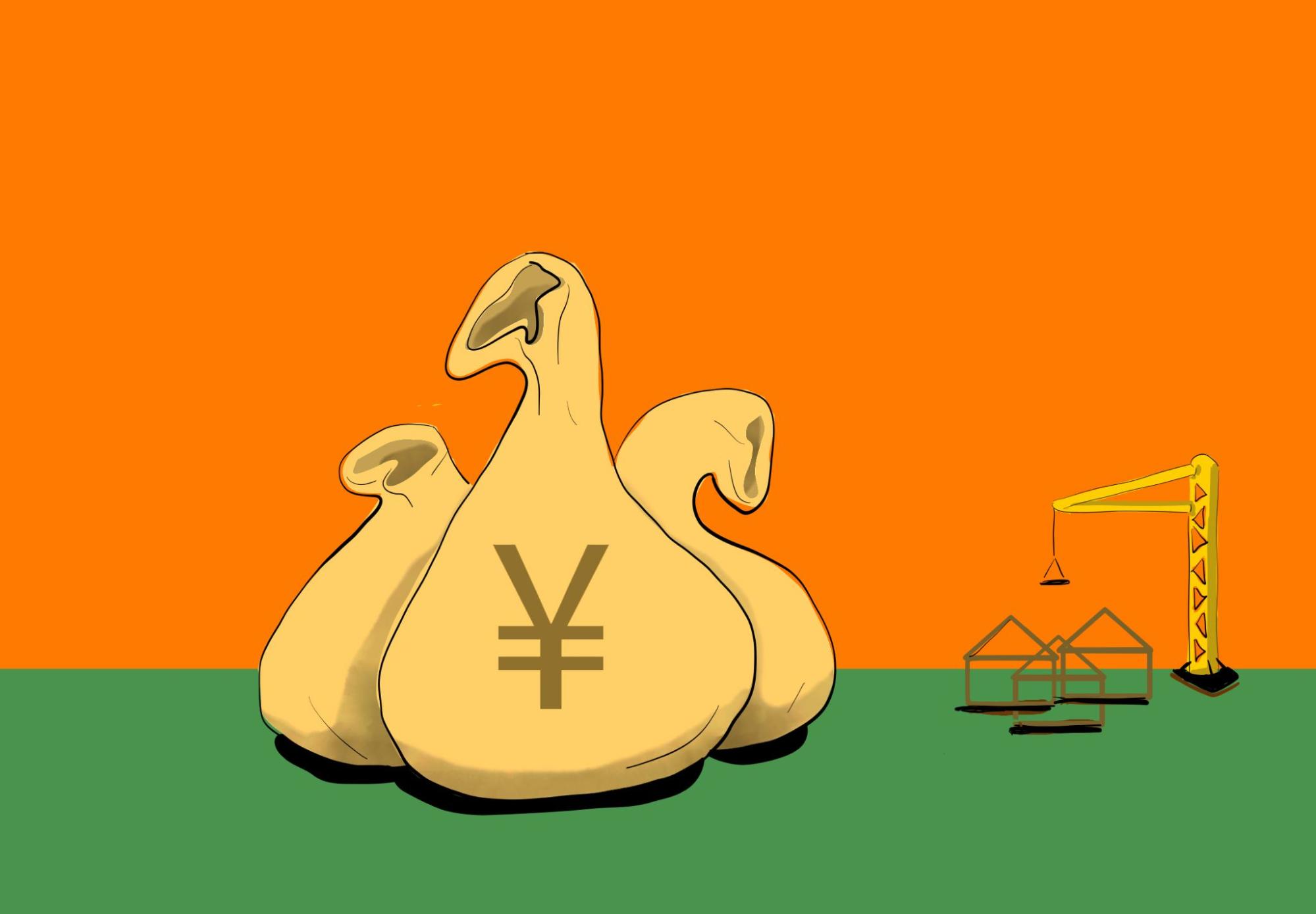

China announces enormous new stimulus packages as COVID-, property-, and drought-hit economy splutters

China’s State Council has allotted tens of billions for a variety of stimulus packages, in the latest acknowledgment from authorities that the country’s economy continues to struggle.

China yesterday announced another round of funds to invigorate its limping economy, as the country’s lackluster performance over the summer has apparently convinced policy makers to overcome their reluctance toward increasing the nation’s debt.

Premier Lǐ Kèqiáng 李克强 outlined a 19-point policy package at a State Council meeting on Wednesday (English, Chinese): “Given the current circumstances, we must seize the window of opportunity and maintain the appropriate policy scale…This will expand effective investment, boost consumption, and help keep economic activities on a steady course,” he said.

- An additional 300 billion yuan ($43.72 billion) will go toward the development of financial tools.

- Power generation firms will be able to issue new bonds of 500 billion yuan ($72.87 billion).

- More support worth 200 billion yuan ($29 billion) will go toward supporting the troubled real estate market, and for disaster relief in drought-stricken areas.

The additional stimulus is part of the growing acknowledgement from top authorities and industry leaders in China that the nation’s economy is still struggling, as it continues to be battered by COVID lockdowns, a downward spiraling property sector, and drought-induced power shortages that have paralyzed a number of key factories.

- Yesterday, Rén Zhèngfēi 任正非, the founder of the Chinese telecom giant Huawei, stoked fears of a global recession in what appears to be a leaked internal memo, financial news outlet Yicai reported.

- “The next ten years [are likely to] be a very painful historical period. The global economy will continue to decline. Now, due to the impact of the war and the continued blockade and suppression by the United States, the world’s economy is unlikely to improve in the next three to five years,” he said per Pekingnology’s English translation of the memo.

But will it be enough? Beijing is “trying to walk [a tightrope] as it seeks to use central government stimulus and looser monetary policy to arrest slowing growth while avoiding saddling the country with more debt,” the Financial Times reports. As Tom Orlik, chief economist at Bloomberg, said in today’s episode of the Sinica Podcast:

China’s stimulus back [in 2008 and 2009], the…famous Wēn Jiābǎo 温家宝 $4 trillion “un” stimulus…restarted China’s growth. But it also put China on an unsustainable trajectory. Debt rose too high. It proved very difficult to turn the lending taps off. And that has contributed to the high level of financial risk in China, which is one of the reasons they can’t now run a massive stimulus. Debt’s already too high, they’ve kind of maxed out.

[Meanwhile,] if you want to solve the real estate problem, you want to pump a bunch of stimulus into the economy. If you want to maintain COVID zero, actually, pumping a bunch of stimulus into the economy can push in the other direction.