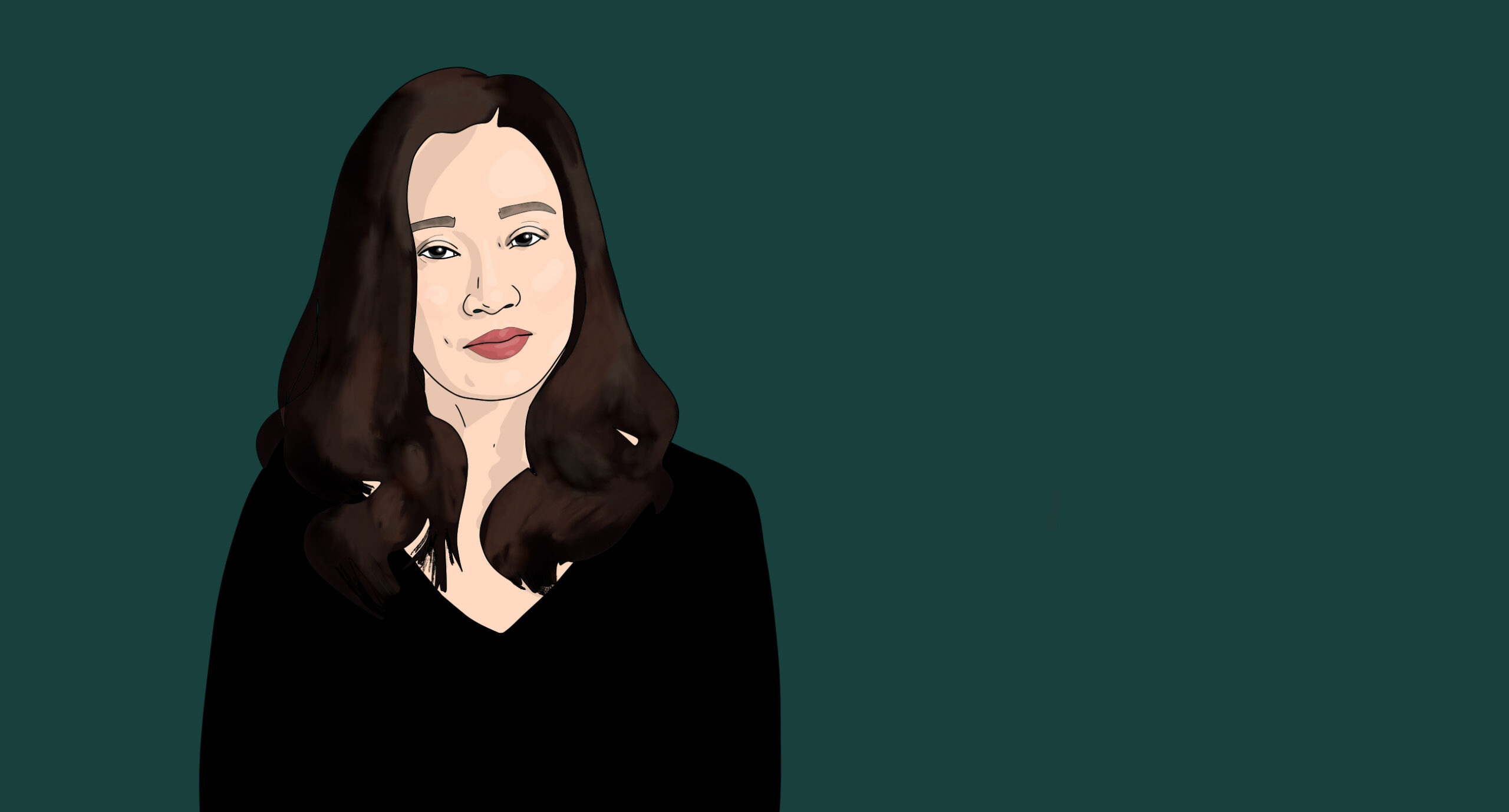

‘Everybody should be worried’ — Q&A with Lingling Wei

China is becoming a black box to investors, business people, and journalists, as the government makes it increasingly difficult to access economic and corporate information. Lingling Wei of the Wall Street Journal knows all about it.

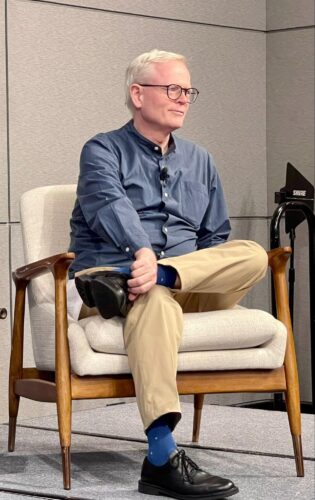

Lingling Wei (魏玲灵 Wèi Línglíng) covers China for the Wall Street Journal. She was based in Beijing from 2011 until 2020, when the government kicked her out, along with a number of other reporters at American media organizations.

She continues to write about business and politics in her native land, despite the growing difficulties of talking to sources and getting access to data.

On May 3, World Press Freedom Day, we talked about those challenges, and who else — aside from journalists — should be worried about the Chinese government’s increasing hostility to the flow of information.

—Jeremy Goldkorn

The book you wrote with Bob Davis, Superpower Showdown, was published in 2020. It shows how U.S.-China trade tensions did not start with Donald Trump, and you argue that the trade battle would not end with him.

Now in 2023, is the business relationship between the U.S. and China worse than you thought it would be, or better?

The trade relationship, actually, the overall bilateral relationship, has become dramatically worse since we published the book. I have to say I was a little surprised by how much worse it has become.

Back then, we sort of argued in the book that China and the U.S. were on the brink of a new Cold War. We used the term “new Cold War” just to make it easier for a lot of readers to understand. Obviously, there are a lot of differences between the first Cold War between the U.S. and the Soviet Union and the relationship between the U.S. and China, but it’s just the easiest way for people to understand. But now we can definitely say we are already in Cold War 2.0.

As you know, Jeremy, right now, there’s no communication between the two governments. Earlier this year, everybody was hopeful that Blinken would go visit China and that could at least stabilize the relationship. And then the balloon happened.

That just really derailed a lot of plans that were being made at the time by both governments. Communication has been frozen. They’re not talking on the military level, not about economic issues, not about anything. The relationship has gotten dramatically worse and more intense from three years ago.

Quite a lot of your recent pieces have been about the difficulties foreign companies and particularly U.S. companies are having in China. How much of this do you think is directly connected to the bad state of U.S.-China relations?

I would say definitely the worsening bilateral relationship has been driving this latest trend of the Chinese government trying to basically crack down on certain foreign firms, especially those involved in collecting information.

We have reported that authorities in China have been looking for ways to retaliate against a number of U.S. initiatives, including the chip ban that was put in place in October. So absolutely, the worsening relationship between the U.S. and China really helped explain a lot of what China is doing now.

However, I would also want to emphasize that over the past decade or so, China has been gradually building up a policy infrastructure that is aimed at safeguarding national security, which is very, very broadly defined by the leadership, through more than a dozen categories that cover data security, financial security, economic security, you name it…So there’s a growing sense of paranoia, it almost seems, in the Chinese leadership about the perceived threats from the United States and the West overall.

The suspicion over foreign forces, the suspicion over Western forces, has just been growing quite dramatically under Xí Jìnpíng’s 习近平 leadership.

Your most recent story, “China locks information on the country inside a black box,” looks at the new restrictions on access to the Wind database [of company information], and mentions the expansion of the espionage law. Firms have been targeted for investigation by the authorities, such as the U.S. consulting firm Bain, and the raid on the American due diligence firm Mintz. You also mention scrutiny on Deloitte, and I think you were the one who broke a story that Capvision, a research firm, had been visited by the police.

I am trying to understand what this means! Do these actions mean that the government defines protecting China’s reputation as part of national security, and that’s why they don’t want foreigners to access this information? Or do you think there actually is a sense that it could be dangerous for foreigners to understand China too well?

It seems to be like cutting off access to Wind is a really interesting choice for a country that is saying it’s committed to opening up to foreign business?

As the saying goes, pay attention to what China does, not what China says.

It’s saying it’s committed to opening up to foreign business, and in some ways, Xi does seem to want a functioning market. They are really emphasizing the need to keep and welcome foreign capital. However, their actions really run counter to this rhetoric. The most recent crackdown on those foreign financial services providers…

One big driver is the Chinese leadership’s need to control the narrative about China. They do not want to lose the narrative. They have learned from many events in the past, like the Arab Spring, how important it is for a one party state to maintain control of narrative.

From a Chinese government perspective, over the past few years, there have been so many reports written by Western think tanks and research firms about China’s human rights record,

China’s trade and economic practices, supply chain issues…All those topics have become increasingly sensitive to the leadership. They feel like China is losing huàyǔ quán [话语权, which means “the right to speak,” but is perhaps better understood as “narrative authority”] on the world stage. And the fact they’re losing, and the reason why they think they’re losing huayu quan is because all those foreign think tanks, foreign research firms have written too many negative reports to “smear” China.

So that really helps explain why they’re trying to crack down on some of those firms now. They want the Party to have the monopoly on how the rest of the world forms opinions about China. It’s very important, it’s not just about propaganda or PR; to the Party, it’s an issue of survival.

On the other hand, I do think some officials within China do realize actions like this could hurt the other objective, which is to keep foreign capital from leaving. But I do not think those in power these days recognize that. They still believe China is such a big market that foreign companies cannot just pick up and leave. So access to China’s markets still is the leadership’s trump card. So they do not see the contradiction here. They think one serves one purpose, the other serves the other purpose. And, in fact, they still believe they can keep foreign capital from leaving, while at the same time keeping the pressure on the foreign firms.

And do you think they’re wrong? Because you still have people like Ray Dalio, who is talking up how wonderful China is…

I like Ray Dalio’s latest piece. It’s not bad, right?

The latest one had a bit of negativity!

And even the American Chamber of Commerce in Beijing made a statement recently about the difficulties American firms were having. AmCham is usually not an organization given to saying anything controversial.

What’s your sense of how American companies are feeling? How frightened are they?

I think everybody’s spooked. Obviously it takes time to see the actual impact on money flows, investment flows. But people certainly are spooked, American and other foreign companies, and local employees on the ground in China. I was told by some of my contacts that Chinese employees are more scared than ever, because of the broadening of the anti-espionage law. You can be easily targeted just for the mere fact that you work for a foreign firm. So it will take time to see the actual impact on investment flows, but I can tell you for sure that this topic is pretty much high on the agenda.

Risks certainly are rising for Western firms operating in China. So the question is, “Can we afford to cut our exposure or leave altogether?” My colleague did a story just today about how existing investments in existing companies are not leaving yet. But what’s at risk is new investments. Can China keep attracting new investments from the rest of the world? That’s the question.

How is all of this affecting your ability to do your work?

Journalists…we are the group that suffered early on, right? By kicking journalists out, American and Australian journalists, China already demonstrated that they were willing to eliminate a very important channel of information to serve their political goals. So we have been trying to cover China from afar for the past three years, and I think we have done a pretty bang-up job here, and doing all that we can to understand not only what’s going on in terms of relationship between China and the rest of the world, but also trying to understand what is going on within China, how China is changing, but also how that is affecting its relations with the rest of the world.

So you didn’t really answer my question! It’s getting tougher right?

Yes, it’s definitely getting tougher. Obviously, we have very limited access to all those databases that we listed in our coverage. At a time when there’s so much uncertainty, we need more windows into China, not fewer. But obviously, it’s getting worse and worse, the challenges are mounting. So a lot of uncertainty, you know, we take it just one step at a time, one story at a time, we keep plugging away.

I suppose personal connections in China are still maybe the most valuable thing you have in the toolbox, because at least the phone still works, if people are willing to talk.

Yes, absolutely. But access to decision makers is becoming quite limited.

How about American executives? Are they more or less willing to talk than they used to be, do you think?

Obviously the stakes are very high.There’s no upside for people to be quoted in the Wall Street Journal saying unflattering things about China. That would really affect their operations in China. But we try our best to get people to talk.

What kind of companies do you think might be next after the ones you’ve reported on recently, Capvision, Bain, and Mintz…information companies, but Deloitte is an auditor…Who else should be worried?

Everyone should be, everyone and anyone, everybody should be worried.

Ha ha ha.

As I said earlier, you know, this anti-espionage law has been significantly broadened. And I know for a fact how worried a lot of those Chinese employees who work for foreign firms are. They’re very vulnerable. They do not have foreign passports. They can’t just leave. They have families, they have connections, their lives are in China. So the stakes are so much higher for them.

For foreign companies, how do you protect your local employees, and at the same time maintain the integrity of your business. It is becoming such a challenging task.

Some commentators have said, “Oh, the actions are really targeted, just a few due diligence firms, a few auditors, few lawyers,” but those are all interconnected. The net effect is chilling for everyone because it’s very arbitrarily done. The authorities never give you any reasons why they’re going after X, Y, and Z. What exactly have they done? It’s all so opaque. So that makes people worry that this can happen to anyone.

That’s why I’m saying everyone and anyone should be worried, and should be really having very serious conversations about their operations in China.

It reminds me of the censorship system, in the sense that the censors never tell you exactly what the rules are. Certainly when I worked in China in the internet and in media, people generally were more conservative than they even needed to be because of the uncertainty.

The new espionage rules seem like censorship rules. It’s like if the government decides this is espionage then it’s espionage. It doesn’t really matter what you’re doing.

Yeah, China has talked for many years, right, the need to wánshàn 完善, to improve their legal system. They have passed many laws, but a lot of those laws and legislation are so vague and so broadly defined, and there are no specific guidelines in terms of how you should implement those laws. So still, the upshot is growing uncertainty over exactly how those laws get implemented…the arbitrary implementation by authorities, it’s just such a big risk. There’s no playbook to refer to.

It’s World Press Freedom Day today, and your colleague Evan Gershkovich is rotting in a Russian jail. What do you think is the best thing people can do to try to support global press freedom and press freedom in China?

Obviously, freedom of the press is under attack. Our colleague, Evan, has been in a Russian jail for five weeks now for some very false accusations.

So, if you can, Jeremy, promote the need to free Evan. We need to do it from very individual cases: free Evan, free other journalists that have been wrongfully jailed. Keeping the pressure on governments, especially authoritarian governments. I think that’s really needed to support quality journalism. People like us, I think, still serve a very important role to shed light on things that are so important like China. And we are keeping at this China story.

China just cannot go dark, right? It’s just so important. It’s not just important for the regime. It’s important for everyone who lives in China, for the rest of the world that interacts with China. So we hope that through our coverage, I don’t know if authorities in China will ever read it…

I’m sure they’re reading it, very closely… yǒuguān bùmén 有关部门 [the relevant departments]. They’re reading it…

I hope the message comes across. You can’t have it both ways. You can’t cut off access to information about China while keeping people interested in going to China, traveling to China, interacting with China, investing in China.