Of course Netanyahu must go to China

Later this year, Israeli Prime Minister Benjamin Netanyahu is set to meet Xi Jinping in Beijing for the first time since 2017. The past decade has seen China emerge as the largest trade partner for most countries in the Middle East and North Africa. There is no reason for Jerusalem not to expand cooperation with China in multiple realms.

News of Benjamin Netanyahu’s upcoming trip to China triggered a chorus of objections and reproach within the Israeli establishment and beyond. Nevertheless, the Israeli prime minister will travel to China. After all, geopolitical and geo-economic forces compel him to go.

Granted, the timing of the announcement (or, rather, leak) could most certainly have been better: The revelation came on the heels of elevated tensions with the U.S. and appeared as if Netanyahu was using the China card to manipulate Washington. This assessment was reinforced when a “diplomatic source” told the media that “Netanyahu is not going to stand and wait for an invitation that is not forthcoming to visit the White House” and that “he is also working in parallel channels.”

Perhaps ironically, that very same diplomatic source also offered a cogent justification for why Netanyahu must travel to Beijing: “China has stepped up its involvement in the Middle East of late, and the prime minister needs to be there in order to represent Israel’s interests.”

The past decade has indeed seen China emerge as the largest trade partner and a significant source of investment for most countries in the Middle East and North Africa (MENA). Amid rising tensions with Washington, Beijing has doubled down on its cooperation with the Global South as a counter to U.S. containment efforts — the MENA region appears at the fulcrum of this strategy.

In 2018, the same year Donald Trump began firing shots at China from America’s economic cannon, China’s global infrastructure and investment projects declined in every region except for MENA. In 2021, Arab and Middle Eastern countries saw Chinese Belt and Road Initiative (BRI) investments increase by around 360% and construction engagement increase by roughly 116% compared with the previous year. A year later, Middle Eastern countries received about 23% of Chinese BRI engagement (up from 16.5%) and about 21% of Chinese investment volume — twice the share of 2021.

At a major business conference held in Saudi Arabia just last month, Chinese firms and Middle East investors inked some 30 new deals worth over $10 billion — the largest, a staggering $5.6 billion investment from the Saudi government to form a joint venture with Shanghai-based electric vehicle startup Human Horizons.

A marked uptick in diplomatic engagement has accompanied this growing economic cooperation.

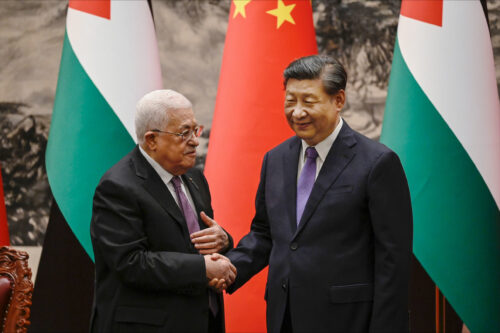

In December 2022 alone, Xí Jìnpíng 习近平 mingled with some 14 MENA leaders at the China-Arab States Cooperation Forum and China-Gulf Cooperation Forum held in Saudi Arabia. At the same time, Beijing enjoys a 25-year strategic partnership with Iran, and remains an important player in the ongoing nuclear negotiations. In June 2023, the chairman of the Palestine Liberation Organization, Mahmoud Abbas, arrived in Beijing for a three-day visit, where he met with Xi Jinping and signed a strategic partnership agreement. Meanwhile, MENA countries have been lining up to join Chinese-led multilateral institutions like the SCO and BRICS.

Beijing has eagerly transformed this economic and diplomatic capital into political clout. China’s recently brokered rapprochement between Saudi Arabia and Iran serves as one compelling example. China leveraged this achievement, framing it as an accomplishment for its Global Security Initiative in a clear attempt to add legitimacy to the newly proposed security framework.

China’s leadership has since become increasingly vocal about its desire to play peacemaker between Israel and the Palestinians. While some, like Singaporean Ambassador Bilahari Kausikan, have called this “a thankless task that is almost certainly bound to fail,” involving China as a mediator in this long-standing conflict could still generate myriad challenges for Israel regardless of the outcome.

In stark contrast with the rest of the region, an Israeli leader has not met face to face with Xi since Netanyahu’s last visit to Beijing in 2017. The global geopolitical landscape has changed dramatically in the six years since that last encounter, and the potential impact of Chinese diplomatic and economic initiatives in the Middle East alone is reason enough to mobilize a high-level delegation.

What some pundits fail to appreciate is that Washington’s sentiments regarding any such visit will be influenced more by the purpose of the trip and content of the prospective discussions than by the mere act of Netanyahu arriving in Beijing: Addressing Iran’s nuclear program sits on the one end of the spectrum; advancing cooperation on potentially dual-use technologies rests firmly opposite.

Make no mistake, neither economics nor technology cooperation will be absent from the agenda. The two sides are likely to convene the 6th China-Israel Joint Committee on Innovation Cooperation (JCIC), established in 2014 to promote connections and dialogue between approximately 15 government ministries and agencies from both countries.

It will be the first time since 2018 that the meeting will be held in person. The optics of hosting a forum focused squarely on innovation at a time when Israel’s closest ally is fiercely competing with China in the realm of advanced technology may seem off. But relationships are built on substance, not optics, and there is no shortage of that in the Israel-U.S. relationship. Meanwhile, the same cannot be said for the Sino-Israeli relationship.

Relative to the rest of the region, Israel’s trade and investment relations with China seem to have taken a different turn. Recent years have seen Israeli imports of Chinese goods steadily increase — from $6.75 billion in 2020 to $13.12 billion at the close of 2022. Meanwhile, Israeli exports to China hit an all-time high in 2018, $4.77 billion, and in 2022 stood at $4.5 billion. Chinese investment in Israel also seems to have peaked in 2018. The slowdown is partly a result of Israel’s accommodation of U.S. concerns and its own national security considerations, especially regarding critical infrastructure.

While Israel should stick to its commitment to withhold dual-use and military technology from China, there is no reason for Jerusalem not to expand cooperation in the realms of health-tech, agri-tech, food-tech, water-tech, and other civilian technologies. On the contrary, such collaboration harbors potential to yield favorable outcomes for Jerusalem by opening avenues to channel the soft power of Israel’s technology sector in ways that might influence China’s perception of and behavior toward Israel and the region at large.

The JCIC could serve as a vehicle to achieve this aspiration. As then Israeli Foreign Minister Yair Lapid remarked last year at the 5th JCIC virtual meeting: “This is an important platform, which enables the realization of the special framework for relations between our two countries — the Innovative Comprehensive Partnership — which was announced in 2017.” Skeptics should consider that such a meeting can also be a platform for Israel to delineate the boundaries of technology cooperation while engaging in an exercise of strategic empathy.

Netanyahu is not oblivious to the China challenge. In a November 2022 interview with Bari Weiss, he stressed that the art of foreign policy is to strike a balance between interests and values. Still, Netanyahu qualified that “there is a limit to how much we can open ourselves up to being dependent on non-like-minded states.” He explained that “matters of national security are also uppermost in our minds as they are in the minds of others. We’ll continue to work with China, but we’ll also protect our national interests.” This upcoming visit is no exception.

If Jerusalem plays its cards well, Netanyahu’s visit will demonstrate that Israel is not some leaf caught between two winds, unable to find its own course. Rather, it is a confident middle power that is being proactive in seeking ways to secure its interests, expand its room to maneuver, and preserve its strategic autonomy.