Record high foreign investment in Chinese stocks, Chinese tech IPO boom, Genki Forest drops Japanese character

Business briefs from the Chinese media — Thursday February 16

Foreign investment in Chinese stocks at a record high: The State Administration of Foreign Exchange (SAFE) yesterday reported a record monthly high of $27.7 billion in January. Foreign investors have been able to buy Chinese A-share stocks since 2003 via the Qualified Foreign Institutional Investor (QFII) system. Foreign investment is still flowing into China: According to the Ministry of Commerce, Foreign Direct Investment (FDI) into China increased by 8% year-on-year in 2022 to $189.13 billion.

A boom for Chinese tech IPOs in 2022 that looks set to continue: According to a new report by PricewaterhouseCoopers, there were 124 technology, media, and telecommunications (TMT) IPOs in China in the second half of last year, compared to 68 in the first half of 2022. The 124 IPOs, which raised a total of about 133.5 billion yuan ($19.49 billion), included 77 IPOs in the technology, hardware, and equipment industry, accounting for 62% of the total. The number of IPOs this year will likely increase further: In early February, the China Securities Regulatory Commission unveiled draft regulations to simplify IPO procedures that would permit Chinese stock exchanges themselves to approve listings, thus speeding up the process.

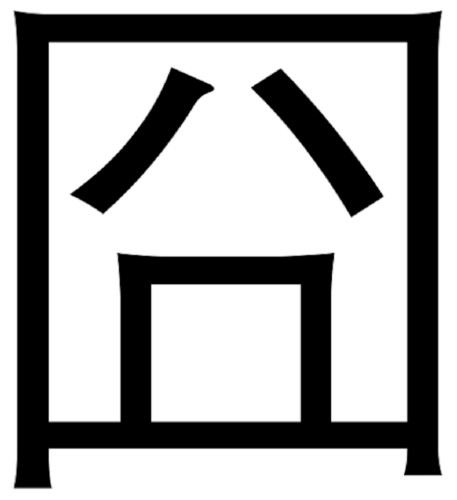

Genki Forest quietly drops label with Japanese character: A new sparkling water product launched at an event earlier today by beverage company Genki Forest featured an altered label: the Japanese version of the character for gas (気) was replaced with the Chinese version (气). The company removed the Japanese character from its logo in 2020, but it remained on its sparkling water bottles — until today. Genki Forest is one of several Chinese brands that used Japanese imagery and characters in their branding, only to change it later with the advent of the patriotic “national fashion” (国潮 guócháo) trend in recent years.

Sign up for The China Project’s weekly newsletter, our free roundup of the most important China stories.China news, weekly.