China-owned companies reckon with U.S. state, national land purchase bans

Arkansas recently ordered ChemChina-owned Syngenta to sell its land in the state. Other states are also putting up walls for Chinese buyers.

Smithfield Foods, maker of Nathan’s hot dogs and Farmer John bacon, is among the Chinese-owned agricultural companies whose American operations may be affected by newly passed or proposed state and national laws in the U.S.

On October 17, Arkansas Attorney General Tim Griffin ordered Chinese state-owned seed and pesticide giant Syngenta, to sell its land holdings in the state in compliance with recently passed state legislation.

Chinese ownership of American farmland came under increased scrutiny at both the national and local level after the Fufeng Group, producer of the flavor enhancer MSG, announced in November 2021 its intentions to invest near Grand Forks, North Dakota. Despite promises to improve the local economy, opposition emerged over the company’s Chinese origin, and its plans to build a facility near a U.S. Air Force base. The flight of a Chinese spy balloon over the U.S. in February 2023 added fuel to fears that Chinese businesses could spy on nearby U.S. military installations.

Arkansas, Florida, Louisiana, Montana, North Dakota, Ohio and three more states have since passed legislation that restricts some land ownership for Chinese citizens or companies. The laws vary in their application, and only the Arkansas law has forced Syngenta (owned by China National Chemical Corporation (ChemChina)), which in 2022 generated almost a quarter of its annual revenue in North America, to sell off its holdings.

The Florida law, for example, bans Chinese owners from buying land “within 10 miles of any military installation or critical infrastructure facility” such as seaports, airports and wastewater treatment plants. The law doesn’t apply to purchases made before July of 2023, but current owners must register their property with the state by January 2024 or face fines and the risk of state authorities seizing their land.

Montana’s governor in May signed legislation that prohibits Chinese individuals and companies from buying farmland, critical infrastructure, and homes near military facilities. Other states have passed laws that put a cap on the number of acres Chinese buyers may own.

The state provisions are likely to come under legal objection from affected companies, said Ronald Cheng, a lawyer who focuses on complex litigation involving China at the law firm Pillsbury.

“It’s going to be sorted out in the courts,” he said. “There will be equal protection arguments made, there will be arguments made about preemption, that these are decisions that should not be made by state or local governments, that they should be made at the national level, and it’s going to take some time to sort these things out.”

A federal provision to restrict Chinese land ownership throughout the U.S. is now being proposed as an amendment to the National Defense Authorization Act (NDAA), the annual must-pass Pentagon budget, the final version of which currently is being hashed out in Congress.

The amendment was added to the Senate version of the NDAA in July when it passed overwhelmingly by a vote of 91-7, demonstrating its bipartisan appeal. Specifically, the bill would empower the Treasury Department’s Committee on Foreign Investment in the U.S. (CFIUS) to review land purchases from “countries of concern,” including China, and direct the President to waive or halt the investment.

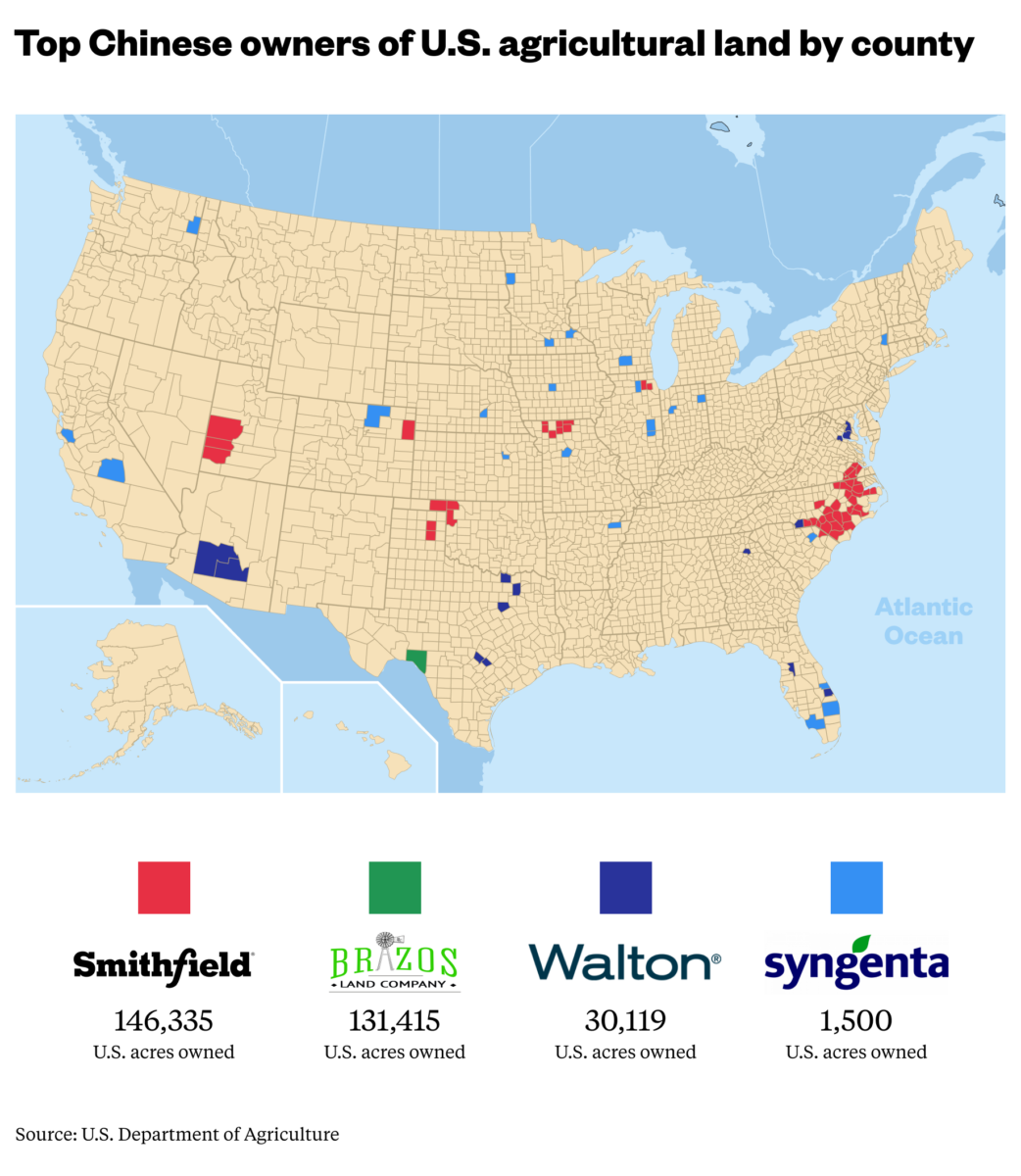

According to USDA data, as of December 2021, Chinese owners held 384,000 acres of American farmland, which was slightly less than 1% of all foreign holdings, which, in turn, accounted for around 3% of all U.S. agricultural land. Syngenta’s holdings were around 1,500 acres. Smithfield Foods and China-owned Brazos Highland Properties were major owners, with more than 100,000 acres each

The USDA data, however, is not completely up-to-date and accurate, highlighting concerns that some have raised over the extent to which the U.S. government even understands the full picture of Chinese land ownership in the U.S. For example, much of the Syngenta-owned land, including the Arkansas land it was recently ordered to sell, is still listed as Swiss-owned in the USDA data.

The largest foreign owners of U.S. agricultural land hail from historical allies, including Canada with over 12 million acres, and the Netherlands, with almost 5 million acres.

National security threat?

After Arkansas Attorney General Griffin ordered Syngenta to sell its American farmland, Governor Sarah Huckabee Sanders turned the anti-China rhetoric up a notch.

“That is a clear threat to our national security, and to our great farmers, especially since the Chinese government enacted a law in 2017 requiring Chinese citizens abroad to collaborate with their country’s security officials on intelligence work, with no questions asked,” Gov. Sanders, a Republican, said at a press conference on October 17.

Some observers remain skeptical of the potential for Chinese agricultural investment as a conduit of malign influence.

“In the case of China, I think the restrictions are a bit absurd because Chinese investment in U.S. agricultural land is so low,” Kristen Looney, Georgetown University associate professor of Asian Studies and Government, told The China Project. “There’s just not that many deals at all.”

By pushing out Chinese companies or restricting future investments by Chinese firms in U.S. agriculture, the U.S. runs the risk of losing out on economic opportunities and the reciprocal access for U.S. agricultural products to China’s enormous market often brought into play by such investments, Looney, who published a recent paper on China’s agribusiness expansion abroad, said.

Syngenta spokesperson Saswato Das defended the company’s work and its contribution to the U.S. economy in a statement emailed to The China Project.

“Syngenta seeds and industry-leading crop protection technology are crucial to the future success of American agriculture and American farmers,” Das wrote. “Syngenta’s work in the United States continues to benefit American farmers and makes this country a more innovative and competitive participant in the global agricultural marketplace. Anything that impacts our ability to continue this work is concerning.”

Jim Monroe, vice president of corporate affairs at Smithfield Foods, which is owned by the Chinese company WH Group, also highlighted his company’s contributions to the U.S. economy in an emailed statement.

“We are concerned about any policy that restricts our ability to execute on our mission to produce good food the right way while making enormous contributions to the U.S. economy and the communities where we operate,” he said.

Brazos Highland Properties, whose CEO tried to build a wind farm near a USAF base on the Texas-Mexico border, couldn’t be reached for comment.

China’s food security

Some researchers have pointed out that China’s investment in U.S agriculture has a long-term strategic dimension, complicating claims by Syngenta and Smithfield Foods that their U.S. operations are for the sake of the health of the American economy.

China, with a population of more than 1.4 billion but disproportionately small and shrinking quantities of arable land, has moved in recent years to strengthen its food security. China is now the world’s largest consumer and importer of agricultural products. As industrialization has contributed to soil pollution, and a growing middle class has raised demands on the country’s farms, the issue has only become more pressing.

China has been seeking public comment on a new food security protection law, and recently fast-tracked the process for moving the legislation forward.

American seed technology has been a target of Chinese espionage for years. In 2013, the U.S. charged six Chinese nationals of digging up genetically modified seeds in Iowa, and planning to send them back to China.

When ChemChina bought Swiss agritech behemoth Syngenta in 2017 for $43 billion in what was then the biggest takeover of a non-Chinese business by a Chinese company, the Chinese state-owned enterprise established a legitimate channel through which to explore genetically modified foods.

During the COVID-19 pandemic, China-owned Smithfield increased exports of pork to China, even as demand for meat in the U.S. increased, raising concerns over China’s control of parts of the U.S. food industry. The pandemic highlighted risks of supply chain shocks to Chinese policymakers, Looney said.

“I don’t think China [investing in agribusiness abroad] should be interpreted as, ‘it’s about to run out of food,’ but I do think certain international crises, such as the COVID-19 pandemic, such as the war in Ukraine…that has a huge effect on international markets,” Looney said. “Chinese Communist Party officials are worried about really sudden hikes in food prices.”

The U.S. government in recent years has flagged concerns over Chinese investment in U.S. agriculture. A May 2022 report from the U.S. China Security and Economic Review Commission noted that the USDA lacks rules for reporting foreign land ownership, and is limited in how it can enforce accurate reporting. The report also highlighted the possibility that Chinese might steal American intellectual property, thus harming innovation in crop development, and touched upon fears over Chinese leverage on U.S. supply chains, and even a potential Chinese use of genetically modified seeds to create a bioweapon.

New American fears of Chinese influence through agricultural investment mark a departure from a time when agricultural trade and cooperation thrived between the two countries.

“U.S.-China agricultural relations used to be a really bright spot in the U.S.-China trade relationship,” Looney said. “And yet, even agriculture has been kind of securitized or weaponized given this downturn in agricultural relations, and I think the bans are a further reflection of that.”