersons are from new energy companies.

- Of these 20, two out of the top five (ranked second and fourth) are from photovoltaic companies, namely, Cáo Rénxián 曹仁贤 of Sungrow Power Supply 阳光电源 and Gāo Jǐfán 高纪凡 of Trina Solar 天合光能.

- The other three are all related to electric vehicles and car batteries: BYD 比亚迪, Ganfeng Lithium 赣锋锂业, and Semcorp 云南恩捷新材料.

With a market capitalization currently standing at over 440 billion yuan ($65 billion), since 2019, LONGi has achieved the third-highest growth in market capitalization (after BYD and battery manufacturer CATL 宁德时代). Over the same period, the new energy stock index increased by 172.94%, and the photovoltaic sub-industry index increased by an even higher amount, 192.20%, higher than the new energy vehicle sub-index (129.87%) and the lithium battery sub-index (171.23%).

The photovoltaic industry is just getting started in China

On July 29, the National Energy Administration released data on the 30.88 GW photovoltaic power generation capacity newly installed in the first half of the year, a year-on-year increase of 138%, which included 11.22 GW of photovoltaic power stations, and 19.65 GW of distributed solar photovoltaics (including 8.91 of household distributed photovoltaics). According to one estimate, during the 14th Five-Year Plan period (2021–2025), China will add an average of 75 GW of photovoltaic power generation capacity every year. Total newly installed capacity in 2022 is expected to reach 85–100 GW, a year-on-year increase of more than 54.8%.

Solar energy, moreover, is now cheaper than thermal energy produced by burning oil, liquid natural gas (LNG), or coal. The levelized cost of electricity (LCOE), a measure of the average cost of electricity generation, of photovoltaics has dropped by 88% since 2010. The cost of photovoltaic power stations is concentrated in the initial investment and setup, but the LCOE then drops to below 0.2 yuan/kilowatt-hours (kWh). (The LCOE of thermal power is about 0.4 yuan/kWh, and the LCOE of hydropower is about 0.3 yuan/kWh.)

Yet even with these huge increases in capacity, photovoltaic power in China is just getting started: China’s total power generation in 2021 was 8.38 trillion kWh, a year-on-year increase of 9.8%, and photovoltaic power generation was 327 billion kWh, a year-on-year increase of 25.2% but proportionally only 4% of China’s total power generation.

Coming problem 1: Chip shortage

Along with the solar panels and their composite silicon materials, solar inverters — which convert direct current (DC) electricity generated by the solar panels to alternating current (AC) for the electrical grid — comprise the other crucial element in the photovoltaic boom. Without the inverter, the entire solar power plant would be totally useless. A Chinese journalist visited a number of domestic solar inverter manufacturers this week and found that the companies are swamped with orders and making huge profits.

Solar inverters, however, use insulated-gate bipolar transistor (IGBT) microchips, used for power conversion and circuit control, and the problem for China’s inverter industry (and the photovoltaic industry as a whole) is that IGBT microchips are almost exclusively made by foreign (mostly German and Japanese) companies. GoodWe 固德威, one of China’s largest inverter producers, had already announced in 2021 that demand for IGBT microchips was exceeding supply. The shortage of these microchips is likely to become a serious concern very soon: A domestic firm has estimated that China’s photovoltaic capacity can only reach 250 GW in 2022 (it reached 170 GW in 2021) due to the shortage of IGBT microchips.

Coming problem 2: Sanctions and tariffs

China’s photovoltaic producers are profiting hugely from rapidly increasing demand from abroad, especially from the European Union (EU): In the first quarter of this year, China’s exports of photovoltaic modules to the EU amounted to 16.7 GW, a year-on-year increase of 145%. China’s total exports of photovoltaic products in the first half of the year amounted to $25.90 billion, an increase of 2.13 times year-on-year and a record high.

But this export bonanza is under threat. In addition to the microchip shortage, China’s photovoltaic companies are now finding themselves in an increasingly complex global trade situation, with trade barriers, tariffs, and patent litigation. In fact, China’s photovoltaic companies are frequently involved in lawsuits abroad.

- In July, for example, Trina Solar announced that it’s the subject of an arbitration claim by the Indian power contractor Sterling and Wilson, and Trina Solar’s U.S. subsidiary was recently sued by Total Energy, a dispute that ensued from Withhold Release Orders (WROs), first enforced in January 2021, which allows the U.S. Department of Homeland Security to ban entry to the U.S. of products suspected of involving detainee or prison labor and situations of forced labor.

- Following the passing of the U.S. Uyghur Forced Labor Prevention Act in June this year, reports have now appeared of solar equipment piling up at the U.S. border. As much as 12 GW of solar modules could be detained by the end of the year, and many Chinese manufacturers have reportedly stopped exporting to the U.S.

- Chinese companies have also been involved in patent lawsuits, such as the one filed by South Korea’s Hanwha Corporation against LONGi in the U.S. in 2019.

In addition to the U.S., the EU has likewise taken measures to suppress imports of Chinese photovoltaic products. In June, the EU parliament passed a resolution to enact customs measures against forced labor, and legislation is expected to be passed in September.

The takeaway

The photovoltaic industry is expanding rapidly in China and producing some of China’s richest men and most profitable companies. But the industry is really just getting started in China. Even so, it’s facing the imminent challenge of a debilitating microchip shortage and the very real and immediate threat of trade barriers and frictions.