Andrew Cainey on ‘Xiconomics’ and strategies for foreign businesses

In a newly published book, Andrew Cainey, the founding director of the U.K. National Committee on China and a senior fellow at the Royal United Services Institute, delves into the complexities of China's domestic economy and its implications for multinational corporations that seek to do business with China.

What is “Xiconomics”? How do we understand China’s economic policies? What strategies can businesses use to navigate through increasing uncertainties in the China market?

These are some of the topics I discussed with Andrew Cainey, drawing insights from his recent book, Xiconomics: What China’s Dual Circulation Strategy Means for Global Business, co-authored with Christiane Prange.

Although “Xiconomics” is used in Chinese official media, like much Party-speak, the term is vague and ambiguous. Andrew helped unpack what Xiconomics really means and highlighted Dual Circulation as a key component. We also discussed whether this is something entirely new or a repackaging of China’s prior solutions to old problems, and why these ideas are important for China and for its relations with the rest of the world in the age of decoupling, de-risking, and deglobalization.

This is a lightly edited transcript of our discussion.

—Christopher Marquis

Christopher Marquis: My first question is broad and relates to the title: What is Xiconomics? And how is this different than previous economic policy making?

Andrew Cainey: Let’s start with the origin of the word, Xiconomics. We coined this in a sense to describe what Xi is doing in terms of leading the Chinese economy and the changes we’ve been seeing. But, in fact, Xiconomics an officially approved word used by Chinese state media in discussing China’s economy. Xinhua states that Xiconomics is Xí Jìnpíng ‘s 习近平 economic philosophy and articles goes on to describe that using words such as “holistic”, “human-centred” and “high-quality”. These are all good words — hard to argue with — but it is all somewhat ambiguous in what they actually support in terms of economic policy.

Actually, back in the summer of 2022, the Party issued a set of study guidelines on Xiconomics or, in Chinese, the long phrase “Xi Jinping Economic Thought on Socialism with Chinese Characteristics for the New Era.” There’s a hundred thousand characters or so of this stuff, which is a set of principles and guidance about what to do in the economy. In our book we’re trying to make sense of what see more pragmatically and say “What actually is this?”

To pick out a couple of points to begin with. Firstly, it is, in fact, Xiconomics and not Likonomics — based on Lǐ Kèqiáng 李克强, or now Lǐ Qiáng 李强 as premiers. Historically, economic policies been more in the sphere of the Premier, not the Party General Secretary or the President. And that’s changed under Xi. So this is Xiconomics, and particularly identified with Xi Jinping. Xiconomics really is quite centralized and personalized.

Secondly, Xiconomics is indeed holistic. It’s not just about economic growth. It’s about the distribution of economic prosperity. It’s about national security, and there’s a stronger role for ideology now. All these things come together with Xi. But at the same time, there is nothing here that reinvents, in a sense, the challenges facing China or the potential practical solutions. It’s more “bundling it all together” in some way. The challenges are still there, and the potential policy options are still pretty much the same.

Christopher Marquis: That’s all very helpful. One of the things your book really clarified for me is the significant change in how the Party is really running things now in ways it was not before. Some of my academic papers have contrasted Party Secretaries and Governor or Mayor and how the last role is usually engaged with business and the economy. The Party Secretaries at different levels were more in charge of setting overall direction and Party coordination. But the shift to Xiconomics as opposed to Likonomics — and I didn’t realize Likonomics was a term until reading your book! — really encapsulates an important shift, obviously centralization around Xi but then also, the role of the Party and having the CCP now at the center of economic affairs.

Andrew Cainey: That’s right. As Xi Jinping has said “The Party leads everything” — and, as we know, Xi clearly leads the Party. And actually this means Xiconomics becomes more holistic almost by definition because of Xi’s role as Party General Secretary. You are looking more at security certainly. And at ideology too. One of the issues in China today is that all this stuff is going on at once. Everything is an objective. And nobody is quite sure where the balance is or the trade-offs. And the best sense is that it’s security taking precedence in the economic sphere too. There’s a lot of uncertainty, and not just for the Western analysts such as ourselves. Chinese on the ground too are trying to make sense of this and don’t make want to make the wrong call.

Christopher Marquis: One theme that is strongly emphasized in your book relates to Dual Circulation. And it’d be great if you can describe Dual Circulation. What are the different elements and why is that important to understanding Xiconomics?

Andrew Cainey: Sure. So the Dual Circulation Strategy was announced by Xi Jinping in the spring of 2020, and at its simplest it says, “Let’s look at the whole world economy through the lens of economic activity that flows and circulates around between different economic agents or entities”. This is a conceptual approach that goes back a long way to Adam Smith, to Marx, to Keynes and to others. But — crucially — dual circulation then says, “Let’s split the world into two parts. There’s the internal circulation in China, the domestic economy, and there’s the external circulation taking place in the rest of the world. So we’ve now got two distinct domains, and now let’s think about how those domains can or should interact.”

In some senses this is obvious. Through the centuries it is how people have looked at the home economy and the rest of the world. But right now we’re coming out of a couple of decades of increasing so-called “seamless globalization” where borders were not meant to matter — or at least mattered ever less. And even back in the eighties a Chinese economist Wáng Jiàn王建 talked about China’s plans to enter into what he called the “great international circulation”. Now we are back to saying, “Hang on a minute. You know there’s ‘at home’ and there is ‘the rest of the world’. How do they come together?” At one level, this Dual Circulation is simply a framework. It’s a way of looking at the world and it’s one which is increasingly relevant for anybody, for the US, for Europe, in an age of decoupling, deglobalization, and de-risking.

The strategy in the Dual Circulation Strategy comes from how you apply this framework. It tees up some strategic choices. How important is the internal, and how important is the external? How does the internal economy work? On what principles and with what goals? And how can the internal and external mutually reinforce one another? How big do you want those barriers between them to be — or is the focus on connectivity and, if so, on what terms?

In 2020 Xi Jinping stated that domestic circulation should be the “mainstay”, should be the most important. But China should continue to be open to the world and should look for mutual reinforcement between the internal and the external. At home it should be about rising consumption, increasing technological capabilities. None of those things is hugely new. We can go back 20 years to discussions about China needing to become more technologically advanced through indigenous innovation and to create more of a consumption-driven economy. But it’s a new way of framing and a stronger impetus. Xi too is putting more emphasis on the security benefits of the internal focus, of self-reliance. He’s talked about the need to create “controllable supply chains” and create a domestic economy that can function normally under “extreme circumstances”. There is consistency too at least in the aspirations even if the reality has been more challenging. In 2023 at Davos, Liú Hè 刘鹤 used exactly the same words to describe dual circulation as Xi Jinping had done in the spring of 2020.

Christopher Marquis: I also really appreciated the historical connections in your book. As someone who has studied the lasting influence of Mao, in particular I appreciated your citing his idea of “making the foreign serve China,” which certainly is echoed in how external circulation should benefit China.

But regarding the internal circulation part, for as long as I’ve been spending time in China, there has been a lot of focus on driving more consumer spending, a greater focus on consumption. But people still keep saving. And particularly in recent times, there’s a lot more uncertainty and lack of trust among the Chinese people, which is really what drives how persistent the savings behavior is. What’s your sense of the Party’s ability to robustly create this internal circulation dynamic?

A related topic is innovation. China has had a lot of innovation success in the pre-COVID period. But the Party seems to be stifling that now, for example, increased control of private enterprises, doubling down on gigantic top-down investment programs like in semiconductors that have led to significant waste and corruption. Also the culture of fear that has been reported. All of which to me does not bode well for the domestic economy.

Andrew Cainey: The leadership is thinking, “We still have to get consumption up, we have still got to innovate.” But dual circulation on its own doesn’t really help move things much further forward. The closest it gets is an initiative called the National Unified Market 全国统一大市场, which is about improving domestic circulation and internal activity flows between provinces of China. This is really pushing for steady removal of internal barriers, some of which have come back again during COVID. But this doesn’t really hit on these consumption and technology questions. Certainly, consumption has grown a lot because the economy has grown a lot, but it remains at a low share of GDP compared with other countries. And savings are high as a share of household income.

There is a lot of discussion about the need for increased health and pensions provision by the government — and, while limited in scale, this is steadily improving. But in terms of a broader ‘safety net’, Xi Jinping stresses the need to avoid “welfarism”. It’s a really quite conservative approach, a cautious approach on this. A sense that “we don’t want to put too much of this in place for fear we’ll unleash ever-increasing expectations.” So families can still be financially wiped-out by getting cancer and then having to pay the medical costs of treatment themselves. Reducing savings and getting consumption share up is challenging indeed.

Christopher Marquis: I have always found Xi’s avoidance of welfare state type of programs, given China is supposedly a socialist country, a bit surprising. You have seen this come up a bunch in the discussion of youth unemployment, and Xi’s response to this is they need to chīkǔ 吃苦, eat bitterness like their parents. It’s all on them. China is in a real precarious economic situation now, both domestically and internationally, but it just seems Xi and the CCP are ill-equipped to handle it.

So what’s your sense looking forward a bit? Is this Dual Circulation focus something that is going to help China recover its prior economic growth rates? Or is it maybe it is too focused on national security or protection of China? That tension is a big part of the challenges at the moment.

Andrew Cainey: Xi has laid out his big focus on national security and this is very broadly defined. So basically, you can take any aspect of life and put the word “security” after it, like environment or nature, or finance, or resources, or whatever. It’s actually quite understandable in the current geopolitical context. The export controls, for example, that China is facing in advanced semiconductors mean it makes sense to look for other so-called “chokepoints.” It does though risk making tense international relations even worse and dampening down economic activity at home. China is a bit running to stand still as it has to innovate to replicate what it could import previously.

And it’s also confusing. People don’t quite know where the priorities are right now. How does the Chinese leadership bring back confidence — consumer confidence, confidence in private sector business? How do you build that climate in this environment? I think it’s pretty challenging. It’s been reinforced by what you’ve touched on — this personal style of Xi’s messages to the young and to others on what to do and what not to do.

So Xiconomics in an official sense expressed in Party writings — much of it quite ambiguous in meaning, but also much of it aspirational and hard to disagree with — like many political statements in any country. But it also has more personal viewpoints from Xi Jinping talking. He exhorts the young graduates to go to the countryside, if they can’t find a job in the city. For many hearing this, it harks back to the Cultural Revolution, whether or not it is meant like that. Or the young need to spend less time online and go outside and do more sports. This can all sound just like the older generation lecturing the younger generation.

Christopher Marquis: You mentioned the Party documents. And this was something that I found really both interesting and effective about your book. In my limited experience looking directly at these, it all sounds like propaganda gobbledygook. However, from various case studies that I’ve done of entrepreneurs, they talk about how reading Qiushi is really important for understanding CCP priorities to help them think ahead. So there’s something there. But it’s hard to really parse the signal and noise.

Given your use of the documents, can you talk about what’s just propaganda versus valuable material? How can we use these documents to really gain good insight into what the priorities are?

Andrew Cainey: As you say, there’s value in looking at them, but they’re not something to be slavishly followed line by line. Reading about dual circulation and common prosperity, Xi says some quite direct things. “We shouldn’t promise more than we can deliver” which, again, could be a line from Margaret Thatcher around the role of the state. This does directly put in context other interpretations on what “Common Prosperity” means. Under Mao it meant common ownership of the means of production.

I think reading these documents also brings home the diversity and scale of the challenges that China’s leadership faces. If you’re leading a country of 1.4 billion people, what are you really dealing with? In a business sense, “what does success look like?” And, given the imperative to stay in power, what things are critical to political stability for Xi? Because, particularly for Western companies, we tend to be much more aware of the richest 200, 300 million, 400 million people in China, and don’t think about the broad sweep of the whole country.

Reading these documents also reminds us what Party officials are focusing on and what they’re hearing from their bosses up the line. But we still need to remember that many of these are political, aspirational statements. And the documents rarely if ever say “Hey, we failed on this one. Or this thing is never going to happen, or we’d like to do this, but we haven’t got any money.”

To judge what’s actually going to happen all we can do is try and pick up signals where programs have been announced or just seeing what gets repeated time and again in speeches. One of the examples we talk about in the book is the crackdown on private tutoring. After that happened, people said, “Oh, it was mentioned in Xi’s book. He said that the profit motive should play no role in in in education. And if only I’d read that!” Now it’s good to know the context and the direction of things. But timing is what really matters in business decisions. Tons of Chinese private equity money went into the tutoring sector the year before the crackdown. Clearly, a mistake in hindsight — but even reading Xi’s book gave no sense when and whether there would be a ban on the for-profit sector.

Christopher Marquis: I’m sure people have downloaded all of his texts and done various content analyses or something to try to understand the different themes. But Xi has supposedly written like 160 books at my last count and I am sure a lot more now. It’s funny if you visit the CCP website with his books, it is all Xi on this topic or another one. So it’s hard to know exactly where the needle in the haystack is.

Another topic I really wanted to get to is what business should do. So much discussion about China is at more of the macroeconomic level that intersects with policy and geopolitics. And there’s less on actually unpacking strategies for business. But you dive into this in a deep and thoughtful way in the book, which I really liked.

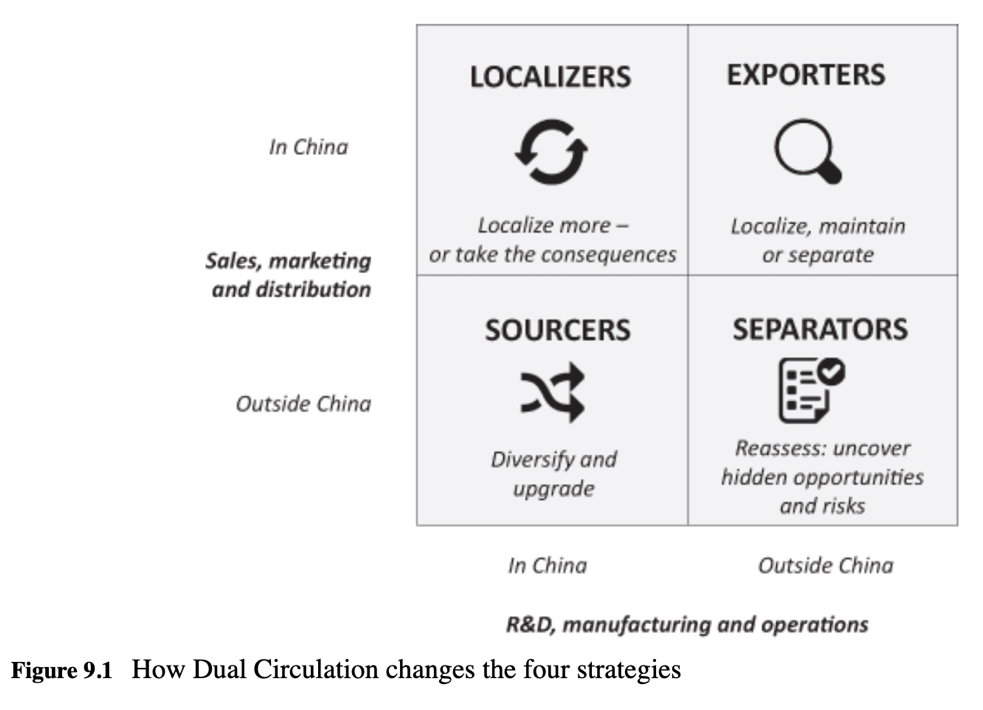

You have a 2 x 2 that you unpack in a few places in the book, and like many good 2 x 2’s, it seems obvious and simple, but actually provides some important insights. So one axis is sales, marketing and distribution. The other is R&D, manufacturing and operations.

One of the reasons why I find it really useful is in the context of Apple and recent discussions of China potentially banning the use of iPhones by government workers. It is important to recognize that that is just one axis. I have a good friend who is a former executive at Apple China, and he would talk quite passionately about how everyone always says Apple is dependent on China because of selling iPhones, but according to him that focus distracts from the more significant dependency on production and supply chain. That they really can’t replicate production in any other place. So using this 2 x 2 helps orient people very well with respect to exposure to China. And then when you plot the four cells it becomes very obvious that you have these four different quadrants which have different characteristics. And so under a Dual Circulation regime, people would need to think of different strategies. Can you describe this a bit?

Andrew Cainey: An important point to pick up, given you talked about Apple, is that, while I’ll talk about the four strategies, many companies, such as Apple, are actually running several of these strategies at the same time. And what the 2 x 2 does help is break that apart and be clear about what the different forces are on each of the strategies rather than mixing them all in together.

The strategies are being a Sourcer, being an Exporter, being a Localizer and being a Separator. And I’ll explain what those each mean.

Start with Sourcer, because that’s how so much of Western involvement in China started: China as a place to do manufacturing, to produce at scale, low-cost goods for the rest of the world. Apple today through its supply base with Foxconn and others, is sourcing massively from China. And there’s long been a discussion going back 15 years or so at least: Is China becoming uncompetitive — leaving geopolitical questions to one side — because labor costs are rising. But productivity has risen too. And all this is just a classic supply chain optimization question about where do I put my facilities given the changing economics?

What dual circulation has done, together with the geopolitical tensions, is overlay on that an increased need for diversification. China has become such a large position in the sourcing footprint of many multinationals that people are saying, “Let’s diversify a bit.” So there is a non-political aspect to this as well, and there’s a move to Southeast Asia and India and elsewhere. Partly because of costs, partly because of tariffs, and partly because of a more challenging operating environment in China and geopolitical tensions between the West and China.

So we get this story that “everyone’s leaving China”. But it’s not quite that simple. Because at the same time the Chinese economy is upgrading, becoming more sophisticated. And we see companies looking at China for sourcing in a different way. BMW Mini announced last autumn it was bringing some EV production from the U.K. into China at a time when other firms are leaving. Companies increasingly want to access China talent in China — effectively they are sourcing talent and ideas. They’re sourcing innovation from China. Johnson and Johnson emphasizes China as a source of pharmaceutical innovation. So sourcing from China is changing — and if the technology ambitions of dual circulation become reality then it will change even more.

Then there’s the category of Localizer, which is saying, “I may or may not be sourcing from China, but I also want to sell in the China market at scale, and I’m really committed to thriving in a different, fast changing, competitive market.” Volkswagen is a really early example of going into China well ahead of many others and getting a big share in the China auto market. KFC customized extensively to the China market and has thrived. There are many large multinationals — like Starbucks — that have large businesses in China still and have big growth plans. They are talking about doubling down whatever the near-term headwinds. It’s not just about helping China’s development agenda as in the past. It’s competing in the China context with Chinese companies. One news story that got headlines was the CEO of Astra Zeneca China saying Astra Zeneca in China will seek “to love the Communist Party”. This localization raises questions. Is this appropriate for a British listed company, for whom the U.S. is the largest market and China’s the second largest? The logic is completely appropriate for succeeding in China. The question is rather, how does that work internationally? How do I see that from headquarters?

The third category are the Exporters. Here we have a whole range of companies that sell to China but that, for different reasons, are not manufacturing there. This includes classic designer goods companies like Chanel or products like Scotch whisky where the choice to export is inherent in the product. It also includes medium-sized German companies and others that lead the world in specialized industrial equipment. It’s these companies that face some of the greatest challenges. Often they have kept their manufacturing outside of China — either because the China market maybe not big enough or because they have concerns about IP protection or both. Medtronic, the largest med-tech company in the world, is both an Exporter and Localizer. They have acquired and manufacture in China — hence a Localizer. But they have kept their most advanced product manufacturing out of China — acting as an Exporter.

Now these companies either need to move more onshore into China — with all the associated challenges — or face even greater headwinds as the Chinese government prioritizes domestic production over imports and as Chinese competitors grow. The Chinese government now says, “If you’re a foreign company and you manufacture in China, we will treat you on equal terms”. While what that really means in practice can vary a lot, certainly those who only export to China are at a marked disadvantage.

From China’s perspective, the dual circulation stance on technology innovation is, “Bring your technology to China; please bring semiconductor knowledge. And that can help build Chinese capabilities.” And it’s the U.S. and others who think, “Hang on a minute. We’re not sure that makes sense for competitive business reasons or for broader geopolitical reasons.” Exporters can keep just exporting, but they’re likely to keep losing ground if they do. It’s challenging.

And finally, the Separators are the guys who, so far, have taken a look at China and said, “That’s not for me. I either don’t want to adapt to the market in the way that I would need to or I just think it’s too complicated.” And we had a few observations on this category. One is that many companies that think they are Separators may actually not be — they are actually quite involved in China in some way. Maybe in their supply chain or in their customer base.

And they should anyway always keep taking another look at China because things keep changing. Alphabet is an example of one such company. Google exited search then actually built up an AI capability in China. It looked at reentering with a censored search product that complied with Chinese law then concluded not to after a lot of employee resistance. It also has now shut the AI center given the geopolitical context. In the financial services sector, there actually has been continued deregulation and opening up in in the past few years. Companies such as Fidelity and Schroders are doing things in China that previously they hadn’t been able to do. They had said, “We don’t want to do a JV on, say, mutual funds”. But now they can do it 100%-owned. So even when there are a lot of stories about China closing in on itself, there are some still going in even if they also find challenges.

Christopher Marquis: Being able to identify those different strategies is quite useful. And I think one of the things that you mentioned that is important, and as you unpack things in the book, is that companies can be multiple places in this matrix at the same time with different product lines, business units.

Andrew Cainey: Absolutely. Adidas is a very good example of localizing to the China market and their celebrity endorsements and going to lower tier cities. They also have a global sourcing organization where China is a large part. But bundling those two things together misunderstands the challenges they’re facing. It’s better to look at those separately and say, there are different pressures and opportunities in each of those areas.

Christopher Marquis: We’ve talked about a lot of different industries and different strategies, so this probably is an unfair question. But the last question I have for you is, for a company interested in entering China, what’s the one piece of advice that you give them?

Andrew Cainey: Overall it’s all about the change and the uncertainty. And now, maybe more than ever. So don’t project the future to be like today, where there may be lots of concerns. Or even like it was yesterday or a few years ago, which was very positive. One really needs to think about some different scenarios which are partly around the economy, but also around the politics and the global context. Right now as we’re talking, there’s a lot of negativity about China. There are clearly some very real substantial problems in the economy. But there’s both a scenario where things get a lot worse and also a scenario where things come back once again. And there’s the whole policy context. That’s probably not going to ease off but may at least stabilize and reach a new equilibrium. But we also can’t rule out a drastic worsening from the Chinese side or in the US, where there may be a new administration with new policies in a year or so. What does that mean? So have different scenarios rather than just saying, this is the way it is today, this is how it’s going to be.

Christopher Marquis: That’s really useful to think about. With such uncertainty, as one thinks into the future, having a range of scenarios, and starting to think of varied strategies so you can see where things are tracking is a great insight. Thanks so much Andrew.