Beijing makes third threat to cut off rare earth elements to U.S.

In the center of page 3 of today’s People’s Daily, the official newspaper of the Chinese Communist Party, a commentary titled “The U.S. must not underestimate the ability of the Chinese side to hit back” made a very explicit and specific threat in its second-to-last paragraph (in Chinese, our translation):

Without a doubt, the U.S. wants to use the rare earths exported by China to beat down China’s development, and the Chinese people simply cannot accept this. Today’s America totally overestimates its own capability to control global supply chains, and is due to slap itself in the face when it sobers up from its happy, ignorant self-indulgence. The relevant Chinese government departments have said in many solemn statements that the U.S. and Chinese supply chains are highly integrated and complementary, and that with cooperation both benefit but with fighting all is hurt, so a trade war has no winner. May we offer a bit of advice that the U.S. not underestimate China’s capability to safeguard its own development rights and interests; don’t say we didn’t warn you!

- The last phrase, “don’t say we didn’t warn you,” is 勿谓言之不预 wù wèi yán zhī bù yù in Chinese.

- It is “generally only used by official Chinese media to warn rivals over major areas of disagreement, for example during a border dispute with India in 2017 and in 1978 before China invaded Vietnam,” according to Reuters.

- But more recently, it has been used several times without severe action following, notes New America cybersecurity fellow Samm Sacks.

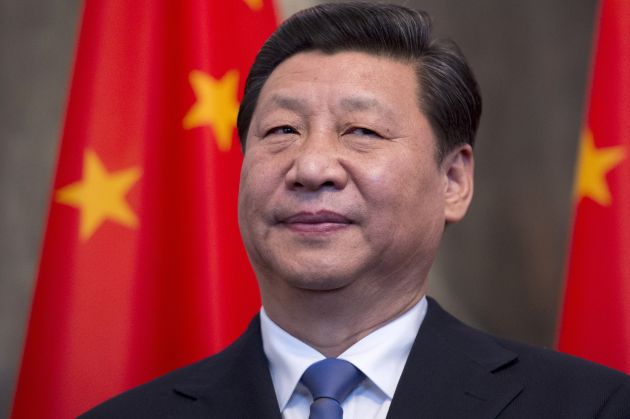

- In this case, the phrase can be taken literally: The visit of President Xí Jìnpíng 习近平 to a rare earths processing facility in Jiangxi Province early last week was the first implicit warning. Then, a Q&A posted by the National Development and Reform Commission on May 28 used very similar language (in Chinese) to the People’s Daily commentary today. On the same day as the People’s Daily commentary, Xinhua wrote, “U.S. risks losing rare earth supply in trade war.”

- What are rare earths? Reuters has a helpful explainer on what they are, and why they are so important to global technology supply chains.

- How big a deal would China cutting off access be? There are different answers depending on where you look:

- The impact might not be huge in the end because rare earth elements aren’t actually that rare, according to this article in The Verge.

- But at least in the short term, the impact could be “devastating,” given the U.S.’s reliance on China for “about 80% of its supply,” Bloomberg says (porous paywall).

- “Most of the rare earths mined outside China still end up there for processing — even the sole U.S. mine at Mountain Pass in California sends its material to the nation — as Beijing seeks to dominate manufacturing of higher-value products,” Bloomberg notes.

- And finding new sources for rare earths can be a major environmental challenge: The SCMP reports on “not in my backyard” protests in Malaysia against rare earth refining by the Australian company Lynas Corporation.

China’s threat of supply chain attack should be seen as a direct response not so much to Trump’s tariffs, but more so to the U.S. Commerce Department’s announcement that it would ban exports of American technology components to Huawei. As we have written in this newsletter, and as Paul Triolo and Douglas Fuller wrote in a column for The China Project, this has massive implications that could overshadow any effects of tariffs. Here is the latest on the battle over Huawei, in brief:

- Huawei “filed a motion…to accelerate its lawsuit against the White House, which it filed in March in a federal court in Texas. The request for summary judgment could expedite an outcome without the costs and time of a full trial, including avoiding handing over sensitive corporate information during the discovery process,” the New York Times reports (porous paywall).

- As many as 1,200 U.S. suppliers will be affected by the Commerce Department blacklist if and when it goes into effect, Huawei executives told the Financial Times (paywall).

- South Korea is stuck in the middle between the U.S. and China, as a government source there told Reuters: “Sorry, we are not the United States, and can’t just do the same as what the U.S. is doing to China.” Huawei by itself “bought $10.7 billion worth of South Korean products last year, accounting for about 17% of the country’s electronics parts exports to China,” Reuters says.

- “American intelligence officials and telecommunications executives and experts have begun to concede that the United States will be operating in a world where Huawei and other Chinese telecom companies most likely control 40 to 60 percent of the networks over which businesses, diplomats, spies and citizens do business,” according to the New York Times (porous paywall).

- “Huawei’s yearslong rise is littered with accusations of theft and dubious ethics,” the Wall Street Journal reported in an extensive piece (paywall).

More to read and take note of related to the U.S.-China trade war and technology tensions:

- “Today marks the 16th straight day of People’s Daily 钟声 (loosely, “Voice of China”) commentaries on the trade war. We’re into the US-failure-is-inevitable phase, on the heels of the your-China-theory-is-wrong phase,” The Economist correspondent Simon Rabinovitch posted on Twitter, with an accompanying graphic. He also shared this link (in Chinese) to a collection of those state media commentaries.

- If you need a recap on state media propaganda on the trade war and Beijing’s recent allowance of more anti-American rhetoric, see this piece by Shen Lu in the Columbia Journalism Review.

- Trump’s “tough rhetoric plays into Chinese economic nationalism,” former Australian PM Kevin Rudd writes in the New York Times today.

- “Vietnam looks to be winning Trump’s trade war,” Brad Setser writes at the Council on Foreign Relations. The Financial Times also highlights Mexico as a winner, and the SCMP says that the trade war is driving Chinese students to the U.K., Canada, and Australia.

Finally, on China’s economy amid the trade war, a few points:

- Industrial profits in China are falling, with April’s official numbers showing a 3.7 percent drop from a year ago, Bloomberg reports (porous paywall). “State-owned enterprises’ profits fell 9.7% in the first four months of 2019, while private businesses’ profits increased 4.1% during the same period,” Bloomberg added.

- “The economy is still decelerating. We are not likely to hit bottom until Q3,” economic consultancy Trivium wrote yesterday.

- Factory activity in May is expected to shrink slightly, after expanding for two months, according to a Reuters poll.