Battery swapping is the future of electric vehicles

CATL, NIO, and another brand new company launched this week are going to take swapping electric car batteries into the mainstream.

A new battery in just a few minutes

On Wednesday, a new company, Shanghai Jieneng Intelligent Electric New Energy Technology (a literal translation of 上海捷能智电新能源科技), was established, boasting an impressive range of investors including SAIC Motor 上汽集团 (the largest shareholder at 37.5%), Sinopec 中国石化 (25%), PetroChina 中国石油 (12.5%), and Contemporary Amperex Technology Limited (CATL) 宁德时代 (12.5%). With registered capital of 4 billion yuan ($564.95 million), the core business of Shanghai Jieneng is battery leasing, or in other words, the battery swap model for electric vehicles.

- The company will conduct research and development and promote battery swap technology to construct a complete ecosystem and a standardized platform.

- It also plans to launch a range of battery swap stations based on Petrochina and Sinopec’s existing network of more than 50,000 gas stations across China.

Although battery swapping is still a niche practice for electric vehicles (EVs) with few operational EV models as of yet, it has the potential to eliminate the slow charging speed and relatively short battery life of the more conventional battery charging mode, while also reducing the original price of the EV. Taking into account the 20 million EVs predicted to be on China’s roads by 2025 (according to Ministry of Public Security data), the advantage of battery swapping EVs to reduce pressure on the electrical grid is considerable. And replacing the battery takes just a few minutes. Battery swapping is now also growing in prominence as China will soon have to retire its first round of electric vehicle batteries, and recycling those batteries is still not a fully developed industry.

The costs of constructing battery swap stations and maintaining them are considerable, however: Construction costs are about three times that of charging stations, which has slowed down the adoption of the technology as mainstream practice. But since 2020, an increasing amount of Chinese companies have entered the battery swap business, such as EV manufacturers NIO 蔚来汽车 and XPeng 小鹏汽车, and battery manufacturer CATL. Following the establishment of Shanghai Jieneng, SAIC Motor will now launch battery swap models for all its car brands.

Just last week, CATL announced the launch of a new battery swap Module to Bracket (MTB) technology for electric trucks and construction machinery, for which the company has partnered with Qiyuanxin Power 上海启源芯动力科技 (literal translation), a subsidiary of State Power Investment Corporation 国家电投集团. As of February this year, Qiyuanxin had established 100 heavy duty truck battery replacement stations across China.

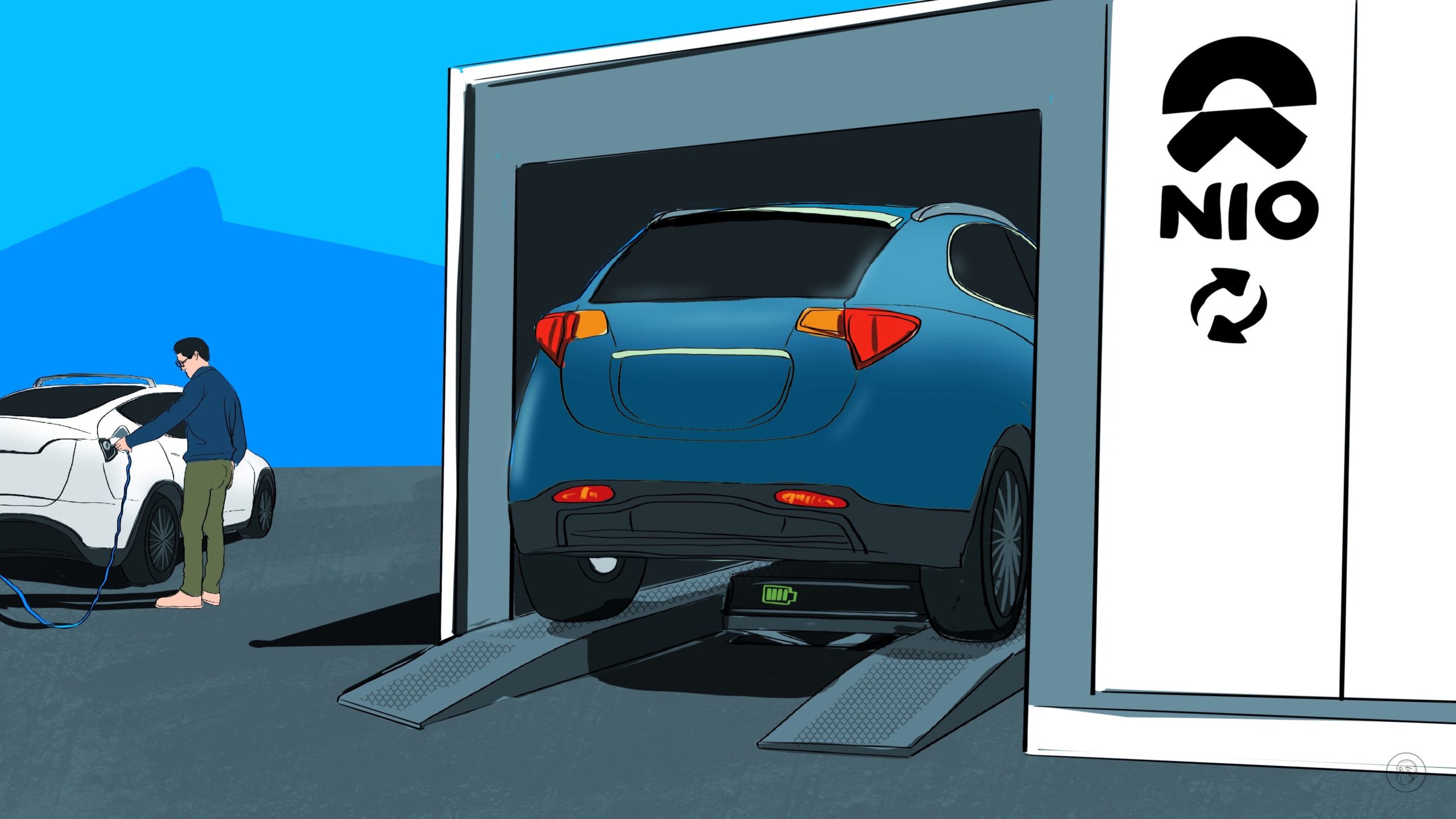

NIO is the domestic EV brand that has ventured furthest down the path of battery swapping EVs, investing considerable funds to construct its own network of swapping stations. The company now has over 1,100 swapping stations across China that have swapped a cumulative 12 million batteries. By 2025, NIO plans to have a total of 3,000 battery swap stations.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Take-off and standardization

The concept of battery swapping stations have appeared in government reports and plans since 2020.

- A New Energy Vehicle (NEV) industrial development plan up to 2035 released by the State Council in October 2020, for example, encouraged the development of the battery swap model.

- Guidelines on EV charging infrastructure released by the National Development and Reform Commission (NDRC) and other government departments in January 2022 proposed speeding up the application of the battery swap model.

With official support, the battery swap model is now in a take-off phase: According to a domestic research report, by the end of 2021, there were a total of around 1,406 EV battery swap stations across China, and this number is expected to jump to 30,000 by 2025.

The biggest challenge facing the battery swap mode is standardization: EVs contain a wide variety of battery packs in terms of capacity, materials, shape, and size, meaning that swapping stations cannot be used for all battery types. In fact, battery swap services launched by car companies are often only applicable to the cars they produce. The guidelines released by the NDRC in January mentioned the importance of standardizing battery swap technology, and a planning document released by the Ministry of Industry and Information Technology in March this year proposed the formulation of standards for the battery swap system.

Yesterday, an employee of CATL informed a Chinese newspaper that the company is actively exploring vehicle and battery standardization, which is a common expectation for the future of the industry.