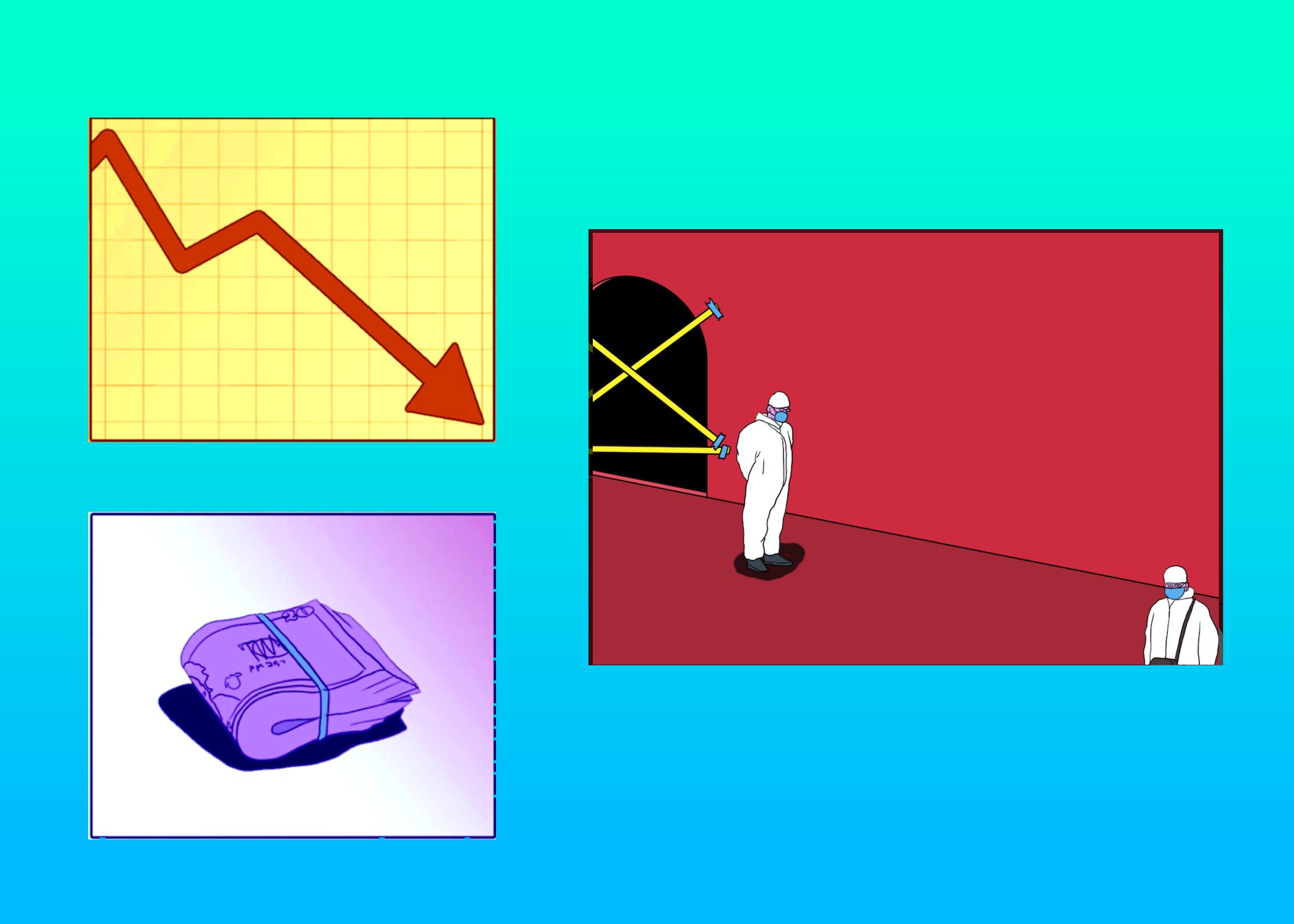

COVID-zero and the end of breakneck economic growth in China

The crippling effects of COVID-zero have weighed China’s economy down so much that, for the first time in 30 years, China will now grow slower than the rest of Asia.

China’s economy is expected to grow slower than the rest of Asia’s for the first time in over three decades, according to a biannual report released on Tuesday by the World Bank.

The sharp decline in the world’s second largest economy is mainly due to Beijing’s COVID-zero policies of mass testing and of restrictions on movement, which have “disrupt[ed] supply chains, industrial and services production, domestic sales, and exports.”

- Growth in developing Asian countries (excluding China) is expected to increase to 5.3% in 2022 from 2.6% in 2021.

- In contrast, China is projected to grow only by 2.8% in 2022, a sharp drop from 8.1% in 2021, despite previously leading economic recovery in the region. (COVID curbs are also still significantly weighing on the Marshall Islands, Micronesia, and Palau.)

- Growth in Asia as a whole (including China) is still expected to slow to 3.2% this year from 7.2% in 2021, before increasing to 4.6% next year. But the optimistic outlook could be threatened by slowing global demand, rising levels of debt, and a reliance on short-term, band-aid style fixes to cushion soaring inflation.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

The World Bank findings echo similar predictions in a report by the Asian Development Bank (ADB) released last week:

- The ADB further downgraded growth forecasts in the region, and now expects developing countries in Asia (excluding China) to grow by 5.3% in 2022, while China is projected to grow by 3.3% in the same year.

- Profits at China’s industrial firms also shrank at an even faster pace at 2.1% for the first eight months of this year, compared with the same period last year, the National Bureau of Statistics (NBS) reported today.

- “The slowdown in external demand is the biggest uncertainty faced by China’s trade,” vice commerce minister Wáng Shòuwén 王受文 said today, per Bloomberg: “Our companies are reporting falling orders, as the demand from major markets is declining.”

- Despite the gloom, China continued to recover somewhat in September, as an increase in car and home sales in the biggest cities made up for weaker global demand and falling business confidence.

But speculation over a shift away from COVID-zero may finally ease the economic pain in the region: A host of major banks, including Goldman Sachs, Nomura, and Morgan Stanley, are now predicting that China may lift restrictions and reopen the country by spring next year — after the nation’s big political reshuffle in October.