PAID OFF: Congress says it’s cracking down on Chinese lobbying. The truth is more complicated

New legislation would change the rules around how Chinese companies disclose their lobbying activity, but it might not reduce the amounts they spend on buying influence in the U.S.

Members of the U.S. Congress introduced new legislation in February to close loopholes in the laws that govern how lobbying activity is reported. They emphasized that the legislation would “Prevent Foreign Adversaries From Influencing U.S. Policy,” per one congressman’s press release headline. In addition to a senate version of the bill, Representatives August Pfluger (R-TX) and Jason Crow (D-CO) introduced the same legislation in the House of Representatives.

“For too long, America’s adversaries have taken advantage of loopholes in our lobbying system to influence policy making through multimillion-dollar disinformation campaigns,” said Sen. John Cornyn (R-TX) of the new bill.

The members were speaking about the Preventing Adversary Influence, Disinformation and Obscured Foreign Financing, or PAID OFF Act, which closes loopholes in the 1930s Foreign Agents Registration Act (FARA). FARA imposes sweeping requirements on agents acting on behalf of a foreign principal to influence U.S. policy or public opinion.

Currently, FARA contains several exemptions which allow foreign companies to avoid registering as foreign agents. The PAID OFF Act would remove two of those exemptions for foreign agents acting on behalf of “countries of concern,” a list of countries comprising China, Russia, Iran, North Korea, Cuba and Syria.

One of the exemptions has to do with the type of activity foreign principals carry out, allowing an exemption for those engaging only in the nonpolitical “furtherance of bona fide trade or commerce.” The other exemption allows for agents already registered under the Lobbying Disclosure Act (LDA) to bypass FARA requirements. In other words, agents lobbying on behalf of foreign companies who are already registered as lobbyists do not have to register under FARA.

When it comes to Chinese firms operating in the U.S. the PAID OFF Act would indeed require many more activities on behalf of Chinese companies to be reported under FARA, leading to more transparency and accountability. But despite what lawmakers say, requiring lobbyists working for Chinese companies to register under FARA wouldn’t necessarily block or end their lobbying activity, as recent cases show.

The offices of PAID OFF Act sponsors Senators Sheldon Whitehouse (D-RI) and Cornyn did not respond to requests for comment.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

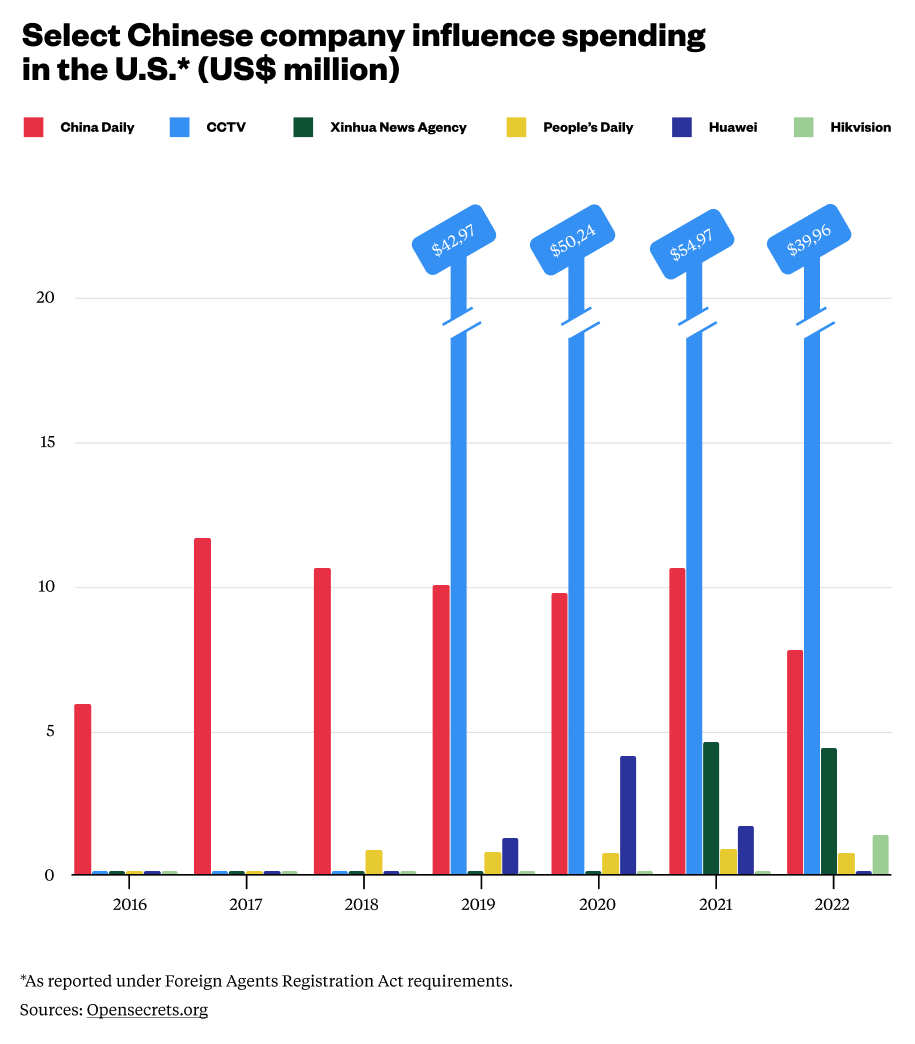

State media is outspending Hikvision and Huawei

As U.S.-China relations have grown more tense in recent years, large Chinese companies have seen much greater scrutiny from American regulators. Sanctions and export controls have been among the higher profile measures taken by U.S. authorities, but the Department of Justice (DOJ) has also forced some Chinese companies that were previously exempted to register as foreign agents under FARA.

In 2018, the DOJ ordered the U.S. branches of Chinese state news agency Xinhua and state broadcaster CGTN to register under FARA. It also demanded in 2022 that the lobbying firm Sidley Austin register as a foreign agent on behalf of Hikvision, a Chinese manufacturer of surveillance technology that has also been sanctioned by the U.S. Commerce Department. American PR firms working for Huawei have also registered under FARA.

Other Chinese media have long been registered under FARA. China Daily, also state media, registered as a foreign agent in 1983, and the People’s Daily Overseas Edition registered in 1996.

FARA’s provisions are stringent, requiring “significant disclosures, and much more than the LDA,” says Tessa Capeloto, a partner at the law firm Wiley Rein, who specializes in FARA. “For instance, under FARA, registrants must identify in detail all their political contacts and media outreach on behalf of the foreign principal and must report all disbursements made/monies received on behalf of the foreign principal.”

Unlike the LDA, FARA has no de minimis exception, meaning nearly all influence activity must be reported. While a U.S. corporate executive would not have to disclose an afternoon of meetings with lawmakers on Capitol Hill under the LDA, a foreign executive subject to FARA requirements likely would. Similarly, all communications, including emails, between foreign agents and government officials must be disclosed. Currently, most lobbyists acting on behalf of foreign firms registered under the LDA enjoy FARA’s LDA exemption, but all that will change if the PAID OFF Act passes.

The PAID OFF Act’s proponents argue these higher standards will help to hold foreign companies acting in the U.S. accountable. “It has been a long time since FARA has been updated,” Rep. Pfluger told The China Project in an emailed statement. “The threat landscape has changed significantly in the last 20 years, and malign actors are finding unique ways to exploit loopholes in the law.”

Yet while registering under FARA does entail stricter reporting requirements than the LDA, it by no means prevents registrants from spending millions on influencing policymakers and the broader public. China Daily continues to be among the top spenders when it comes to Chinese companies buying influence in the U.S., spending over $5 million each year since 2016, according to the watchdog database Open Secrets.

After CGTN was ordered to register as a foreign agent in 2018, China rose to the top of the rankings tracking foreign influence spending. The broadcaster spent over $50 million spending disclosed under FARA in 2020 alone.

Given that their explicit purpose is to influence public opinion, Chinese state media’s relatively high FARA spending is to be expected, as most of their activity must be reported. But non-media entities like Hikvision also continued to spend heavily on influence in Washington after registering as foreign agents: the surveillance tech firm reported more than $1.6 million in FARA spending in 2022.

While registering under FARA clearly does not prevent influence outright, it may have a chilling effect on foreign firms’ influence efforts, Capeloto told The China Project. “It is not uncommon for parties to forgo undertaking certain activities on behalf of foreign clients so that they don’t have to register under FARA and make all of the required public disclosures, including potentially sensitive information,” she said.

Path to the president’s desk

FARA reforms like the PAID OFF Act have been introduced several times in recent past Congresses, but have failed to become law. Sen. Chuck Grassley (R-IA) introduced the Foreign Agents Disclosure and Registration Enhancement Act in both 2019 and 2021, and Katie Porter also proposed FARA reforms in her Foreign Political Influence Elimination Act of 2021, but both bills failed to find traction.

There are signs that support may be stronger for the current PAID OFF Act making its way through the Senate. In December 2022, the DOJ for the first time endorsed eliminating the LDA exemption from FARA, although notably did not endorse removing the commerce exemption. (The DOJ’s FARA unit did not respond to a request for comment.) The general heightening of hawkish views toward China in Congress, best exemplified by the newly formed House Select Committee on Strategic Competition between the U.S. and the CCP, could contribute to growing support for the bill.

“This legislation has wide bipartisan, bicameral support,” Rep. Pfluger said. “We made some great progress last year and plan to build on that momentum this Congress to hopefully get this across the finish line.”

If the PAID OFF Act does eventually become law, an early effect would likely be to simply reveal much of the influence operations undertaken by the many agents working in the U.S. on behalf of Chinese foreign principals. This would almost certainly alarm a swathe of the broader public, but whether that would translate to concrete action to counter that spending is an open question.

The takeaway

Efforts in Congress to increase oversight of Chinese lobbying in Washington are gathering steam. But while the PAID OFF Act is being billed as a way to prevent foreign influence, it is primarily a mechanism for increasing transparency and reporting requirements. Past examples offer evidence that if Chinese influence efforts are to be systematically countered, further action will have to be taken.

Companies:

Sources and additional data:

- Risch Joins Cornyn, Colleagues in Introducing Bill to Prevent Foreign Adversaries from Influencing U.S. Policy / Senate Foreign Relations Committee

- Justice Department Has Ordered Key Chinese State Media Firms to Register as Foreign Agents / Wall Street Journal

- DOJ asks Sidley Austin to register Hikvision work under FARA / Politico

- DOJ-ordered foreign agent registrations boost China and Russia’s 2020 FARA spending / Open Secrets

- US firms register as foreign agents of embattled Chinese telecom giant Huawei / Open Secrets

- PAID OFF Act Introduced in 118th Congress / Wiley

- Department of Justice Reveals Support for Eliminating the LDA Exemption to FARA and Other FARA Reforms / Covington

- Grassley Legislation Would (Re)Impose FARA Obligations on Private Sector Entities / Covington