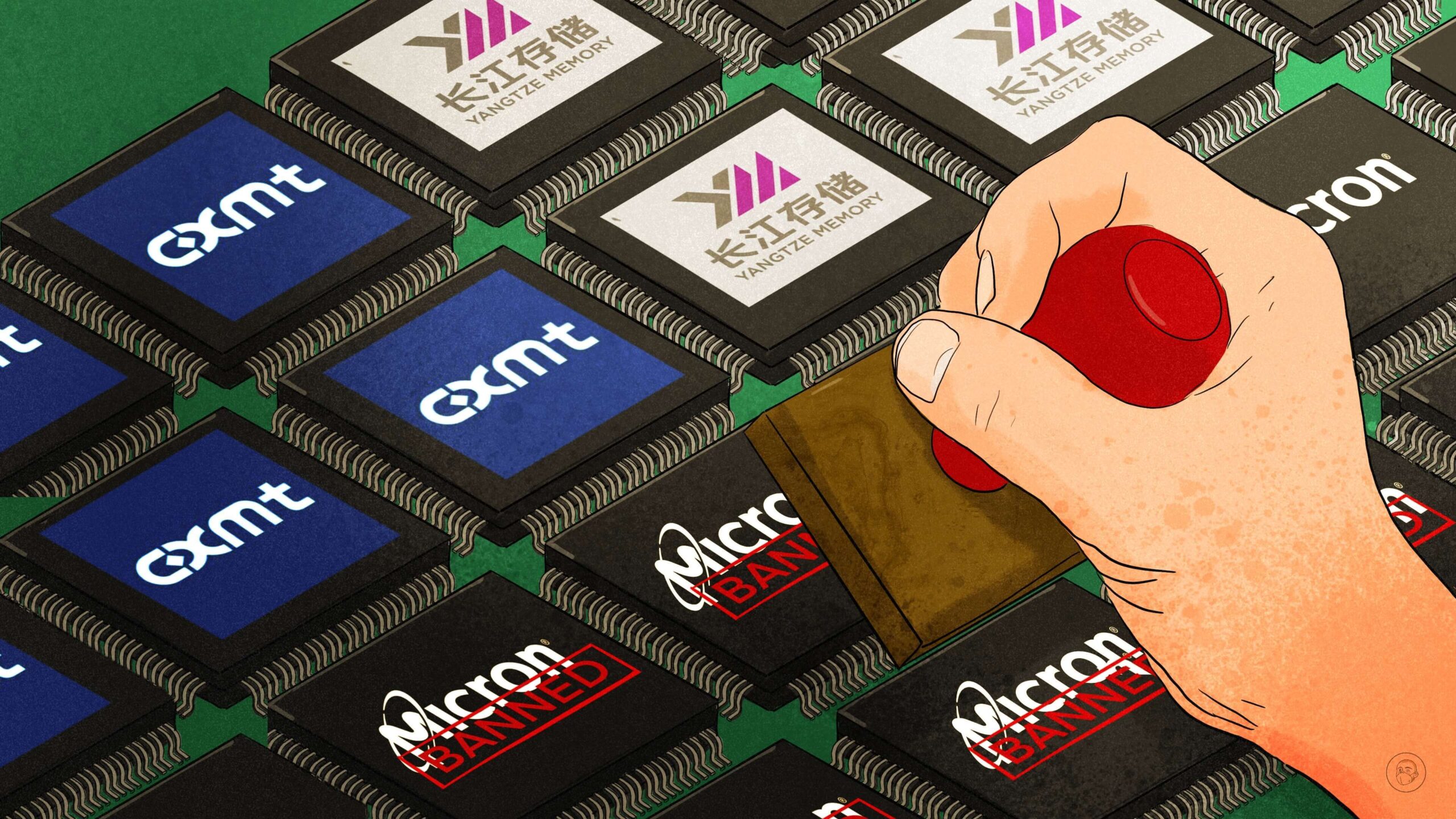

China bans Micron — which Chinese companies stand to benefit?

As China bans the products of a major U.S. memory chipmaker, Chinese competitors are slowly stepping forward.

On the evening of May 21, the Cybersecurity Review Office at the Cyberspace Administration of China (CAC) announced that, after conducting a review of U.S. memory chip company Micron Technology (美光 Měiguāng in Chinese), the company’s products were found to “have serious network security problems and potential risks to China’s critical information infrastructure.” Henceforth, Micron’s products would be banned in China.

Micron is the largest U.S. memory chipmaker (i.e. chips for storing information) and the first U.S. chipmaker to be targeted by authorities in China after the U.S. imposed a series of export controls on Chinese chip companies. Micron manufactures memory and storage products for the healthcare and automotive industries, and for personal computers, data centers, and networks; and the company’s manufacturing facilities are located in the U.S., Singapore, Taiwan, and Japan. In 2022, Micron generated $5 billion of revenue in China, accounting for about 16% of total revenue.

The global memory chip industry is dominated by companies from Korea, the U.S., and Japan. According to Trendfore data, in 2022, Micron held 23% of the global dynamic Random access memory (DRAM) market and 10.7% of the NAND flash memory (a type of non-volatile storage technology) market. DRAM and NAND are the core types of memory chips: in 2021, these two types accounted for 97% of all memory chips in China.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

Chinese competitors

The CAC review is likely a serious blow to Micron’s business prospects in China, and the company is now caught up in the geopolitical struggle for chips. But this is good news for the emerging memory chip companies in China.

China’s most well known DRAM manufacturer is ChangXin Memory Technologies (CXMT) 长鑫存储. In 2018, CXMT developed China’s first 8Gb DDR4 memory chip. In 2021, the company adopted 19nm memory chip technology, and completed trial production of 17 nanometer (nm) DDR5 memory chips in 2022. CXMT’s global market share for DRAM chips is currently about 1%, and it is planning to launch an IPO this year on Shanghai’s Nasdaq-style STAR Market that could value the company at $14.5 billion.

In terms of NAND chips, China’s leading player is Yangtze Memory Technologies Corp (YMTC). In 2017, YMTC released its first 32-layer NAND flash memory chip in 2017. With its innovative Xtacking technology, the company has fabricated denser NAND flash memory chips than any other company in the world. As of 2021, it held a global market share of 4.5%. In 2022, Apple announced that it was planning to use YMTC chips, but this was canceled following the imposition of U.S. export controls.

Links and sources:

- 美光公司在华销售的产品未通过网络安全审查 / CAC

- China’s Micron ban revives US trade tensions, fuels Asian chip rally / Reuters

- China’s top 10 semiconductor firms / The China Project

- 美光OUT,国产存储芯片崛起进行时 / 36Kr

- Micron Stock: How Does Micron Technology Make Money In 2022? / Forbes

- China’s Changxin Memory mulls local IPO at $14.5 bln valuation-Bloomberg News / Reuters