China’s loss-making cloud companies search for a silver lining

With a saturated market in a challenging macroeconomic environment, Alibaba Cloud and its competitors are desperately seeking new ways to grow.

Kingsoft Cloud 北京金山云 is a cloud services provider spun off in 2012 from Kingsoft, one of China’s oldest software companies, which was founded in Beijing in 1988. On November 17, the company announced its financial results for the third quarter of 2022, and as expected, there was no profit in sight. Kingsoft reported revenue of 1.96 billion yuan ($276.81 million), a year-on-year decrease of 18.4%, and a net loss of 801 million yuan ($112.61 million), compared with a net loss of 507 million yuan ($71.27 million) one year ago.

It’s not an easy business. Even Alibaba Cloud 阿里云 — which was established in 2009 and has long been China’s leading cloud services provider with an early mover advantage — is the only Chinese company in the industry that is not bleeding money, and it only made a profit for the first time in 2021.

But there should be money to be made: According to an October report by the International Data Corporation (IDC), in the first half of 2022, China’s public cloud services market was worth $16.58 billion, which represents year-on-year growth of 45.4%. However, none of the companies in the industry are finding it easy.

Alibaba Cloud currently has the largest market share in China of 34.5% (followed by Huawei Cloud 华为云 with 11.6%). For the fiscal year ending March 31, Alibaba Cloud reported its first ever annual profit of 1.14 billion yuan ($161.11 million), after a net loss of 2.25 billion yuan ($316.46 million) the previous year. Yet what is unmistakable is that Alibaba Cloud’s revenue growth has stalled: from 62% year-on-year growth in the third quarter of 2020 to 33% in the third quarter of 2021, and finally to only 4% in the third quarter of 2022, when total revenue amounted to 20.75 billion yuan ($2.91 billion).

Why isn’t the cloud raining money?

Cloud services use an asset-heavy business model with high fixed costs that depends on achieving scale by attracting large numbers of customers. Alibaba Cloud itself has ascribed its decline in revenue to the overall decline in the macroeconomic environment this year, especially for small and medium-sized enterprises (SMEs), which as a result are spending less on IT.

Yet Alibaba Cloud is also facing other challenges to growing its business, which are more specifically related to the cloud services industry in China:

Difficulty of gaining customers from competitors: Companies are accustomed to using the software and tools of a specific cloud service provider, and if they do want to choose another service provider, migrating data is a difficult and even risky procedure.

Little differentiation: The underlying Infrastructure as a Service (IaaS) technology, including computing, storage, and networking resources on demand, of all the major competitors are actually quite homogeneous. To win new customers, Alibaba Cloud would have to compromise on price.

The collapse of the bundled services model: Cloud service providers used to bundle IaaS with other services, notably Platform as a Service (PaaS), a complete cloud platform, including hardware, software, and infrastructure; and Software as a Service (SaaS), including cloud-based apps. But IaaS can now be separated from PaaS and Saas, and this has cut a hole in the revenue of cloud service providers.

Exclusion from government contracts: According to a report by the IDC published in August, China’s government cloud market size in 2021 was 42.71 billion yuan, a year-on-year increase of 21.47%. Yet just one company, Inspur Cloud 浪潮云, is already running most of the government’s cloud services, serving 245 provincial and municipal governments and 20,000 government departments.

Inspur Cloud is state-controlled, as are China Telecom 中国电信 and China Mobile 中国移动, which respectively won 104 and 68 government contracts from August 2021 to August 2022. During the same period, Alibaba Cloud won only nine government contracts.

With non-state companies apparently excluded from most government contracts and the private sector cloud market almost saturated, the only way to win new customers would be a damaging price war.

Searching for a silver lining

A price war would be a disaster for the bottom lines of the cloud companies, so they are currently exerting themselves to find new clientele. Tencent Cloud 腾讯云, for example, is expanding cloud services for the retail and ecommerce industries, as well as the game, audio, and video markets, hoping to leverage its parent Tencent‘s 腾讯 dominant position in the social and entertainment landscape. In November, Tencent Cloud also launched cloud services aimed at the energy industry and the financial industry.

Huawei 华为, on the other hand, has long experience in working with government clients, and Huawei Cloud 华为云 has (according to an IDC report) built up a market share of 25.8% in China’s government cloud market. At a Huawei conference on November 7, Huawei Cloud launched 15 new cloud services, including a global storage and computing network called KooVerse.

Huawei Cloud has also been prominent in the emerging “automotive cloud,” which has emerged as a new cloud market segment in 2022. Alibaba Cloud, Tencent Cloud, and Baidu Wangpan 百度网盘 have also all launched cloud services for the automotive industry, which incorporates IaaS, PaaS, and SaaS services to manage production, research and development, supply chains, sales, autonomous driving, and services. According to an industry report released in May 2022, the automotive cloud market in China amounted to 33.52 billion yuan ($4.71 billion) in 2021, and is expected to grow rapidly to more than 80 billion yuan ($11.24 billion) by 2026 as “smart” cars generate more and more data, and the processes to manufacture them become more data intensive. According to the report, Huawei Cloud is the leading player in the automotive cloud market with a market share of 22.8%.

Another emerging market is the “real estate cloud,” including cloud contract signing that allows buyers and sellers of commercial housing to complete the transaction process without meeting each other. In September, Beijing implemented new regulations stipulating that renting a house also requires online contract signing and registration.

China news, weekly.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.

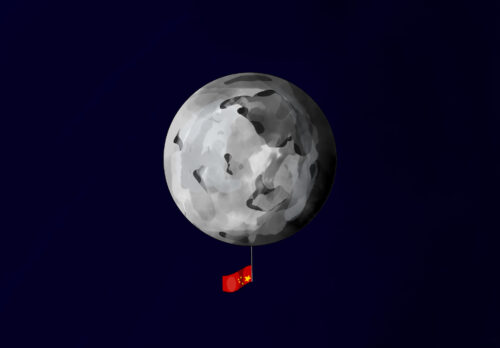

Chasing foreign clouds

With profits scarce in China, the country’s cloud service providers are inevitably turning their focus toward foreign markets. In February, for example, Tencent Cloud launched a cloud service for cross-border ecommerce. In March, Huawei Cloud released a global cloud services product, and in September, Alibaba Cloud announced an investment of 7 billion yuan ($984.12 million) to support its global cloud services ecosystem. Most of these efforts, however, are focused on the Asia-Pacific region and Southeast Asia, where Chinese companies may have a geographical and cultural advantage over foreign competitors such as Amazon, Microsoft, and Google.

Entering foreign markets is a challenging business, however. Offering cloud services abroad requires the setting up of data centers, and these require the use of a large amount of electricity. Yet in recent years, the price of electricity has fluctuated greatly in many countries: According to a recent report, the average spot price of electricity in five European countries increased by 250% from July 2021 to July 2022.

The biggest challenge is stiff competition: According to a report by Synergy Research, Amazon Web Services and Microsoft Cloud in 2022 hold global cloud services market shares of between 22% and 35% each, while Alibaba Cloud holds only about 5%. And what European or American company is going to take the risk of hosting data with a Chinese-owned company?